Key Takeaways

Allora (ALLO) is a decentralized, self-improving AI network on the Cosmos Layer 1, solving centralized AI’s trust deficit with verifiable, context-aware machine learning.

The network uses Inference Synthesis to combine competing AI model predictions for superior, self-optimizing collective accuracy via a Proof of Contribution model.

Allora achieves auditable AI by integrating Zero-Knowledge Machine Learning (zkML), cryptographically verifying model execution integrity without exposing proprietary weights.

Centralized AI models currently dominate the predictive intelligence market, creating a multi-billion-dollar trust deficit for Web3 applications.

Allora, however, solves centralized AI’s fundamental problem by building a sovereign decentralized intelligence layer on the Cosmos ecosystem. The network operates a self-improving collective of AI models that have already shown statistically significant accuracy boosts, generating over 1,000% APY in back-tested trading signals.

Allora’s collective intelligence sets a new standard for transparent and adaptive AI, giving autonomous agents and DeFi protocols trustworthy insight.

Learn more: Binance Review 2025: Is It Legit and Safe? Binance Pros & Cons

What is Allora (ALLO)?

Allora is a decentralized, self-improving AI network that supplies applications with secure, context-aware machine learning. It creates a verifiable intelligence oracle, solving centralized AI’s trust and access problems.

Source: Allora

The protocol runs on a specialized Layer 1 blockchain built using the Cosmos SDK, ensuring fast, secure, and interoperable performance via the CometBFT consensus engine.

Allora’s core innovation is its objective-centric approach. Users and dApps do not select or validate individual AI models. Instead, they define a specific prediction objective, a “Topic,” such as forecasting ETH volatility. The protocol then dynamically coordinates multiple underlying models, called Workers, to collectively achieve that defined goal.

Furthermore, its architecture breaks AI silos, transforming fragmented resources into standardized, openly accessible commodities. Allora ensures continuous self-optimization using a Proof of Contribution model, where only the most accurate models gain network influence and rewards.

For these reasons, Allora delivers verified intelligence as a product, powering crucial Web3 use cases. The project provides Predictive Price Feeds for platforms like PancakeSwap, runs Automated Liquidity Management for DeFi (e.g., Steer Protocol), and supports Intelligent Yield Agents for complex trading strategies (e.g., Drift Protocol).

Key collaborations with Alibaba Cloud (for S&P 500 prediction markets) and Coinbase (AgentKit integration) also show its immediate value.

Architecture for Auditable AI

Allora’s architecture creates the necessary environment to transform opaque AI outputs into auditable, on-chain assets, effectively resolving the Crisis of Trust prevalent in centralized systems.

Layer 1 Integrity and Consensus

Allora constructs its network on a specialized Layer 1 blockchain utilizing Cosmos SDK. Their design choice gives the protocol critical speed, security, and interoperability across the broader Web3 ecosystem. It provides the immutable ledger essential for guaranteed AI execution.

Allora’s blockchain executes transactions and orchestrates the economic game using the CometBFT consensus engine. This delivers near-instant finality and high throughput, which Allora requires for processing real-time machine learning inferences and cryptographic proofs. Validators secure the underlying chain through a Delegated Proof-of-Stake (DPoS) mechanism, committing ALLO tokens as security bonds.

That Allora uses L1 integrity eliminates non-auditable risk. The distributed Validator set secures the base layer, thereby transforming AI from a centralized, vulnerable service into a highly available, robust, decentralized utility. Allora’s decentralized execution actively eliminates single points of failure (SPOF), which previously plague centralized prediction systems and pose systemic risk to high-stakes dApps.

Allora’s Validators – Source: Allora

Cryptographic Verification via zkML

The Allora Network deeply integrates Zero-Knowledge Machine Learning (zkML), fundamentally solving the “black box” problem inherent in proprietary AI models. This process transforms a typical AI inference from an opaque output into a cryptographically guaranteed, verifiable truth that the system records on the blockchain.

