KEY TAKEAWAYS

Candlesticks originated in Japan and are useful for recognizing market sentiment and the balance of power between bulls and bears.

Key components include the real body, shadows, and color.

Understanding bullish and bearish patterns help traders and investors predict short-term price movements.

Candlesticks offer visual and analytical advantages over other chart types.

Due to their limitations, they are best used alongside other technical tools.

History of Candlesticks

With its origins in 18th century Japan, candlestick charting was built on the idea that market prices are influenced by both trader psychology and the balance of power between the bulls and bears. By studying historical price changes, Homma identified patterns that signaled shifts in sentiment and market control, helping him anticipate price reversals and trends. His system became widely adopted among Japanese merchants and evolved into a structured approach to market analysis.

The use of candlestick charts remained confined to Japan until Nison introduced them to Western financial markets in the late 20th century. Nison's research and teachings highlighted the power of candlestick formations in predicting price movements, leading to widespread adoption among traders across stocks, forex, and commodities markets.2

Today, candlestick charts have been integrated into the architecture of technical analysis, offering traders a visually intuitive way to assess market sentiment.

Components of a Candlestick

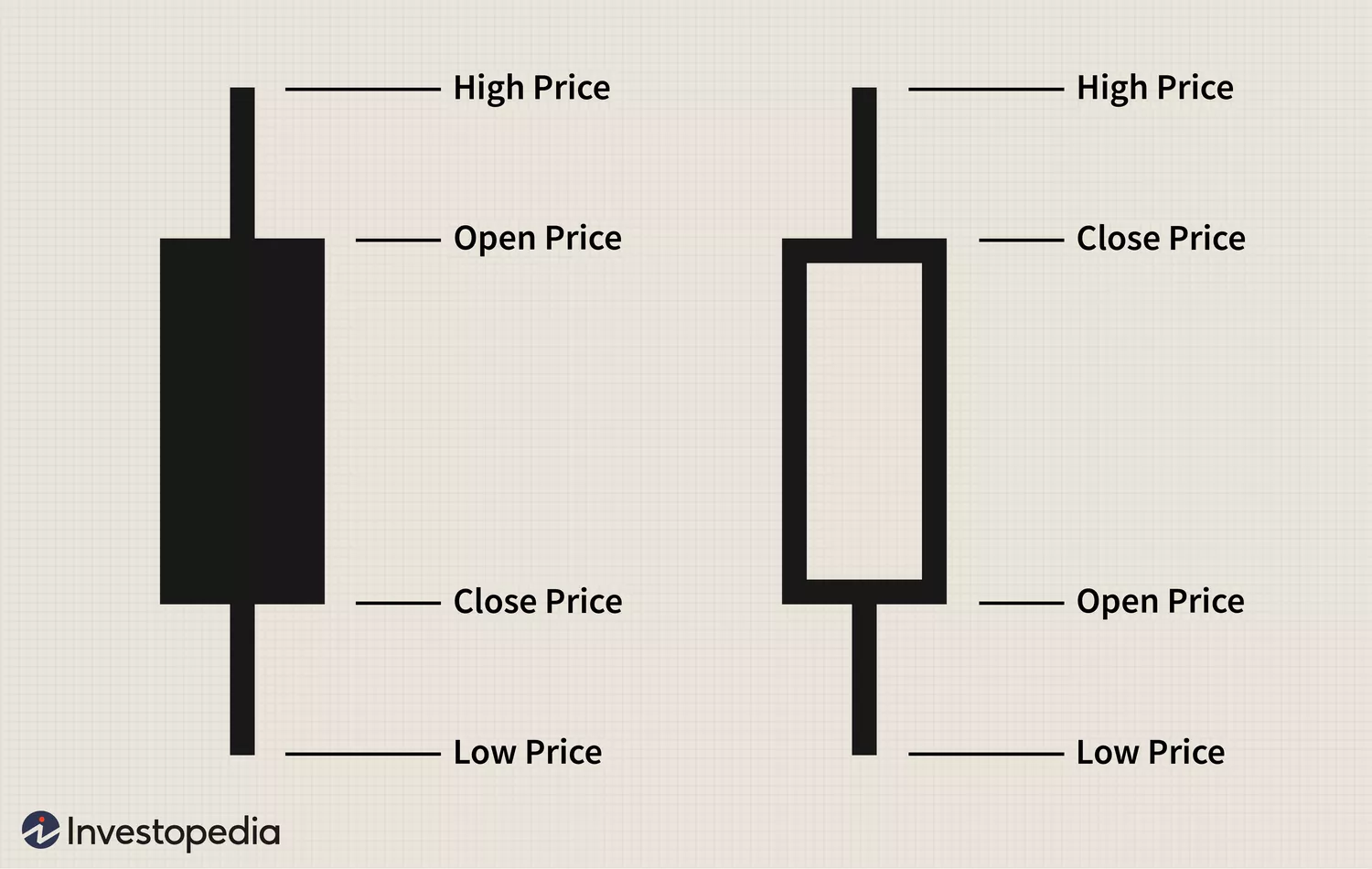

Each candlestick represents a specific period and is made of three (3) components:1

Real Body or Body: This is the rectangular section of the candlestick. It shows the range between the opening and closing prices. Long bodies indicate strong buying or selling pressure, while short bodies suggest indecision.

Shadows or Wicks: These extend above and below the body, marking the highest and lowest prices reached during the period, offering insights into market volatility.

Color: The color of the candle provides a quick snapshot of price direction. A bullish candlestick is typically green or white and means the closing price is higher than the opening price, indicating upward momentum. Inversely, a bearish candlestick, generally red or black, signals that the closing price was lower than the opening price, reflecting downward pressure.

Investopedia / Julie Bang

How to Read a Candlestick

Similar to bar charts, candlestick charts comprise four price points: open, high, low, and close. The high is marked by the top of the upper shadow or the real body if there is no shadow, while the low price is represented by the bottom of the lower shadow or the real body if there is no lower shadow.

