Described as the first “universal collateralisation infrastructure” project, Falcon Finance launched its $FF token in late September 2025 after the debut of Falcon USD ($USDf) earlier this year.

Falcon Finance now has a complete dual-token ecosystem and is working to establish itself as a name in the space, having failed to break into the top 100 projects by market cap.

7/ Boost your Miles in Season 2 by staking $FF when your claim under the Falcon Miles category:

• Stake ≥50% → 1.1× boost across all tasks in Season 2

• Stake ≥80% → 1.25× boost across all tasks in Season 2Plus, staked FF earns generous Miles multipliers:

• 160× for…— Falcon Finance ?? (@FalconStable) September 29, 2025

Stablecoin-focussed competitor Plasma XPL sits at position 93 at the time of writing, with a market cap around five times the size of Falcon’s ($1.5 billion vs around $300 million).

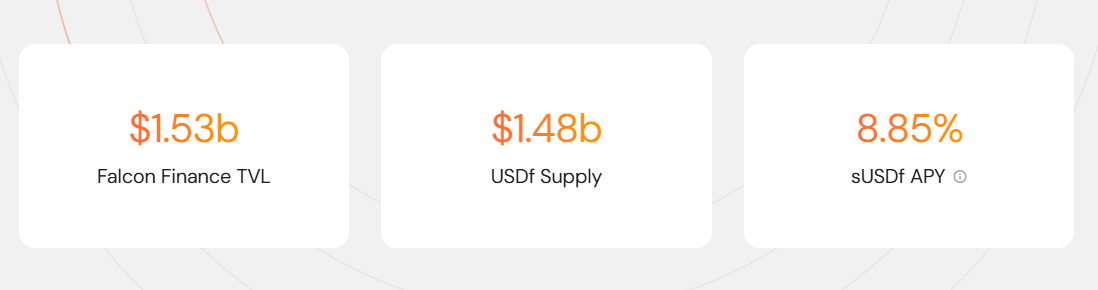

Falcon Finance today supports over one and a half billion dollars total value locked (TVL) and offers 9.29% APY on staked USDf.

The $FF Token launch

Aiming to capture a share of the growing stablecoin market cap, Falcon Finance’s $FF token is a key part of their governance and rewards mechanism.

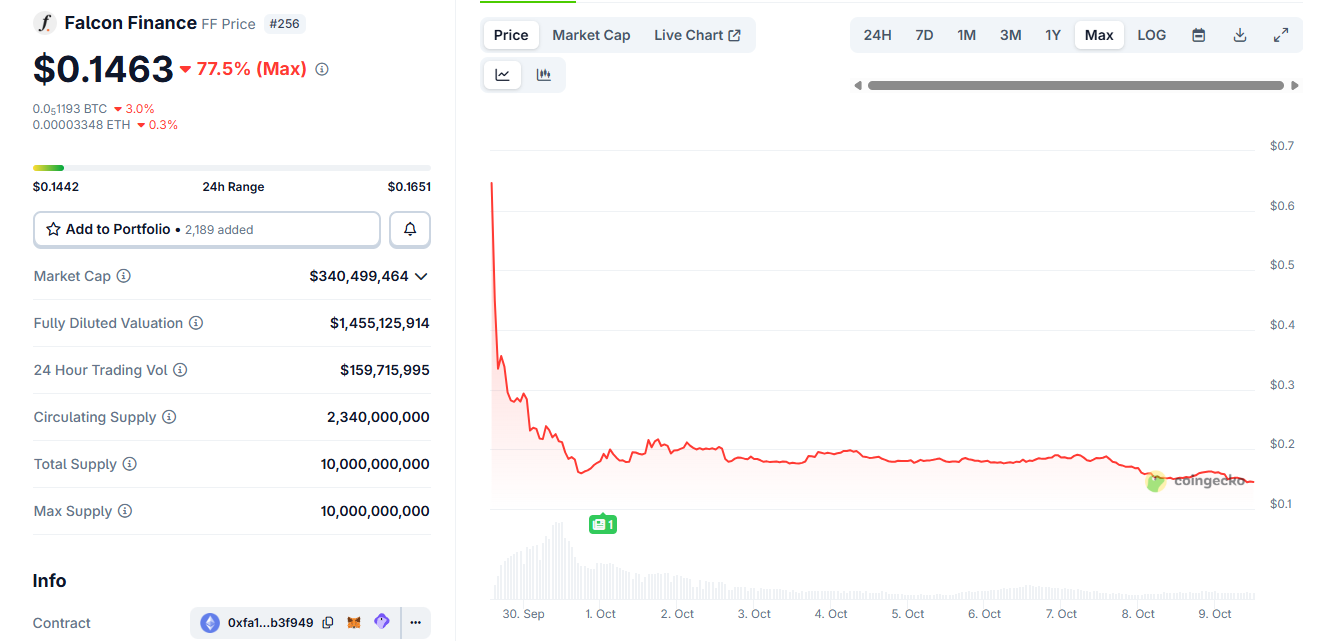

2.4 billion $FF tokens were issued at launch, of a 10 billion supply. Prior to the launch, farming campaigns took place both within the Falcon Finance ecosystem and externally, utilising USDf to earn an $FF airdrop allocation.

