KEY TAKEAWAYS

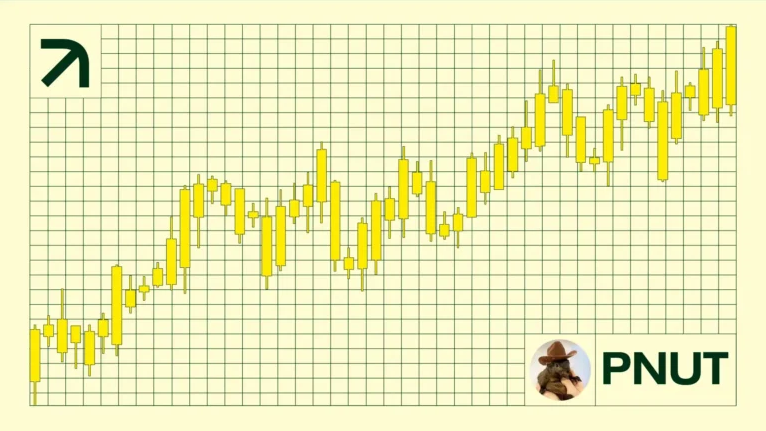

Peanut the Squirrel memecoin price soared from $0.16 to $0.48, its highest since January, before retracing to $0.40.

Despite the rally, declining CVD and fading bullish momentum hint that the PNUT uptrend may not be sustainable.

If bears maintain control, PNUT could dip to $0.35, or even slide to $0.26, but buying pressure could change the trend.

In the past seven days, PNUT, the memecoin introduced in honor of the deceased Instagram-famous Peanut the Squirrel, has surged by 150%. This rally took PNUT’s price above $0.48 for the first time since January.

However, PNUT has pulled back to $0.40 as of now after the asset became overbought. This twist raises a burning question.

Will PNUT bounce back from this dip, or is a prolonged correction coming?

PNUT Rally Becomes Overheated

Last week, PNUT’s price broke out of the descending triangle that has existed since Jan.19. Amid the price rally that took the memecoin from $0.16 to $0.48, the Relative Strength Index (RSI) jumped to 83.58.

The RSI measures momentum using the speed and size of price changes. It also tells when a cryptocurrency is overbought or oversold.

Readings below 30.00 mean that the asset involved is oversold. As long as buying pressure increases, this triggers a bullish reversal most of the time.

On the other hand, when the RSI is above 70.00, it indicates an overbought position. Therefore, the current RSI reading on the PNUT/USD chart indicates that the memecoin is overbought.

Due to this, the market value is likely to experience a further pullback, especially as the Chaikin Money Flow (CMF) has also turned downwards. Should this trend continue, PNUT’s price might find it challenging to surge above the $0.42 resistance.

Selling Pressure Overpowers Buyers

Furthermore, on the same timeframe, we observed that the Cumulative Volume Delta (CVD) has dropped to -1.29 million. The CVD measures the net difference between buy and sell volume over a specific period.

When the CVD rises, the market is absorbing selling pressure, and buying volume is higher. On the other hand, a negative CVD value indicates increasing selling pressure.

In PNUT’s case, the recent price increase and declining CVD indicate that the uptrend has weakened. If sustained, PNUT’s price might drop below $0.40 in the short term.

PNUT Price Analysis: Pullback to Continue

Concerning the short-term price action, the 4-hour chart shows that the Awesome Oscillator (AO) has flashed red histogram bars. Like the RSI, the AO measures momentum.

Despite a positive reading, the red histogram bars indicate that bullish momentum is fading. As such, PNUT’s price might drop to $0.35.

In a highly bearish scenario, the market value of the memecoin might decline to $0.26 near the 0.382 Fibonacci level.

However, if buying pressure increases, PNUT might break the overhead resistance. In that scenario, the memecoin might rise beyond $0.50.