AAVE price prediction has become a key topic for new crypto investors who want simple explanations and clear guidance. Many people feel overwhelmed when they first explore decentralized finance, so this article breaks everything down in an easy way. You will learn what Aave is, how it works, what drives its price, and what experts expect in the coming years. Each part uses simple language and short sentences to help beginners understand every concept without confusion.

The AAVE token shows strong price movement in October. The current price sits near $220. The monthly low reached about $203 on October 18. The monthly high touched $300 on October 7. These numbers show how fast the market moves and why many investors look for reliable Aave price predictions before they act. Clear predictions help beginners avoid emotional decisions and understand the long-term picture.

This guide walks you through Aave’s role in decentralized lending. It explains main features, token utility, price history, and long-term expectations. You will also find expert opinions, technical analysis, and answers to the most common beginner questions. The goal is to give you a complete overview without using complex jargon. After reading, you will understand how AAVE works, what can influence its price, and what to expect in the future.

| Current AAVE Price | AAVE Price Prediction 2025 | AAVE Price Prediction 2030 |

| $220 | $370 | $1,700 |

Aave (AAVE) Overview

Aave is a decentralized lending protocol that runs on the Ethereum blockchain. It lets users lend and borrow cryptocurrencies without banks or intermediaries. The process is simple. People deposit their assets into liquidity pools, and these pools allow others to borrow funds. Lenders earn interest, and borrowers pay interest based on supply and demand. The entire system operates through smart contracts, which remove the need for trust between users.

The AAVE token powers the protocol. It works as a governance token, so holders vote on upgrades, risk parameters, and new asset listings. The token also protects the system through the Safety Module. Users can stake AAVE to secure the protocol. In return, they receive rewards, but their stake may cover deficits if extreme market events occur. This creates a balanced and responsible ecosystem.

Aave launched in 2017 under the name ETHLend. Stani Kulechov created the platform to offer a transparent and open lending market. In 2020, the team rebranded to Aave and expanded its focus from peer-to-peer lending to liquidity pool lending. The new model improved speed, efficiency, and user experience. Since then, Aave has become one of the largest DeFi protocols with billions in total value locked.

Aave also supports flash loans. These are instant loans that must be repaid within the same transaction. Although advanced users work with them, the idea made Aave famous as an innovative player in DeFi. Borrowers can use flash loans for arbitrage, liquidations, and refinancing, but beginners usually ignore this feature due to complexity.

The protocol now runs on multiple chains, including Ethereum, Polygon, Avalanche, Base, and others. This multi-chain approach reduces fees and provides users with greater flexibility. Aave continues to develop new tools for developers, institutions, and retail users to grow the decentralized finance space.

