XRP is showing renewed resilience above $2, bouncing off key support as traders watch for signals that could influence the cryptocurrency’s medium-term trajectory.

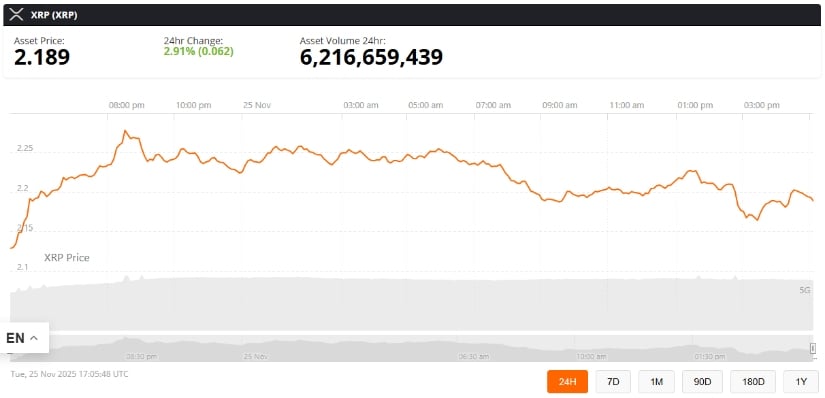

The cryptocurrency is currently trading around $2.19, up approximately 2.9% over the past 24 hours, with a 24-hour volume of $6.2 billion. This price action places XRP close to the psychologically significant $2 support level, an area closely monitored by analysts and investors amid periods of consolidation and heightened market volatility.

Technical Outlook: 100 WEMA in Focus

XRP’s weekly chart indicates a retest of the 100-week Exponential Moving Average (WEMA) at approximately $1.90, the first since its breakout in November 2024. This moving average coincides with the Supertrend indicator, creating a technical confluence that historically can act as a stabilizing support zone. “$XRP has the potential to turn the 100 WEMA into support. This is the first retest of this moving average since the break above in Nov 2024,” noted independent market analyst @ChartNerdTA, who focuses on trend-based models and medium-term technical analysis.

XRP tests the 100-week WEMA near $1.90, aligned with Supertrend support, marking its first retest since November 2024. Source: @ChartNerdTA via X

From an educational perspective, the 100 WEMA is often used by traders to assess medium-term trends, as price reactions at this level can indicate periods of accumulation or consolidation. Historical fractals, like those seen in 2017, are included as reference points; however, these patterns are illustrative rather than predictive, given that market conditions and liquidity differ across cycles.

On-Chain Activity: Whales in Focus

On-chain data shows notable activity from large XRP holders, often referred to as whales. Over the past 72 hours, addresses holding between 1 million and 10 million XRP reduced their holdings by over 180 million tokens, coinciding with a 17% price surge. “While $XRP jumped 17% in the last 72 hours, whales used the move to lock in profits,” reported @ali_charts, who monitors blockchain metrics and supply concentration.

XRP jumps 17% in 72 hours as whales sell over 180M tokens to lock in profits. Source: @ali_charts via X

According to Santiment on-chain analytics, the total supply held by these large addresses fell from roughly 6.3 billion XRP in mid-October to about 4.7 billion by late November. While this may reflect profit-taking, historical analyses suggest whale activity sometimes aligns with consolidation bottoms, depending on the broader accumulation trend.

Providing context, traders often interpret whale reductions cautiously: the move does not inherently drive price direction but offers insight into market sentiment and liquidity distribution.

Key Support and Resistance Levels

XRP’s current technical range highlights critical support between $1.90 and $2.00, with immediate resistance at $2.35–$2.45. These levels are derived from historical price reactions and trendline analysis, providing context for short-term market behavior.

XRP rebounds from $2 support, hinting that the 2017 fractal pattern may still be influencing price action. Source: @galaxyBTC via X

Support: $1.90–$2.00

Resistance: $2.35–$2.45

Potential extension scenario: ~$4 (based on historical consolidation patterns and prior swing highs, but not a guaranteed target)

The support zone is crucial for near-term stability. A breach below this range could prolong consolidation or trigger short-term weakness, while a sustained hold may indicate balanced supply-demand dynamics.

Market Implications

For traders and investors, XRP’s retest of the $2 support and 100 WEMA presents a scenario-based inflection point rather than a definitive forecast:

Scenario 1: Holding above $2 may allow consolidation and gradual upward momentum, assuming liquidity conditions remain supportive.

Scenario 2: Falling below $1.90 could lead to extended consolidation or pressure toward lower support, emphasizing the need for cautious position sizing.

Integrating technical and on-chain insights offers a broader risk framework, encouraging market participants to consider multiple signals rather than relying solely on short-term price moves.

Final Thoughts

XRP is navigating a delicate balance between support and resistance, with the 100-week WEMA providing a key reference for trend assessment. While whale activity and historical fractals provide context, these factors should be interpreted as part of a wider analytical approach rather than deterministic predictors.

XRP was trading at around $2.18, up 2.91% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Traders are advised to maintain risk awareness and combine technical analysis, on-chain metrics, and market context when evaluating XRP’s near-term prospects.