Finally, the closing price's relationship to the open determines whether the candlestick is bullish or bearish. If the price closes above the open price, the candlestick is bullish. On the other hand, if the price closes below the open price, the candlestick is bearish. With colored candlesticks, you can recognize bullish or bearish candlesticks instantly.

By analyzing these four price points over multiple candlesticks, traders can identify market sentiment and how the bulls and bears are faring against each other, helping to predict potential price changes.

Common Candlestick Patterns

Bullish Patterns

Bullish Engulfing Pattern

This pattern consists of two candlesticks. The first is a small, bearish candle followed by a larger, bullish candle. As the name implies, the larger candle completely engulfs the previous candle's body. That is, it opens below the lowest point of the smaller candle's body, but the bulls take over and push the price to a close above the highest point of the previous candle's body. This indicates a shift from bearish to bullish, reflecting strong buying pressure that may mark a potential reversal.3

Investopedia / Julie Bang

Bullish Harami Pattern

Another bullish candlestick pattern is the bullish harami. This is a two-candlestick reversal pattern. It consists of a large bearish candlestick followed by a smaller bullish candlestick that is completely contained within the body of the previous larger candle. This formation suggests that selling pressure is weakening, and on the second day, buyers are reasserting control. Confirmation is seen when the harami is followed by a strong bullish candle.

Investopedia / Julie Bang

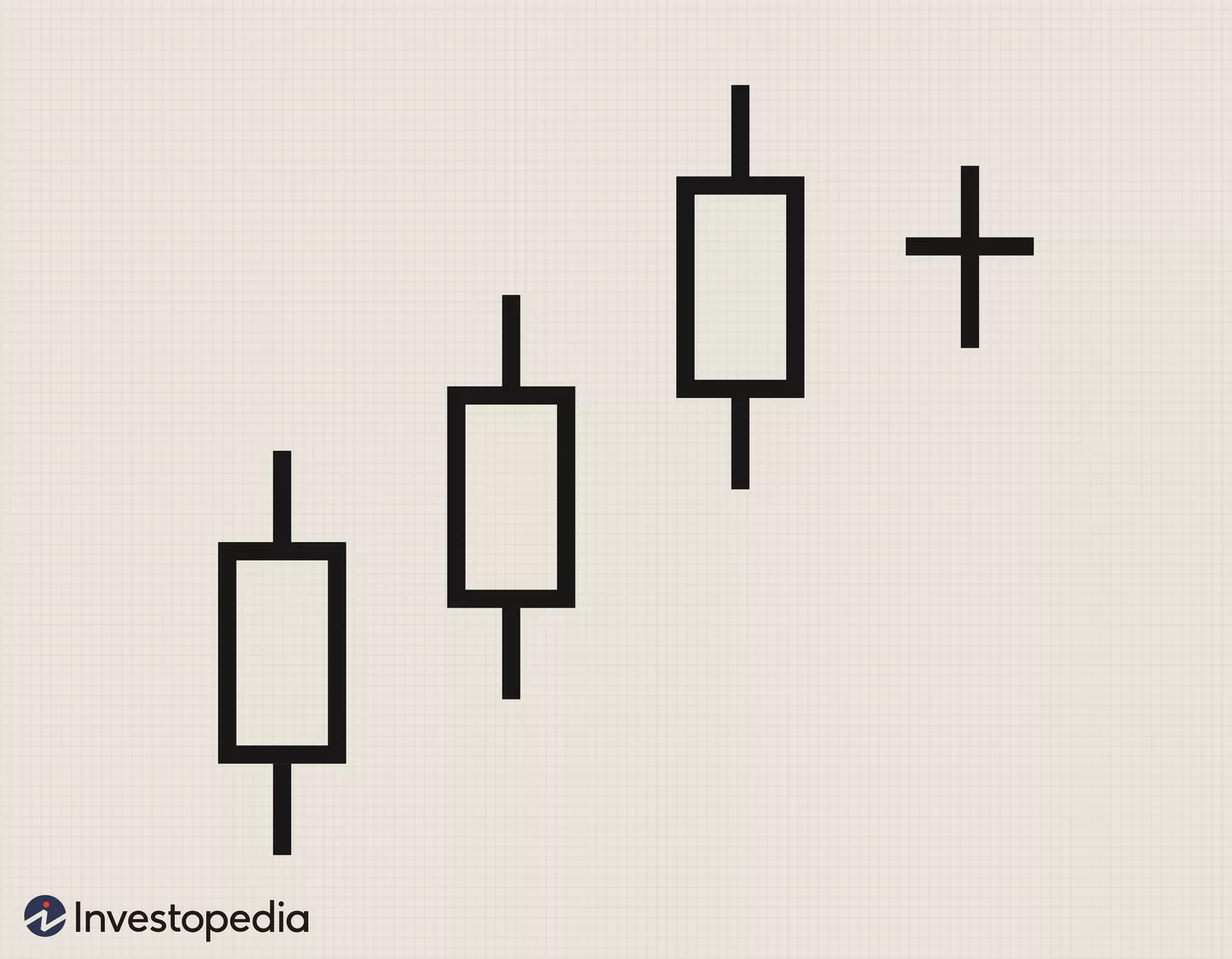

Bullish Harami Cross

This is a variation of the bullish harami pattern where the second candlestick is a doji, signifying very little difference, if any, between the open and close. Unlike the bullish engulfing pattern, which shows the bulls gaining the upper hand, the doji reflects a stalemate. This often means selling pressure has faded and the bulls are about to take over for a while.