Aave Price Statistics

| Current Price | $220 |

| Market Cap | $3,505,270,023 |

| Volume (24h) | $259,064,056 |

| Market Rank | #32 |

| Circulating Supply | 15,259,520 AAVE |

| Total Supply | 16,000,000 AAVE |

| 1 Month High / Low | $300 / $203 |

| All-Time High | $661.69 May 18, 2021 |

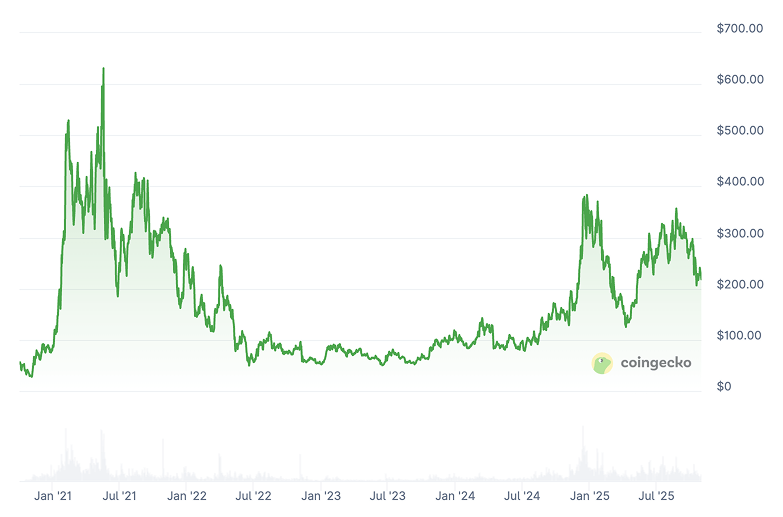

AAVE Price Chart

CoinGecko, October 30, 2025

Aave (AAVE) Price History Highlights

2020 — Launch of AAVE After Migration From LEND

Aave entered the market in October 2020 after completing the migration from the LEND token. The first trading range sat near $52–$75, which marked the start of a new phase for the project. Interest in DeFi grew quickly at that time, and the market welcomed Aave as one of the most promising protocols. By December 2020, the price climbed to $88 as more users explored lending and borrowing on-chain. The protocol expanded its liquidity pools, improved its branding, and gained strong visibility in the new DeFi cycle. This period built the foundation for the major growth that followed in 2021.

2021 — Peak of the DeFi Boom and AAVE’s All-Time High

Aave started 2021 at around $88. DeFi activity soared, and demand for decentralized lending hit record levels. On 18 May 2021, AAVE reached its all-time high at $661, driven by liquidity mining, rapid user growth, and strong market sentiment. Soon after, the entire DeFi market corrected. AAVE dropped to nearly $293 within a week. Although Bitcoin and Ethereum set new highs in November 2021, AAVE did not return to its peak. The token closed the year near $255, with an average yearly price close to $325. Despite the correction, the year confirmed Aave’s position as a core DeFi protocol with deep liquidity and global adoption.

2022 — Sharp Declines After the Bubble Burst

The year opened at about $255, but strong sell pressure pushed the price down throughout 2022. By mid-year, AAVE touched lows near $50, which matched the broader crypto winter. Liquidity left the DeFi sector, TVL dropped, and the market faced major collapses of several protocols. Prices remained between $50–$100 for most of the year, showing high volatility around 125%. Aave kept developing its systems, but market conditions limited price recovery.

2023 — Sideways Trading and News-Driven Moves

Aave started 2023 at roughly $52. For many months, the price ranged between $50 and $95, reflecting a market stuck between fear and slow recovery. In June, the SEC lawsuits against Binance and Coinbase triggered a short-term drop of about 15%. Despite this pressure, AAVE tested $100 again in November. The year ended near $109 as institutional interest started to return and DeFi protocols began consolidating.

2024 — Renewed Uptrend and Strong Market Momentum

Aave opened 2024 at $109 and closed the year close to $309. The token broke several resistance levels in spring and rallied strongly in late 2024, reaching a local high of $399. Growth came from Layer-2 adoption, improved capital efficiency, and deeper liquidity. Aave also expanded its GHO stablecoin plans, strengthened cross-chain operations, and executed strategic buybacks. These factors supported long-term confidence in the ecosystem.

2025 (Up to October) — High Volatility and DeFi Revival

Aave entered 2025 at around $308. The year brought intense volatility. The token dropped to nearly $115 during strong market sell-offs but later bounced toward $382. In late October, AAVE trades near $220, showing signs of stabilization. Renewed interest in staking, treasury reserves, DAO upgrades, and growing demand for GHO all contribute to a more positive outlook. The market also shows early signs of a DeFi recovery, which supports stronger price action.

AAVE Price Prediction 2025, 2026, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $206.5 | $551.3 | $370 | +70% |

| 2026 | $458 | $715.9 | $550 | +150% |

| 2030 | $1,090 | $2,296 | $1,700 | +670% |

| 2040 | $4,015 | $87,864 | $45,000 | +13,923% |

| 2050 | $5,447 | $146,441 | $75,000 | +27,817% |

AAVE Price Prediction 2025

According to DigitalCoinPrice, AAVE may reach a minimum of $206.49 (-10%) in 2025. Their forecast also indicates a potential rise to $503.86 (+120%) at its peak.

PricePrediction expects a stronger move next year. Analysts predict that AAVE could drop to $308.72 (+35%), while its maximum potential may rise to $344.49 (+50%).

Telegaon provides a wide forecast range. Their 2025 minimum target is $311.45 (+35%), and their maximum estimate reaches $551.31 (+140%).

AAVE Crypto Price Prediction 2026

DigitalCoinPrice analysts expect a continued uptrend. In 2026, AAVE might fall to $493.89 (+115%) at its lowest level. At the same time, it could surge to $594.49 (+160%) per coin at its peak.

PricePrediction’s 2026 outlook suggests a minimum of $458.06 (+100%) and a maximum of $545.79 (+140%).

