Blockchain technology operates as disconnected networks. Bitcoin, Ethereum, and Solana each dominate separate verticals: store of value, DeFi depth, and transaction speed. Users attempting cross-chain activity face delays, fees, and security risks.

LiquidChain ($LIQUID) launched its crypto presale with a Layer 3 model that merges these three ecosystems.

Unified liquidity pools aggregate Bitcoin, Ethereum, and Solana assets into one execution environment. No wrapping required, no centralized custodians.

The presale attracted over 3.3 million staked tokens at $0.0122 per token. Over $40,000 raised shows early commitment from participants locking positions ahead of the mainnet launch.

For investors scanning infrastructure plays with measurable utility, this crypto to buy offers one of the best access.

Three Separate Blockchain Ecosystems Operate Without Unified Liquidity

Bitcoin, Ethereum, and Solana each dominate separate verticals. Bitcoin functions as a store of value. Ethereum hosts the deepest DeFi protocols and liquidity pools. Solana delivers fast transaction speed for high-frequency applications.

Current blockchain technology forces these ecosystems to operate in isolation. Traders and protocols remain siloed within their chosen chain. Liquidity sits trapped without efficient cross-chain access.

Users face cumbersome bridging when interacting cross-chain. Multi-chain transactions require swaps and multiple steps. Slow, costly, and risky processes create friction.

Wrapped asset risks introduce centralized custodians or synthetic tokens vulnerable to hacks. Developer redundancy increases costs and splits user bases across chains. Siloed capital limits market efficiency. Billions in liquidity remain locked within separate ecosystems.

DeFi users face friction when attempting to move assets or access opportunities across chains. LiquidChain addresses these challenges through a unified Layer 3 architecture.

Layer 3 Model Merges BTC, ETH, and SOL Into One Execution Environment

LiquidChain is a Layer 3 protocol, interoperating directly with Bitcoin, Ethereum, and Solana. The architecture combines high-performance execution with trust-minimized state verification. Cross-chain composability happens in a single environment.

The high-performance VM was built for real-time, complex DeFi applications across multiple chains. Solana-class execution environment powers instant cross-chain operations. The Liquid VM executes multi-chain operations instantly with Solana-class throughput.

For traders, this means executing swaps that tap liquidity from three separate ecosystems in one transaction. Deeper pools, faster execution, better price. Single-step execution eliminates the need for bridges or multiple transactions.

For developers of dApps, memecoins, and prediction markets, LiquidChain opens access to users across chains.

Crypto Presale Attracts 3.3M Tokens Staked at $0.0122

The LiquidChain crypto presale launched with strong early participation. Over 3.3 million tokens are already staked by participants positioning ahead of mainnet launch. The entry price sits at $0.0122 per token.

The presale raised over $40,000 from early adopters. Participants locking positions show conviction in the cross-chain infrastructure thesis.

The staking mechanism reduces circulating supply during early growth. Locked tokens create potential pressure as adoption rises. The presale phase precedes mainnet launch and Q3 2026 centralized exchange listings.

