BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January.

The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Continues To Accumulate ETH

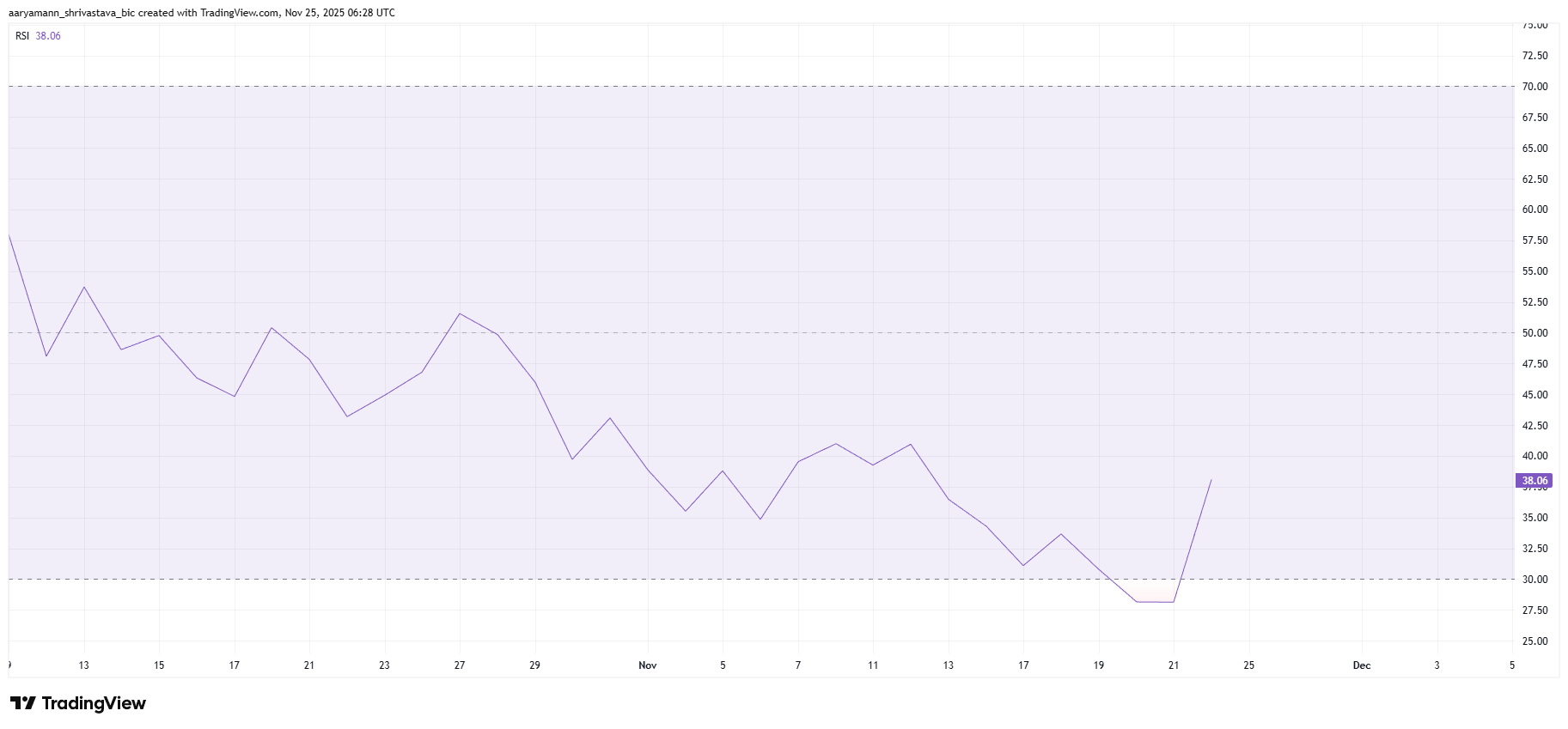

The relative strength index is showing a sharp uptick following BitMine’s major ETH acquisition. The purchase, equivalent to roughly 3% of Ethereum’s total circulating supply, sent a clear signal of confidence from the company. This triggered widespread optimism among investors and lifted the RSI out of oversold territory, a zone that typically precedes trend reversals.

However, the RSI alone cannot confirm a sustained bullish shift. While the indicator’s rise suggests improving sentiment, BMNR still requires consistent buying pressure to support a full recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR RSI. Source: TradingView

Macro momentum indicators highlight another critical area to watch. The Fibonacci Retracement tool shows that BMNR is approaching the 23.6% Fib line, a historically important support level during bearish phases. This threshold, positioned at $31.46, represents a potential pivot point for the stock.

Reclaiming this level as support would strengthen BitMine’s recovery outlook and enable a more convincing bounce. However, the stock remains just below this threshold and still requires stronger bullish participation to break through.

BMNR Fibonacci Retracement. Source: TradingView

BMNR Price Reclaims $30

BMNR is trading at $31.10, hovering above the crucial $30.88 support zone. Despite the recent ETH-driven rally, the stock remains down nearly 42% for the month. This positions Monday’s surge as an important—but not yet decisive—step toward recovery.

If bullish momentum persists, BMNR could climb toward the $34.94 resistance level. A break above this barrier may pave the way for further gains toward $37.27 and beyond. This is especially true if investor confidence strengthens around BitMine’s aggressive accumulation strategy.

BMNR Price Analysis. Source: TradingView

If uncertainty prevails and the company fails to capitalize on the excitement surrounding its ETH purchase, BMNR risks losing the $30.88 support. A breakdown could send the stock to $27.80 or even $24.64. This would invalidate the bullish thesis and signal continued weakness in the short term.