Telegaon forecasts a minimum of $556.57 (+145%) in 2026 and a maximum of $715.86 (+215%).

AAVE Price Prediction 2030

DigitalCoinPrice believes AAVE will grow dramatically by 2030. Their minimum forecast is $1,090.31 (+375%), and their maximum target reaches $1,258.93 (+450%).

According to PricePrediction, by 2030 AAVE may drop to $1,905 (+730%), while its bullish target reaches $2,296 (+900%).

Telegaon predicts more moderate growth. The minimum price expected in 2030 is $1,550 (+580%), and the maximum could hit $2,110 (+830%).

AAVE Coin Price Prediction 2040

PricePrediction forecasts explosive long-term growth. By 2040, AAVE could fall to $49,067 (+21,250%) at its minimum. At the top of the range, the price may jump to $87,864 (+38,200%).

Telegaon is far more conservative. Their 2040 prediction suggests a minimum of $4,015 (+1,660%) and a maximum of $4,501 (+1,870%).

AAVE Price Prediction 2050

PricePrediction analysts believe AAVE may enter an extreme valuation zone by 2050. Their minimum forecast is $109,260 (+47,500%), while the maximum projection reaches $146,441 (+63,600%).

Telegaon expects a much softer trajectory for 2050. The minimum price estimate is $5,447 (+2,300%), while the maximum may hit $6,028 (+2,550%).

Aave (AAVE) Price Prediction: What Do Experts Say?

Aave continues to attract strong attention from analysts, traders, and industry leaders, and their insights offer a clearer view of the token’s potential direction.

Ali Martinez, one of the most respected analysts on X, shared several notable observations throughout October 2025. He pointed out that AAVE broke out of a falling wedge pattern on the four-hour chart, which is normally a bullish setup. Based on this move, Martinez set a price target of $335, suggesting meaningful upside if the bullish momentum holds.

His view relies on pattern structure, volume confirmation, and the strength of buyer demand during breakouts. At the same time, he cautioned that $135 remains a major “magnet” level. If AAVE loses critical support zones, the token could revisit this area before forming a stronger base.

Despite that risk, Martinez highlighted a positive accumulation trend, noting that whales bought more than 62 million AAVE tokens in just 72 hours. This kind of activity often signals confidence from large holders and can lead to higher volatility on the upside. Martinez also underlined that AAVE must break the $250–$270 zone before any sustainable move toward $300 can take place.

The JrKripto technical analysis team offered a similar perspective. In late October 2025, they confirmed that AAVE continued to trade inside a falling wedge, which aligns with a bullish reversal narrative. According to their outlook, a breakout above $257 could trigger a strong push toward $300. They identified the $300–$308 region as the most important breakout area, because holding above this range would signal the start of a broader trend reversal.

JrKripto provided a clear structure of market levels as well. Their support zones include $229, $217, and $200, while resistance stretches across $250–$257, $277, $300–$308, $336, and $385. This gives traders a roadmap for watching price reactions and planning entries or exits.

Stani Kulechov, the founder of Aave, shared a broader and more fundamental perspective during TOKEN2049 in Singapore. Instead of offering price targets, he focused on macroeconomic conditions that influence DeFi growth. Kulechov explained that interest rate cuts by major central banks often benefit decentralized finance because they increase demand for yield and reduce borrowing costs.

He drew comparisons to 2020’s “DeFi Summer,” when cheap liquidity powered massive expansion. According to Kulechov, Aave is no longer an experiment but a global financial layer connecting fintech and real-world assets. He also highlighted strong growth metrics. Aave’s total value locked doubled in 2025, rising from $21 billion to over $44 billion, while active loans exceeded $30.2 billion by September. These fundamentals support the bullish outlook from technical analysts and offer long-term confidence for investors.

