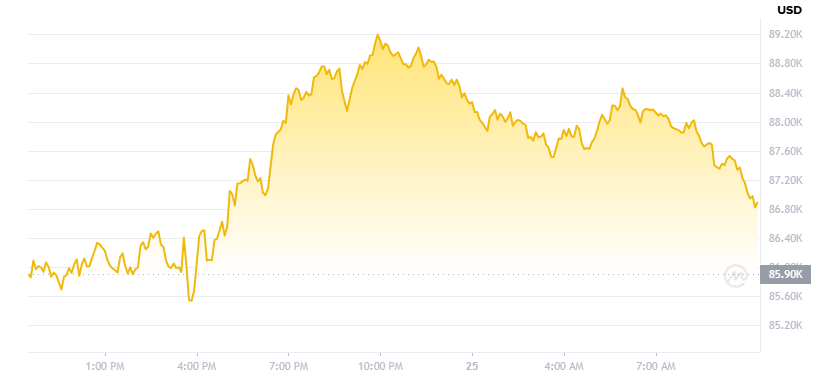

Bitcoin price prediction has become increasingly difficult to trust as BTC stalls below $87,000, weighed down by ETF outflows, treasury risks, and quiet long-term holders.

While short-term gains have sparked temporary optimism, the broader signals point to weakness and smart money is now moving into Bitcoin Hyper, a low-cap token gaining momentum ahead of its next presale price rise.

Bitcoin Price Action Shows Signs of Fragility Despite Temporary Bounce

As of today, Bitcoin’s market cap is $1.73T, with 24-hour volume reaching over $69B, up 12.12%.

While that sounds bullish, context matters: this rebound comes after BTC dropped nearly 30% from its $126K October high. Several key indicators suggest this is more likely a relief bounce, not the start of a fresh bull leg.

10X Research’s Markus Thielen noted that ETF outflows hit $3.5B in November, the largest since February, hinting that institutional buyers are retreating. Instead of absorbing dips, these funds have become net sellers, adding pressure to the market.

The Volume/Market Cap ratio sits at 3.98%, indicating moderate activity, but not the kind of breakout energy seen during real bull runs.

With supply nearing its cap – 19.95M BTC already circulating out of 21M total – there’s little narrative left to drive explosive demand unless new catalysts emerge.

Rate Cut Rumors Stir Hype, But Macro Uncertainty Remains

Fed-watchers are pricing in a potential rate cut in December, which initially helped lift BTC off its monthly lows. However, analysts now say it may be a “hawkish cut” – a defensive move during economic weakness, rather than a green light for high-risk assets.

Bitcoin has failed to reclaim the $90,000 resistance zone, and if that level holds, the next leg down could send BTC toward $85,000, or worse – $80,000, where the next major support level sits.

Adding to the caution: on October 10, a single leveraged liquidation event erased $19B from the market in one day. That memory still haunts traders who now see every rally as a potential exit opportunity, not a breakout.

Long-Term Holders and Cycle Believers Are Quietly Cashing Out

Historically, Bitcoin’s four-year cycle driven by halvings has played out with surprising consistency. But this time, many believe it’s breaking down.

According to blockchain analyst Nicolai Søndergaard, OG holders are aging out of the game:

“There has been OG people selling every single cycle… Maybe I’ve gotten old enough, and I want to use this money now for something else.”

This demographic shift, combined with growing skepticism around the halving’s impact, is creating a soft top. With whales and long-term wallets offloading ahead of the expected 2026 run-up, momentum is drying up.

Bitcoin Treasury Giant Faces Index Removal – Risk of Broader Sell-Off

New pressure is also emerging from the traditional finance side. Strategy, one of the largest Bitcoin treasuries, is facing potential removal from MSCI indexes following warnings by JPMorgan.

Their reason? Too much volatility, balance sheet strain, and underperformance. If removed, funds tracking MSCI would be forced to dump Strategy’s shares, which could trigger collateral Bitcoin selling.

Strategy founder Michael Saylor fired back on X, insisting the firm is a real company, not a passive trust:

“We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy.”

