Large-cap altcoins such as Ethereum (ETH), Solana (SOL), and XRP are gradually losing their appeal to crypto investors. These assets were once considered essential holdings for smaller investors. However, they have now fallen below the price levels seen at the start of the year.

On-chain data indicates that investors are increasingly facing losses. The question is whether they still have a chance to recover what has been lost.

Loss Pressure May Push New Investors Away

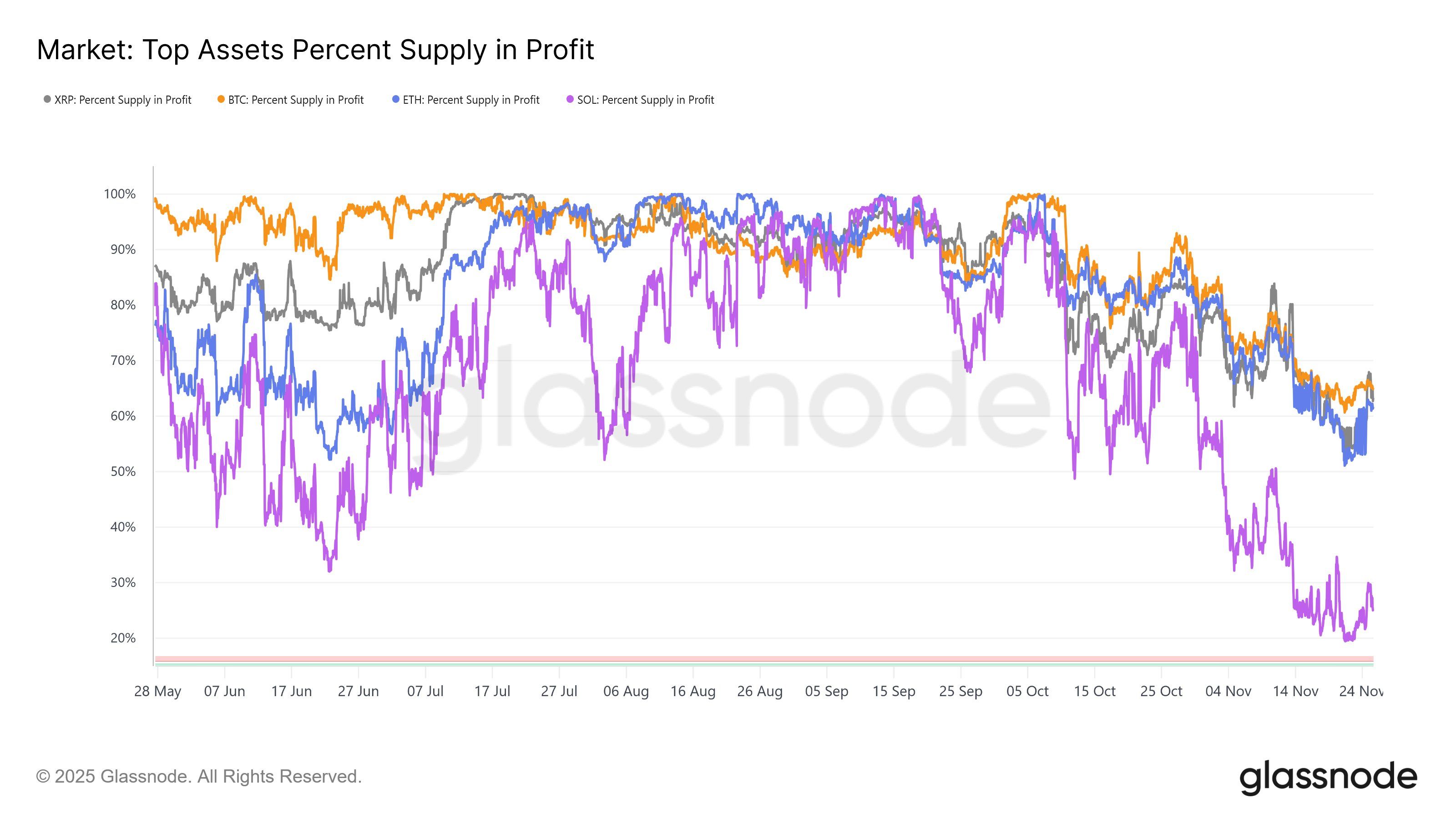

Glassnode’s Percent Supply in Profit data for ETH, XRP, and SOL shows a continued decline since October.

Percent Supply in Profit measures the number of coins whose last movement occurred at a lower price than the current value. A decline in this indicator means fewer coins are sitting in profit.

Conversely, the number of coins held at a loss increases as large-cap altcoin prices continue to fall.

“Here’s the percent of supply in loss, for top assets:BTC: 34.91%XRP: 36.70%ETH: 38.37%SOL: 74.84%” — Glassnode reports.

