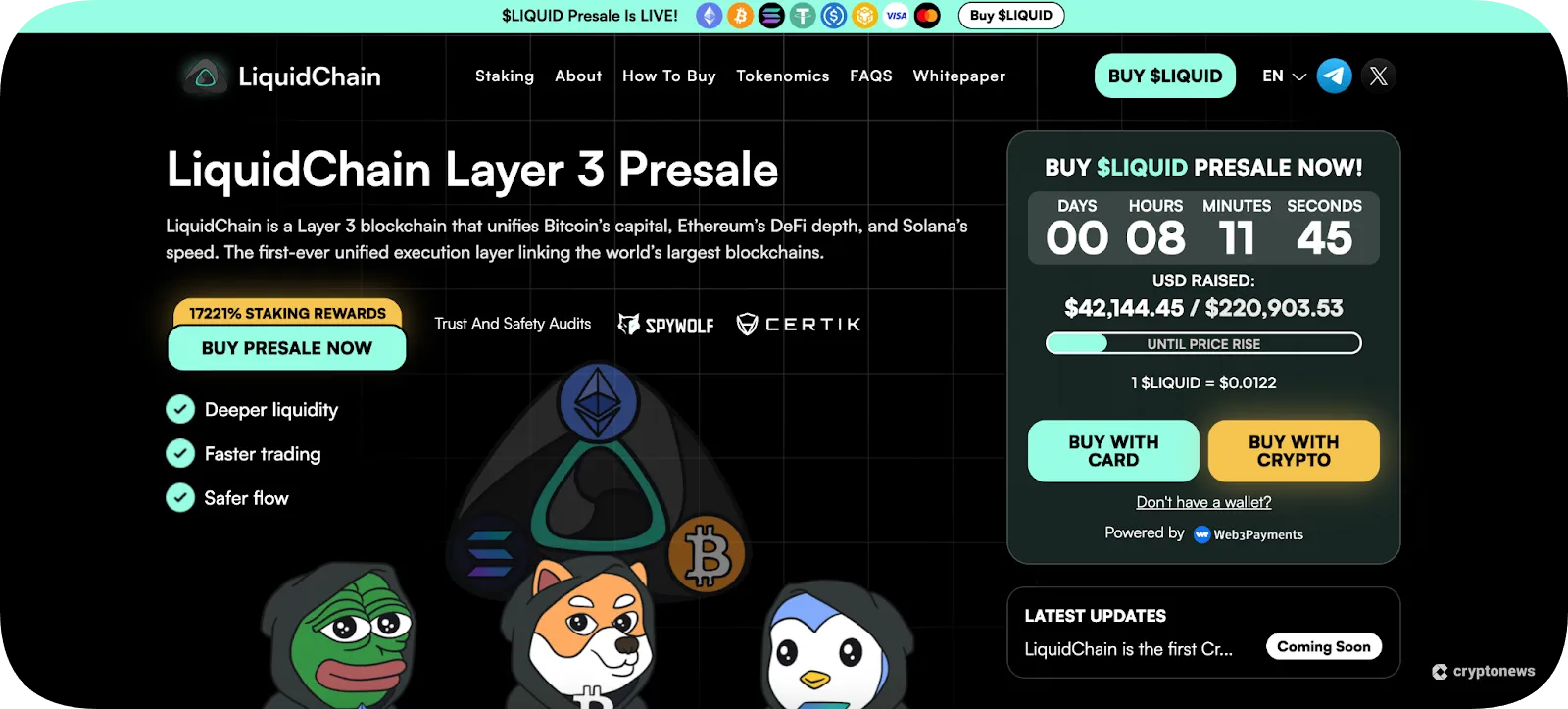

To buy LiquidChain (LIQUID), connect a non-custodial wallet to the presale website and exchange an accepted asset. Participants receive LIQUID tokens upon the end of the presale event.

LiquidChain is an innovative Layer 3 network for the three largest blockchain ecosystems: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The cross-chain technology enables faster, more scalable transactions and access to decentralized applications (dApps) without relying on wrapped tokens.

Discover more about LIQUID in this beginner-friendly guide, which includes its use cases and future potential. We also explain how to buy LiquidChain tokens in simple terms.