Investopedia / Julie Bang

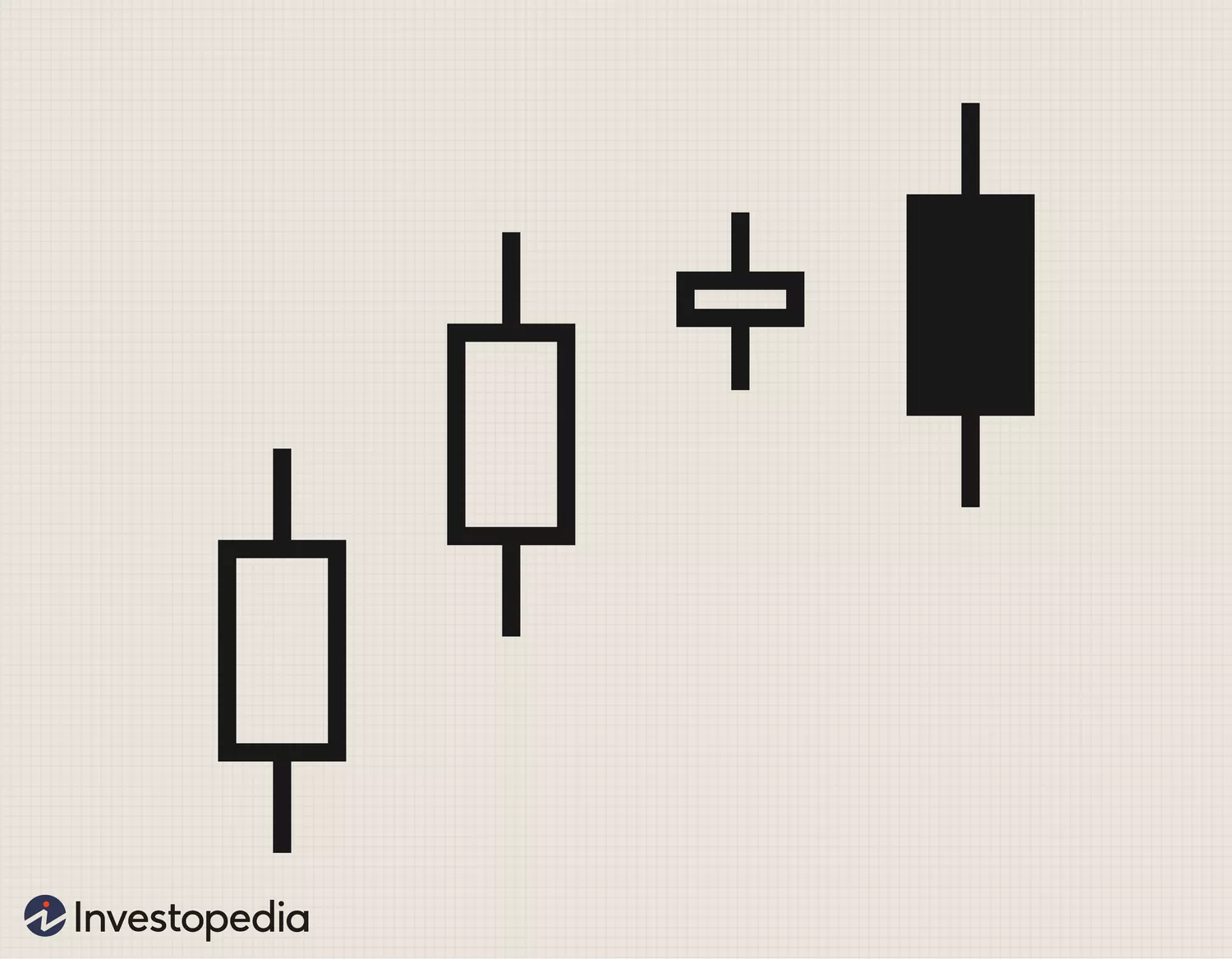

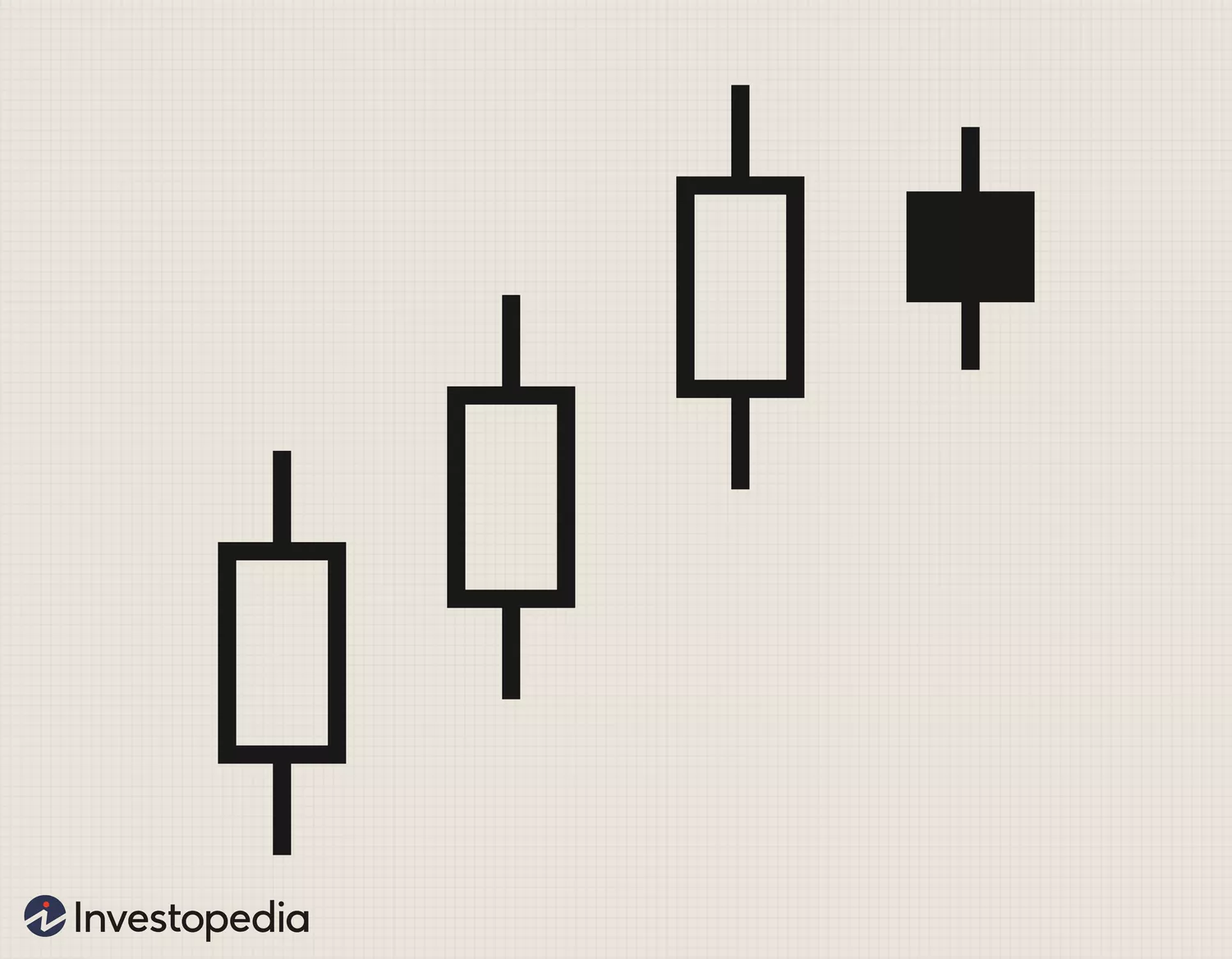

Rising Three Methods

This bullish continuation pattern signals a temporary consolidation before the prevailing uptrend resumes. The components include a strong bullish candlestick, followed by three or more smaller, bearish candlesticks that remain within the range of the first candle. Finally, another strong bullish candlestick closes above the most recent bullish candle's close.

The smaller bearish candles reflect a brief period of profit-taking or a pause in buying without much selling pressure. The final bullish candle confirms that buyers have regained control and the price is likely to continue moving higher.

Investopedia / Julie Bang

Morning Star

The morning star is a three-candlestick pattern that appears at the bottom of a downtrend. This first candle is a long bearish candle, while the second is a small-bodied candle that indicates a stalemate, much like the bullish harami cross. Lastly, there is a strong bullish candle that confirms the reversal. This pattern suggests that on the third day of the pattern, buyers have gained control. It often leads to an uptrend.

TradingView

Bearish Patterns

Bearish Engulfing Pattern

This pattern consists of two candlesticks. The first is a small, somewhat bullish candle at the top of an uptrend, followed by a larger bearish candle that completely engulfs the previous candle's body. The bearish engulfing pattern indicates a shift in market sentiment from bullish to bearish, suggesting an impending price decline. It typically marks the end of an uptrend.

Investopedia / Julie Bang

Evening Star

This is a three-candlestick pattern that appears at the top of an uptrend. The first candle is a long bullish candle. It is followed by a small-bodied candle that signals market indecision. Finally, a strong bearish candle confirms the reversal. This pattern suggests buying momentum is weakening and sellers are taking control. It often leads to a downtrend.

