If you’ve been looking into POL price prediction, you’re not alone. Polygon, which rebranded from MATIC in late 2023, is one of the most popular projects built to make Ethereum faster and cheaper to use. Investors and beginners alike are paying attention to how it’s moving on the market.

Right now, the price of POL is $0.24. Earlier this month, it touched a high of $0.263 on August 19, while the lowest level was $0.191 on August 3. That’s about a 25% recovery from the bottom, showing that the token is still holding interest even in a volatile market.

In this article, we’ll break down what Polygon (POL) is, why it matters, and how its price has changed over time. You’ll also see expert forecasts, technical analysis, and long-term POL price predictions, so you can decide if it is worth adding to your portfolio.

| Current POL Coin Price | POL Prediction 2025 | POL Price Prediction 2030 |

| $0.24 | $1 | $9 |

POL (ex-MATIC) Overview

Polygon, formerly known as MATIC, is a blockchain project created to solve one of the biggest problems in crypto: Ethereum’s speed and cost. While Ethereum is the most widely used network for decentralized apps (dApps), it often becomes slow and expensive when traffic is high. Polygon was designed as a scaling solution that makes transactions faster, cheaper, and easier to use.

The project was founded in 2017 by three Indian developers: Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun. Their goal was simple but ambitious — create a framework that could support Ethereum’s growth and help bring blockchain technology to mainstream adoption. In the early days, it was called the “Matic Network.” Over time, it grew into one of the most recognized names in the crypto space.

In October 2023, the team officially rebranded MATIC to POL, introducing a new token model and expanding its vision. The rebrand wasn’t just cosmetic. POL is designed to act as a unified token for the entire Polygon ecosystem, powering multiple chains, enabling staking, and supporting governance. This shift represents Polygon’s long-term plan to position itself as a key infrastructure layer for Web3.

Polygon uses what’s called a layer-2 scaling approach. In practice, this means it processes transactions off Ethereum’s main chain, then secures them back to Ethereum. This system gives users the same level of security while making transfers much faster and cheaper. Developers also benefit because they can launch apps that work like Ethereum dApps but cost a fraction of the gas fees.

Over the years, Polygon has gained strong recognition and adoption. It has partnered with major companies such as Meta, Starbucks, Reddit, and Nike, showing that it’s not just a niche project. These partnerships help demonstrate how blockchain can be used in everyday products, from loyalty programs to digital collectibles.

Polygon’s ecosystem has also become home to thousands of decentralized applications, from DeFi platforms to NFT marketplaces. With POL as its native token, the network aims to unify governance and security across all Polygon-based chains, ensuring smooth operation and scalability.

POL Market Information Data

| Current Price | $0.24 |

| Market Cap | $2,199,036,840 |

| Volume (24h) | $141,528,891 |

| Market Rank | #59 |

| Circulating Supply | 9,121,441,765 POL |

| Total Supply | 10,488,912,065 POL |

| 1 Month High / Low | $0.263 / $0.191 |

| All-Time High | $2.92 Dec 27, 2021 |

In short, Polygon (POL) is not only a continuation of the MATIC legacy but also an upgrade that expands its possibilities. Its mission is clear: make blockchain more scalable, affordable, and ready for mainstream use.

POL Features

Polygon’s rebrand from MATIC to POL introduced more than just a new name. It also brought updates to how the network and its token work. Let’s break down the main features that make POL stand out.

1. Multi-Chain Support

One of the most important features of POL is that it supports multiple chains within the Polygon ecosystem. Instead of being tied to one chain, POL is designed to act as a unified token across all Polygon blockchains. This makes it more flexible and useful in the long run.

2. Staking and Security

POL can be staked by holders to help secure the network. In return, stakers earn rewards. This system not only strengthens the security of the Polygon ecosystem but also gives token holders a chance to earn passive income. Validators, who process transactions, are rewarded in POL for their role in keeping the network safe and reliable.

3. Governance

With POL, users have the ability to participate in decision-making. Token holders can vote on proposals that shape the future of the Polygon ecosystem. This governance feature makes POL more than just a transaction token; it gives the community a real voice in how the network evolves.

4. Low Transaction Costs

One of Polygon’s biggest selling points has always been its low fees compared to Ethereum. POL keeps this advantage alive. Transactions on Polygon remain much cheaper, often costing just a fraction of a cent, which makes it attractive for both developers and everyday users.

