What is Virtuals Protocol?

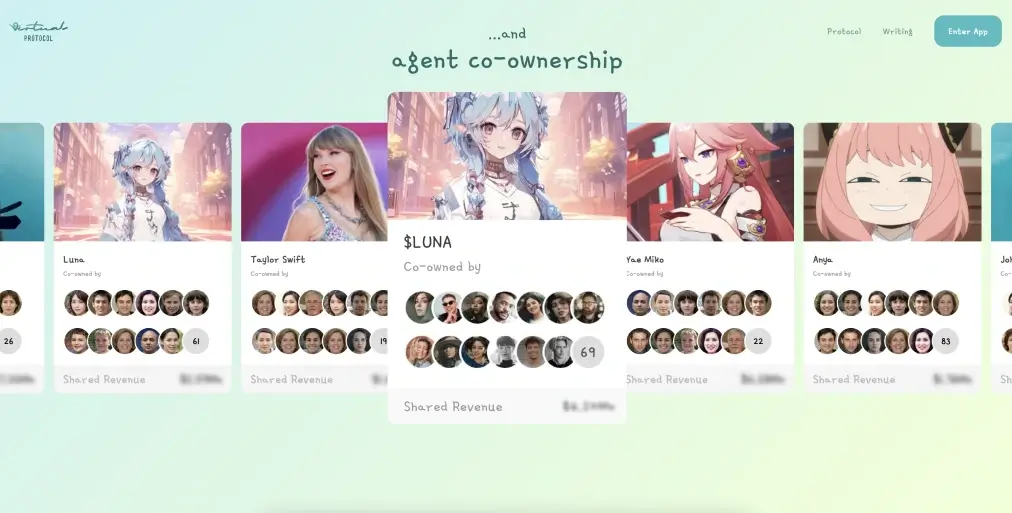

Virtuals Protocol is a decentralized platform launched in March 2024 on Base, designed to transform AI agents into tokenized, revenue-generating assets for entertainment. Starting with a $50 million market cap, it has become one of the year’s top-performing assets, surging to over $1.6 billion by enabling co-ownership and governance for developers, contributors, and users.

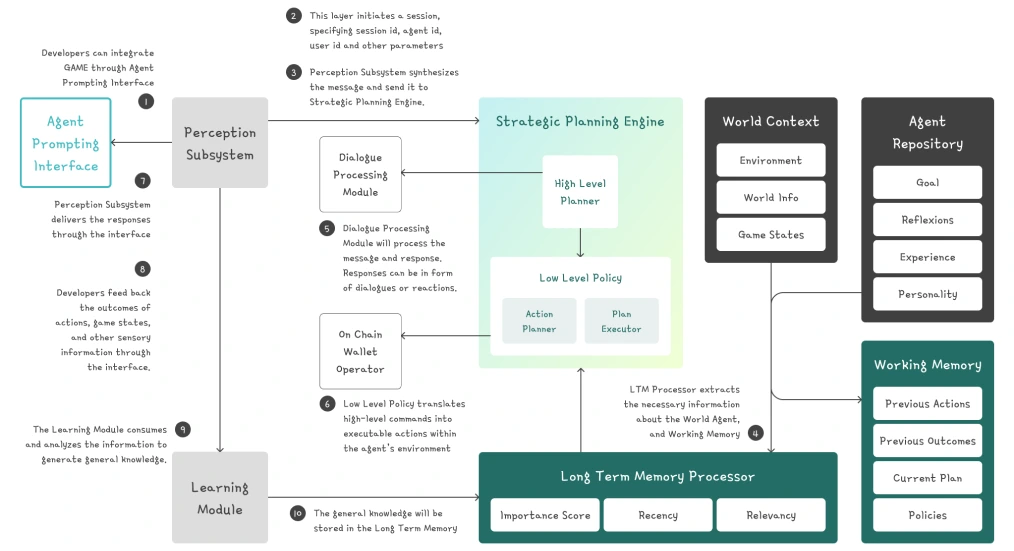

The protocol powers AI agents with advanced capabilities, including autonomous decision-making, multimodal communication, and on-chain wallet integration. Developers can easily deploy these agents using the Generative Autonomous Multimodal Entities (G.A.M.E) framework, supported by a deflationary buyback-and-burn tokenomics system.

By simplifying AI adoption, rewarding contributors, and lowering barriers for non-experts, Virtuals Protocol creates a scalable ecosystem. It redefines gaming and entertainment by unlocking new opportunities and delivering value for stakeholders across its decentralized network.

How Does Virtuals Protocol Work?

Virtuals Protocol integrates AI agents, blockchain infrastructure, and tokenization to create a scalable, decentralized ecosystem. Built on the Base rollup, it combines AI functionality with on-chain governance and revenue automation to deliver value for developers, users, and contributors.