Workers on the Allora Network execute their ML model computations within a zero-knowledge circuit, generating the prediction and an accompanying Zero-Knowledge Proof (ZKP), which uniquely fingerprints the model, and the system stores the proof on Polyhedra’s EXPchain.

Source: Allora

The proof mathematically attests to the integrity of the computation, confirming two critical factors:

Model Integrity: The system used the correct, specified model weights.

Input Integrity: The model executed correctly on the provided data.

Validators then verify the ZKP directly on-chain, utilizing Polyhedra’s infrastructure. The process confirms the Worker ran the model correctly and honestly, all without ever revealing the proprietary, confidential parameters or weights of the model.

Their collaboration delivers a crucial Dual Assurance that empowers decentralized AI:

Verifiable Truth: Allora Network achieves cryptographic certainty over the AI output, allowing high-stakes dApps to safely rely on the intelligence, a feature Polyhedra calls Proof of Intelligence (PoI).

Intellectual Property Protection: Allora’s design guarantees IP security. It enables the open and necessary participation for the decentralized Allora Network while actively preventing the exposure of Workers’ valuable proprietary algorithms.

Inference Synthesis: The Engine of Collective Superiority

Allora’s Inference Synthesis actively eliminates the inherent Performance Plateaus found in static, isolated models. Allora achieves this by establishing a dynamic, self-optimizing collective intelligence.

