We just received data on a new analyst forecast for $AMP. Kevin Heal from Argus Research set a price target of 554.0 for AMP.

To track analyst ratings and price targets for $AMP, check out Quiver Quantitative's $AMP forecast page.

Should you buy $AMP?

Some analysts are better than others. To view the past performance of Argus Research, check out Quiver’s Analyst Ratings dashboard. You can also see Quiver’s Analyst Buys Strategy, which uses a proprietary method to track the companies being recommended by the top Wall Street analysts.

$AMP Price Targets

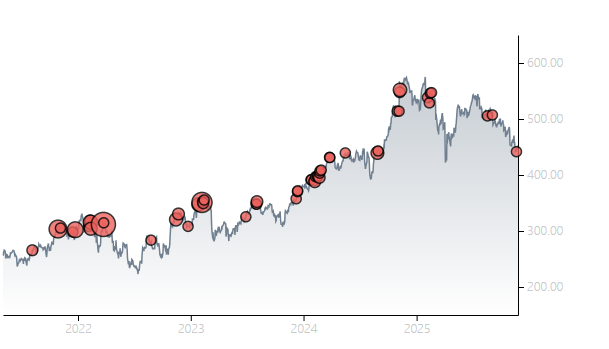

Multiple analysts have issued price targets for $AMP recently. We have seen 10 analysts offer price targets for $AMP in the last 6 months, with a median target of $552.0.

Here are some recent targets:

Kevin Heal from Argus Research set a target price of $554.0 on 11/13/2025

Ryan Krueger from Keefe, Bruyette & Woods set a target price of $530.0 on 11/03/2025

Kenneth S. Lee from RBC Capital set a target price of $550.0 on 11/03/2025

Thomas Gallagher from Evercore ISI Group set a target price of $570.0 on 10/09/2025

Brennan Hawken from BMO Capital set a target price of $525.0 on 10/03/2025

Michael Cyprys from Morgan Stanley set a target price of $484.0 on 10/01/2025

Wilma Burdis from Raymond James set a target price of $582.0 on 07/25/2025

Receive $AMP Data Alerts

Sign Up

$AMP Insider Trading Activity

$AMP insiders have traded $AMP stock on the open market 2 times in the past 6 months. Of those trades, 0 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $AMP stock by insiders over the last 6 months:

WILLIAM F TRUSCOTT (CEO, GLOBAL ASSET MANAGEMENT) sold 9,929 shares for an estimated $5,032,933

HEATHER J. MELLOH (EVP AND GENERAL COUNSEL) sold 1,500 shares for an estimated $768,502

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$AMP Hedge Fund Activity

We have seen 539 institutional investors add shares of $AMP stock to their portfolio, and 648 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

JPMORGAN CHASE & CO removed 1,466,509 shares (-23.4%) from their portfolio in Q3 2025, for an estimated $720,422,546

UBS AM, A DISTINCT BUSINESS UNIT OF UBS ASSET MANAGEMENT AMERICAS LLC removed 1,033,668 shares (-46.0%) from their portfolio in Q2 2025, for an estimated $551,699,621

PERRITT CAPITAL MANAGEMENT INC added 627,398 shares (+53304.8%) to their portfolio in Q2 2025, for an estimated $334,861,134

ARISTOTLE CAPITAL MANAGEMENT, LLC removed 616,166 shares (-19.5%) from their portfolio in Q2 2025, for an estimated $328,866,279

BLACKROCK, INC. removed 493,311 shares (-5.2%) from their portfolio in Q3 2025, for an estimated $242,339,028

AGF MANAGEMENT LTD removed 313,966 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $167,573,073

THRIVENT FINANCIAL FOR LUTHERANS added 282,317 shares (+1946.6%) to their portfolio in Q3 2025, for an estimated $138,688,226

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.