KEY TAKEAWAYS

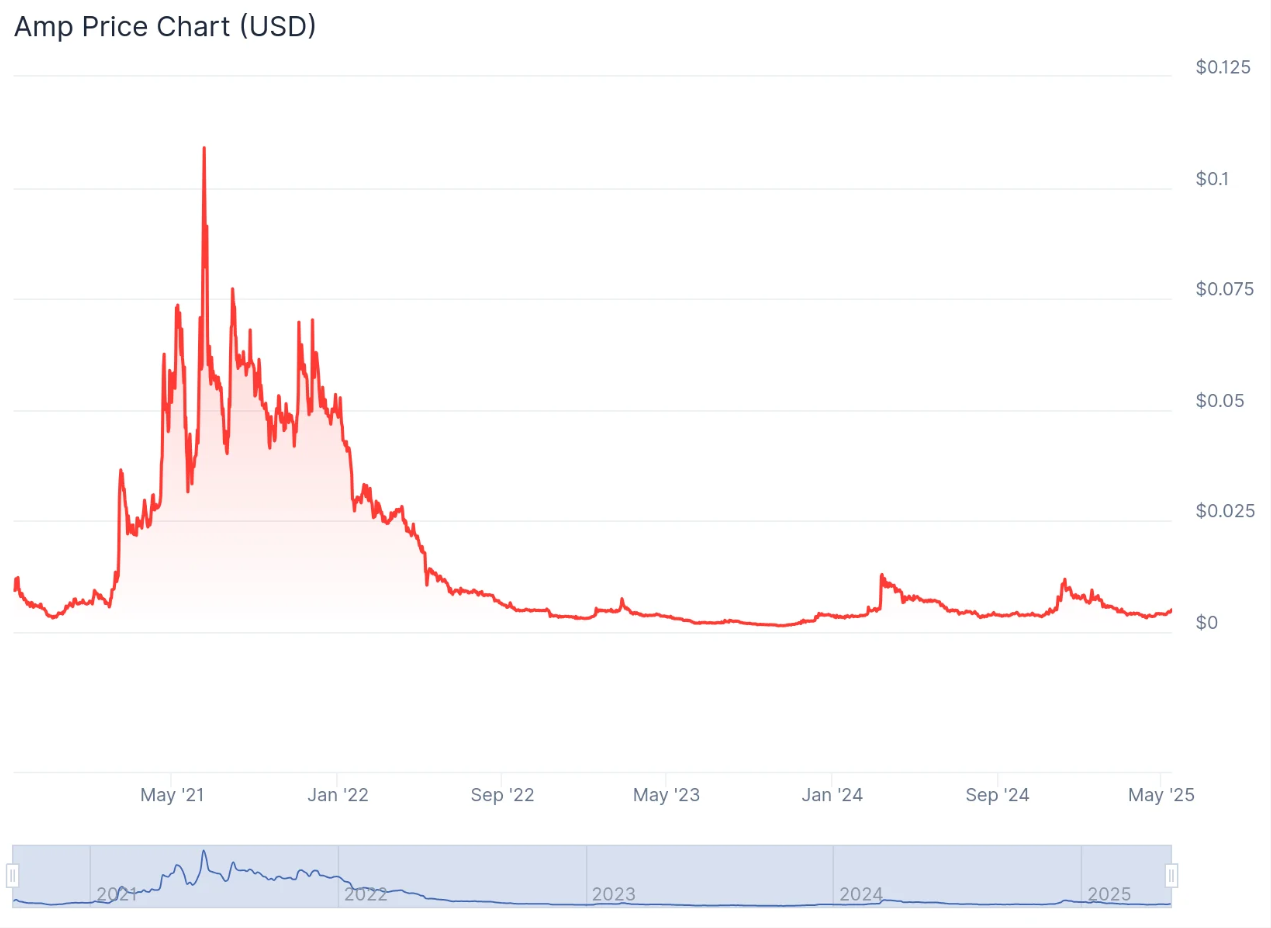

AMP has dropped 28% since this time last year.

Price peaked in February 2025, then reversed sharply lower.