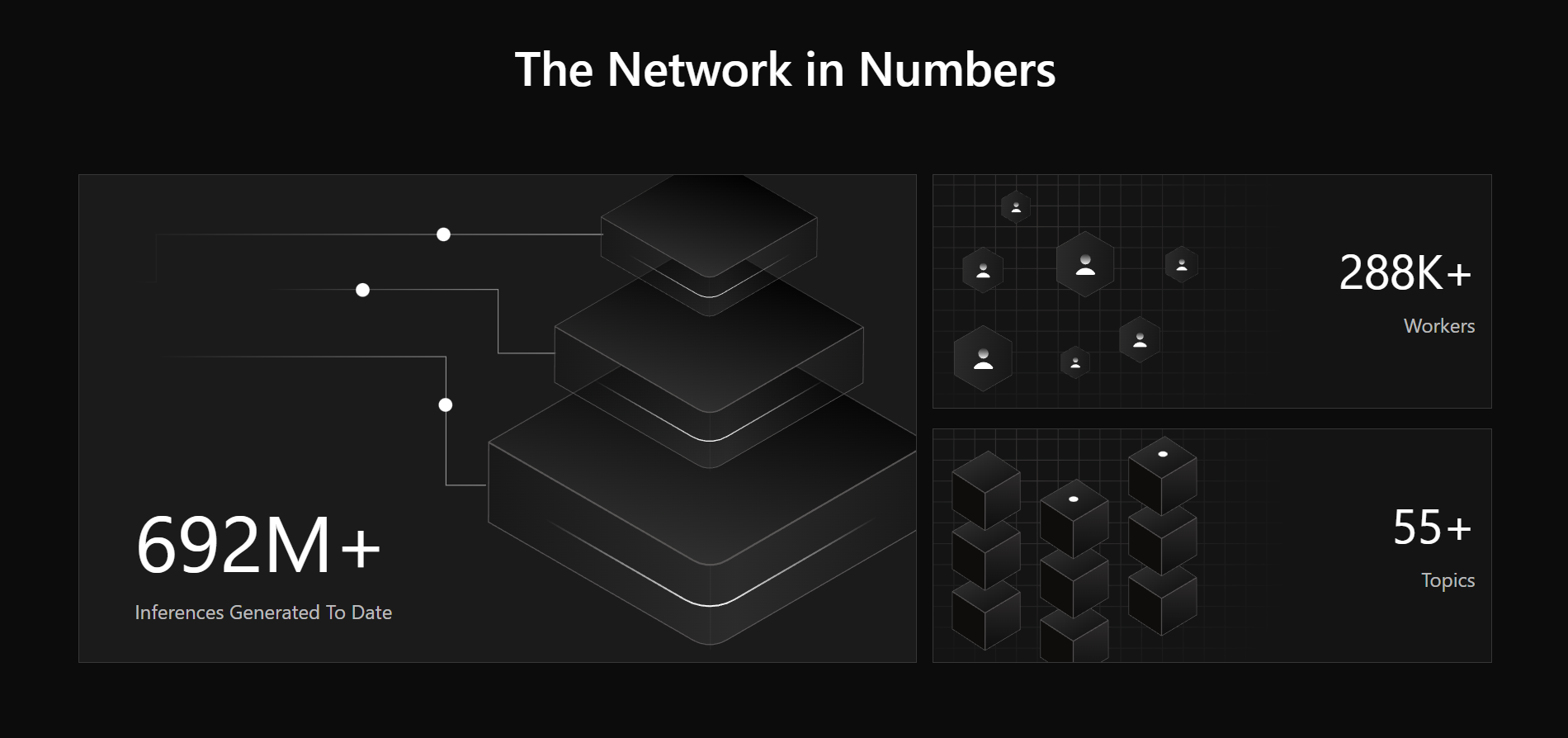

Allora’s Inferences Generated – Source: Allora

Network Flow and Participant Roles

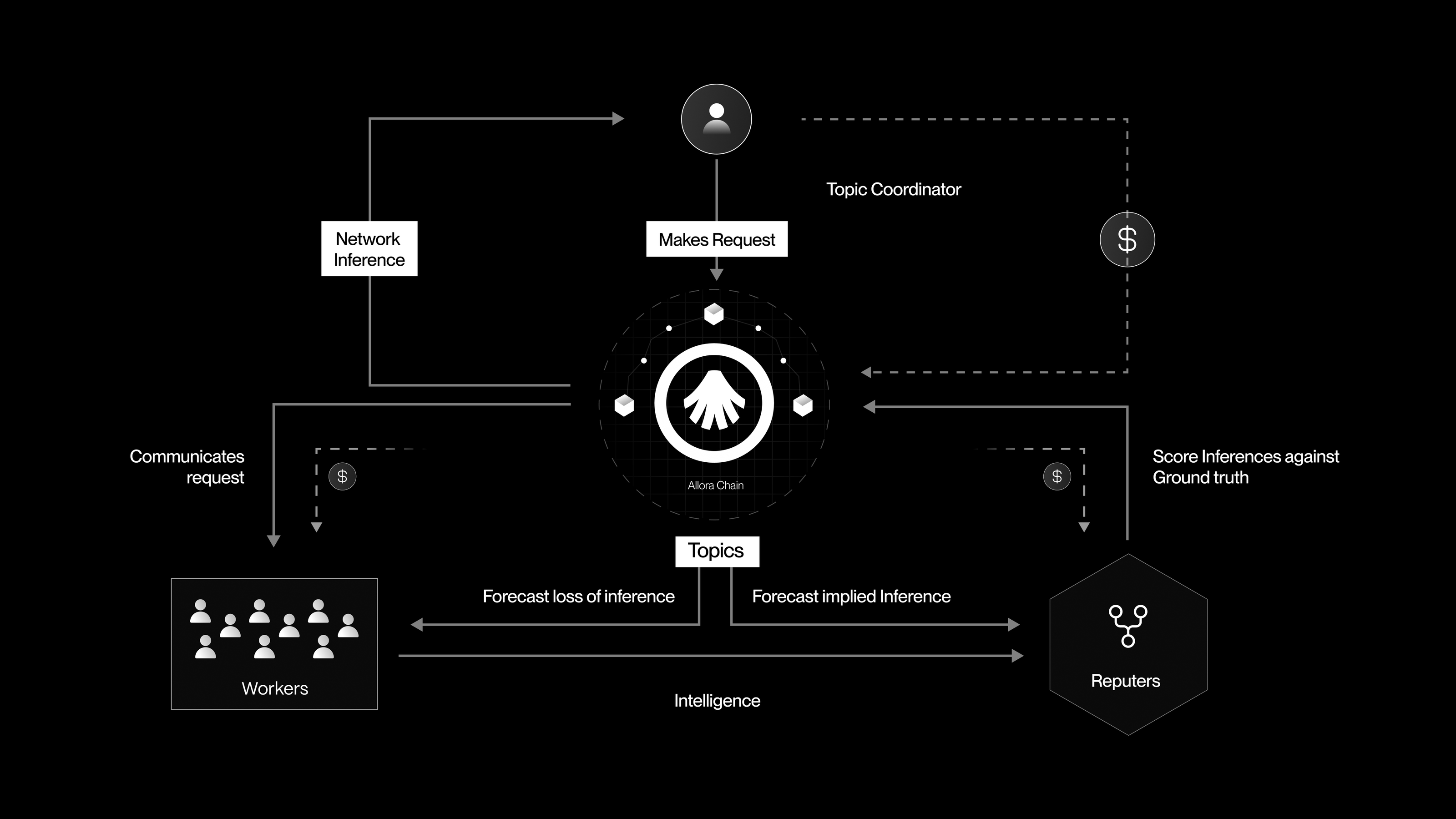

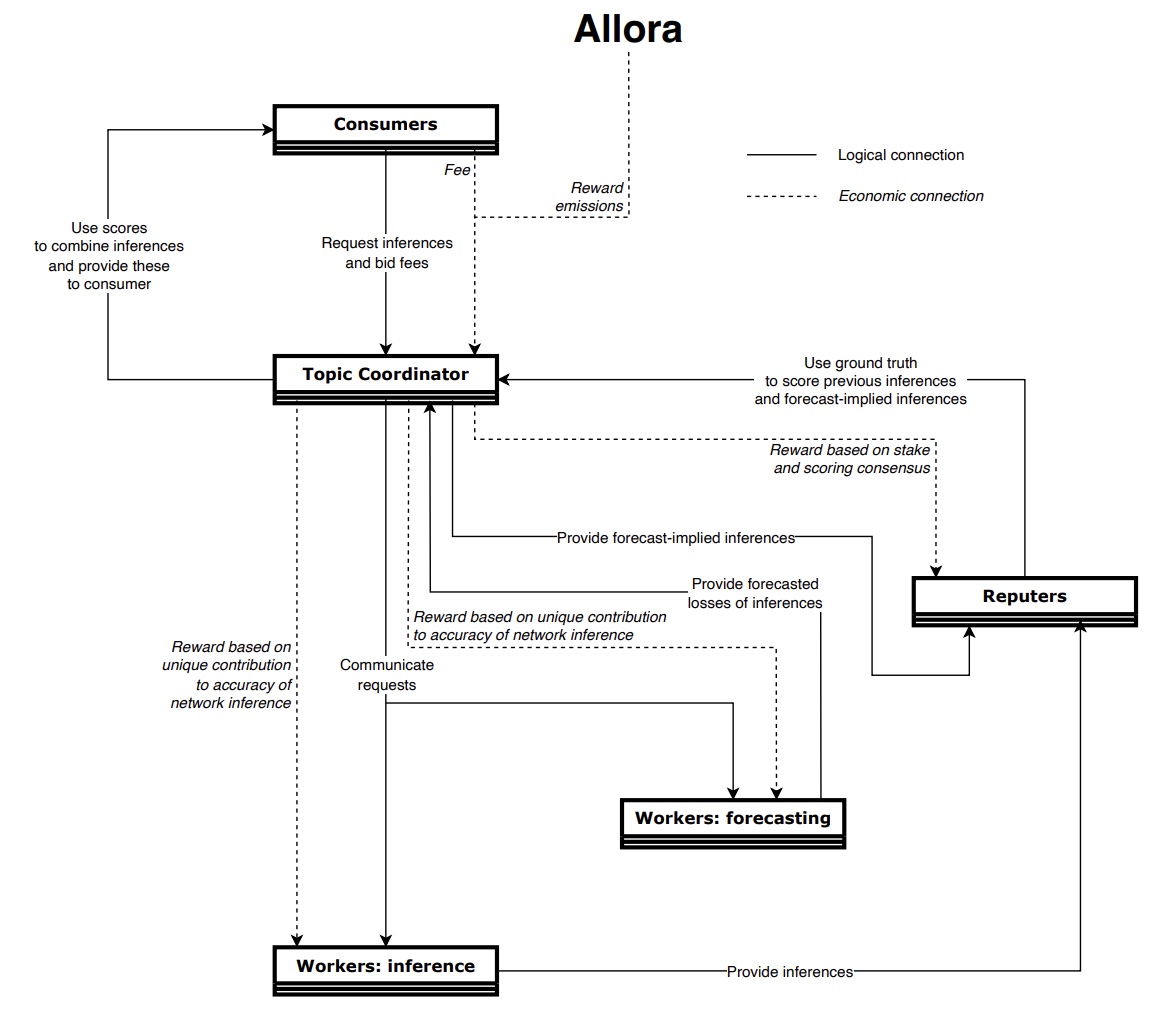

The project structures prediction tasks around Topics, defining specific machine learning objectives and their associated Loss Functions. Such modularity empowers Allora to handle diverse prediction problems concurrently.

Consumers drive demand by requesting inferences, paying ALLO to signal and prioritize high-value prediction tasks.

Workers execute the core computational task, operating ML models and staking ALLO to commit to honest, accurate performance.

Reputers act as the quality control layer, evaluating Workers against the objective ground truth and staking ALLO to ensure honest, accurate assessment of performance.

Workers submit the Inference (raw prediction) and the crucial Forecasted Loss (a meta-prediction estimating the performance of all other models). Meanwhile, the ALLO token acts as the singular fuel: rewards flow strictly proportional to a Worker’s unique contribution to the final collective accuracy.