5. Interoperability

Polygon has worked hard to be compatible with Ethereum. Developers can use the same tools and coding languages they already know from Ethereum, while benefiting from Polygon’s faster and cheaper environment. POL supports this interoperability, allowing assets and applications to move smoothly between networks.

6. Tokenomics

Unlike some tokens that only serve as payment, POL has a broader utility. It’s used for staking, paying fees, securing the network, and governance. This multi-purpose design gives it stronger fundamentals and helps maintain long-term demand.

7. Sustainability and Innovation

Polygon has also committed to becoming carbon-neutral. It’s one of the first major blockchain projects to take sustainability seriously, showing a vision beyond just technology. POL reflects this ethos by supporting projects that aim to make blockchain greener and more efficient.

POL Price Chart

CoinGecko, August 21, 2025

POL (prev. MATIC) Price History Highlights

Polygon’s story as a token began in April 2019, when MATIC first launched at around $0.002. Back then, it was a small project with a big vision: to make Ethereum faster and cheaper.

2019–2020 – During these early years, MATIC slowly gained attention. The rise of decentralized finance (DeFi) in 2020 helped shine a light on the project. As Ethereum became congested, MATIC’s promise of scalability started to attract developers and investors. Prices climbed steadily through this period, even though the crypto market was still relatively small compared to later years.

2021 – The big breakthrough came in 2021. As the crypto bull market took off, interest in DeFi and NFTs exploded. MATIC’s price skyrocketed, reaching an all-time high of $2.92 in December 2021. Like most tokens, it wasn’t a straight climb. The market correction in mid-2021 dragged MATIC down to around $0.79 by July, but it quickly bounced back, showing strong resilience.

2022 – In 2022, MATIC managed to hold ground despite a bearish global market. It benefited from new partnerships and ecosystem growth, trading around $1 by the end of the year. This was impressive given that many other altcoins fell much harder during the same period.

2023 – By 2023 MATIC continued to be a top choice for developers. The token moved between $0.5 and $1.5 throughout the year. Importantly, this was also the year when Polygon announced a major shift. In October 2023, MATIC officially rebranded to POL, setting the stage for its new role as the central token of the Polygon ecosystem.

2024 – In March 2024, during a volatile bull run, POL (formerly MATIC) reached about $1.29. By the end of the year, however, it had dropped to $0.3, reflecting the broader ups and downs of the market.

2025 – Polygon (POL) started 2025 at around $0.45. In the first few months, the price showed weakness, slipping lower as overall market sentiment cooled. By April 2025, POL dropped sharply, testing levels near $0.18 — one of its lowest points since the rebrand from MATIC.

After this decline, the token entered a narrow trading range. For most of the year, it has been hovering between $0.18 and $0.25, occasionally pushing higher but struggling to hold momentum.

POL Price Prediction: 2025, 2026, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.22 | $2.19 | $1 | +315% |

| 2026 | $0.37 | $4.41 | $2 | +730% |

| 2030 | $1.15 | $17.3 | $9 | +3,650% |

| 2040 | $42.6 | $174.4 | $100 | +41,500% |

| 2050 | $206.7 | $242.2 | $220 | +91,500% |

POL Price Prediction 2025

DigitalCoinPrice experts expect POL in 2025 to trade between $0.22 (-10%) and $0.53 (+120%). This shows a conservative outlook, with the token potentially facing some downside but also room for steady growth.

PricePrediction takes a more cautious stance. Their analysts forecast that POL might reach a minimum of $0.2516 (+5%), while its maximum could rise to $0.2787 (+15%). Such levels would mean very limited growth compared to today’s price.

Telegaon, on the other hand, is much more bullish. They believe that POL could bottom out at $0.78 (+225%), while in a strong bull market it might climb as high as $2.19 (+810%). This wide range highlights the uncertainty but also the potential for explosive gains if adoption grows.

POL Price Prediction 2026

DigitalCoinPrice projects a stable rise for POL in 2026. Their forecast shows the coin holding above $0.52 (+115%) at its minimum, with a possible rally to $0.63 (+160%).

PricePrediction analysts expect a softer performance, predicting a minimum of $0.369 (+55%) and a maximum of $0.4346 (+80%). This keeps POL in a modest growth channel.

Telegaon offers the most aggressive scenario. Their forecast suggests POL could surge to between $2.24 (+830%) and $4.41 (+1,730%). If this happens, it would place POL among the strongest performers in the market by 2026.

POL Price Prediction 2030

By 2030, long-term projections become even more divided. DigitalCoinPrice expects POL to maintain steady growth, with a minimum of $1.15 (+375%) and a maximum of $1.33 (+450%).

