Introduction

Blockchain technology has revolutionized industries, offering decentralized solutions for various applications. However, challenges like high fees, slow transaction speeds, and limited scalability remain significant hurdles. Movement Network aims to overcome these issues with its innovative approach to blockchain technology, leveraging the Move programming language and Ethereum’s infrastructure to provide unparalleled performance and security.

In this article, we’ll explore what Movement Network is, how it works, the role of its native token (MOVE), how you can buy MOVE tokens using RocketX, and its potential in the evolving blockchain ecosystem.

What Is Movement Network?

Movement Network is the first Move-EVM Layer 2 (L2) solution for Ethereum, designed to offer fast, secure, and cost-effective blockchain solutions. It bridges the gap between the Move programming language and Ethereum’s extensive ecosystem, allowing developers to create high-performance decentralized applications (dApps) and rollups.

Key Highlights:

Move Programming Language: Initially developed by Facebook for the Libra project, Move is a resource-oriented programming language designed for security and scalability.

Ethereum Layer 2: Movement operates as an L2 solution, inheriting Ethereum’s security and liquidity while drastically improving transaction speed and reducing costs.

Parallelized Transactions: Unlike linear transaction processing in traditional blockchains, Movement introduces parallel processing, enabling faster and more efficient operations.

Movement Network has secured significant backing from industry leaders, including Polychain Capital, Binance Labs, and Placeholder, further solidifying its position as a key player in the blockchain space.

How Does Movement Network Work?

Movement Network is designed to solve the problems faced by traditional blockchains like Ethereum, such as high fees and slow transactions. Here’s a simple breakdown of how it works:

1. Layered Design for Efficiency

Movement Network separates its core functions—data storage, transaction processing, and network security—into different layers. This approach makes it faster and easier to connect with other blockchains.

2. Quick Transaction Confirmations

The network uses a system called fast-finality settlement, which means transactions are confirmed in just a few seconds. Validators, who secure the network by staking MOVE tokens, help achieve this speed while keeping the system safe.

3. Partnership with Celestia for Data Security

Movement Network works with Celestia, a system that stores and protects transaction data. This ensures that data is always secure, decentralized, and accessible when needed.

4. Faster Transactions with Parallel Processing

Unlike most blockchains that process transactions one by one, Movement uses a method called parallel processing to handle multiple transactions at the same time. This allows the network to process up to 160,000 transactions per second (TPS), compared to Ethereum’s 30 TPS or Polygon’s 7,000 TPS.

5. Compatibility with Ethereum and Move Ecosystems

Movement supports both Move Virtual Machine (MoveVM) and Ethereum Virtual Machine (EVM), making it easy for developers to create apps that work with Ethereum and Move-based blockchains.

These features make Movement Network a versatile platform for developers, enterprises, and users seeking efficient and secure blockchain solutions.

Everything You Need to Know About MOVE Token

The MOVE token is the native utility token of Movement Network, playing a central role in its ecosystem. It facilitates transactions, staking, governance, and more.

Key Utilities of MOVE Token:

Staking and Delegation: Validators stake tokens to secure the network and earn rewards. Users can delegate their tokens to validators to participate in the network’s security and receive staking rewards.

Gas Fees: MOVE tokens are used to pay transaction fees within the Movement Network and other Move-based Layer 2 solutions built on the MoveStack.

Governance: Token holders can participate in governance, voting on proposals that shape the future of the Movement ecosystem.

Collateral and Liquidity: MOVE serves as a native asset for collateral, liquidity provisioning, and payments within applications built on Movement Network.

Tokenomics:

Total Supply: 10 billion.

Circulating Supply: Approximately 22.5% as of December 2024.

Airdrop Allocation: 2% in Season 1, with additional allocations planned for subsequent seasons.

MOVE tokens also power sequencer decentralization, ensuring fairness, censorship resistance, and enhanced security.

How to Buy MOVE Tokens Using RocketX

MOVE tokens are currently available on the Ethereum blockchain, making them easily accessible to many users. Whether you are holding Bitcoin, Ethereum, or other cryptocurrencies, RocketX allows you to swap them for MOVE tokens seamlessly.

Additionally, the MOVE mainnet is not yet live. Once it goes live, you’ll also be able to buy tokens directly on the mainnet using RocketX.

