The new ISO 20022 may benefit projects like XRP. The ICP chart shows $9.50 is the next target. DeepSnitch AI presale surged over $580,000 on January launch news.

A major shift is underway, with the financial world moving to the new ISO 20022 standard. This should also impact the crypto market, bringing new opportunities, with investors wondering what the next undervalued altcoins ready to surge will be.

Projects like XRP and ICP are on the list of cryptos expected to benefit from this change, but a big surprise could be DeepSnitch AI. This AI project brings agents that can analyze on-chain data, something that will be very necessary with this new standard. DSNT is still in presale, but it’s booming, already raising over $580,000 with the token rising 60%.

Banks are migrating to ISO 20022, but how will this affect the cryptocurrency market?

One of the most important topics right now is the new ISO 20022, a new international standard for financial transfers. Several central banks around the world have already indicated that they will adopt it, and this could impact the entire global economy, including the cryptocurrency market.

Currently, most banks and companies use the SWIFT model, which uses MT technology (such as MT103, MT202, etc.) that has limited fields and little structure. The new ISO 20022 will use XML technology, which will allow for the incorporation of much more information (such as the purpose of the payment, KYC data, company rules, etc.).

This will be the new “universal language” for global payments starting in 2026, and will allow for faster, more transparent, and traceable payments. Crypto companies that can connect to this language will have a greater chance of being used by banks (like CBDCs, international remittances, etc). And some cryptos are already ready for that.

For example, Ripple was one of the first cryptocurrencies to adapt to this new ISO 20022 standard (actually, since 2022). This means XRP is already 100% compatible and can offer real interoperability with banks, giving a huge competitive advantage, and could help it gain major global adoption. This positions XRP as a potential next crypto to explode.

DeepSnitch AI: The crypto with 100x potential

The trending topic now is the shift of the global financial system to ISO 20022, which could impact several crypto projects, and DeepSnitch AI is one of them. Although it’s an artificial intelligence project that seems unrelated to this transition, DSNT could greatly benefit from it.

DeepSnitch AI is a blockchain intelligence project that uses five AI agents to monitor and track on-chain activities. For example, the SnitchFeed agent tracks whale movements, while the SnitchScan agent analyzes token security and scam suspicions. It’s not a blockchain that can provide a structure for payments (like XRP), but it is an on-chain data analysis platform.

This allows DSNT to offer a benefit that is not direct, but indirect and strategic, because ISO 20022 will require a lot of data messages (KYC, AML, LEI, transaction purposes), which will generate a massive volume of data. Processing all of this will be laborious and will require the use of advanced tools, like DeepSnitch AI.

This places DSNT on a select list of potential projects to benefit from the new ISO 20022, making it a potential next big cryptocurrency in 2026. Its presale is booming, but you can still invest cheaply in the token, which is currently at $0.02477. A great entry point for those seeking the next crypto to explode with 100x potential.

ICP: Swiss banks plan to use ICP with ISO 20022

Being compatible with the new ISO 20022 standard is merely a technical requirement for a crypto to offer interoperability with the banking system. It doesn’t guarantee global adoption, but offering this gives it an advantage. This is the case with Internet Computer.

While ISO 20022 requires messages with a lot of data structure, most blockchains have expensive or limited storage, unable to store everything necessary. ICP allows storing gigabytes of on-chain financial data for cents. It’s one of the reasons why ICP was chosen to partner with major Swiss banks, like Sygnum Bank.

Switzerland has “Crypto Valley” (a pioneering region for crypto projects), and banks like Sygnum see ICP not just as a token, but as blockchain infrastructure that can be used to connect tokenized finance with global finance, within the ISO 20022 standard.

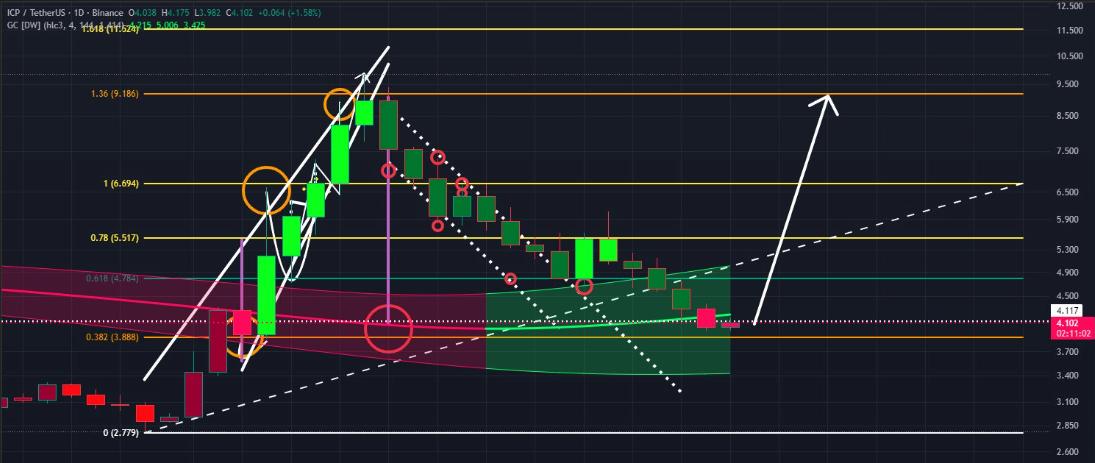

Looking at the chart, after falling 40% in November, ICP may be starting its next upward movement, to test $9,50 again. This could take days, but with Internet Computer on the list of cryptos ready to be used in ISO 20022, we have a perfect scenario for ICP to be one of the next cryptos to explode.

HBAR: ISO 20022 may cause a rise in token demand

For a bank to communicate directly with a cryptocurrency (without needing 50 intermediaries), that crypto needs to speak the same “language,” which in this case is the new ISO 20022 standard. Hedera Hashgraph has been certified as ready to connect and approved by the committee itself.

Among several necessary technical items, HBAR offers a cheaper on-chain traceability structure, as well as a secure blockchain for transacting sensitive data. Having Google and IBM on its governance board helps HBAR convey even more security and trust to the institutional market.

If chosen as one of the infrastructure for use by 20022, this could bring a real increase in transaction volume on the network, with banks needing to buy the token to make transactions, and causing a rise in the demand for HBAR for fees and staking. This is why HBAR is projected as one of the next cryptos to explode in 2026.

Conclusion

The new ISO 20022 is expected to impact the financial world, and projects like XRP, ICP, and HBAR, which already have infrastructure to connect to this new model, could benefit. However, because they are already established projects, this limits their potential gains.

Projects like DeepSnitch AI could benefit indirectly, as they have the technology to analyze large volumes of on-chain data using AI. And because they are still in presale, they offer investors the opportunity to invest at a low price, with more upside and a 100x return potential, making DSNT the best choice of the next crypto to explode.