PricePrediction provides a slightly higher outlook, forecasting a low of $1.71 (+610%) and a high of $1.93 (+700%). This suggests stronger institutional and retail adoption could drive further demand.

Telegaon remains extremely bullish, projecting that POL could fall no lower than $13.35 (+5,440%) and potentially reach $17.34 (+7,100%). This shows how some analysts believe POL could evolve into a high-value asset if the ecosystem matures significantly by 2030.

POL Price Prediction 2040

By 2040, predictions diverge massively. PricePrediction sees POL trading between $139.37 (+57,750%) and $174.37 (+72,250%), numbers that assume a full-scale global adoption of the project.

Telegaon provides a more tempered forecast, but still very bullish. They expect a minimum of $42.56 (+17,560%) and a maximum of $50.89 (+21,000%). Even at the lower end, this would mean exponential growth compared to today’s price.

At this point, both sources agree that POL could become a major player in the crypto space by 2040, though the exact magnitude of growth remains uncertain.

POL Price Prediction 2050

For 2050, only PricePrediction provides estimates. They project POL to hit a minimum of $206.69 (+85,750%) and potentially soar to $242.18 (+100,450%).

While such numbers may seem extreme, they reflect a very long-term vision in which POL continues to scale with the broader blockchain economy. If realized, this would make POL one of the most successful long-term investments in the market.

POL (ex-MATIC) Price Prediction: What Do Experts Say?

When it comes to POL price prediction, expert opinions are mixed but lean toward cautious optimism. Analysts highlight both strong fundamentals and technical setups that could drive growth in the near and mid-term.

Crypto Rand, a well-known technical analyst, shared one of the most detailed recent outlooks on August 7, 2025. He pointed out that POL has been building support between $0.48 and $0.5, with clear resistance at $0.65. According to him, breaking above this level could unlock an immediate target of $0.85 and potentially an extended target of $1.1, which acted as structural resistance in the past. Rand believes the token is “absolutely ready to smash the next targets,” supported by a breakout from a descending trendline that had held since March 2024.

Daniel Crypto, another respected market analyst, took a more fundamental approach. He suggested that POL could move toward the $1–$1.2 range, provided Polygon maintains its role as Ethereum’s leading scaling solution. His outlook stresses that strong fundamentals, developer adoption, and network utility are likely to support price growth, especially if overall market conditions improve.

On August 6, Globe Of Crypto shared a chart-based analysis, noting that POL was moving within a long-term symmetrical triangle pattern. They identified a short-term target of $0.35 if POL breaks above the $0.23 resistance level, followed by a possible 100–120% rally to $0.45–$0.55. Their analysis emphasized the importance of volume, as a strong breakout above $0.23 could trigger momentum-driven rallies.

From an on-chain perspective, Renksi highlighted Polygon’s impressive real-world performance. With over 3 million transactions processed daily at fees below $0.002, the analyst argued that such strong fundamentals naturally support bullish momentum, even without setting strict price targets.

Polygon’s co-founder and CEO, Sandeep Nailwal, added further optimism during an AMA on August 8, 2025. He announced a roadmap that includes scaling Polygon PoS to 5,000 TPS by late 2025, expanding AggLayer adoption, and completing the Heimdall v2 hard fork. While Nailwal did not comment directly on POL’s price, analysts see these technical milestones as major bullish catalysts.

Finally, community sentiment adds another layer. On Reddit, discussions range from ambitious calls of $3–$7 in this bull run to more conservative targets around $0.45. Some long-term holders remain frustrated about token dilution from the MATIC-to-POL migration, but overall tone remains cautiously positive.