How to Buy Liquidchain in 4 Steps: Summarized

Follow these simple steps to invest in the LiquidChain presale:

Set Up a Secure Wallet: Download and set up a reputable non-custodial crypto wallet. Popular options include Best Wallet, MetaMask, and Exodus.

Fund Your Wallet for Swapping: Deposit or buy an accepted digital asset like ETH, SOL, Tether (USDT), or USDC (USDC).

Connect Your Wallet to the LiquidChain Presale: Visit the LiquidChain website, click “Buy $LIQUID”, and select a wallet provider.

Buy and Stake LiquidChain: To complete the purchase form, input the payment asset and amount. Confirm the investment, and stake LIQUID tokens to earn passive rewards right away.

How to Buy Liquidchain – Simple Step-by-Step Guide

New to crypto presales? The following walkthrough shows you how to buy LiquidChain. We explain each step in beginner-friendly terms, including how to set up a suitable wallet, connect to the presale website, and complete the payment form.

Step 1: Set up a Crypto Wallet

If you already have a funded crypto wallet, move straight to Step 3.

First-time buyers must download a non-custodial wallet that connects with the LiquidChain presale. The event accepts hundreds of wallet providers, although our research shows that Best Wallet is the most user-friendly option.

Best Wallet offers a free mobile app for iOS and Android that connects with 60+ networks, including Ethereum, the blockchain that LIQUID runs on. The wallet suits investors without existing crypto holdings, as it lets users buy assets with traditional money.

Go to the Best Wallet website to download the app. Then set up the app, which requires an email address and PIN. You can also activate two-factor authentication and biometrics for added safety. Ensure you write down the 12-word seed phrase for wallet recovery.