AAVE USDT Price Technical Analysis

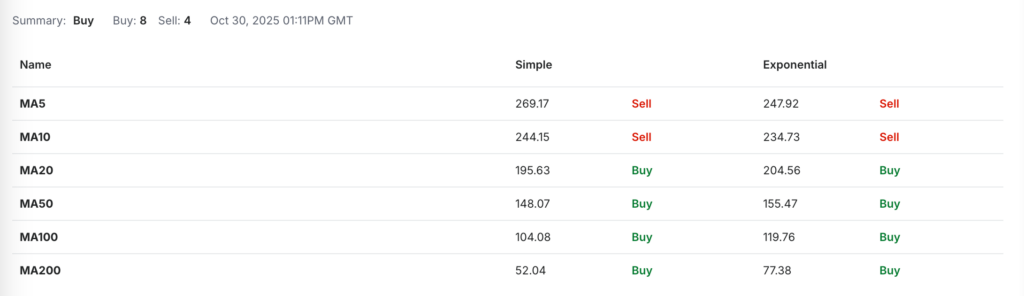

Monthly data from Investing shows that AAVE continues to display a constructive technical structure despite recent volatility. The overall rating sits in the Buy zone, supported by both moving averages and technical indicators. This suggests that market momentum remains positive on higher timeframes, even though short-term corrections still appear on lower charts. The combination of trend strength and improving indicators offers a clearer picture for long-term traders.

Investing, October 30, 2025

The technical indicator summary shows 5 Buy, 4 Neutral, and 1 Sell signals. RSI (14) is at 53.79, which places AAVE in a neutral zone with no signs of overheating. Stochastic (9,6) sits at 58.71, giving a Buy signal, while StochRSI (14) flashes Oversold, which often appears before stronger rebounds. MACD (12,26) prints 34.2, confirming bullish momentum as it remains above the signal line. The ADX reading of 38.87 reflects a strong trend, suggesting that buyers maintain control. Other indicators such as CCI, Williams %R, and Highs/Lows remain neutral, showing that AAVE is not stretched in either direction. Meanwhile, ROC and the Ultimate Oscillator provide additional Buy signals, supporting the idea of upward continuation. The only bearish signal comes from Bull/Bear Power, but this alone is not enough to offset the broader trend.

Moving averages also strengthen the bullish picture. The monthly summary shows 8 Buy and 4 Sell readings. Short-term averages such as MA5 and MA10 remain below the current price and issue Sell signals, reflecting recent pullbacks. However, the more important mid- and long-term averages—MA20, MA50, MA100, and MA200—remain in strong Buy territory. These levels between $148, $155, $205, $119, and $77 suggest that AAVE holds a solid long-term uptrend on the monthly frame. Long-term structure often plays a larger role than short-term fluctuations, which supports the positive monthly outlook.

Pivot points also help map the potential trading range. The classic pivot sits at $284.92, with resistance near $321–$367 and support at $202–$238. Fibonacci pivots show similar structure, while Camarilla levels narrow the range around $266–$289. Together, these pivots indicate that AAVE trades in the middle of its monthly range, with room to expand upward if market sentiment improves.

What Does the Aave Price Depend On?

The price of Aave depends on a mix of market demand, protocol fundamentals, token utility, and wider economic conditions. Beginners often view crypto prices as random, but AAVE follows clear patterns influenced by adoption, liquidity, and macro trends. When these factors align, the token strengthens. When they weaken, AAVE faces pressure. Understanding these drivers helps investors make informed decisions instead of reacting emotionally to short-term moves.

A key factor is overall DeFi activity. When users lend, borrow, and move liquidity across protocols, TVL rises, and demand for AAVE increases. Strong lending volumes often push the token higher because they reflect real usage. Market interest also grows when Aave upgrades its protocol, launches new products, or expands to new blockchains. These upgrades show that the project evolves, and this attracts both retail users and institutions.

Another major influence is liquidity conditions in global markets. When interest rates fall, borrowing becomes cheaper, and more capital flows into DeFi. This boosts loan demand and increases activity on Aave. On the other hand, high rates reduce risk appetite, which can slow DeFi growth. Regulatory decisions can also have a strong impact. Positive regulation increases confidence, while negative announcements may reduce trading activity.

Token-specific factors also affect AAVE’s price. These include governance decisions, staking rewards, Safety Module participation, and treasury operations. Buybacks, new proposals, and major DAO votes create strong price reactions. The launch and adoption of the GHO stablecoin is another element that could influence long-term demand for AAVE, as it connects deeper stability mechanisms to the protocol.

Some influences are easier to measure:

Rising TVL often leads to stronger price trends.

Higher borrowing demand increases the protocol’s revenue.

Major upgrades, such as Aave v4 or cross-chain expansions, attract new liquidity.

Large whale accumulation can trigger momentum shifts.

Treasury decisions, including buybacks, can support long-term valuation.