Top Assets Percent Supply in Profit. Source: Glassnode

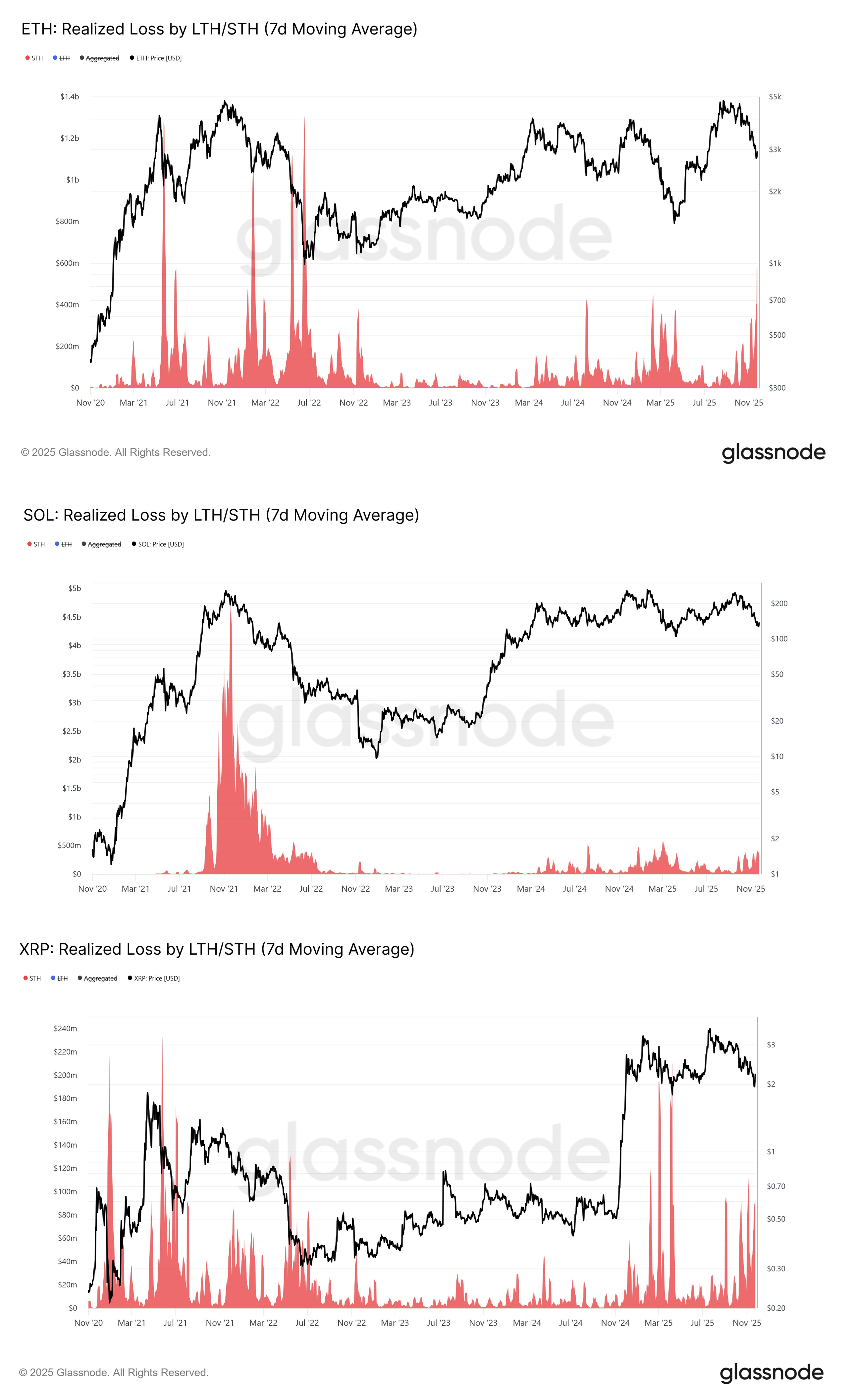

In addition, Realized Loss offers a more concrete view. It denotes the total USD value of coins moved at a time when their previous price was higher than the current market price.

The metric reflects a 7-day average Realized Loss, highlighting the condition of new traders who bought during recent price declines.

Large-Cap Altcoins Realized Losses. Source: Glassnode

As of November 25, ETH, SOL, and XRP all recorded the highest 7-day average realized Loss since the market drop in April.

“Realized losses among new investors in major altcoins are rising, as prices continue to struggle to recover, signalling growing stress across the speculative end of the market.” — Glassnode comments.

Loss pressure may continue to prompt new market entrants to exit, thereby preserving capital, which could exacerbate downward price momentum.

Instead, many investors are starting to pay attention to altcoins with more attractive stories, such as Privacy Coins and Neobank Coins.

Short-Term Outlook: The Most Important Condition for Recovery

Santiment offers a more optimistic framing using on-chain indicators. Based on the MVRV (Market Value to Realized Value) ratio, short-term and mid-term holders of ADA, LINK, ETH, and XRP are experiencing notable losses.

Rather than emphasizing losses, Santiment states that these assets may be undervalued. This implies potential recovery back toward average valuation levels.

What conditions are necessary for large-cap altcoins to rebound and reclaim their leadership role in the market? Altcoin Vector — Swissblock’s institutional-grade report states that the answer depends on Bitcoin’s price movements.

“The final Q4 stretch could offer a turnaround if $BTC stabilizes as in April, setting the stage for expansion.” — Altcoin Vector forecasts.

However, even Bitcoin has faced strong selling pressure this month. A Bitcoin recovery may serve as the fastest catalyst to break the pessimistic market sentiment that has persisted throughout the month.