Still, optics matter. If Bitcoin treasuries start getting labeled as too risky for indexes, it could lead to a wave of deleveraging across the sector – and that’s when price floors collapse.

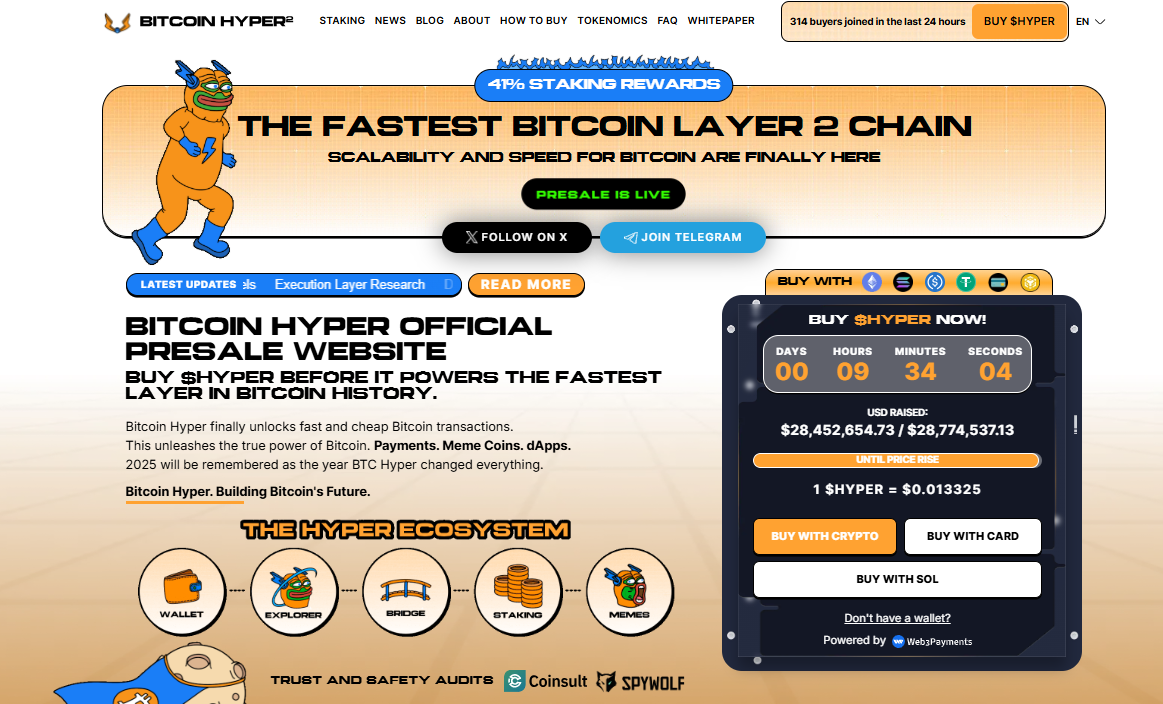

While Bitcoin Stalls, Bitcoin Hyper Raises Over $28M – Whales Are Jumping In

Amid this backdrop, Bitcoin Hyper is emerging as a whale-favored alternative. The presale has just crossed $28.45 million, pricing each $HYPER token at $0.013325 – with less than $322,000 left before the next price jump.

One whale wallet was spotted buying exactly $28,191 worth of $HYPER, according to presale data. That’s not retail curiosity – that’s deliberate rotation from BTC into a fresh play.

Why the interest?

Deflationary tokenomics paired with a fixed early-stage price

A low-cap narrative positioned to capitalize on Bitcoin fatigue

Viral growth mechanisms baked into the referral structure

In contrast to Bitcoin’s tired macro struggles, Bitcoin Hyper is being framed as the “momentum reset” token. For traders seeking upside, it’s easier to triple your capital at $28M market cap than to expect BTC to reclaim $150K anytime soon.

And with Bitcoin whales moving in already, the signal is clear: while BTC holds the throne, $HYPER is where the action is building.