Broader crypto market sentiment remains a crucial factor. When Bitcoin and Ethereum rise, altcoins usually follow, and AAVE tends to move faster due to its exposure to DeFi cycles. In bearish phases, AAVE often shows deeper corrections because leverage unwinds in lending markets. However, strong fundamentals help the token recover when market conditions improve.

AAVE Features

Aave includes a wide range of advanced features that support lending, borrowing, risk control, and cross-chain operations. These features help the protocol serve beginners, developers, institutions, and large liquidity providers with the same efficiency. The ecosystem continues to expand, and each upgrade improves capital efficiency and user safety. Below is a clear breakdown of Aave’s most important functions.

Aave operates as a decentralized lending system powered by smart contracts. Users supply assets, and the protocol locks them inside liquidity pools. Borrowers then use these pools to obtain loans by posting collateral that exceeds the value of their borrow. The system is non-custodial, so users remain in full control of their funds. All logic is handled through transparent and open-source smart contracts audited by multiple security firms. This design removes the need for intermediaries and allows the market to dictate interest rates through supply and demand.

Key features include:

Non-custodial liquidity pools built on Ethereum using audited smart contracts

Transparent, open-source code with audits from OpenZeppelin, SigmaPrime, ABDK, and Certora

Multi-chain deployment across more than 20 blockchain networks including Ethereum, Polygon, Arbitrum, Base, BNB Chain, Sonic, and others

Support for both Aave V2 and V3 depending on the network

Flash loans that allow uncollateralized borrowing inside a single transaction

Efficiency Mode (E-Mode), which increases borrowing power when collateral and borrowed assets are correlated

Isolation Mode, which protects the protocol when listing volatile or experimental assets

Cross-chain Portal functionality for bridging liquidity across networks

aTokens that represent interest-bearing positions and increase in balance automatically

Supply and borrow caps that limit exposure to risky assets

A dynamic interest rate model that adjusts based on real-time pool usage

A Virtual Balance Layer that improves accounting and prevents issues caused by external token transfers

Flash loans remain one of Aave’s most famous innovations. These loans must be borrowed and repaid in the same block. If repayment fails, the entire transaction reverses. This mechanism allows arbitrage strategies and advanced financial operations without requiring collateral.

E-Mode increases capital efficiency by grouping assets that move together, such as stablecoins or ETH-pegged tokens. This lets users borrow up to 97% of their collateral’s value. Isolation Mode limits risk when new assets enter the system by restricting what borrowers can take out.

Cross-chain Portal functionality allows Aave to operate as a multi-network liquidity layer. It burns aTokens on the source chain and mints them on the destination chain while relying on governance-approved bridges.

These features make Aave one of the most powerful and flexible lending protocols in the entire DeFi ecosystem.

Aave Price Prediction: Questions and Answers

Is AAVE Crypto a Good Investment?

AAVE can be a good investment for people who believe in long-term DeFi growth. The protocol has strong adoption, deep liquidity, and a proven track record. Its multi-chain deployment and continuous upgrades help Aave stay competitive. However, AAVE remains a volatile asset, so beginners should research risks, market cycles, and their own financial goals before investing.

Why Is Aave Crypto So Popular?

Aave is popular because it offers non-custodial lending, flexible borrowing options, and advanced features unavailable on traditional platforms. Flash loans, multi-chain support, and high capital efficiency attract both retail users and institutions. The protocol also has strong security audits and an active community. These elements make Aave one of the most trusted and widely used DeFi platforms.

What Is Aave Used For?

Aave is used for lending, borrowing, and earning interest on crypto assets. Users supply tokens to liquidity pools and receive yield based on market demand. Borrowers use collateral to access liquidity without selling their holdings. Developers also use Aave for flash loans, arbitrage strategies, and capital-efficient DeFi operations. Its multi-chain structure expands these use cases across many networks.

What Makes Aave Unique?

Aave stands out due to its advanced features and strong security model. Flash loans, E-Mode, Isolation Mode, and cross-chain Portal functionality make the protocol more flexible than traditional lending systems. Aave also uses aTokens, supply caps, and dynamic interest models to manage risk and improve efficiency. Its open-source architecture and multi-chain design help maintain leadership in the lending sector.

How Much Is 1 AAVE Now?

At the moment, AAVE trades around $220, though the price often moves quickly due to market volatility. The monthly low sits near $203, while the monthly high reached $300. Beginners should always check real-time charts before making decisions because AAVE reacts strongly to market sentiment, protocol upgrades, liquidity shifts, and global macroeconomic trends.

