LiquidChain is a new Layer 3 (L3) blockchain project that’s expected to trade as high as $0.110 in 2026 and reach up to $0.135 by the end of the decade. The project is currently in its presale phase, raising funds as it builds the first-ever liquidity layer combining Bitcoin, Ethereum, and Solana.

The native crypto, LIQUID, is priced at $0.0123 per token and gradually rises after each presale phase. In our LiquidChain price prediction, we analyze the project’s future performance and potential price scenarios through 2030.

Liquidchain Price Prediction 2025–2030

Here are the key takeaways of our LiquidChain (LIQUID) price estimates:

LiquidChain introduces the first Layer 3 blockchain that pools liquidity from Bitcoin, Ethereum, and Solana. Its presale has already raised over $45.6K, with over 3.4 million LIQUID tokens sold.

It’s estimated that LiquidChain launched with an initial presale price of $0.01215, which increased to $0.0122 during the next presale stage. Throughout the token sale, we expect the price of LIQUID to increase gradually at each stage. Currently, LIQUID is priced at $0.0123.

Since the presale launched in November 2025, the project is expected to remain in its token sale phase for the remainder of the year, with LIQUID potentially being offered at up to $0.015.

According to the whitepaper, the token will go live on decentralized exchanges (DEXs) before the mainnet launch. By Q3 2026, the team plans on having LIQUID listed on centralized exchanges (CEXs), leading the LiquidChain token to trade as high as $0.1101 in 2026.

By collaborating with key ecosystem partners, expanding across blockchains, and driving sustained growth, LiquidChain could be priced as high as $0.1350 by the end of 2030.

Visit LiquidChain

Liquidchain Price History

At the presale stage, new cryptocurrency projects like LiquidChain do not have any public trading or price history. Throughout this initial phase, LIQUID will follow a fixed presale price scheme, with prices increasing incrementally at each stage.

Before the TGE, which happens after the presale ends, users can only purchase LIQUID tokens through the official presale platform. Additionally, token holders will only be able to start selling their LIQUID holdings once the native crypto launches on exchanges.

On November 11, 2025, LiquidChain officially launched its token presale. Our analysis indicates that the token sale began with the cryptocurrency initially priced at $0.01215. In the succeeding presale stage, the price increased by $0.00005 to $0.0122.

As of this writing, the LiquidChain presale is offering LIQUID at $0.0123 and has already raised over $45.6K through token sales. It’s estimated that more than 3.4 million LIQUID tokens have already been sold.

Additionally, LiquidChain offers crypto staking rewards that users can earn during the presale phase. By locking up their LIQUID token allocations, participants can earn variable presale staking rewards at up to 16,251% APY (annual percentage yield).

The presale platform will distribute staking rewards once the claim goes live. LIQUID token rewards will occur at a rate of 224.5 LIQUID tokens per ETH block. Investors have staked over 3.43 million LIQUID tokens so far.