Moreover, strict slashing rules brutally punish underperforming or dishonest actors. The network’s fierce economic pressure mandates continuous model improvement, effectively eliminating the stagnation inherent in single-model systems. Creating competition forces the entire intelligence layer to perpetually evolve, constantly pushing the frontier of accuracy.

Source: Allora

Context-Aware Weighting via Regret Minimization

The Workers’ submission of Forecasted Loss introduces Context Awareness into the weighting process, which significantly enhances performance beyond simple aggregation. The meta-predictions effectively signal prevailing market conditions or contextual shifts to the network in real-time.

The Topic Coordinator applies a dynamic weighting system informed by these Forecasted Losses. The system specifically utilizes an adaptation of Regret Minimization, a mathematical technique central to online learning and game theory.

The algorithm instantly and proportionally reduces the weight of any model that forecasters predict will fail under the current context (e.g., dynamically down-weighting models built for low-volatility during a flash crash). Therefore, the system constantly minimizes “regret,” which is the difference between the current collective performance and the best possible performance.

In other words, Allora’s mechanism ensures the collective prediction is statistically superior and more stable than any individual static model.

Source: Allora

Allora’s Use Cases: Fueling the Decentralized Economy

Empowering developers with an essential toolkit, Allora allows them to deploy verifiable intelligence. Its initial suite of core solutions accelerates the creation of dApps:

AI Price Feeds: Deliver dynamic, real-time valuation for a wide array of assets, providing reliable, data-driven market insights.

AI-Powered Vaults: Offer bespoke, intelligent asset management solutions that automatically adapt to market changes and optimize returns without human intervention.

AI Risk Modeling: Provides predictive insights that enable more informed decision-making and robust risk mitigation strategies.

AnyML: Democratizes access to advanced machine learning, allowing users to seamlessly integrate any AI or ML model into their products.

Source: Allora

DeFi presents the primary use case for Allora’s verifiable AI, since Allora radically transforms the sector’s efficiency and capability.

Advanced Asset Valuation: AI Price Feeds overcome traditional oracle limitations, delivering reliable valuations for complex, low-liquidity assets, including Real World Assets.

AI-Optimized Liquidity Management: The AI dynamically adjusts order books on Perpetual DEXs to minimize slippage and safeguard capital.

