Irys launched only a few hours ago, and the price is already showing a wide, early trading range. It is a Layer 1 data chain built to merge on-chain data storage and smart-contract execution, which has made it one of the more anticipated launches this cycle. A possible airdrop-related supply unlock also means early IRYS price volatility is expected.

Now the chart shows the first real test: both upside and downside remain open, and volume signals will decide the first trend.

Early Strength Holds, but Volume Signals a Cautious Start

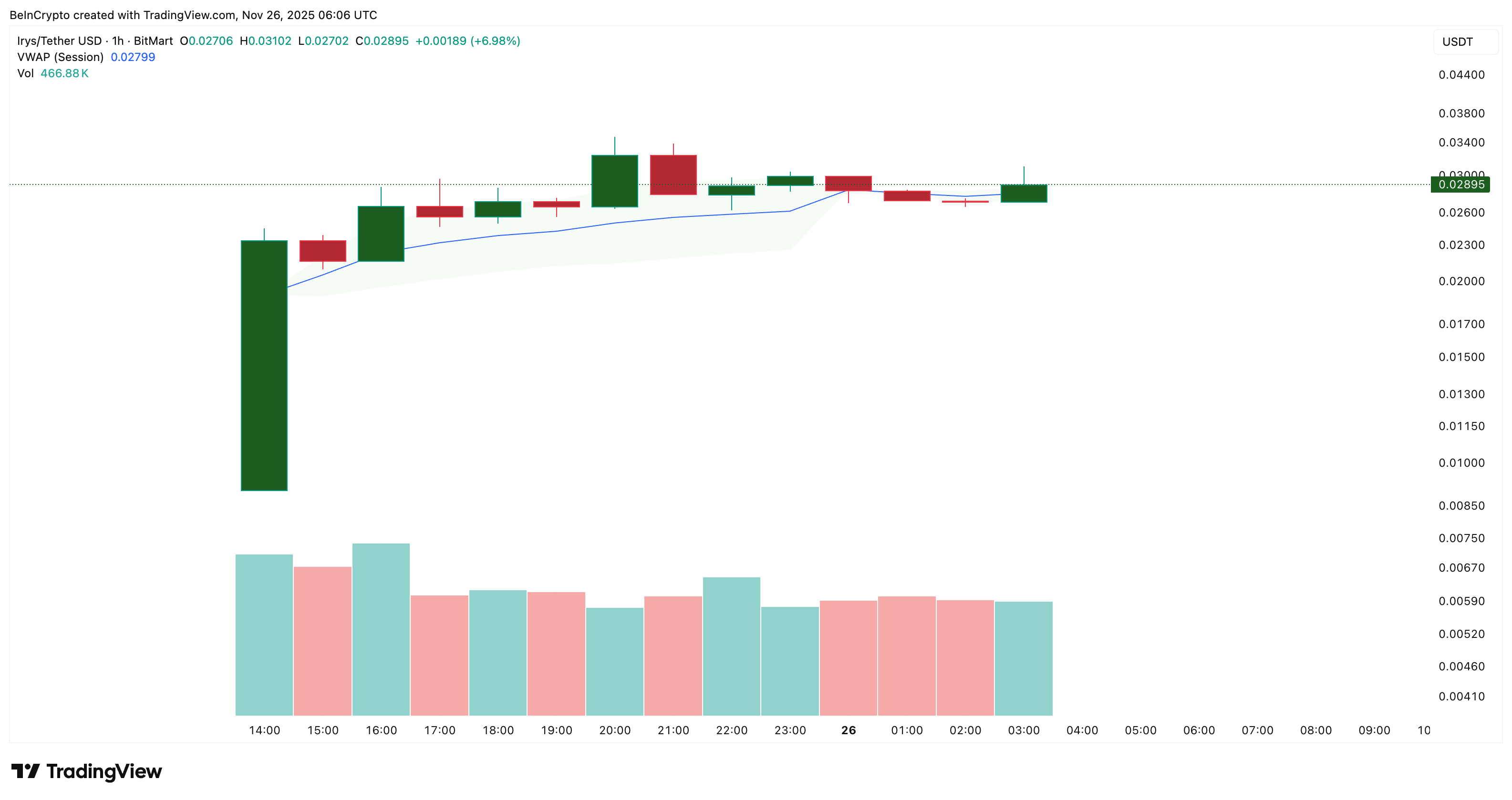

On the 1-hour chart, the IRYS price is using the volume-weighted average price (VWAP) as its main guide. VWAP tracks the average trading price in a session, but weights each trade by its volume, so it shows where the “real” bulk of trading is happening.

Since launch, the first large green candle closed above the VWAP line, which kicked off the initial move.

Standard volume bars back this up: early candles came with heavy volume, then activity cooled but stayed stable while price held near or slightly above VWAP.

The last two candles briefly closed below the line, but the next candle quickly reclaimed it. That shows dips below VWAP are being bought for now, even though no clear volume spike has appeared to confirm a strong trend yet.

VWAP Shows Active Buying: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

OBV on the 1-hour chart presents the other half of the picture. On-Balance Volume (OBV) tracks whether real trading volume is flowing in or out.

Since launch, the IRYS price has made a higher low. Yet, the OBV has made a lower low, meaning buyers are in control of price but not yet of volume. OBV sits in negative territory near –389,970, and the first level it must reclaim is 70,960. Clearing that level and then the next band at 583,600 would mark a proper higher-high formation.