Investopedia / Julie Bang

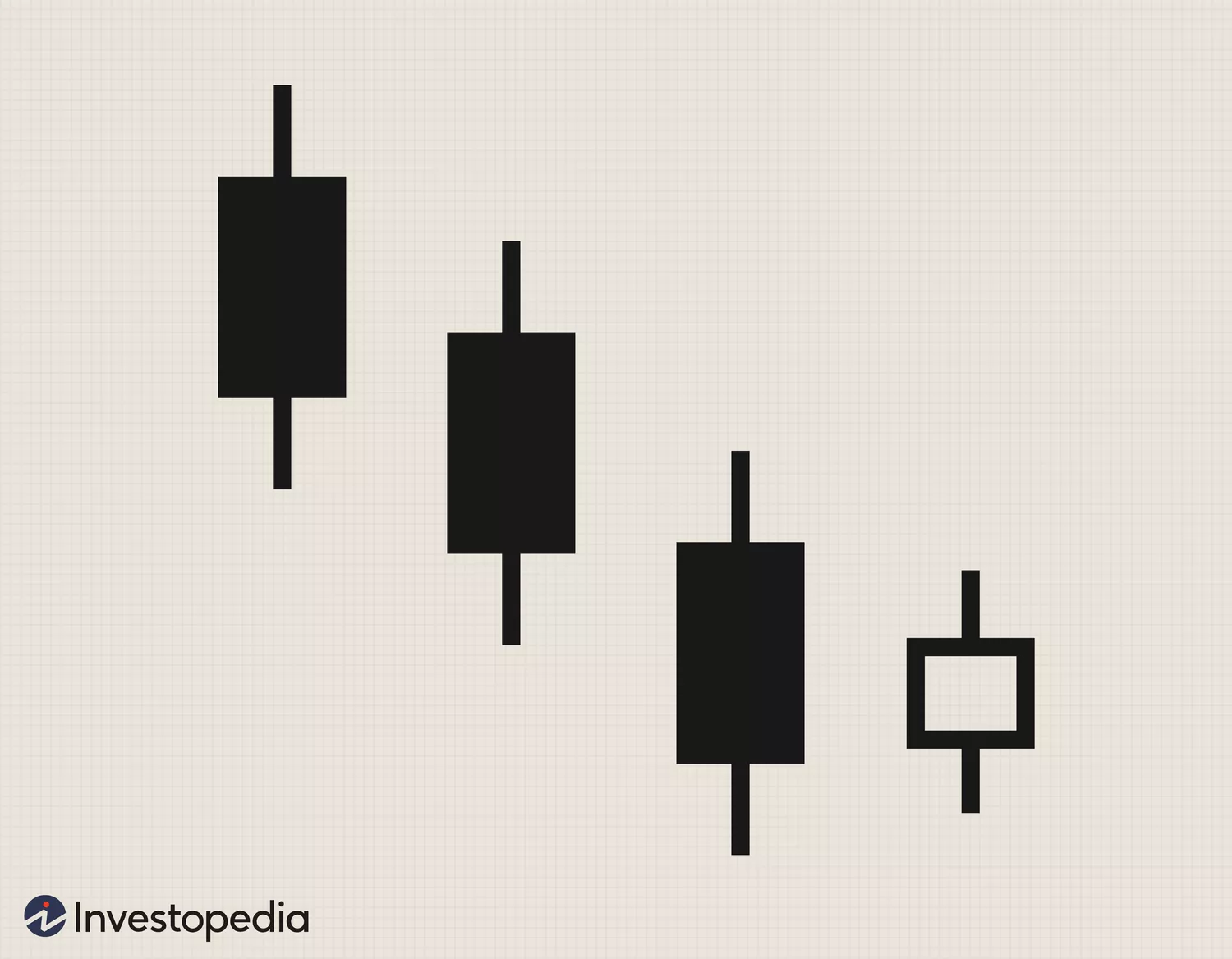

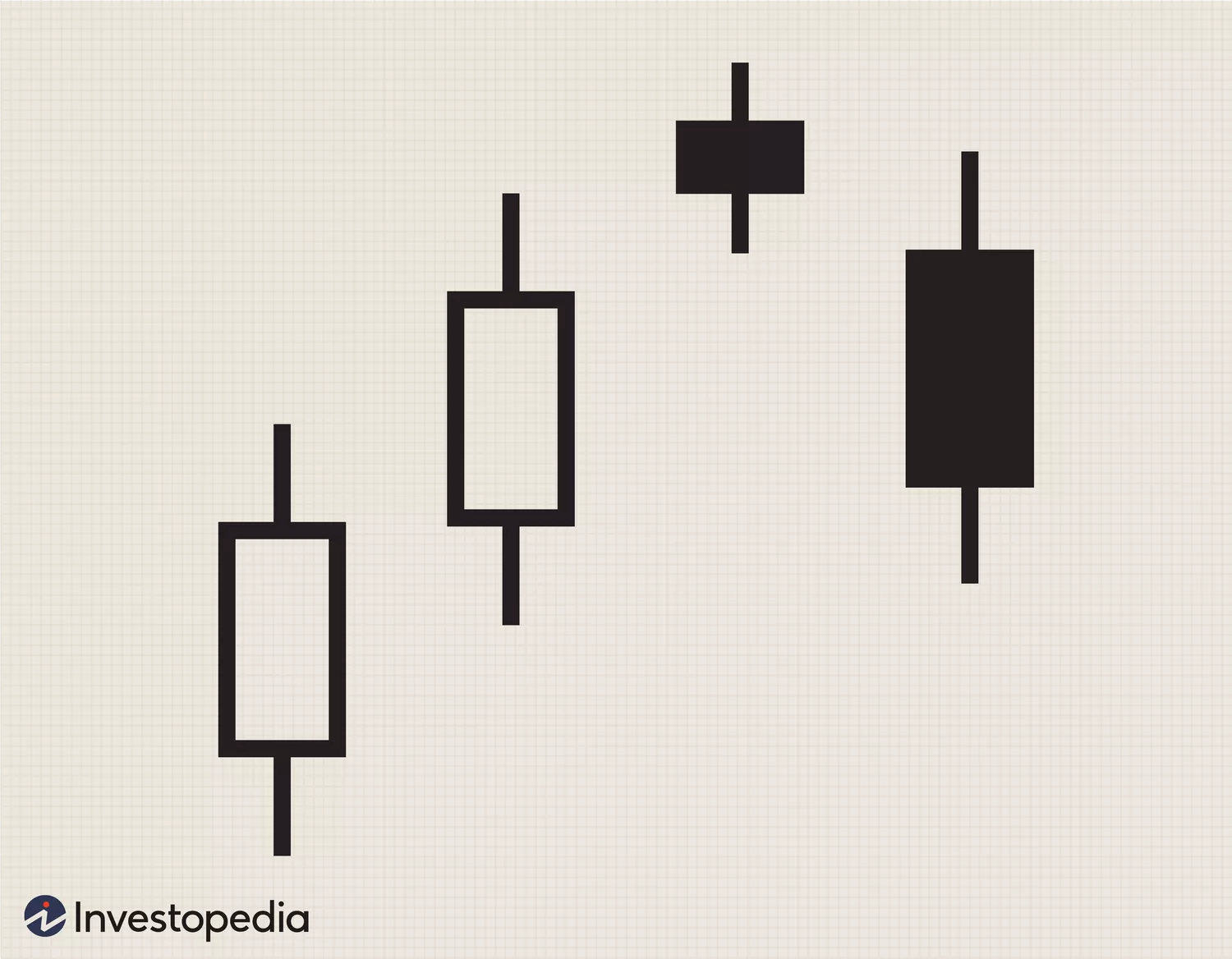

Bearish Harami

This is a two-candlestick pattern that signals an uptrend's potential reversal. It comprises a large bullish candlestick that is followed by a smaller, bearish candlestick that is completely contained within the body of the previous candle. The bearish harami signals that buying momentum is weakening, and sellers may be starting to take control. A strong bearish candle would confirm the reversal.