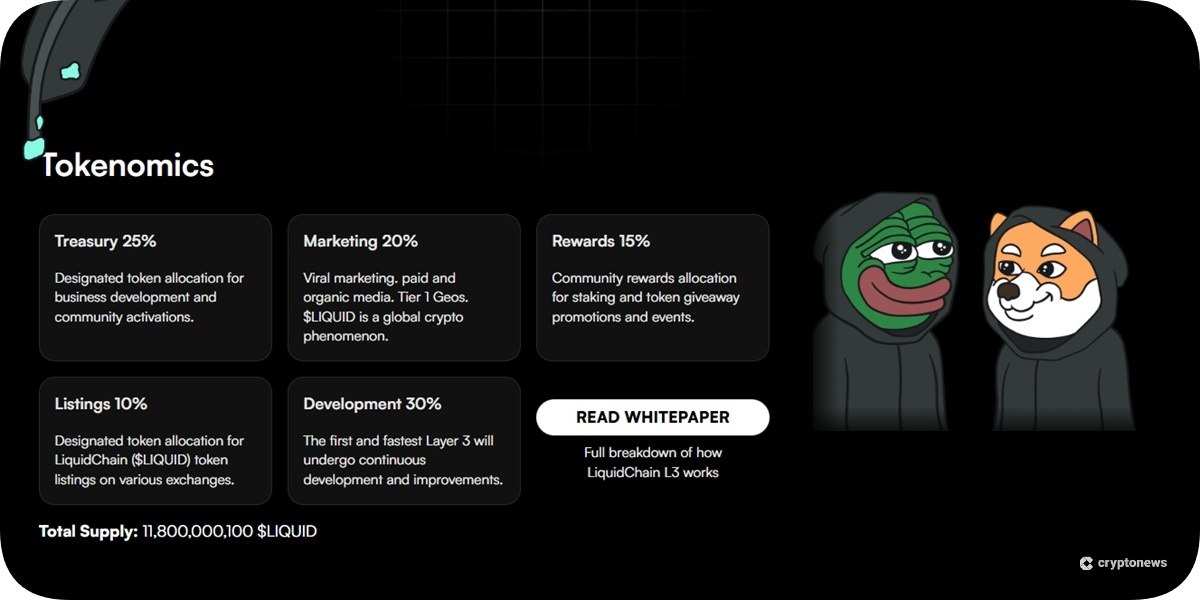

According to the LiquidChain whitepaper, the project has a fixed total supply of 11,800,000,100 LIQUID tokens. Interested investors can purchase LIQUID through the presale, which supports payments in ETH, BNB, SOL, USDT, USDC, and credit/debit cards.

Liquidchain Price Prediction 2025: Early-Stage Projections

Potential Low: $0.0126

Average Price: $0.0130

Potential High: $0.0150

Having launched its token sale in Q4 2025, LiquidChain will most likely remain in its presale phase for the rest of the year. This means the current stage of the presale will solely determine the cryptocurrency’s price.

Although LiquidChain has not disclosed any presale fundraising goals, the project has a fixed number of tokens to offer in the token sale, as with any other upcoming ICO. If demand for LIQUID tokens increases during the presale phase, each stage may sell out faster, leading to higher prices.

One way LiquidChain can increase demand for its token during the presale is through marketing efforts. According to the official presale website, various crypto publications have already featured the project, and its social media channels have been gaining traction. Just a few days after going live, the LiquidChain X account has gained over 3,000 followers.

As LiquidChain increases its exposure across the Web3 space, our price estimates suggest that the presale could offer LIQUID as high as $0.0150 and as low as $0.0126 by the end of 2025. Throughout the presale phase, the team plans on developing the testnet L3 infrastructure and the high-performance virtual machine (VM).

Liquidchain Price Prediction 2026: a Look Ahead

Potential Low: $0.0151

Average Price: $0.0520

Potential High: $0.1101

After reviewing the LiquidChain project roadmap, we believe that the presale could continue until the first half of 2026. So far, the team has not made any official announcements about when exactly they will launch LIQUID. However, the whitepaper does mention that the token will debut on DEXs before the launch of the L3 mainnet.

As with some of the fastest-growing cryptocurrency presales, the official token launch will likely face selling pressure as holders can finally liquidate their holdings. While this will be a potential challenge for LiquidChain upon launch, we predict the project can stabilize prices through staking initiatives, incentive programs, and unified liquidity pools.

LiquidChain’s CEX listings are planned for Q3 2026, which could boost exposure and demand for the cryptocurrency. Coupled with possible excitement for the mainnet launch (likely late 2026 or early 2027), LiquidChain shows strong upside potential as it achieves Phase 2 milestones and gears up for the next phase of its roadmap.

Given these estimates, we could see LiquidChain trading at an all-time high of $0.1101, representing nearly a 10x increase from the initial presale price. It’s also possible that the price could return to presale rates, falling to as low as $0.0151 in 2026.

Liquidchain Price Prediction 2030: Long-Term Estimates

Potential Low: $0.0510

Average Price: $0.0905

Potential High: $0.1350

Since LiquidChain is still in the conceptual stage, making a long-term price prediction is difficult. Even top analysts struggle to accurately predict the best crypto to buy, which have been traded publicly for years. So, consider these estimates as possibilities rather than guarantees.

By 2030, the LiquidChain mainnet would have been operational for several years, continuously deploying developer grants and community programs to sustain growth. In addition to its liquidity staking program, LIQUID holders will be incentivized to continue contributing to the L3 as builders launch more decentralized applications (dApps) within the ecosystem.

A key factor in the platform’s long-term success is its build-once architecture, which offers developers easy access to interoperability. Because LiquidChain connects major blockchains, dApps built for Layer 3 crypto will launch with compatibility across Bitcoin, Ethereum, and Solana.

