RAIN rallied more than 120% in the past 24 hours after biotech firm Enlivex said it would raise $212 million and begin shifting its corporate treasury into the token, according to a press release shared with The Defiant.

The token, which powers the decentralized predictions and options protocol of the same name, is currently trading at $0.008, with a market capitalization of $1.7 billion. RAIN is the second-largest gainer of the day among the top-100 tokens, and ranked 65th by market capitalization, according to CoinGecko.

Enlivex Therapeutics Ltd, a publicly traded biotech company trading on the Nasdaq under the ticker ENLV, plans to raise the funds through a private investment in public equity (PIPE), selling 212 million shares at $1.00 each – an 11.5% premium to its previous close on Nov. 21.

The company said it will use the proceeds to accumulate RAIN and continue developing its Allocetra knee-osteoarthritis therapy.

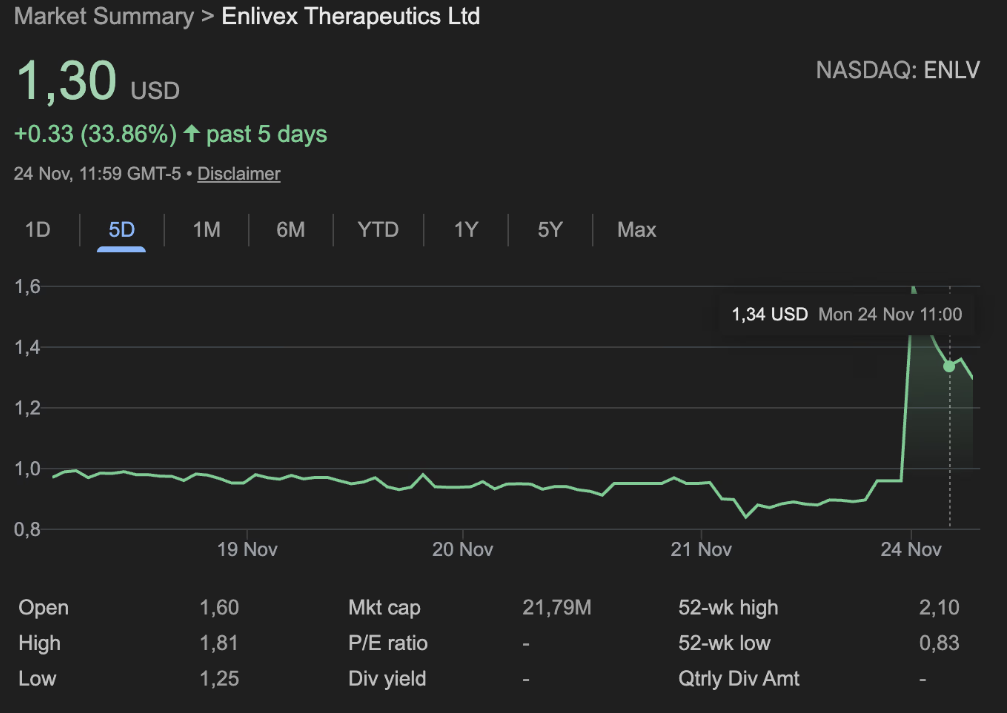

ENLV shares also rallied on the news, currently trading at $1.30, up 45% on the day.

Prediction Markets Get a DAT

The move would make Enlivex the first U.S.-listed company to focus its treasury on a prediction-markets token, Shai Novik, Chairman of the Board of Directors of Enlivex said in the company’s press release.

“RAIN’s decentralized protocol uses blockchain technology to let participants trade on expectations of future events, and we believe it will become a dominant force in this expanding market segment,” Novik added.

The announcement comes as more public companies are actively exploring digital asset treasury (DAT) strategies — and despite pressure on these strategies as crypto markets struggle.

Meanwhile the broader prediction markets sector has been gaining momentum in recent months. Kalshi, a U.S.-based prediction marketplace that recently began integrating on-chain infrastructure, recently reportedly raised $1 billion in a funding round, just a month after raising $300 million at a $5 billion valuation.

October also marked the prediction market sector’s strongest month yet, with Kalshi and on-chain prediction market Polymarket processing a combined $7.4 billion in volume, The Defiant reported.

RAIN runs on the Arbitrum network and allows users to create and trade custom on-chain markets, with outcomes resolved using AI. The token also has a built-in buyback and burn mechanism.

Former Italian Prime Minister Matteo Renzi is expected to join Enlivex’s board after the deal closes.