Investopedia / Julie Bang

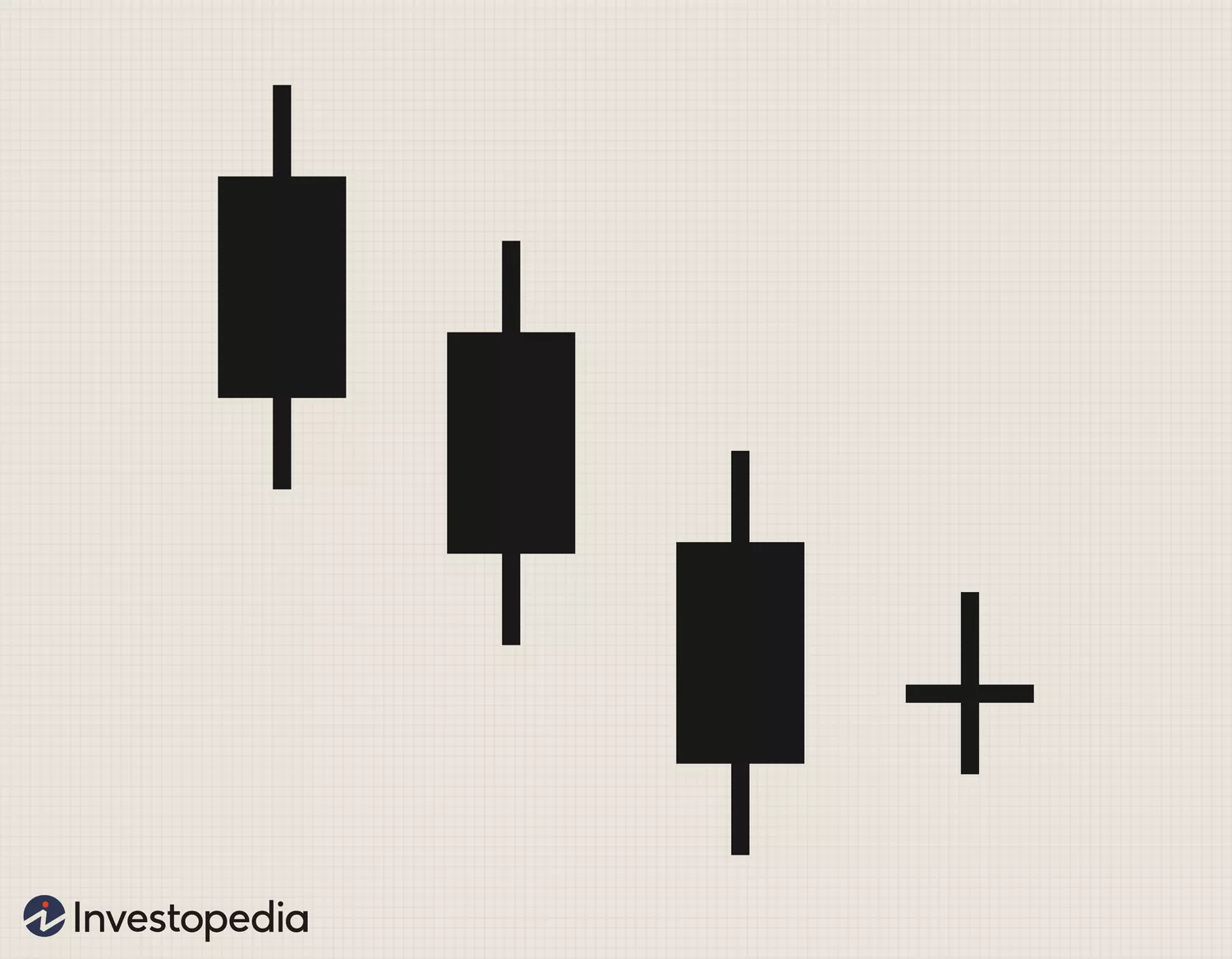

Bearish Harami Cross

This is a variation of the bearish harami, where the second candle is a doji, showing near identical opening and closing prices. This signals strong indecision and weakening bullish momentum. A strong bearish candle would confirm the reversal.

