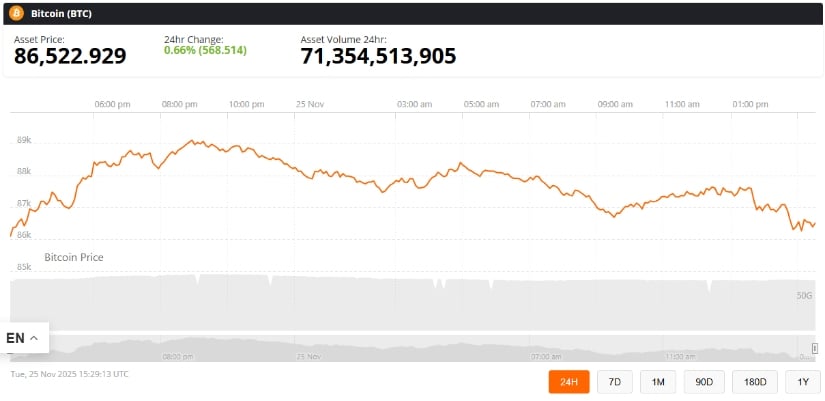

Bitcoin (BTC) is trading around $86,522, gaining 0.66% in the past 24 hours as volatility picks up ahead of key U.S. economic data releases.

Despite broader market hesitation, Bitcoin continues to defend a crucial support band that has consistently acted as a stabilizing zone throughout 2024. The level remains important as traders evaluate BTC’s market structure, institutional flows, and short-term liquidity pressures shaping Bitcoin price today.

Bitcoin Faces Resistance Near $89K

Market analyst Ted (@TedPillows)—known for tracking derivatives positioning and BTC liquidation heatmaps—reported that Bitcoin recently encountered strong selling pressure between $88,500 and $89,000, triggering a mild pullback. According to him, “$BTC faced some selling pressure around the $88,500–$89,000 zone… it could retest the $85,000 level.”

Bitcoin slips from the $88.5K–$89K resistance and may retest $85K, with a breakdown opening the door to a deeper move lower. Source: @TedPillows via X

Charts referenced in his post highlight the risk of a revisit to $85,000, a historically meaningful psychological support. This level previously acted as a stabilizer during periods of sharp volatility, similar to Bitcoin’s behavior near $16,000 in late 2022.