How High Could Aave Go?

AAVE’s long-term potential depends on adoption, DeFi expansion, and future upgrades. Analysts show a wide range of targets. Moderate projections suggest several hundred dollars per token, while aggressive forecasts for 2030–2050 reach into the thousands. The price could rise significantly if lending activity grows, GHO adoption increases, and Aave maintains its leading role in decentralized finance.

Can AAVE Reach $1,000?

AAVE could reach $1,000 in a strong market cycle. Some long-term forecasts place the token well above that level by 2030 or later. To hit $1,000, Aave would likely need rising TVL, strong cross-chain usage, higher GHO adoption, and favorable macroeconomic conditions. While the target is realistic, it depends on broad DeFi growth and sustained liquidity inflows.

Can Aave Hit $10,000?

A move to $10,000 is a very long-term and highly speculative scenario. Such a price would require massive global adoption, deep institutional involvement, and DeFi volumes far above current levels. Long-term forecasts for 2050 show extreme ranges, but they are theoretical. Investors should treat this target with caution and consider it a possibility only in an aggressive, multi-decade growth environment.

Can Aave Reach $100k?

Reaching $100,000 is extremely unlikely under current market structures. This level would require Aave to surpass most global financial networks and reach unprecedented liquidity depth.

How Much Will AAVE Be Worth in 2025?

Based on stored forecasts, analysts expect AAVE to trade within a wide range in 2025. Minimum targets fall near $205–$310, while maximum predictions reach $345–$550, depending on the source. These forecasts suggest possible growth from current levels, but they also show that AAVE may face volatility during market swings. As always, predictions are not guarantees.

What Will Aave Be Worth in 2030?

Analyst forecasts for 2030 show strong long-term growth potential. Minimum targets range from $1,100 to $1,550, while maximum projections reach $2,100 to $2,300. These estimates suggest that Aave could multiply several times from its current price if DeFi adoption expands. However, long-term predictions depend on market cycles, global regulation, interest rate trends, and Aave’s ability to maintain its leadership in decentralized lending.

What Is the AAVE Price in 2050?

Long-term models for 2050 vary widely. Some conservative forecasts place AAVE near $5,400–$6,000, while extreme projections exceed $100,000 in aggressive scenarios. These large ranges reflect uncertainty about future global finance, technology integration, and institutional adoption. While Aave has strong fundamentals, no forecast this far ahead can be guaranteed, so investors should treat such numbers with caution.

Is Aave Built on Ethereum?

Yes, Aave was originally built on the Ethereum blockchain. Its smart contracts use Ethereum’s secure infrastructure to manage lending, borrowing, and liquidations. Over time, Aave expanded to more than 20 networks, including Polygon, Avalanche, Arbitrum, Base, and others. Despite this multi-chain architecture, Ethereum remains the protocol’s primary settlement layer and governance base.

Does Aave Crypto Have a Future?

Aave has a strong future because it continues to innovate and expand. It remains one of the largest and most trusted DeFi protocols, with billions in total value locked. Features like flash loans, E-Mode, GHO stablecoin integration, and multi-chain deployment support long-term relevance. As global interest in decentralized finance grows, Aave is well-positioned to keep leading the sector.

How to Make Money With Aave?

Users can earn money with Aave by supplying assets to liquidity pools and collecting interest. They can also stake AAVE in the Safety Module to receive rewards. More advanced users use flash loans or leverage borrowing strategies, but beginners usually stick to simple lending.

How Much Can You Earn With Aave?

Earnings vary depending on the asset supplied and market conditions. Stablecoins often offer moderate yields, while more volatile assets can produce higher rates but include greater risk. Staking AAVE can also generate additional rewards through the Safety Module. The protocol updates interest rates dynamically, so user returns change as borrowing activity increases or decreases.

Is AAVE Crypto a Good Buy?

AAVE can be a good buy for investors who believe in long-term DeFi growth and want exposure to one of the most established lending protocols. It offers real utility, multi-chain presence, and strong development activity. However, the token remains volatile, and market cycles can cause large price swings. Researching risk, setting clear goals, and understanding market conditions remain essential.

Where to Buy AAVE Crypto?

StealthEX is here to help you buy $AAVE crypto if you’re looking for a way to invest in this cryptocurrency. You can buy $AAVE coin safely and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.