Investopedia / Julie Bang

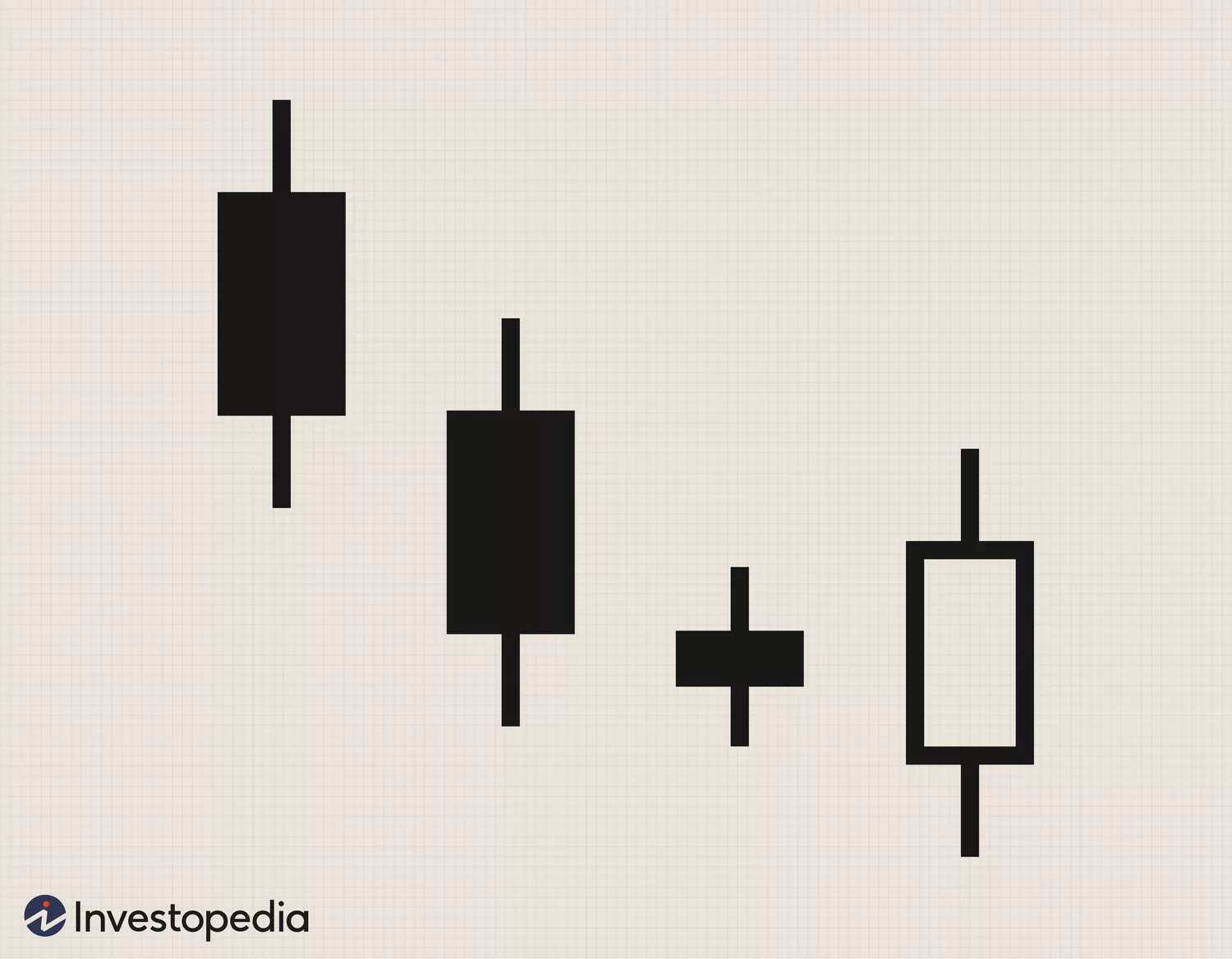

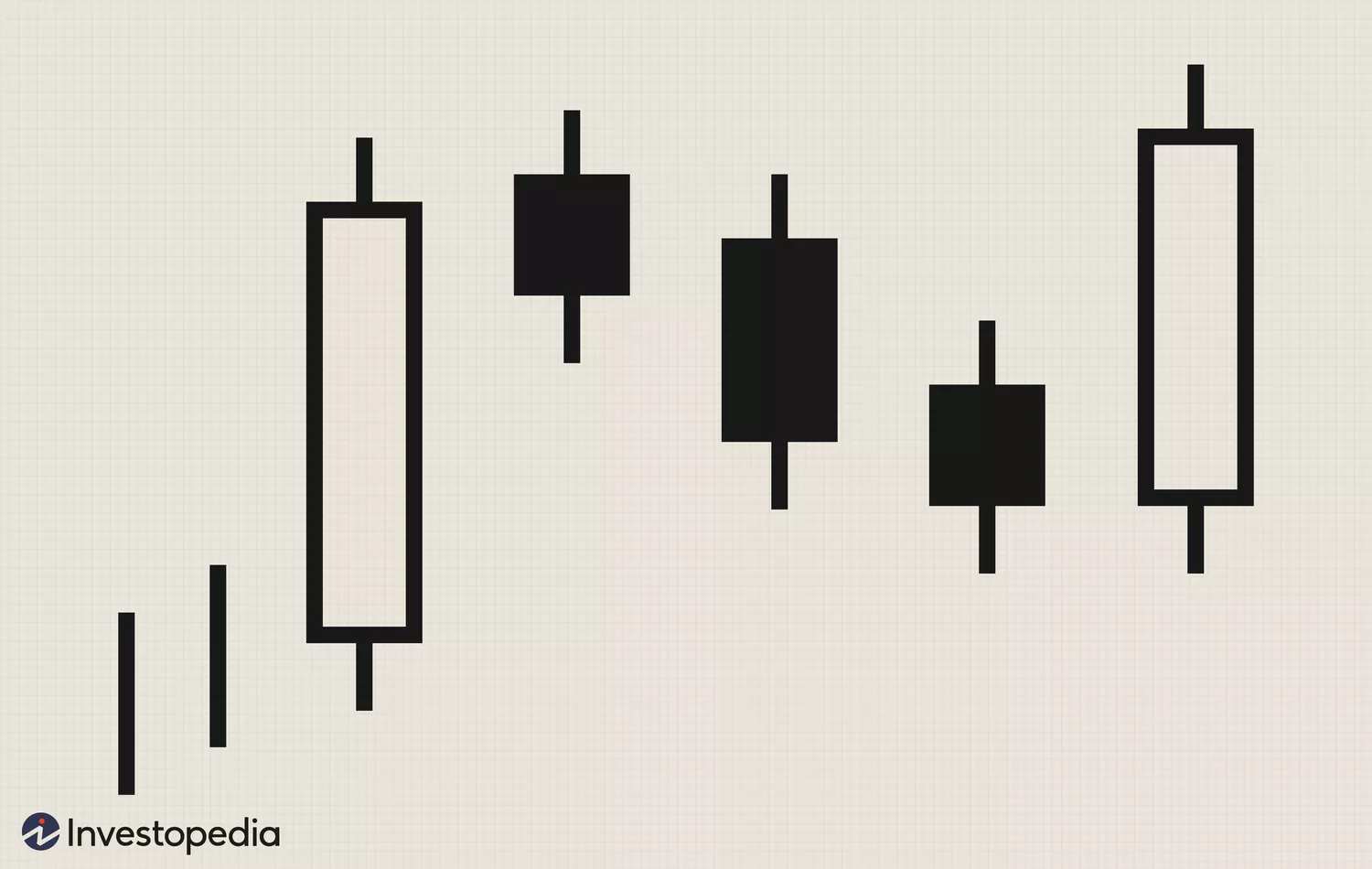

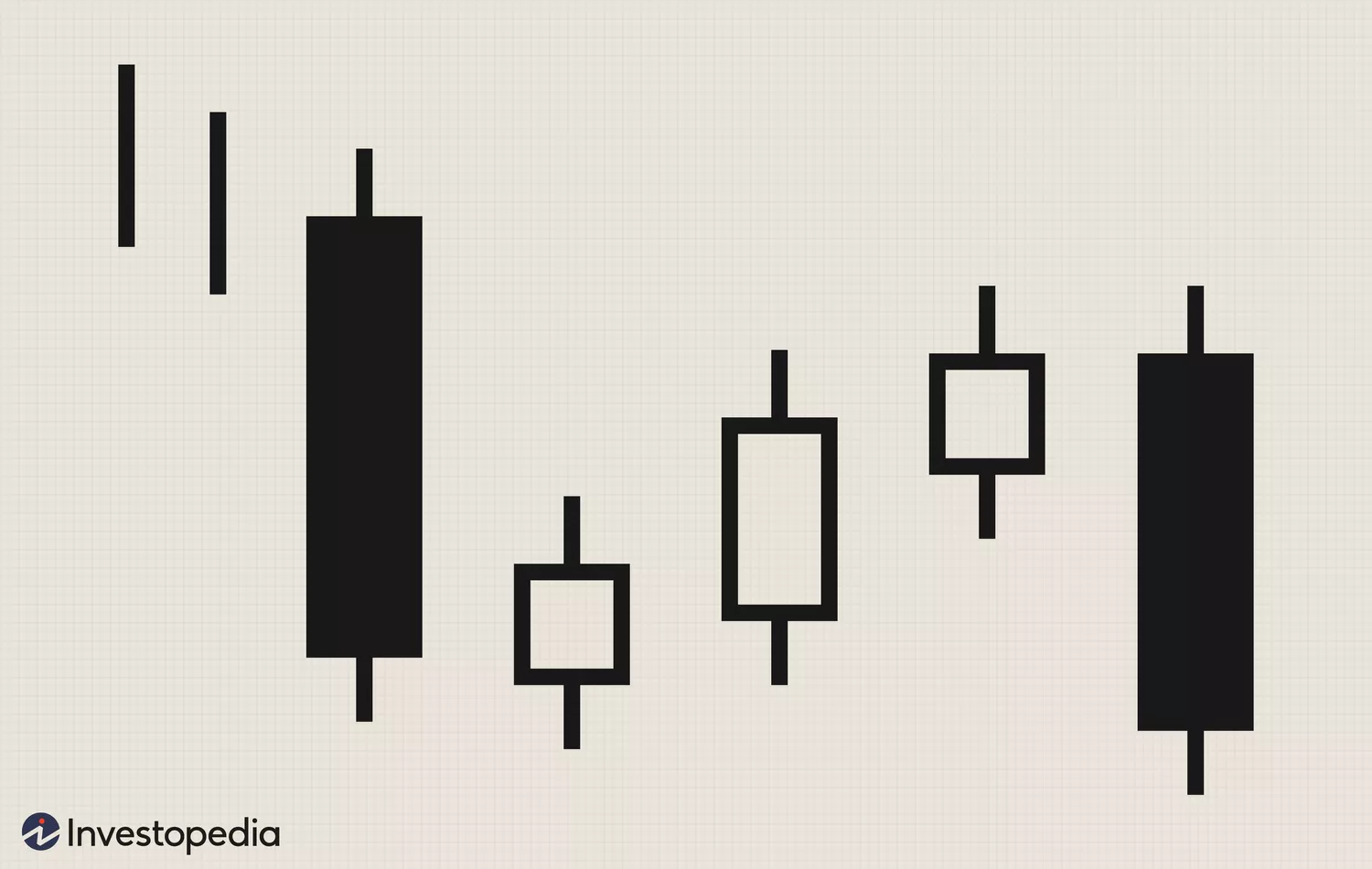

Falling Three Methods

The falling three (3) methods is a bearish continuation pattern that indicates a temporary consolidation before the downtrend resumes. It consists of a strong bearish candlestick, followed by three or more smaller bullish candlesticks that stay within the range of the first candle, and finally, another strong bearish candlestick that closes below the first candle's close. The smaller bullish candles represent a brief pause in selling pressure, but their inability to break higher suggests that bears remain in control. The final bearish candle confirms the continuation of the downtrend.

Investopedia / Julie Bang

Comparing Candlestick Charts to Other Chart Types

Candlestick charts offer superior visual representation and pattern recognition, making them ideal for active traders. While bar charts provide similar data, they lack the intuitive visual signals offered by candlesticks. Line charts, though useful for spotting trends, do not provide detailed price action.4

| Feature | Candlestick Charts | Bar Charts | Line Charts |

| Price Points | Open, High, Low, Close | Open, High, Low, Close | Close Only |

| Visual Clarity | High | Moderate | Low |

| Pattern Recognition | Strong | Strong | Weak |

Practical Applications of Candlestick Charts

Candlestick charts help traders analyze potential market turning points by more clearly illustrating what's happening in the battle between the bulls and bears than bar charts or line charts. Practical applications include:4

Trend Identification: Traders and investors analyze candlestick patterns to determine whether a market is trending, though for this purpose they're best used in conjunction with an indicator such as the Average Directional Index.

Confirmation: Used with other technical analysis indicators as well as support and resistance levels, candlestick formations can flag and confirm short-term market turning points.

Limitations and Considerations

Candlesticks do have limitations. Their predictive power is limited mostly to the short term, and they are most useful to swing traders. Relying solely on candlestick patterns can lead to misinterpretations and suboptimal decision making. Incorporating additional indicators, volume analysis, support and resistance levels, and even fundamental analysis can help traders and investors make more informed and accurate decisions.5

The Bottom Line

Candlestick charts help traders and investors analyze price movements, market sentiment, and trend reversals. Developed in Japan, they use opening, high, low and closing prices to form predictive patterns. Since patterns can produce false signals, confirming them with support, resistance and other technical tools is essential.