Step 2: Buy a Cryptocurrency for Swapping

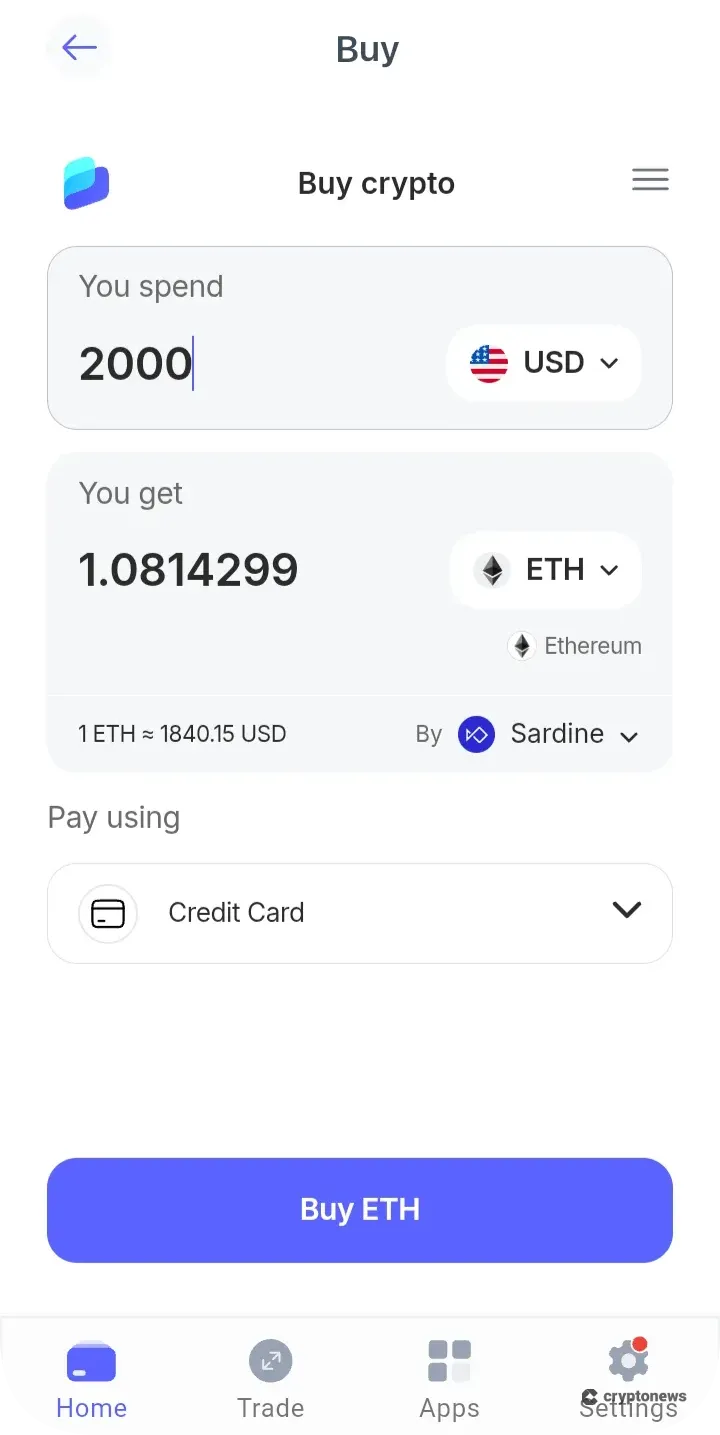

The LiquidChain presale allows participants to invest in top cryptocurrencies like ETH, USDT, USDC, and BNB. Transfer one of these assets to the Best Wallet app, or buy some via the built-in fiat gateway.

If you purchase cryptocurrencies with traditional money, buy ETH. LIQUID uses the same token standard, so you simplify the claim process after the presale.

On Best Wallet, tap “Trade” and “Buy”, and enter the local currency, purchase size, and payment method. The wallet supports dozens of deposit types like debit/credit cards, Neteller, PayPal, and Google/Apple Pay.

Step 3: Visit the Presale and Connect Your Wallet

The next step requires you to connect the Best Wallet app to the LIQUID platform.