Two Liquidity Clusters Define Near-Term Price Action

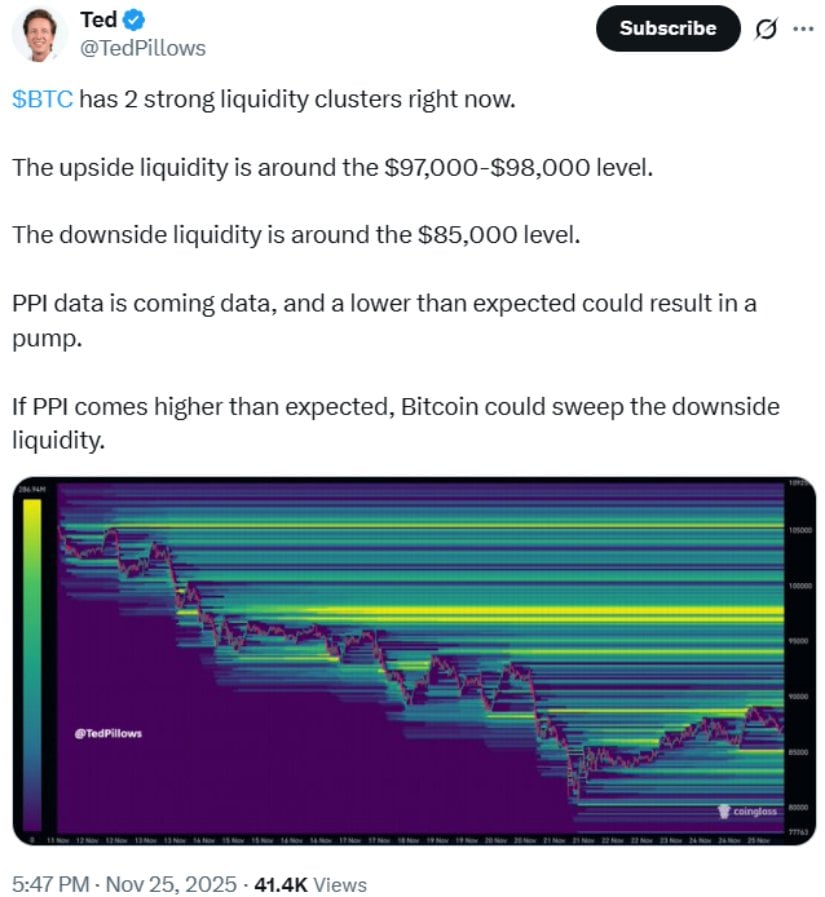

In an additional market update, Ted highlighted two major liquidity pockets shaping Bitcoin’s short-term trajectory. He noted, “The upside liquidity is around the $97,000–$98,000 level. The downside liquidity is around the $85,000 level.”

Bitcoin eyes a breakout as liquidity clusters form at $97K–$98K and $85K, with upcoming PPI data set to decide whether BTC pumps or sweeps the downside. Source: @TedPillows via X

These levels, shown on a recent Coinglass BTC liquidation heatmap, mark areas where significant leveraged long and short positions are concentrated. Liquidity clusters frequently act as magnets during volatile price swings, as large orders trigger cascading liquidations.

A clear move above the current $89K ceiling could open the door toward the $93K supply zone, an area where sellers historically outweigh buyers. Conversely, a failed defense of $85K could expose Bitcoin to a liquidity sweep toward $83K, and in more extreme cases, toward the $80K zone highlighted in prior downside events.

On-Chain and Macro Factors Keep Traders Split

On-chain metrics paint a mixed picture of current market conditions. Data shows long-term holders continue accumulating, with supply near multi-year highs—a trend typical before major volatility phases. Meanwhile, short-term holders recently registered higher realized losses after BTC failed to extend its earlier rally.

Activity on the blockchain also reflects ongoing adjustments in Bitcoin transaction fee patterns and miner behavior—topics that remain relevant as the market moves further from the Bitcoin halving 2024 date. These shifts often influence sentiment around Bitcoin’s future.

Technical Outlook: Bulls Need a Breakout Above $93K

Technical analyst ijaz_crypto, who specializes in multi-timeframe BTC market structure on TradingView, offered a detailed breakdown of Bitcoin’s recent behavior across the 1D and 4H charts.

Bitcoin battles resistance after a liquidity sweep, with $85K–$85.6K as the must-hold zone and a breakout above $93.2K needed to flip momentum toward the $98K–$100K target. Source: ijaz_crypto on TradingView

He explained that Bitcoin recently flipped a major support zone into resistance after sweeping liquidity down to $80.6K before rebounding from a daily order block. He noted, “Price is pushing upward and may retest the resistance/supply zone above. But if BTC rejects strongly from that resistance, the downside target reopens toward the 83k–86k region.”

The $85,650–$85,000 area now represents a critical buffer on the 4H timeframe. If this zone fails, momentum could shift rapidly toward $83K or even back to the previous $80K liquidity sweep.

Final Thoughts

Bitcoin’s ability to maintain support above $86K will likely determine the immediate trend as traders navigate macro uncertainty and liquidity-driven volatility. Upcoming economic data releases—including inflation and employment indicators—may play a pivotal role in defining the next major move.

Bitcoin was trading at around 86,522, up 0.66% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

For now, Bitcoin remains range-bound but stable, supported by resilient ETF inflows and firm long-term conviction. As the market balances macro risk with institutional demand, traders continue to watch liquidity clusters, ETF flow trends, and reactions to U.S. economic data to understand where BTC price heads next.