A breakout above $0.0058 would signal bullish continuation.

The Amp (AMP) token has struggled to maintain upward momentum in 2025 despite previous rallies in March and November 2024.

Its current price performance lags behind the broader DeFi market, with recent volatility and investor concentration adding uncertainty.

While the project still holds long-term potential, the short-term outlook remains cautious.

Let’s take a look at recent price performance, AMP’s historical levels, and where the token might head next.

Amp Price Prediction

| Minimum AMP Price Prediction | Average AMP Price Prediction | Maximum AMP Price Prediction | |

|---|---|---|---|

| 2025 | $0.0038 | $0.0062 | $0.0075 |

| 2026 | $0.0060 | $0.0095 | $0.0140 |

| 2030 | $0.0120 | $0.0250 | $0.0450 |

AMP Price Prediction 2025

AMP’s recent 90% rally and breakout from a falling wedge signal a trend reversal, but overbought conditions and bearish divergence suggest a short-term correction is likely.

If the bullish structure holds, the price may recover toward $0.0075 after retesting the $0.0038–$0.0040 support zone.

AMP Price Prediction 2026

With the correction potentially complete, AMP could reclaim momentum and build a higher base above previous resistance at $0.0060. A broader market recovery and continued bullish structure may lift the price toward $0.014.

AMP Price Prediction 2030

Long-term growth and increased utility could lead AMP to stabilize above $0.012 as part of a sustained uptrend. In a strong crypto cycle, it may revisit or exceed past highs, pushing as far as $0.045.

AMP Price Analysis

AMP has broken out of a long-term downtrend and completed a five-wave impulsive rally from the April low, gaining nearly 90%.

This move followed the completion of a W-X-Y-Z corrective structure and a breakout from a falling wedge, with price hitting a high of $0.0058 before facing resistance at the 0.236 Fibonacci retracement.

The rally confirmed a bullish shift, but current rejection and overbought RSI readings suggest a corrective phase may start.

Short-term AMP Price Prediction

AMP consolidates within a symmetrical triangle on the lower time frame after completing a five-wave impulse.

This setup typically precedes an ABC correction, with key supports at $0.0050 and $0.00462.

A deeper correction could target the previous accumulation zone’s $0.00380–$0.00400.

A move above $0.0058 would invalidate the correction and suggest continuation toward $0.0060–$0.0070. However, the corrective scenario remains more probable without strong volume and a breakout.

AMP Average True Range (ATR): AMP Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility.

Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On May 15, 2025, AMP’s ATR was 0.00030, rising from a low of 0.000080 on May, suggesting rising volatility.