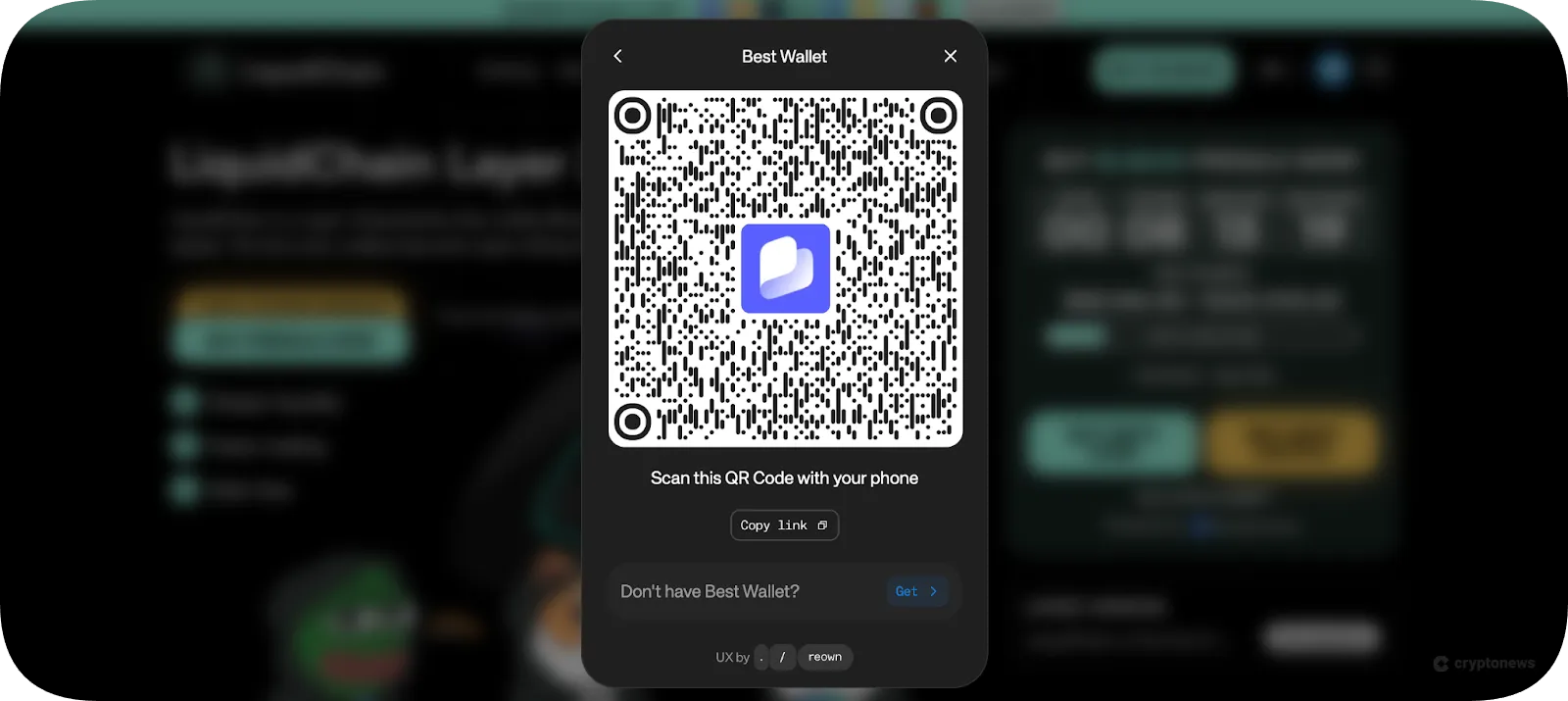

Visit the official LiquidChain website to access the presale dashboard. Click “Buy $LIQUID” and choose “Best Wallet” as the wallet provider. Then open the app to authorize the connection.

Note: If you prefer to invest in LiquidChain on a desktop device, scan the WalletConnect QR code from the Best Wallet app. Once you approve the connection, complete the LIQUID purchase on a laptop or PC.

Step 4: Buy and Stake Liquidchain

Complete the presale investment form to buy LiquidChain tokens. The dashboard requires the payment asset (e.g., ETH) and the purchase size. The platform updates the number of LIQUID tokens you receive based on stated parameters.

Finally, open Best Wallet to approve the presale purchase. A smart contract sends assets to the LiquidChain wallet, which confirms the investment.

Return to the LiquidChain website after the presale to claim your tokens. In the meantime, consider staking LIQUID to earn APYs of 16,251%. This tool enables participants to grow their token holders without requiring additional capital.

Liquidchain (LIQUID): Quick Overview

Here are the key points about LiquidChain and its native LIQUID token:

LiquidChain is a Layer 3 network for Bitcoin, Ethereum, and Solana. It merges the three largest ecosystems to create a unified liquidity pool, improve network performance, and achieve cross-chain functionality.

Platform use cases include dApp access for BTC holders, increased scalability in the Ethereum framework, and a more reliable infrastructure for Solana-based meme coins.

To mitigate security risks and ensure non-custodial control, LiquidChain relies on trust-minimized proofs rather than wrapped tokens. The project is the first to implement this innovative technological solution.

Network users pay transaction fees in the ecosystem token, LIQUID. This structure drives demand over time, which raises the asset price. Holders also use tokens for staking and governance.

The presale event lets participants buy LIQUID tokens before the initial exchange launch. Presale benefits include a discounted entry price and pre-listing staking rewards. As an inclusive project, investors buy LIQUID without completing KYC verification.

How to Avoid Scams and Stay Safe When Buying Liquidchain

While the LiquidChain presale provides a safe purchase experience, investors must be aware of general security risks. Follow these best practices to avoid scams

Buy Only From the Official Site

Phishing scams are a common threat to presale investors. Scammers create identical websites to presale projects like LiquidChain and even pay for Google ads to manipulate search results.

Connecting to these phishing websites can enable malicious smart contracts to steal funds from wallets. To avoid this scam, you can always double-check the website URL.

Here is the official URL for the LiquidChain website: https://liquidchain.com/

Never Share Wallet Credentials or Passphrase

Non-custodial wallets unlock decentralized control of private keys and stored cryptocurrencies. Yet, users are responsible for keeping wallet credentials safe.

Cybercriminals target cryptocurrency beginners through deception strategies. They often pose as support agents or promise fake rewards like airdrops. Never share your private keys or seed phrases; anyone who asks for them is a scammer.

Since these credentials provide remote access to the wallet funds, they allow bad actors to withdraw the assets.

Use a Reputable and Non-Custodial Wallet

Choosing a secure and reputable wallet provider is essential. The best crypto wallets offer advanced security features such as two-factor authentication and Multi-Party Computation (MPC). These features protect users against online threats and ensure only the wallet owner authorizes transactions.

Best Wallet and MetaMask are our top picks for hot wallets, as they combine robust security controls with a convenient interface. LiquidChain buyers who invest large amounts may consider a hardware wallet. These devices store encrypted private keys offline, thereby eliminating cybersecurity risks.