Automated Investment Strategies: AI powers solutions like AI-Powered Reward Strategies and Automated On-Chain Index Funds, analyzing vast datasets to rotate and manage investments.

Advanced Loan Underwriting: The mechanism allows for nuanced risk assessment beyond simple smart contract logic, increasing capital efficiency and expanding credit access.

Intent-Based Blockchain Solvers: AI models interpret complex user goals, executing optimized transaction routes across multiple platforms to efficiently fulfill these “intents.”

DAO Governance Enhancement: Allora supports governance models in DAOs by processing immense amounts of information and distilling complex proposals, ensuring decisions are based on data-driven insights rather than centralized influence.

Learn more: What is Sapien (SAPIEN)? Future of Decentralized AI Data

Tokenomics

ALLO has a fixed Maximum Supply of one billion tokens, which fuels all network operations:

Purchasing Inferences (Fees): Consumers pay for AI predictions using ALLO under a Pay-What-You-Want (PWYW) model, driving market-based price discovery for intelligence.

Staking and Security: Workers and Reputers must stake ALLO as a commitment bond to guarantee honest contributions and network security.

Reward Distribution: Allora distributes ALLO rewards in Epochs to participants based strictly on their measurable impact and quality.

Governance: ALLO holders gain governance rights to vote on key protocol parameters and the creation of high-level prediction Topics.