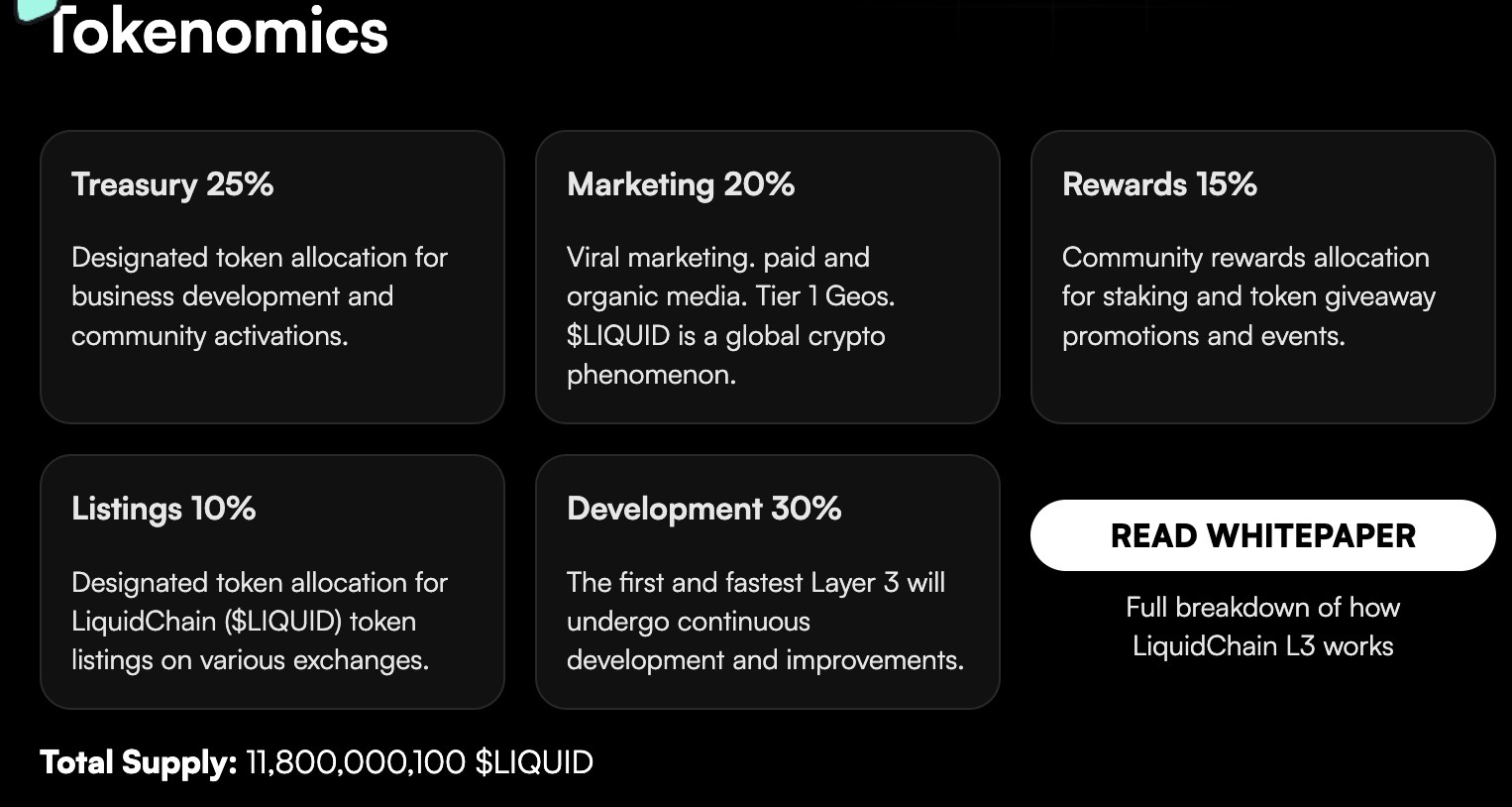

Total supply stands at 11.8 billion $LIQUID tokens. Development receives 30% for continuous infrastructure improvements. Treasury holds 25% for business development and community activations.

Marketing claims 20% to drive adoption across Bitcoin, Ethereum, and Solana communities. Rewards allocate 15% for community staking and token giveaway promotions and events. Listings receive 10% for exchange integration support.

Why $LIQUID Stands Out as an Altcoin to Buy for Cross-Chain Infrastructure

$LIQUID powers the LiquidChain ecosystem across multiple functions. Network transaction fees get paid in $LIQUID. Liquidity providers earn $LIQUID rewards proportional to their contribution to unified pools.

Developers staking tokens receive grants to build applications on the platform. Community rewards support staking and token giveaway promotions and events. The token fuels the entire cross-chain economy.

The roadmap progresses through four development phases. Phase 1 introduces the crypto presale with testnet L3 infrastructure and cross-chain VM deployment. Developer SDK and API beta release begin during this phase.

Phase 2 launches $LIQUID token and unified liquidity pools. Multi-chain swaps and settlements activate. Early dApp partnerships launch to demonstrate cross-chain utility.

Phase 3 deploys LiquidChain Mainnet with live production infrastructure. Developer grant and incentive programs begin to bootstrap ecosystem applications. Cross-chain derivatives and lending modules launch to expand DeFi functionality.

Phase 4 focuses on governance implementation and global scaling. Layer 2 rollups and emerging L1s integrate into the unified liquidity model. Partnerships with major DeFi protocols and exchanges expand network effects.

Each roadmap phase expands utility and increases network demand for $LIQUID. As developers build applications, users execute cross-chain transactions, and liquidity providers stake positions, the token becomes the fuel.

How to Join the LiquidChain Presale Before Mainnet and Exchange Listings

Joining the LiquidChain crypto presale requires a few simple steps. Participants need crypto from a preferred exchange and a compatible wallet. Best Wallet or MetaMask work for presale participation.

Step 1: Get crypto from an exchange. Visit the LiquidChain official website after setting up a wallet. Participants need funds ready to purchase $LIQUID tokens.

Step 2: Participate in the $LIQUID crypto presale. Click any Buy or Connect Wallet buttons on the LiquidChain website to start.

Step 3: Choose the amount of $LIQUID to purchase. Confirm the transaction in the wallet. Select the Buy and Stake option to start earning rewards immediately.

Step 4 (Card Payment): Paying by card requires connecting a mobile crypto wallet or browser extension wallet. Choose Buy With Card and follow the prompts. The wallet receives tokens after transaction confirmation.

The presale window closes before mainnet launch and exchange listings. $LIQUID will debut on decentralized exchanges prior to mainnet launch. Centralized listings are targeted for Q3 2026.