POL USDT Price Technical Analysis

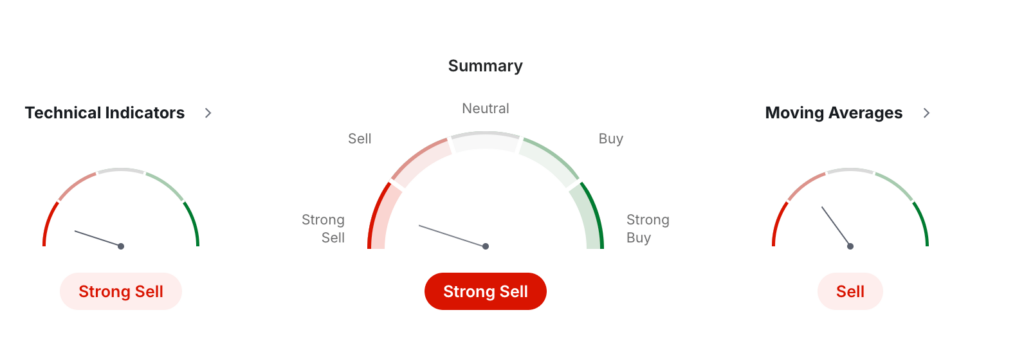

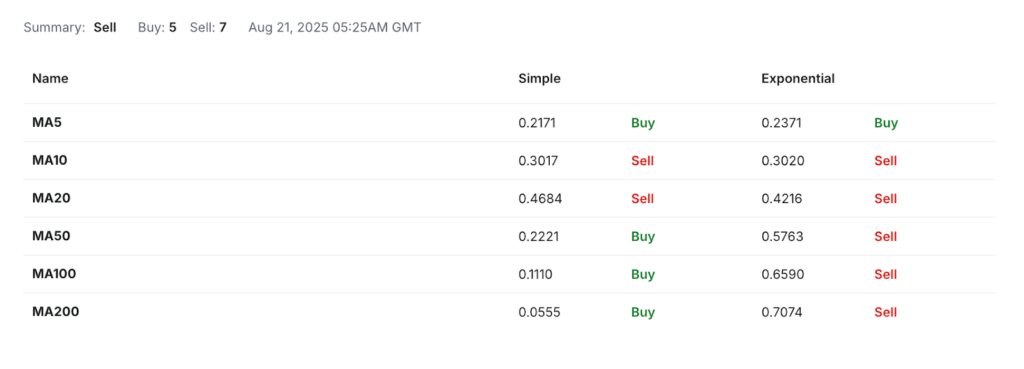

The latest monthly data from Investing.com paints a mostly bearish picture for POL (ex-MATIC). The overall summary shows a Strong Sell, supported by both technical indicators and moving averages that point toward continued weakness

Investing, August 21, 2025

Momentum signals remain negative. The Relative Strength Index (RSI-14) is at 38.44, which reflects a bearish bias but not yet a fully oversold condition. At the same time, the Stochastic (9,6) at 10.18 and the Williams %R at -85.48 indicate that the token is oversold, suggesting that selling pressure has been extreme. Interestingly, the Stochastic RSI (14) is very high at 95.45, showing overbought conditions in the shorter timeframe. This unusual mix highlights how volatile POL has been in recent weeks, swinging between heavy sell-offs and sharp recoveries.

Other indicators confirm the downward trend. The MACD (12,26) remains negative at -0.001, the ADX (14) at 44.71 suggests a strong bearish trend, while the CCI (14) at -80.55 also signals weakness. The Ultimate Oscillator reading of 35.13 leans bearish as well, leaving little doubt about the overall sentiment.

Moving averages reinforce this cautious outlook. Out of the signals, 7 are Sell and 5 are Buy. The short-term averages, such as MA5, show some strength, with both simple and exponential values (0.217–0.237) generating buy signals. However, longer-term moving averages tell a very different story. The MA20, MA50, MA100, and MA200 are all bearish, with the 200-day exponential average sitting as high as 0.707, far above the current market price of around $0.24. This wide gap highlights just how much POL has declined relative to its longer-term trend.

Pivot point data shows that $0.214–$0.226 is a critical zone for support and resistance. If POL fails to hold above these levels, the next downside targets could be $0.165, $0.125, and even $0.076. On the flip side, a recovery would first need to clear resistance near $0.25–$0.3, with stronger barriers around $0.34.

What Does the POL Price Depend On?

The price of Polygon (POL) depends on a mix of technical, fundamental, and market factors. Like most cryptocurrencies, it is influenced by both the health of its ecosystem and broader market conditions.

One of the biggest drivers is Ethereum activity. Since Polygon is built as a scaling solution for Ethereum, high network demand on Ethereum often boosts the need for Polygon. When gas fees on Ethereum rise, more users and developers look to Polygon as a cheaper alternative, which can increase demand for POL.

Another key factor is network adoption. Partnerships with big brands such as Meta, Starbucks, and Nike have shown how Polygon can reach mainstream use. The more companies and developers choose Polygon for apps, games, or NFTs, the stronger the case for long-term growth in POL’s value.

Market sentiment also plays a major role. In bullish cycles, investors are willing to take more risks, pushing tokens like POL higher. During bearish cycles, prices often drop regardless of strong fundamentals.