Allocation

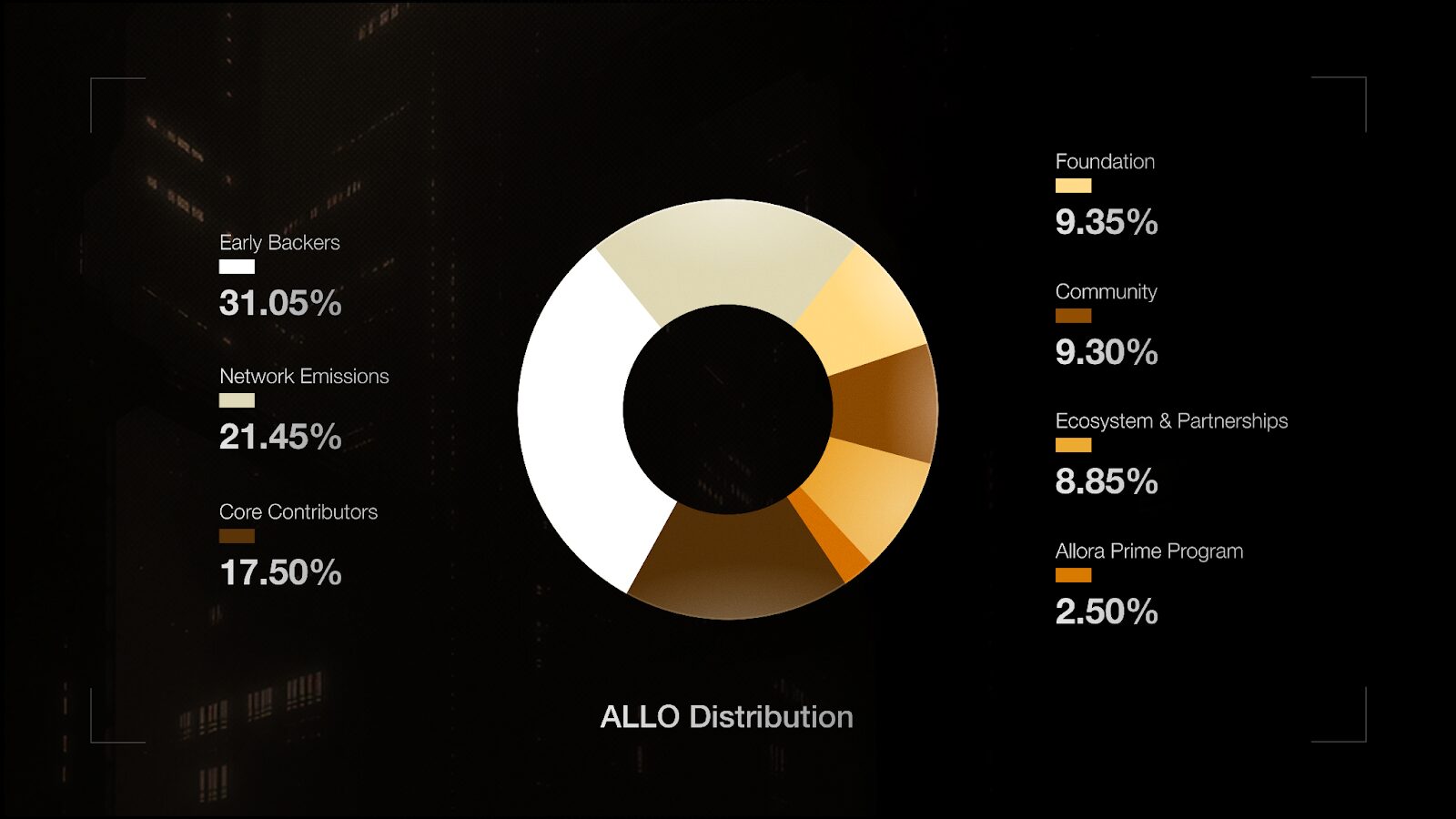

The ALLO token acts as the native utility and governance asset of the Allora Network, facilitating all economic activity. ALLO’s initial circulating supply at the Token Generation Event stood at 20.05% of the total supply.

Allora’s Token Distribution – Source: Allora

| Allocation | Percentage | Purpose |

| Early Backers | 31.05% | Funding and strategic partnerships (locked for 12 months, then 24-month linear vest). |

| Network Emissions | 21.45% | Rewards for Workers, Reputers, and Validators (dynamic, long-term release). |

| Core Contributors | 17.50% | Team and original intellectual property (locked for 12 months, then 24-month linear vest). |

| Foundation | 9.35% | Ongoing network operations, growth, and development. |

| Community | 9.30% | Airdrops and community-focused incentives (includes launch-day unlocks). |

| Ecosystem & Partnerships | 8.85% | Grants to teams building projects on the Allora Network. |

| Allora Prime Staking Rewards | 2.50% | Enhanced staking rewards for early, committed participants. |

To further clarify, the Network Emissions follow a Bitcoin-like halving schedule, where the token issuance rate decreases over time. Allora designed a mechanism to maintain a Stable APY around Token Unlocks specifically to counteract potential sell pressure from large investor and team unlocks.

Team

Allora Labs incubated and launched the Allora Network; the labs evolved from the successful predictive oracle platform, Upshot. The team behind Allora Labs possesses deep expertise in DeFi and machine learning, including:

Nick Emmons (Co-Founder & CEO): Former Lead Blockchain Engineer at John Hancock and Manulife. Emmons leads the strategic vision for the decentralized AI layer.

Kenny Peluso (Co-Founder & CTO): Holds a B.S. in Applied Mathematics from Brown University. Peluso oversees core protocol design and incentive engineering.

Seena Foroutan (Chief Business Officer): Drives partnerships and accelerates the ecosystem’s growth and commercial adoption.

Christopher Kingsley (Chief Marketing Officer): Focuses on community engagement and positioning Allora at the forefront of the decentralized AI narrative.

Investors

Allora Labs successfully raised a total of $35 million in funding across multiple rounds, both under its current identity and its former platform, Upshot. The funding structure includes:

Pre-Seed Round: $1.25 million raised in February 2020.

Series A Round: $7.5 million raised in May 2021.

Extended Series A: A substantial $22 million secured in March 2022.

Strategic Round: A final $3 million raised in June 2024, specifically aimed at onboarding key strategic partners just prior to the mainnet launch.

Leading the charge in these rounds were industry heavyweights like Polychain Capital, Framework Ventures, Blockchain Capital, CoinFund, and Mechanism Capital. Other key strategic investors include Archetype, Slow Ventures, Delphi Digital (Delphi Ventures), CMS Holdings, ID Theory, and notable angel investors such as Stani Kulechov (Founder of Aave).