Store Your Wallet Recovery Phrase Offline

Storing seed phrases online, such as in an email draft or a notepad, can have serious consequences. As it invites online threats, scammers can remotely access the credentials.

In a recent case, an investor who accumulated $3 million worth of XRP suffered a wallet hack. The reason? They manually input their seed phrase into the wallet’s companion app, which exposes the credentials to internet servers.

The best practice is to write the seed phrase on paper.

Regularly Update Your Wallet Software

Wallet providers frequently release software updates to fix bugs and protect against new vulnerabilities. Always install these updates to keep your wallet secure.

Getting to Know Liquidchain: the Core Concepts

LiquidChain revolutionizes the blockchain sector with a Layer 3 network for Bitcoin, Ethereum, and Solana. The technology addresses several shortcomings for ecosystem stakeholders.

Bitcoin lacks smart contract support, so when users engage with the LiquidChain network, they access dApps like staking, lending, play-to-earn games, and metaverse experiences.

Ethereum is currently unable to scale past 15–30 transactions per second, resulting in higher fees and slower processing times. LiquidChain streamlines Ethereum transfers through its highly scalable framework, enabling ERC-20 projects to reduce fees and operate more efficiently.

On the Solana front, the blockchain faces regular outages, especially during ecosystem rallies. LiquidChain’s superior technology ensures Solana-based cryptocurrencies operate with 100% uptime.

In addition to dApp access and improved network performance, the Layer 3 infrastructure achieves cross-chain interoperability. This unique feature creates unified liquidity pools for BTC, ETH, and SOL assets without using the wrapped token system. Instead, LiquidChain maximizes security and decentralization through trust-minimized proofs.

Liquidchain Tokenomics

Seasoned traders evaluate tokenomics before they invest in new cryptocurrencies like LiquidChain.

The Layer 2 project created 11,800,000,100 LIQUID tokens on the ERC-20 standard. As this reflects the total supply, the founders cannot mint additional tokens. This finite mechanism protects LIQUID holders against inflationary risks.

LiquidChain allocates its fixed supply to the following areas:

30% for Layer 3 development, ongoing testing, and security improvements

25% for the treasury fund, which allocates tokens to business development, partnerships, and community activations

25% for the global marketing campaign and to raise product awareness

15% for ecosystem rewards like staking and promotions

10% for exchange listing liquidity

To ensure a smooth exchange launch, presale buyers receive LIQUID once the token generation event (TGE) goes live. This safeguard prevents presale buyers from creating secondary markets before the official listing event.

Liquidchain Roadmap

The whitepaper outlines four roadmap phases.

Here is an overview of key events and product releases:

The first phase launches the presale event. It also releases the Layer 3 testnet with cross-chain development, plus the SDK and API beta. These features provide presale investors with an early glimpse of the technology.

The team launches LIQUID tokens on decentralized exchanges (DEXs). We predict a Uniswap listing initially, as LIQUID operates on Ethereum. The second roadmap phase also covers early dApp partnerships and multi-chain swaps.

The Web 3.0 project launches its mainnet network in phase three. It also enables cross-chain derivatives trading and lending, and offers grants for skilled developers.

In the final phase, LiquidChain integrates Layer 2 rollups with emerging Layer 1 blockchains and targets partnerships with major Tier 1 exchanges and decentralized finance (DeFi) protocols.

While the roadmap serves core ecosystem developments, LiquidChain operates as a going concern. It will continue to improve and innovate, despite having completed its primary roadmap.

Has Liquidchain Been Audited?

Although LiquidChain recently launched its presale event, blockchain security firms SpyWolf and CertiK have audited the LIQUID smart contract. Both audits confirm a secure contract framework that protects holders against honeypots and other scams.

Here are links to each audit:

SpyWolf Audit

CertiK Audit

Why Should I Invest in the Liquidchain Presale?

Discover why some analysts believe LiquidChain could be the next crypto to explode in 2025.

First-Mover Advantage

The presale event gives early investors the chance to invest in LiquidChain from the ground up. This perk helps investors secure the lowest market capitalization, similar to investing in traditional startups.

Solana, for instance, sold SOL to early buyers for just $0.22 via a Coinlist Auction. Based on SOL’s $294 all-time high, those investors saw gains of up to 1,336x.