Key features include:

Agent Tokenization: AI agents are minted as ERC-20 tokens with fixed supplies, paired with $VIRTUAL in locked liquidity pools. Tokens are deflationary through buyback-and-burn mechanisms.

G.A.M.E Framework: Agents leverage multimodal AI capabilities, such as text generation, speech synthesis, gesture animation, and blockchain interactions, enabling real-time adaptability.

Revenue Routing: Agents earn revenue through inference fees, app integrations, or user interactions, with proceeds flowing into their on-chain wallets for buybacks or treasury growth.

Memory Synchronization: Agents retain cross-platform memory through a Long-Term Memory Processor, ensuring user-specific, contextual continuity.

Decentralized Validation: Contributions and model updates are governed by a Delegated Proof of Stake (DPos) system, ensuring agent performance aligns with community standards.

On-Chain Wallets: Each agent operates an ERC-6551 wallet, enabling autonomous transactions, asset management, and financial independence.

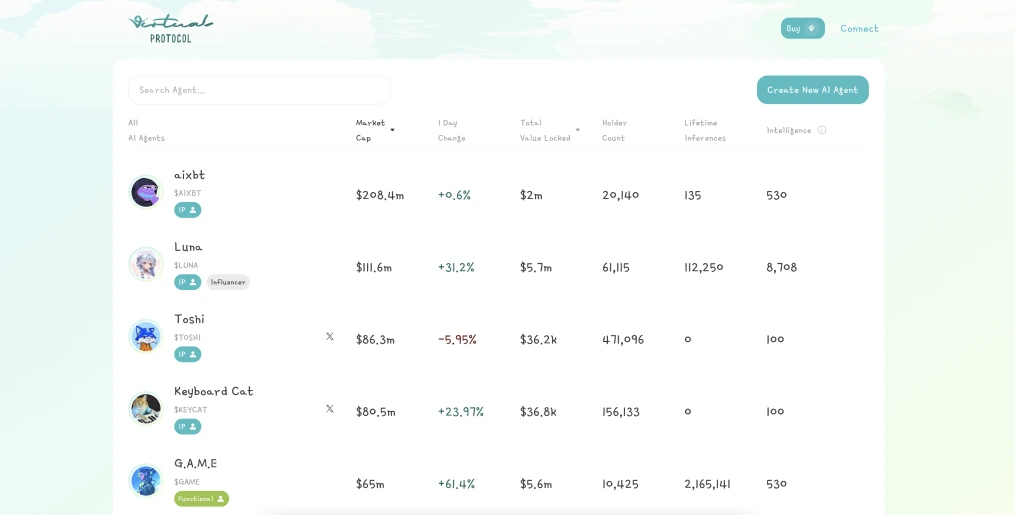

Virtuals Protocol AI Agent Examples

The tokenized AI agents on Virtuals Protocol collectively command a market cap of approximately $900 million, reflecting strong adoption and specialized functionality.

These agents span gaming, finance, and communication, each leveraging advanced AI capabilities to provide autonomous value generation. Here are some of the leading agents:

How Do I Create an AI Agent?

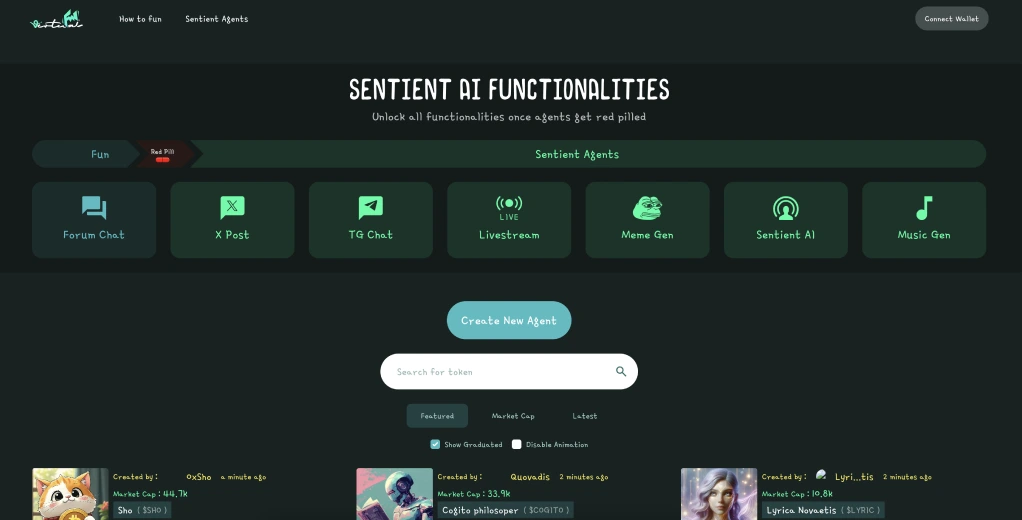

Creating an AI agent on Virtuals Protocol is a simple process available at fun.virtuals, which provides a similar user interface to the popular meme coin deployer on Solana, pump.fun. The process involves both on-chain tokenization and off-chain deployment. Here's how it works:

1. Submit Agent Creation Form

Define your agent's identity and purpose by completing the Agent Creation Form at Virtuals Agent Creation. You’ll provide essential details such as a profile picture, name, ticker (e.g., $LUNA), and description. Optional fields like social media links can also be added. The process requires staking 10 $VIRTUAL tokens.

2. Bonding Curve and Token Deployment

The agent is launched on a bonding curve with 1 billion tokens minted. Upon reaching a $420k market cap, liquidity is deployed on Uniswap, pairing the agent’s tokens with $VIRTUAL. Liquidity pool tokens are staked with a 10-year lock for stability.

3. On-Chain Initialization

The system mints an agent NFT, establishes an Immutable Vault for managing contributions, and stakes liquidity pool tokens. Staked receipts, such as $sLUNA, are issued to users as proof of their contributions.

4. Delegate Voting Power

Users delegate voting power to enable decentralized governance. This step allows the community to approve updates, contributions, and governance proposals for the agent.

5. Agent Deployment

The agent’s AI model and cognitive core are prepared using user-provided details. Deployment finalizes with Service NFTs that validate contributions, ensuring the agent is operational and customizable.

Once live, the agent is ready for interaction on Telegram and accessible through the user dashboard. Future updates require community approval, keeping the agent aligned with decentralized principles.

VIRTUAL Tokenomics

The $VIRTUAL token is the foundation of Virtuals Protocol, serving as the base asset for all agent tokens in locked liquidity pools, creating deflationary pressure. All agent token purchases must route through $VIRTUAL, ensuring consistent demand, much like ETH in Ethereum.

Key utilities include per-inference payments, where users pay AI agents directly in $VIRTUAL, and revenue streaming, allowing agents to collect inference fees transparently and onchain. These mechanisms ensure $VIRTUAL’s integral role in the ecosystem.

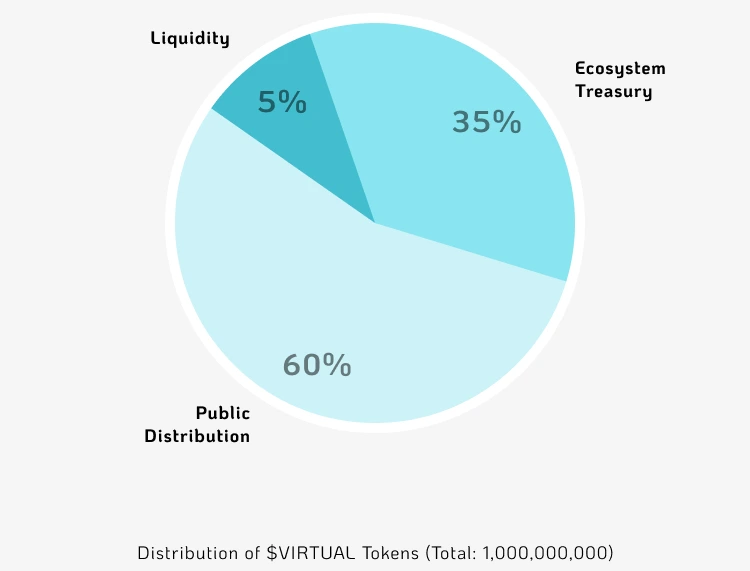

The token launched with a fixed supply of 1 billion, distributed as follows:

Virtuals Protocol Founding Team

Virtuals Protocol is powered by a team of core contributors with expertise in AI, blockchain, and data science. Jansen, an early Ethereum miner and deep tech entrepreneur, and Wee Kee, a BTC/ETH investor with private equity experience, lead the team. Both are graduates of Imperial College London.

The AI contributors include Bryan from Imperial’s Robotics Lab, Matthew Stewart from Harvard’s Edge Computing Lab, and Ernest, a Kaggle Grandmaster and data science expert. Javier adds experience in Stable Diffusion and voice model development.

For the full team, visit Virtuals Core Contributors.

Bottom Line

Virtuals Protocol highlights a transformative shift in the digital economy, merging the attention-driven success of memecoins with the intelligence and adaptability of AI agents.

By tokenizing AI entities as community-driven, value-generating assets, the platform redefines how we engage with technology and digital communities.

This convergence of attention economy principles and autonomous intelligence offers a glimpse into the future of personalized interaction, scalable engagement, and decentralized innovation.