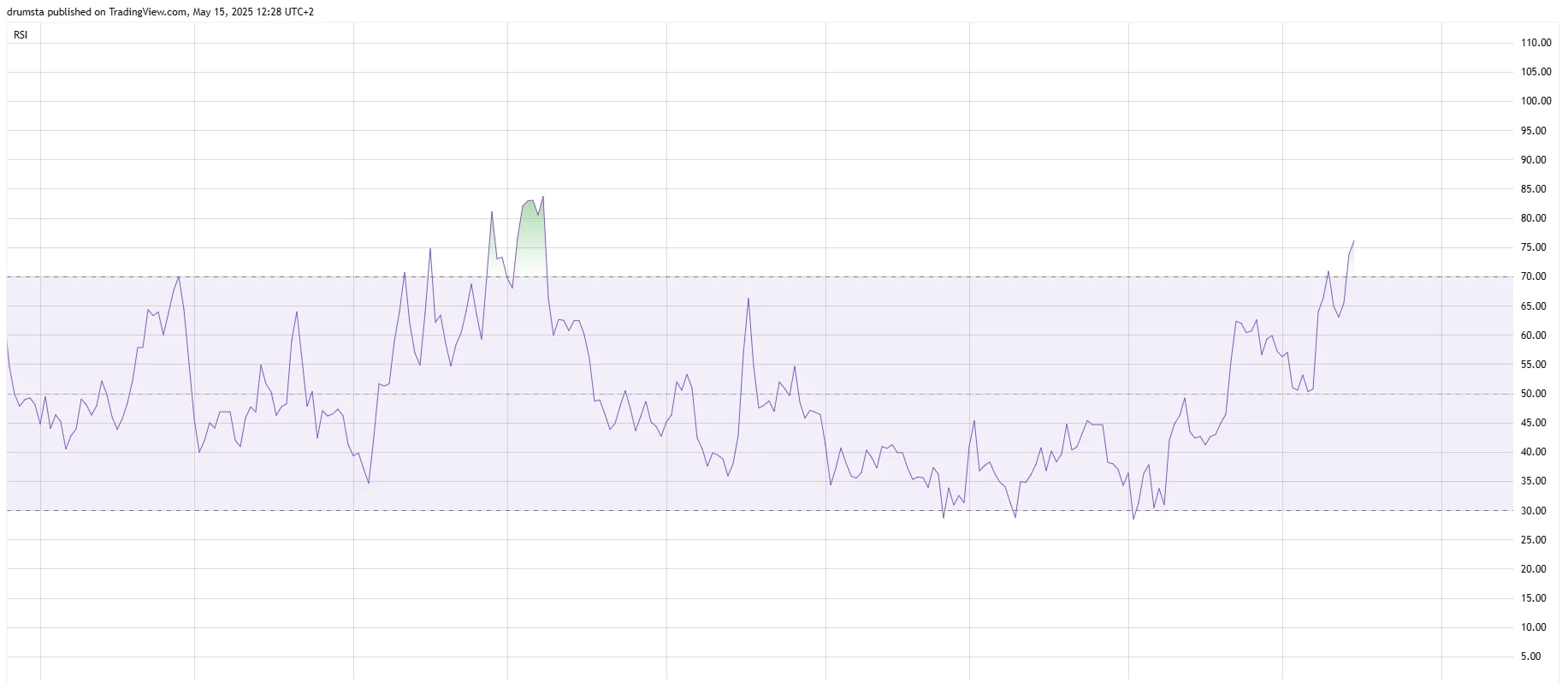

AMP Relative Strength Index (RSI): Is AMP Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator that traders use to determine whether an asset is overbought or oversold.

Movements above 70 and below 30 show over and undervaluation, respectively. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On May 15, 2025, the AMP RSI was 76 on the daily chart, indicating overbought conditions.

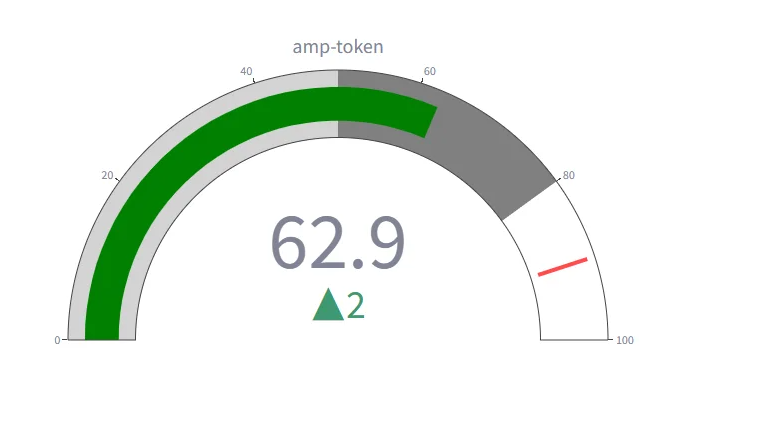

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes.

The same principle applies to rapid declines: a sudden drop will spike the score downward, but as volatility decreases, the score will slowly adjust back up.

On May 15, 2025, AMP scored 62.9 on the CCN Index, suggesting strong momentum.