Gain Exposure to Unique Technology

The whitepaper explains that LiquidChain is the world’s first unified execution layer for Bitcoin, Ethereum, and Solana. As it achieves interoperability with these three blockchains, LiquidChain unlocks over $2 trillion in ecosystem liquidity.

For example, BTC holders can access Ethereum-based DeFi protocols to earn yield and trade meme coins on the Solana network. Since LiquidChain eliminates unsecured wrapped tokens, platform users avoid relinquishing control of their assets.

The presale provides the lowest valuation for exposure to this innovative technology.

Earn Competitive Staking Rewards

The LiquidChain team allocates 15% of its rewards to the ecosystem, which includes a generous staking program. Only presale buyers can stake LIQUID tokens before the exchange listing, and variable APYs sit at 16,251%.

Besides keeping the Layer 3 network secure, staking helps investors grow their holdings passively.

No Minimums or KYC Verification

The LiquidChain presale provides an inclusive investing experience. Unlike the recent MegaETH (MEGA) presale, which required a $2,650 minimum with strict Know Your Customer (KYC) verification, LiquidChain eliminates purchase minimums.

Participants also avoid KYC requirements, so they buy LIQUID tokens anonymously.

What Could Happen to Liquidchain’s Price?

Despite strong fundamentals, LiquidChain remains a speculative investment. Remember to conduct independent research rather than rely on third-party price predictions.

Key factors influencing its adoption and price trajectory:

Presale success, in terms of individual investors and total funds raised.

Meeting roadmap targets on time

The Layer 3 network achieves its development and security goals

Adoption from BTC, ETH, and SOL ecosystem members, as well as Web 3.0 developers

In our view, LiquidChain reaches its full potential once stakeholders trust the underlying technology. A high-performance Layer 3 network for the world’s three largest blockchains could attract significant investor attention and help push the LIQUID price to a billion-dollar valuation.

Based on the initial presale price and total token supply, the project has a modest fully diluted valuation (FDV) of just $144 million. However, presale prices rise frequently, and LiquidChain documents provide no TGE listing rates. This omission prevents us from estimating its launch market capitalization.

Main Factors Influencing Liquidchain’s Future Price

While the price potential becomes clearer as the presale progresses, the following factors influence LIQUID’s future trajectory.

Presale Funding

A successful presale raise is essential for two reasons. It highlights strong investor demand from the broader crypto markets and provides the project with sufficient operating capital.

Both factors create investor confidence and strong market sentiment.

Staking Pool Contribution

While the LiquidChain staking pool unlocks passive yields, it also helps create stable trading conditions. Holders cannot sell LIQUID while tokens are staked, which stabilizes the circulating supply.

With fewer tokens available on public exchanges, the LIQUID price may rise at a much faster rate.

Roadmap Progress

Serious investors demand roadmap progress within stated timelines. LiquidChain targets a wide range of development goals, including dApp partnerships, cross-chain swaps, and the Layer 3 mainnet.

Missing just one roadmap deadline undermines both sentiment and the LIQUID price.

Exchange Partnerships

Exchange listings play a major role in crypto asset prices. Most new projects launch on DEXs only, which attract a fraction of liquidity compared with centralized exchanges (CEXs).

If LiquidChain secures listings with the best Bitcoin exchanges, the LIQUID price may reach its full potential.

User Adoption

Ecosystem adoption is the most important aspect to influence LiquidChain’s price potential. Platform users need LIQUID tokens to access dApps and pay transaction fees.

This framework creates real ecosystem demand, as users buy tokens to access products rather than for financial speculation.

Broader Crypto Sentiment

Bitcoin halvings create market cycles, where broader prices rise and fall for extended periods. During bullish cycles, most cryptocurrencies perform well, and vice versa during bearish markets.

To maximize the growth potential, the LiquidChain team should complete the TGE when sentiment is strong.

Final Thoughts on Buying Liquidchain

LiquidChain provides real solutions to existing blockchain ecosystems. Its interoperability feature connects the Bitcoin, Ethereum, and Solana networks in a decentralized framework, and if the project succeeds, it could unlock significant liquidity across the broader crypto sector.

To invest in the presale, simply visit the LiquidChain website and connect a non-custodial wallet. The presale accepts popular cryptocurrencies without purchase minimums or KYC requirements. Ensure you evaluate the risks before you invest.