PENGU is showing early signs of recovery, holding firm above key support as participants watch for a potential short-term momentum shift.

PENGU’s latest intraday rebound has brought a bit of fresh energy back into the chart, with buyers stepping in right where support was starting to thin out. The recovery wasn’t explosive, but it was steady enough to lift confidence across the community.

PENGU Posts Intra-Day Recovery

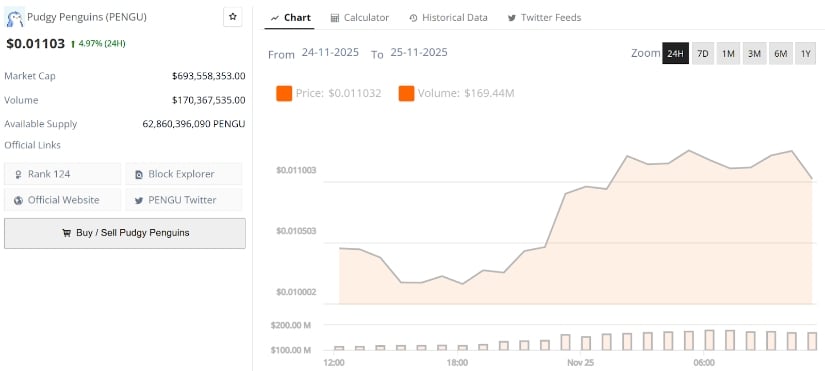

PENGU saw a steady intraday lift, reclaiming the $0.0106–$0.0110 pocket after a brief dip earlier in the session. The short-term chart shows buyers defending the micro-support around $0.0104, which has now acted as a reaction zone multiple times. Volume also picked up slightly during the bounce, hinting that some sidelined traders used the dip to position.

Pudgy Penguins’ current price is $0.01103, up 4.97% in the last 24 hours. Source: Brave New Coin

While this isn’t a major trend shift, it does show that PENGU has absorbed part of the recent selling pressure. A push towards $0.0112–$0.0113 remains possible if momentum continues, especially as short-term structure looks more stabilised compared to the previous day.

Pudgy Penguins Community Still Showing Confidence

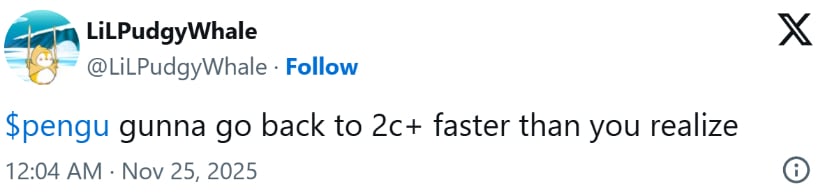

Some parts of the Pudgy Penguins community remain highly optimistic, and posts like the one from LilPudgyWhale reflect that sentiment well. Despite volatility, there’s still a belief that PENGU can re-approach the $0.02 range over time.

Pudgy Penguins’ community sentiment remains resilient, with holders still eyeing a return toward the $0.02 zone despite recent volatility. Source: LilPudgyWhale via X

These community-based expectations don’t guarantee outcomes, but they do show confidence hasn’t collapsed. When retail sentiment stays active during dips, it often helps keep downside pressure limited near key supports.

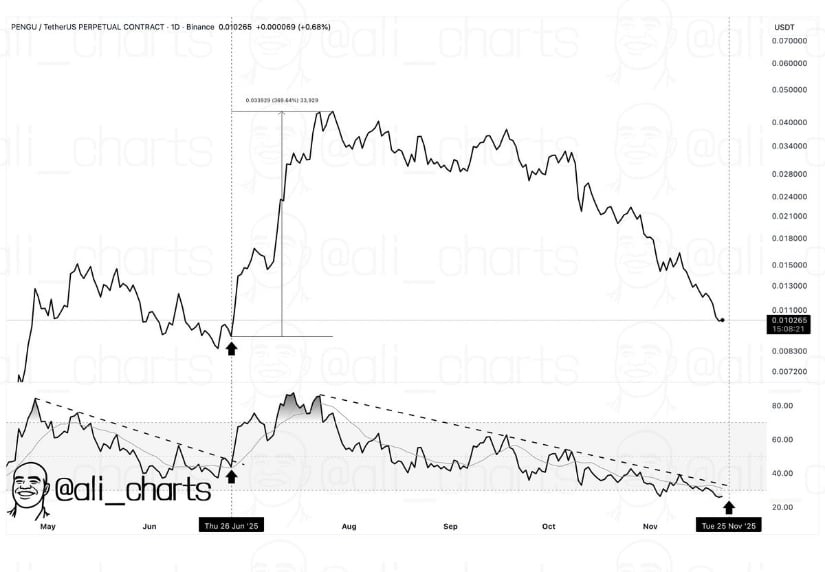

RSI Breakout Could Trigger Short-Term Momentum

Ali Martinez highlighted a key detail on the momentum side: PENGU’s daily RSI is pressing against a descending resistance trendline, the same setup that triggered a 370% move earlier in the year. Price is currently hovering near $0.0107–$0.0110, but RSI is the variable to watch.

PENGU’s daily RSI is pressing against a key descending trendline, echoing the same momentum setup that triggered a 370% rally earlier this year. Source: Ali Martinez via X

If this RSI trendline breaks, it would indicate a shift out of compression, typically followed by a short-term impulse. In that scenario, a move into the $0.0116–$0.0120 region becomes realistic, as previous breakouts saw price move quickly through thin volume pockets.

PENGU Technical Analysis

Tino_esqimo chart outlines a five-wave structure forming on the 1H timeframe, with Wave 3 already completed and Wave 4 retracing towards the $0.01050–$0.01060 zone. This matches the Fibonacci retracement cluster, signalling a healthy corrective dip rather than trend weakness.

PENGU’s 1H chart highlights a clear five-wave structure, with Wave 4 holding firm in a key Fibonacci zone. Source: Tino_esqimo via X

If Wave 5 extends fully, targets land around $0.01150 to $0.01250, with intermediate resistance at $0.01118, also aligning with the double-bottom projection. The structure remains valid as long as PENGU holds above $0.01048, which currently acts as the invalidation line for the move.

Final Thoughts

PENGU continues to show pockets of strength despite broader market volatility. Intraday recoveries hold cleanly, the community remains active, and the RSI setup hints at a possible momentum shift. At the same time, the Elliott Wave count provides a structured short-term roadmap, with targets sitting slightly above current levels.

Upside remains achievable if micro-supports continue holding and RSI confirms a breakout. But for a larger trend shift, Pudgy Penguin PENGU will still need to reclaim higher levels beyond $0.0125 with stronger volume follow-through.