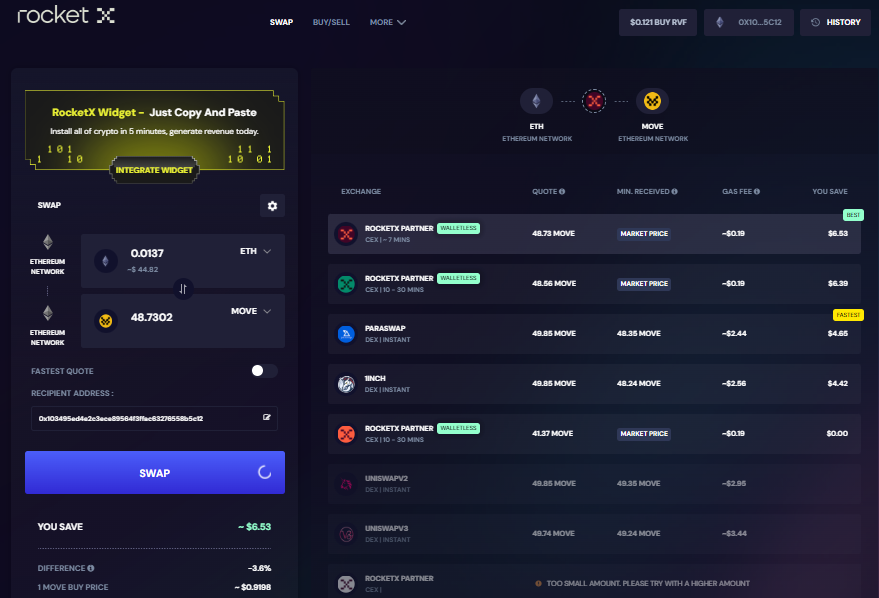

RocketX simplifies the process of purchasing MOVE tokens through its hybrid liquidity aggregator. Follow these steps to get started:

1. Access the RocketX Platform

Visit the official RocketX Exchange website to initiate the transaction.

2. Connect Your Wallet

Click on the “Connect Wallet” button and select a compatible wallet like MetaMask, Rabby, or OKX Wallet.

3. Choose Source and Destination Networks

Select the blockchain and cryptocurrency you wish to swap from (e.g., ETH on Ethereum or SOL on Solana).

Choose MOVE as the destination token on the Ethereum chain.

4. Specify the Swap Amount

Enter the number of tokens you want to purchase.

5. Review the Transaction Details

Carefully review the transaction details, including:

Source and destination networks.

Token amounts.

Wallet addresses.

6. Confirm the Transaction

Click on swap and approve the transaction through your connected wallet.

7. Complete the Swap

Wait for the transaction to process. Once finalized, the tokens will be added to your connected wallet.

Future Potential of MOVE Token

MOVE token and Movement Network are poised to revolutionize the blockchain landscape. Here’s why:

Massive Scalability: With its parallel transaction processing and integration with Celestia for data availability, Movement can handle 160,000 TPS, setting a new standard for blockchain performance.

Widespread Adoption: Movement’s low transaction fees (less than $0.01) make it ideal for microtransactions, gaming, DeFi, and other applications requiring high throughput.

Developer-Friendly Ecosystem: The Move programming language and Movement SDK provide developers with tools to build secure, efficient, and scalable dApps and rollups.

Interoperability: Movement bridges the gap between Ethereum and Move ecosystems, fostering a unified blockchain infrastructure with enhanced liquidity and accessibility.

Airdrops and Incentives: Movement Network plans to distribute MOVE tokens through airdrops, encouraging community participation and rewarding early adopters.

As blockchain technology evolves, Movement Network and MOVE tokens are well-positioned to drive innovation, scalability, and adoption across various sectors.

Conclusion

Movement Network is more than just another blockchain project; it’s a transformative solution that addresses the limitations of traditional networks. By combining the security of Ethereum with the efficiency of the Move programming language, Movement delivers a unique and powerful ecosystem.

Whether you’re a developer, investor, or blockchain enthusiast, Movement Network offers opportunities to participate in the future of blockchain scalability and interoperability. If you’re looking to acquire MOVE tokens and explore this innovative ecosystem, RocketX provides a simple and efficient platform to get started.