The $FF token forms a key part of Falcon Finance’s goal to bridge on and off-chain financial institutions through the collateralisation of crypto and real-world assets to mint USD-pegged stablecoins.

Unfortunately, the token launch was met with negative headlines after a 75% crash in the token’s value on the first day of trading, despite high trading volumes and listing on major exchanges.

Initial downtrends in token price are not uncommon after well-publicised airdrop campaigns, as early investors tend to book profits and marketing ratchets down.

What is more important than short-term price action is that any crypto project has a powerful value proposition and use case scenarios.

the cm newsletter

By submitting your email, you agree to our Terms and Privacy Policy. You can unsubscribe at any time using the link in our emails.

How to earn yield with the Falcon Finance Token

Falcon Finance is clearly more than just another stablecoin project, and has ambitious goals for the stablecoin-driven future: by providing the infrastructure to collateralise any liquid asset, Falcon Finance can provide a yield on those assets and unlock traditional market liquidity without the need to sell assets.

This proposition could be the catalyst that brings mainstream adoption to blockchain and cryptocurrency, as individuals and institutions seek to unlock the financial value of their assets without selling them.

Falcon Finance achieves this goal through its platform and dual-token economy, with its major use cases centring on:

Falcon USD ($USDf): Users can mint USDf by collateralising their existing digital assets. This includes crypto and tokenised real-world assets such as US treasury bonds. USDf can then be staked in exchange for the yield-bearing asset sUSDf.

Falcon Finance token ($FF): Holding this token enables users to enjoy governance rights, favourable fees and APY rates, early access to new product offerings, and more.

The Falcon Finance platform: The platform itself enables not just what is outlined above but also the staking of sUSDf, a rewards program, flexible minting options, and participation in Falcon Finance’s governance.

The goal of the FF token is to spur the growth of the growing stablecoin sector through various initiatives.

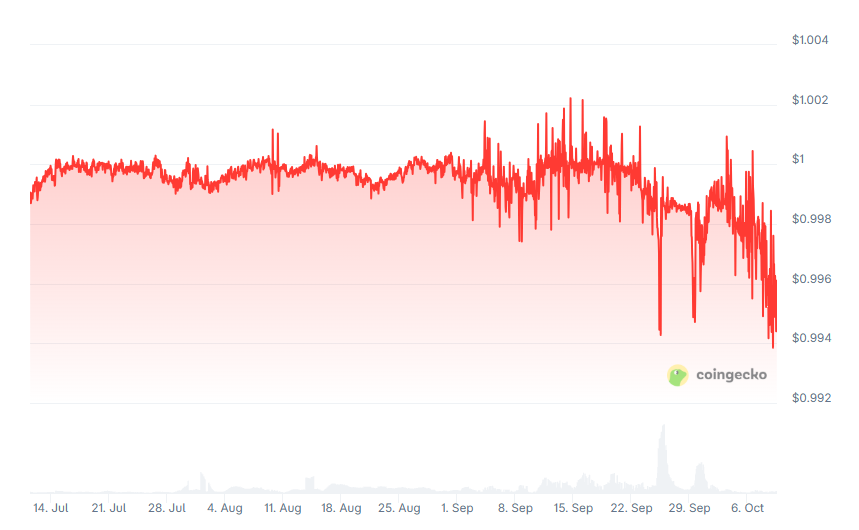

USDf, as an overcollateralised asset, should, in theory, be able to maintain its 1:1 dollar peg and become a trusted stablecoin able to compete with the likes of Tether and Circle’s USDT and USDC, respectively.