From a technical side, supply and tokenomics are important. POL is used for staking, governance, and transaction fees across the ecosystem. This multi-purpose role creates ongoing demand, but any concerns about dilution from the MATIC-to-POL migration can weigh on price.

Additional factors include:

Regulatory news: Global regulations around crypto often affect investor confidence.

Technology upgrades: Improvements like Heimdall v2 or scaling to 5,000 TPS can serve as bullish catalysts.

Competition: Other Layer-2 projects, such as Arbitrum or Optimism, can influence how much attention Polygon receives.

Polygon (POL) Price Prediction: Questions and Answers

Is Polygon a Good Investment?

POL can be considered a good investment for those who believe in Ethereum’s long-term growth. It provides faster and cheaper transactions, strong partnerships, and active development. However, like all cryptocurrencies, it carries risk. Investors should be ready for volatility and only invest what they can afford to lose.

What Is a Polygon Ecosystem Token?

A Polygon ecosystem token, such as POL, is used to power the Polygon network. It pays for transactions, secures the blockchain through staking, and enables governance. In short, it’s the utility token that keeps the ecosystem running, making it central to Polygon’s operations and future growth.

Will POL Coin Go Up?

POL has strong fundamentals, including millions of daily transactions and partnerships with global brands. These factors suggest potential for long-term growth. Short-term movements, however, depend on broader market cycles. If the crypto market enters a bullish phase, POL could move higher, but corrections are always possible.

Can POL Reach $1?

Reaching $1 is realistic for POL if adoption continues and market sentiment improves. Analysts such as Crypto Rand and Daniel Crypto already see this level as a likely target in the coming cycles. Breaking resistance levels and sustaining higher volume will be key to achieving this milestone.

Can Polygon Token Hit $5?

A move to $5 would require a major bull market and wider adoption across Web3 applications. While possible in the long term, it’s unlikely in the near future. If Ethereum scaling demand continues to grow and Polygon maintains leadership, $5 could be achievable over several years.

Can POL Reach $10?

A price of $10 would mean a very large market cap for Polygon. It’s not impossible, but it would require mass adoption, heavy institutional interest, and several strong bull cycles. For now, it remains a long-term speculative target rather than a realistic short-term goal.

Can Polygon Reach $100?

At $100 per token, Polygon would surpass most existing cryptocurrencies in market value. This scenario is extremely unlikely under current conditions. For such a price, blockchain adoption would need to expand globally, with Polygon becoming a dominant infrastructure layer across industries. It’s more a dream than a forecast.

How High Is POL Expected to Go?

Most analysts believe POL has the potential to reach between $1 and $5 in the medium term if adoption and network upgrades continue. Higher levels depend on the growth of the crypto industry as a whole. Long-term targets are possible but uncertain given the competitive landscape.

How Much Is POL Coin Worth in 2025?

As of August 2025, POL trades around $0.24. Expert predictions suggest it could move toward $0.85–$1.1 if resistance levels are broken. On the other hand, if the market weakens, it may continue to hover between $0.18 and $0.3 for the rest of the year.

How Much Will POL Be Worth in 2030?

Looking ahead to 2030, many long-term forecasts place POL in the $5–$15 range, depending on adoption. If Ethereum scaling demand grows and Polygon continues as a leader, prices could trend higher. Still, long-term predictions should be taken with caution because the market evolves quickly.

How High Can Polygon Token Go in 2040?

By 2040, long-term projections suggest POL could trade in the $20–$50 range if adoption continues. This would depend on mass-scale blockchain integration across industries. However, such distant predictions are highly speculative, as crypto markets can shift quickly due to new technology and competition.

What Is the Price Prediction for POL in 2050?

Looking to 2050, some forecasts place POL between $50 and $100 in a best-case scenario. This assumes Polygon remains a leading Ethereum scaling solution and blockchain technology becomes global infrastructure. While possible, these numbers should be treated as theoretical rather than guaranteed outcomes.

How to Get Polygon Ecosystem Token?

You can get POL on major exchanges like Binance and Coinbase, or through instant swap platforms such as StealthEX. On StealthEX, you don’t need to create an account — you simply choose POL and complete the swap. This makes it quick and beginner-friendly. For long-term storage, consider moving your tokens to a secure private wallet.

StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy POL Coin: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

Choose the pair and the amount you want to exchange. For instance, ETH to POL.

Press the “Start exchange” button.

Provide the recipient address to transfer your crypto to.

Process the transaction.

Receive your crypto coins.