AMP Price Performance Comparisons

Amp is a decentralized finance (DeFi) crypto, so let’s compare its performance to projects in the same category with similar market caps.

| Current Price | One Year Ago | Price Change | |

|---|---|---|---|

| AMP | $0.0050 | $0.0070 | -28.57% |

| RSR | $0.00897 | $0.0065 | +38% |

| LUNC | $0.000065 | $0.00010 | -35% |

| 1INCH | $0.22 | $0.37 | -40.54% |

Best Days and Months to Buy AMP

We looked at AMP’s price history and found the best and worst times to buy AMP.

| Day of the Week | Wednesday |

| Week | 7 |

| Month | May |

| Quarter | First |

AMP Price History

Let’s now look at some of the key dates in the AMP price history.

While past performance should never be taken as an indicator of future results, knowing what Amp has done can give us practical context when making or interpreting an AMP price prediction.

| Time period | AMP price |

|---|---|

| One week ago (May 8, 2025) | $0.003997 |

| One month ago (Apr. 15, 2025) | $0.003546 |

| Three months ago (Feb. 14, 2025) | $0.005783 |

| One year ago (May 15, 2024) | $0.006814 |

| Launch price (Sept. 12, 2020) | $0.01115 |

| All-time high (June 16, 2021) | $0.1211 |

| All-time low (Nov. 17, 2020) | $0.0007946 |

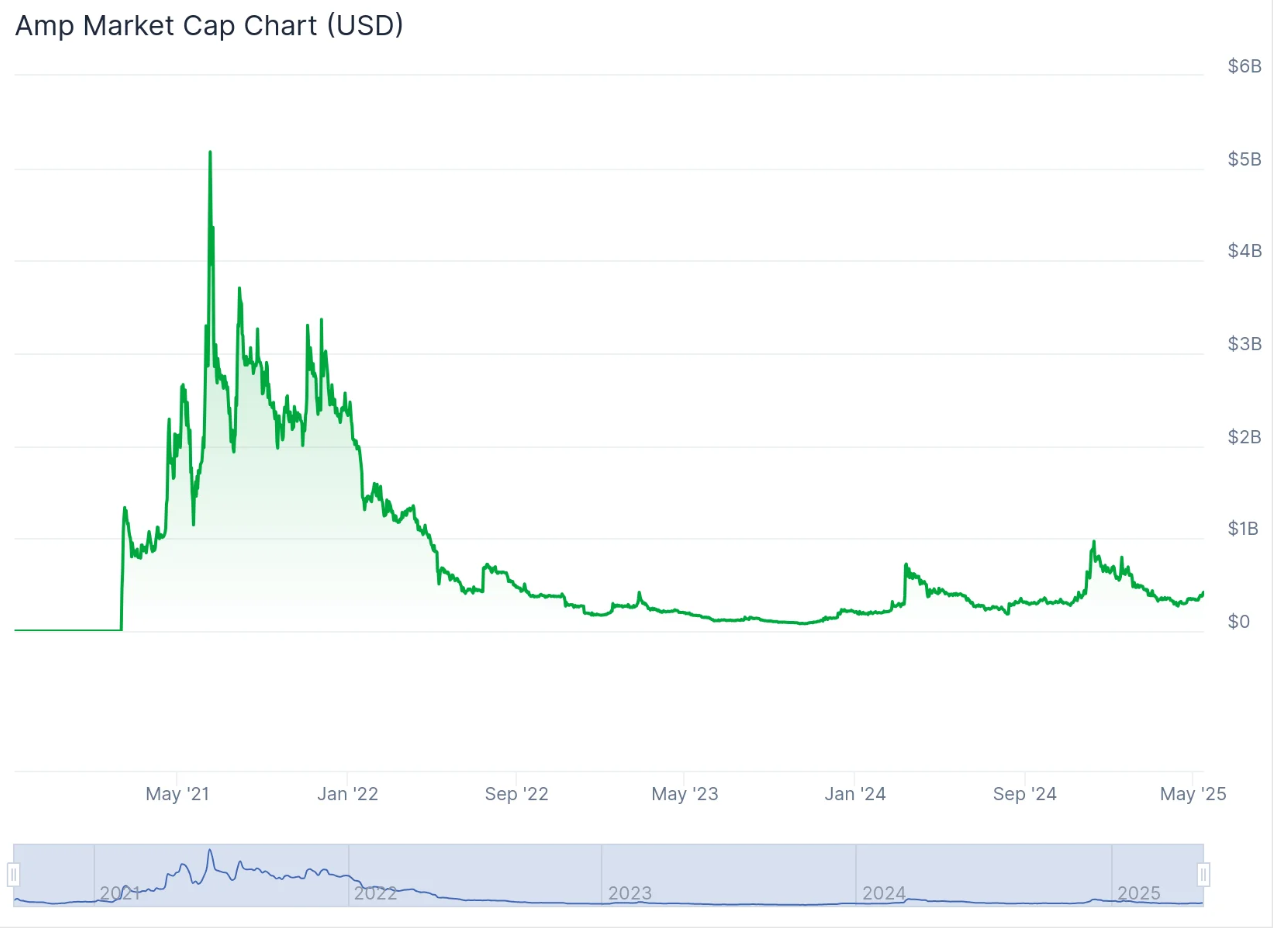

Amp Market Cap

Market capitalization, or market cap, is the sum of the total number of cryptocurrencies in circulation multiplied by their price.

On May 15, 2025, AMP’s market cap was $422,916,435, making it the 189th-largest crypto by that metric.

Who Owns the Most Amp (AMP) Tokens?

On May 15, 2025, one wallet held more than 30% of AMP’s supply.

Richest AMP Wallet Addresses

As of May 15, 2025, the five wallets with the most AMP were

0x706d7f8b3445d8dfc790c524e3990ef014e7c578. This wallet held 32,055,184,550 AMP, or 32.16% of the supply.

0x780f9a570c1bec9f2dc761b9031c992cb3e2ae6e. This wallet held 7,000,000,000 AMP, or 7.02% of the supply.

0x0c3a4a4416562ddccfda34e4fe681569fe60c7bd. This wallet held 5,938,990,202 AMP, or 5.96% of the supply.

0xafcd96e580138cfa2332c632e66308eacd45c5da. This wallet held 5,374,174,722 AMP, or 5.39% of the supply.

0x76ec5a0d3632b2133d9f1980903305b62678fbd3. This wallet held 3,132,105,364 AMP, or 3.14% of the supply.