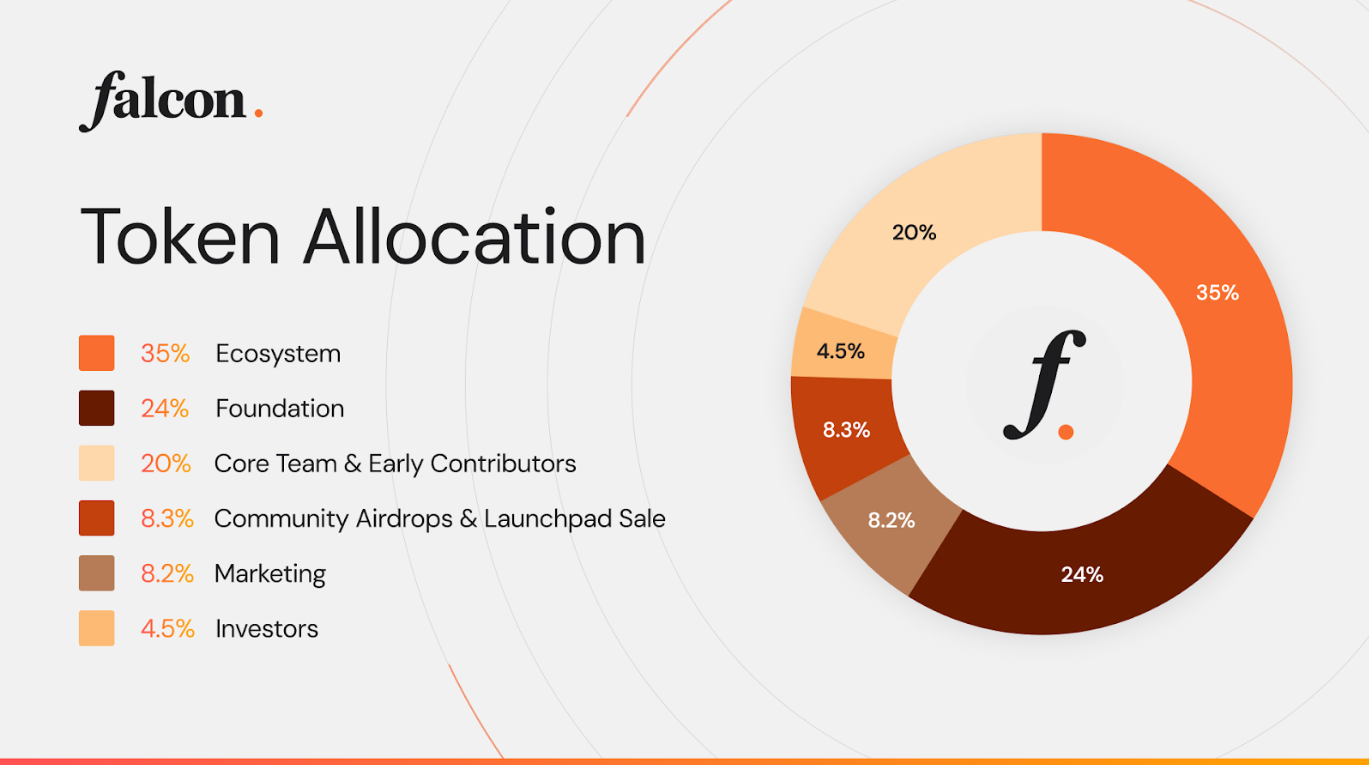

You can see from the $FF token allocation, that significant token volume is allocated to ecosystem, marketing, and airdrops in the future. The currently circulating supply is 2.34 billion of 10 billion, with around 12,700 holders.

Risks & challenges

Like any crypto project, Falcon Finance faces a host of challenges and risks, some of which are specific to its nature as a synthetic stablecoin issuer.

Peg mechanism—Until the launch of Ethena’s synthetic dollar, sentiment had been poor around this type of stablecoin, in large part due to the collapse of Terra Luna’s UST in May 2022, which was devastating for many.

Trust in synthetic stablecoins may have improved, but the fact remains that USDf will need to maintain its peg, something it has failed to do once already. Year-to-date, Falcon USD (USDf) has not spent much time in the green:

This erodes user confidence, and remains a significant risk to Falcon Finance in the long term as its peg mechanisms may fail again.

Collateralisation reserves—Though Falcon Finance has published audits of the reserves backing its stablecoin, critics point out that backing crypto with other crypto assets is risky if markets tank.

Centralisation—More than 95% of tokens are currently held by the top 10 wallets, and reports suggest that the team has “unilateral authority” over how reserve assets are managed.

Competition—Plasma and Ethena have already been mentioned, along with the incumbents like USDC and USDT, but there’s no evidence to suggest there won’t be many more stablecoins issued in the future, all vying for the same market share.

Token—The same is true for the $FF token, which may also suffer from a negative reputation, token unlock sell pressure, and less than expected revenue.

Technical & operational—Falcon Finance relies on complex, sophisticated technology, various stakeholders such as custodians, and interoperability between blockchains – all of which may fail.

Regulation—Though nations around the world are becoming increasingly friendly towards crypto (especially stablecoins), the regulatory environment remains unclear and will likely stay that way for years to come.

Combined, these risks are significant, but Falcon Finance can mitigate them by publishing security audits, providing proof of reserves, and moving towards decentralised governance.

Future outlook & opportunities

Stablecoins are undoubtedly a hot and growing topic for crypto, especially post-GENIUS Act, proving crypto and blockchain’s product-market fit.

The stablecoin market cap recently reached over $300 billion for the first time, growing at a rate of 10x in 5 years. Research from Citi Global puts the stablecoin market cap at nearly 2 trillion by 2030 in its base case estimates. Double this figure and you have the bull case.

If USDf and $FF token are able to capture even a small share of this market, they may perform very well indeed; a rising tide lifts all ships.

Falcon Finance continues to offer Falcon Miles as part of its season 2 of rewards, along with other incentives that may help to steady the ship, but can it entrench itself in the current crypto zeitgeist as a force to be reckoned with in the stablecoin arena in the present? It remains to be seen.