OpenAI has locked itself into $288 billion worth of cloud compute deals and now needs to raise another $207 billion by the end of 2030 to stay in the game, according to HSBC’s US software and services team.

The eye-watering figure comes after two major compute rental agreements were disclosed; $250 billion from Microsoft in late October and $38 billion from Amazon just days later.

The deals boosted OpenAI’s total contracted compute power to 36 gigawatts, adding four more on top of what it had already committed to.

That capacity won’t even fully come online before 2030. Only a third of that 36GW is expected to be deployed by the end of the decade. But OpenAI will still have to pay up. HSBC says it’s looking at an annual data center rental bill of around $620 billion, with the total value of all these deals climbing toward $1.8 trillion.

That’s just the cloud part. And despite the private nature of OpenAI’s finances, it’s now becoming clear why CEO Sam Altman keeps dodging detailed funding questions. This is not a revenue machine. It’s a cash pit.

HSBC models 3B users, 10% conversion to paid

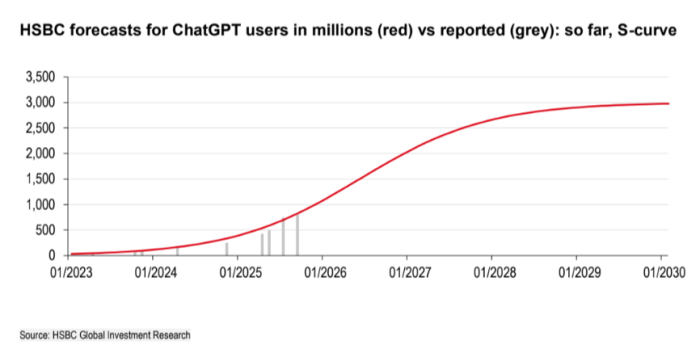

To figure out if OpenAI can even survive its own contracts, HSBC built a forecasting model. It starts with a target of 3 billion users by 2030, which would be about 44% of all adults outside China.

For now, OpenAI reportedly sits at around 800 million users. Most aren’t paying a cent. The company’s short-term plan is to convince more users to sign up for subscriptions while it continues building out other revenue lines.

That includes agentic AI, advertising, and whatever Jony Ive’s rumored hardware project turns into. But the core of the model assumes that OpenAI subscriptions for large language models will become “as ubiquitous and useful as Microsoft 365,” with 10% of users paying by 2030, up from around 5% now. The model also throws in a 2% slice of the global digital ad market as potential revenue.

All that produces solid revenue growth, but HSBC says costs are rising just as fast. So even in a best-case scenario, OpenAI will still be subsidizing most of its users well into the next decade.

That means every fundraising round between now and then will just go straight to data center owners.

HSBC also shared its assumptions. Consumer AI revenue is expected to hit $129 billion by 2030, split between $87 billion from search and $24 billion from ads.OpenAI’s consumer share drops from 71% to 56% by then, as Anthropic and xAI eat into the pie and a mysterious “others” bucket takes 22%.

Google isn’t even counted. On the enterprise side, OpenAI’s market share drops from about 50% to 37%, while the overall enterprise AI revenue hits $386 billion annually.

$207B hole, Altman tired of explaining it

Despite all that revenue modeling, HSBC says the math still doesn’t work. The firm projects cumulative rental costs of $792 billion between now and 2030. That jumps to $1.4 trillion by 2033.

Meanwhile, OpenAI’s total free cash flow by 2030 might reach $282 billion, and Nvidia’s capital injections plus the sale of AMD shares could bring in another $26 billion.

There’s also $24 billion in unused debt and equity facilities, and $17.5 billion in available liquidity by mid-2025.

That still leaves a $207 billion funding gap.HSBC adds a $10 billion cash buffer, just in case. And that’s with what they call “cautious” assumptions.

For example, each additional 500 million users could add $36 billion in revenue by 2030. Converting 20% of users into subscribers could generate $194 billion more. The model doesn’t even factor in OpenAI stumbling into Artificial General Intelligence.

But if revenue growth slows, or investors stop buying the hype, OpenAI may have to make decisions it doesn’t want to. Oracle has already made bond markets nervous. Microsoft’s support has been “a bit flip-flop lately,” and SoftBank is the second-largest shareholder.

The report says ditching some cloud capacity early, before the usual 4-to-5 year term, isn’t off the table. HSBC wrote:

“Given the interlaced relationships between AI LLM, cloud, and chips companies, we see a case for some degree of flexibility at least from the larger players… less capacity would always be better than a liquidity crisis.”

And here’s how bullish HSBC still is on AI overall: “We expect AI to penetrate every production process and every vertical, with a great potential for productivity gains at a global level… A few incremental basis points of economic growth (productivity-driven) on a USD110trn+ world GDP could dwarf what is often seen as unreasonable capex spending at present.”

When they say it like that; what’s another $207 billion between friends?

The smartest crypto minds already read our newsletter. Want in? Join them.