Optimism price shows limited strength as buyers attempt to stabilize the market following weeks of downside pressure.

Open interest remains soft, while broader market data reflects muted activity. Momentum stays fragile as the crypto trades within a narrow support band.

Price Sees Weak Position as Open Interest Signals Limited Demand

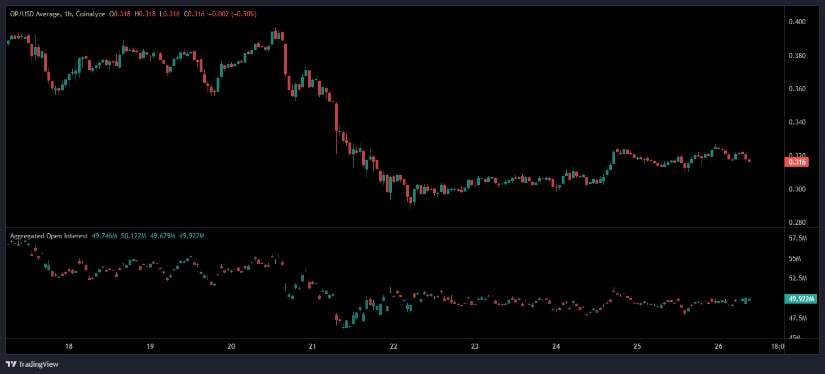

The latest derivatives data shows a constrained environment for the Optimism price, with aggregated open interest holding near 49.92M, reflecting subdued appetite for leveraged exposure.

The chart illustrates a broad decline in open interest between November 21 and November 26, aligning with the steady weakening of the crypto’s intraday structure. Each slight increase in open interest was followed by quick reversals, showing an absence of strong directional conviction.

Source: Open Interest

This trend mirrors the broader contraction in market activity, where sellers maintain the upper hand. The token price has struggled to reclaim higher levels, and derivatives participants appear hesitant to build long positions.

The persistent pattern of lower highs across the open interest chart reinforces the notion that speculative pressure remains light, keeping the coin vulnerable to additional downside. Until open interest expands alongside improving price structure, the market tone is likely to remain neutral to bearish.

Price Supported by Market Data but Recovery Momentum Remains Weak

According to BraveNewCoin data, the Optimism price is trading near 0.32 USDT, reflecting a modest 1.87% increase over the past 24 hours. Market capitalization stands at 615.56M USDT, while daily volume reached 68.70M USDT, indicating a steady but unspectacular flow of activity. The available supply of 1.89 billion tokens places the token among mid-cap assets that continue to see participation but not strong trend confirmation.

Despite the slight improvement in the token price, the underlying metrics signal restrained buying strength. The 24-hour volume remains within its typical range, lacking the expansion normally associated with trend reversals. The price chart over the short-term window shows the coin oscillating between 0.31 USDT and 0.33 USDT, a tight zone that mirrors market indecision.

The broader sentiment across layer-2 networks also reflects mild cooling, as trading ranges compress and volatility subsides. While the data confirms that the token remains supported above key psychological levels, its recovery momentum remains capped, leaving market participants awaiting clearer signals before engaging with conviction.

Price Extends Downtrend as Technical Structure Weakens on TradingView

At the time of writing, the Optimism price sits at 0.3167 USDT, marking a 2.49% daily decline and extending its slide below the mid-November range.

TradingView indicators highlight a persistent bearish trend, with candles positioned along the lower Bollinger Band at 0.283 USDT, indicating sustained downside pressure. Attempts to push toward the median band near 0.371 USDT continue to fail, reflecting limited strength from buyers.

Source: TradingView

The coin price maintains a clean pattern of lower highs and lower lows, underscoring the weakness in its current structure.

The breakdown earlier in the month set the tone for continued pressure, with no significant green candles to challenge the prevailing trend. Market structure signals that unless the asset reclaims and holds above the 0.37 USDT region, the broader direction remains biased to the downside.