Monad’s MON token surged more than 35% within 24 hours of launch, defying both a cold airdrop market and a deep November sell-off across digital assets.

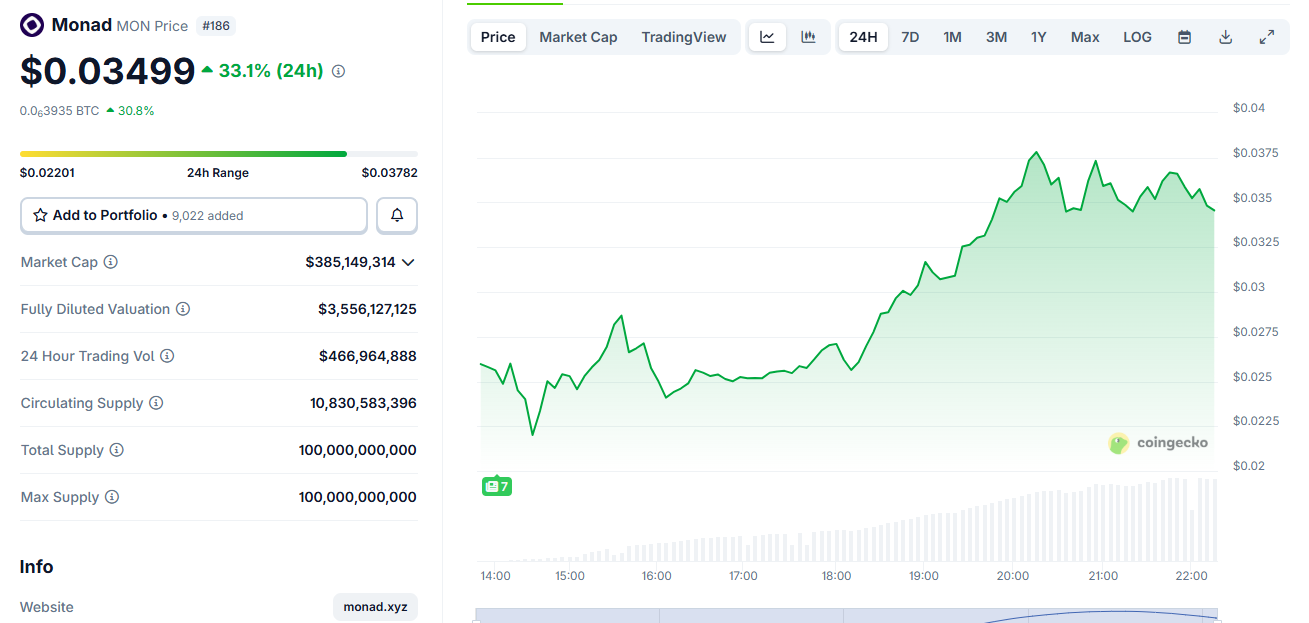

MON traded around $0.035 on Monday, rising from an early range near $0.025 as liquidity spread across major exchanges.

Monad Shines Bright Amid the Bear Market

The move stands out against a market where most airdrops have struggled. Recent industry research shows nearly 90% of airdropped tokens decline within days, driven by thin liquidity, high FDVs, and aggressive selling from recipients.

MON instead climbed strongly despite more than 10.8 billion tokens entering circulation from airdrop claims and a public token sale.

The token launched on November 24 alongside Monad’s mainnet. Around 76,000 wallets claimed 3.33 billion MON from a 4.73 billion-token airdrop, while 7.5 billion more unlocked from Coinbase’s token sale.

Monad Price Chart. Source: CoinGecko

The airdrop alone was valued near $105 million at early trading prices.

MON’s performance also contrasts with the broader market downturn. Bitcoin fell below $90,000 last week after long-term holders sold more than 815,000 BTC over 30 days.

Total crypto market value has dropped by over $1 trillion since October, and sentiment sits in extreme fear territory.

However, MON’s trading demand remained resilient. Its price recovered from initial selling pressure and climbed steadily through the afternoon session.

Most large exchanges listed the token at launch, including Coinbase, Kraken, Bybit, KuCoin, Bitget, Gate.io, and Upbit, supporting deeper liquidity.

Analysts attribute the move to pent-up interest in Monad’s high-performance L1 design and a launch structure that avoided the steep inflation seen in other airdrops this year.

The project delivered one of 2025’s largest distributions but kept real circulating supply focused on early users and public sale participants rather than speculative farmers.

MON’s rally comes as a rare outlier in November’s bear cycle. Its early strength now positions the token as one of the few airdrops this year to post immediate gains instead of sharp declines.