Post-launch, LiquidChain also aims to provide institutions with in-depth liquidity access on the L3 blockchain, bridging traditional capital into DeFi markets.

Taking all of these possibilities into account, our price forecast suggests LiquidChain could trade as high as $0.1350 and as low as $0.0510 in 2030. Our models also show LIQUID averaging $0.0905 by the end of the decade.

Liquidchain Potential Highs and Lows

Here’s a summary of our LiquidChain price estimate ranges for 2025, 2026, and 2030:

| Year | Average Price | Potential Low | Potential High |

| 2025 | $0.0130 | $0.0126 | $0.0150 |

| 2026 | $0.0520 | $0.0151 | $0.1101 |

| 2030 | $0.0905 | $0.0510 | $0.1350 |

Our Liquidchain Price Prediction Methodology

Given that LiquidChain is currently in its presale, our price prediction was based on a fundamental assessment of the cryptocurrency. We examined all key information from the official whitepaper, presale website, and social media channels, including the project’s tokenomics, roadmap, and use cases.

Our methodology also considered LiquidChain’s latest presale performance, innovative concept, and potential for future adoption. We looked at the current presale investment figures and the total tokens staked so far. Note that all of our projections are speculative and based on assumptions from our team’s cryptocurrency expertise.

What is Liquidchain?

LiquidChain is an upcoming cross-chain unification layer built to merge liquidity across Bitcoin, Ethereum, and Solana. Through its Layer 3 network, the project aims to connect the top blockchains to address the fragmented liquidity in today’s DeFi environment.

It’s currently in its presale stage, but once launched, LiquidChain will provide deeper liquidity, high-speed DeFi trading, and safer capital flow. So far, the project has already raised over $45.6K, signalling growing investor adoption.

The native token, LIQUID, fuels the entire LiquidChain L3 ecosystem. Specifically, the cryptocurrency enables cross-chain transactions as the payment token for network and execution fees. Additionally, users can participate in liquidity staking by locking up their LIQUID holdings and providing liquidity to earn rewards.

For efficient and secure management of BTC, ETH, and SOL liquidity pools, LiquidChain users a high-performance VM for seamless multi-chain compatibility. As a result, the L3 does not require token wrapping, which can often come with custodial risks. The platform’s Solana-like VM can execute real-time transactions and handle complex DeFi applications across networks.

A key advantage that LiquidChain offers with its deep liquidity is a build-once architecture for developers. dApps, prediction markets, and meme coins developed on the L3 ecosystem will launch with built-in interoperability for the top blockchains.

When LiquidChain is live, users contributing to the liquidity staking program can earn rewards proportional to the liquidity they provide on unified pools. Additionally, presale participants can already start earning staking rewards by locking up their LIQUID holdings during the public token sale. It currently offers variable rewards with an APY of up to 16,251%.

Is Liquidchain a Buy?

As a new presale project, LiquidChain is a high-risk, high-reward crypto with its innovative L3 concept. At just $0.0123, LIQUID is worth a fraction of its potential future value, which could increase substantially in the coming years based on our price projections.

Still, the discounted price comes at a cost. Without a live L3 network or even a testnet, the project remains speculative like many crypto presales. We recommend doing your own research and following proper crypto trading risk management practices as you consider investing in LIQUID.

In our analysis, LiquidChain has the potential to become one of the top crypto projects in the coming years, driven by its liquidity-unifying concept, developer benefits, and future cross-chain expansion plans. It has also completed independent audits by CertiK and SpyWolf, demonstrating the credibility of its smart contract.

Investors can purchase LIQUID tokens through the official LiquidChain presale platform. The site accepts payments in ETH, BNB, SOL, USDT, USDC, and credit cards. Participants can choose to immediately stake their LIQUID holdings upon purchase to earn variable staking rewards.

Conclusion

LiquidChain is one of the most promising cryptocurrency projects in 2025. It’s building the first execution layer that unites BTC, ETH, and SOL for increased liquidity and more efficient cross-chain operations. Currently in its presale phase, LiquidChain continues to attract early investors as it develops its L3 ecosystem.

Our LiquidChain price prediction model indicates bullish momentum for LIQUID in the upcoming years. The 2026 forecasts suggest the cryptocurrency could reach as high as $0.1101 after the official token launch and CEX listings. By the end of the decade, we expect LiquidChain’s value to rise to $0.1350 as long-term platform adoption increases.