Amp Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Total supply | 99,669,205,039 |

| Circulating supply (as of May 15, 2025) | 84,231,346,590 (84.51% of total supply) |

| Holder distribution | Top 10 holders owned 63.74% of supply as of May 15, 2025 |

From the AMP Whitepaper

In its technical documentation or whitepaper, Amp describes itself as a “universal collateral token designed to help fast and efficient transfers for any real-world application.”

It says: “When using Amp as collateral, transfers of value are guaranteed and can settle instantly.”

While the underlying asset reaches final settlement, a process that can take anywhere from seconds to days, Amp is held in escrow by a collateral manager.

“Once the transaction successfully settles, the Amp collateral is released and made available to collateralize another transfer. It exists to serve as universal collateral for anyone and any project.”

What is Amp?

Amp operates as a decentralized digital collateral system part of the larger Flexa pay platform. In theory, people can sell AMP to cover losses on Ethereum and Bitcoin.

Because it is based on the Ethereum blockchain, Amp is a token, not a coin. You might see references to an Amp coin price prediction, but these are wrong.

How AMP Works

AMP pays for costs on the AMP platform. People can stake it or set it aside in return for rewards. AMP can also be bought, sold, and traded on exchanges.

Is Amp a Good Investment?

It is hard to say. Despite rallying in late 2024, along with much of the crypto market, AMP has dropped considerably recently.

Time will tell whether or not it can make a recovery.

As with crypto, you must do your research before deciding whether or not to invest in AMP.

Will Amp go up or down?

No one can tell right now. While the Amp crypto price predictions are largely optimistic, price predictions have a well-earned reputation for being wrong.

Keep in mind that prices can and do go down and up.

Should I invest in Amp?

Before you decide whether or not to invest in AMP, you will have to research AMP and other related coins and tokens, such as Ethereum (ETH) and Telcoin (TEL). Either way, you must also ensure you never invest more money than you can afford to lose.