It would then confirm a volume-supported reversal on the one-hour chart.

Buyers Gaining Control: TradingView

A possible IRYS airdrop distribution earlier could also explain the initial negative OBV print, as early holders likely claimed and sold small amounts.

Together, VWAP and OBV show the full picture. VWAP tells us where most trading took place, but OBV shows who is actually controlling that volume. Right now, price is holding above VWAP, but OBV still lags. That is why the next move depends on whether volume flows back to buyers.

Key Levels Show a Wide Early Range for IRYS Price

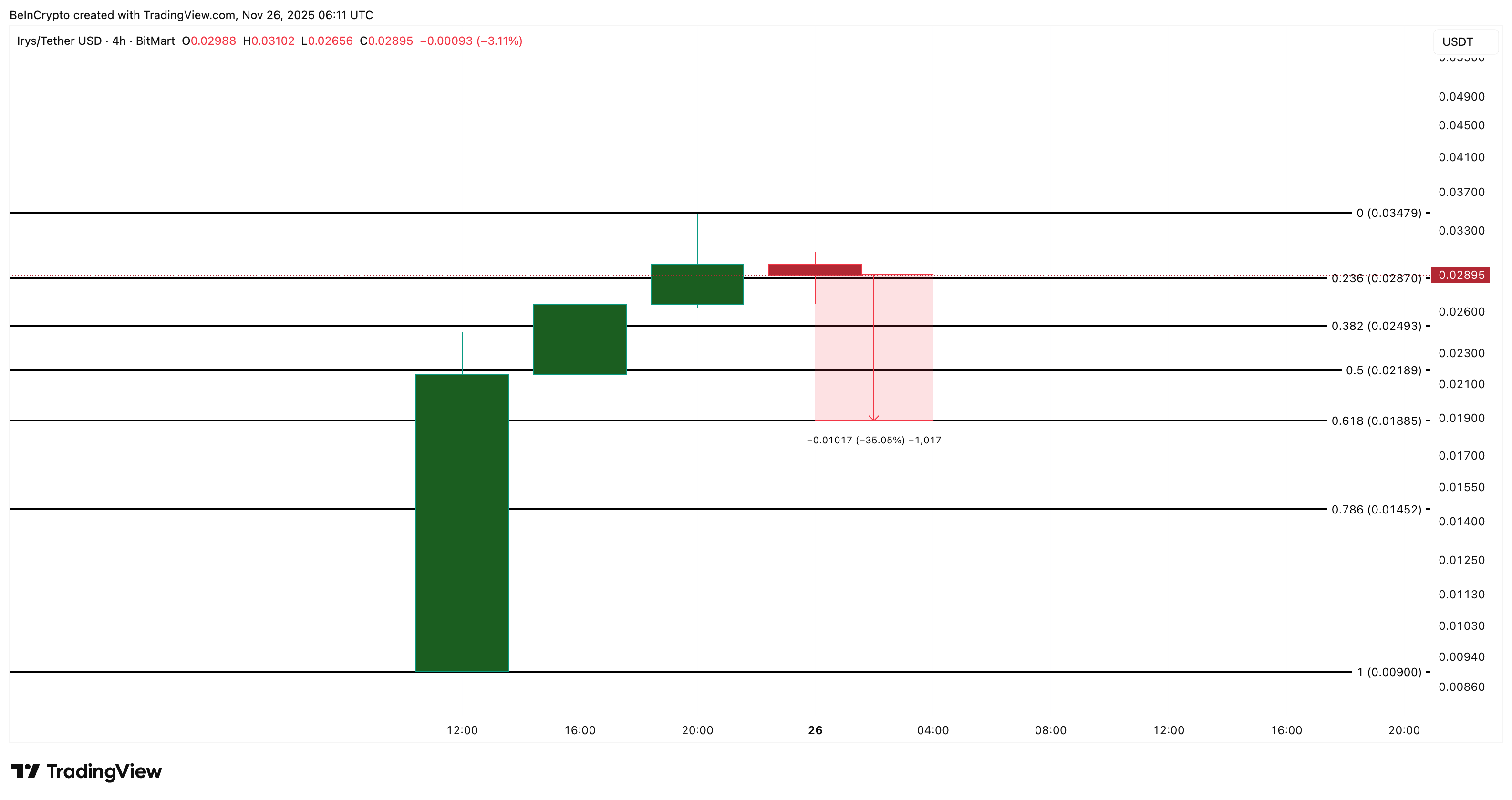

The 4-hour IRYS price chart shows a fresh trend-based Fibonacci layout. The immediate upside level is $0.032, followed by $0.039 and the strongest early resistance at $0.042. This last zone sits near the 0.618 Fib, often the level where early listings find their first real sell wall.

If momentum strengthens, $0.052 remains the top extension for the first leg.

IRYS Price Analysis: TradingView

But this requires OBV strength and a VWAP-supported expansion, not just isolated green candles.

On the downside, the key support sits at $0.024, with deeper support at $0.018, followed by $0.014. A break below $0.018 even exposes $0.009. That would signal that the first post-launch IRYS price phase is turning into a full retracement.

However, that would mean that OBV might have broken down its ascending trendline, highlighted earlier on the 1-hour chart.

IRYS Price Analysis (Downside Projection): TradingView

Right now, Irys trades in the middle of this wide band, and both outcomes remain possible. VWAP support and OBV improvement would open the upside. However, fading volume and a break under $0.018 would shift control to sellers.