Bubblemap, a blockchain analytics platform, has raised an alarm that Edel Finance sniped 30% of EDEL during the launch earlier this month. According to the platform, the wallets were linked and funded in a coordinated fashion immediately before trading opened.

In its X post, Bubblemaps wrote, “Edel Finance sniped 30% of $EDEL […] Then tried to hide it behind a maze of wallets and liquidity positions.”

Bubblemaps revealed that a cluster of approximately 160 wallets accumulated 30% of the EDEL token supply, worth $11 million. It was funded through a coordinated strategy involving Binance and MEXC, executing the purchase in a manner consistent with “sniping” -a tactic where bots automate trades to secure tokens at launch.

The link between Edel Finance team and the snipers

Bubblemaps detailed that the wallets were funded with Ether and structured through several layers of fresh wallets before executing trades. Half of the purchased tokens were distributed among 100 secondary wallets, all linked to MEXC.

This created, according to the platform, a clear link between the team and the snipers. The analytics firm noted that the token contract’s code explicitly included these secondary wallets, suggesting that they were intentionally hidden.

“Both the snipers and the secondary wallets used the same obfuscation method […] Created Uniswap LP positions (NFT) with $EDEL, sent the NFTs to new wallets, burned the NFTs to get back their tokens on new wallets,” Bubblemaps stated.

Additionally, Bubblemaps cited transparency issues. According to the platform, the company failed to disclose the so-called strategy. “You never disclosed any of this ‘planned’ sniping. Not on Telegram. Not on Twitter. Not in your docs,” the platform wrote.

Edel Finance is a decentralized lending protocol aiming to bring traditional stocks into on-chain lending. According to its X page, the team is backed by former employees from State Street, JPMorgan and Airbnb.

Meanwhile, the EDEL token, which supports a lending protocol for tokenized stocks and real-world assets (RWAs), has experienced a 62% decline in its market cap to $14.9 million over the past week. The token is currently trading at $0.02937.

Edel Finance and the co-founder refute ‘sniping’ accusations

In response to the allegations, James Sherborne, the co-founder of Edel Finance, stated that the team planned to acquire 60% of the token supply, which was subsequently locked into token vesting contracts. “Cool chart – but not accurate…we actually acquired ~60% of supply and placed the tokens into a vesting contract, as per the docs,” Sherborne wrote.

However, Bubblemaps didn’t buy it. Instead, the platform called it the Hayden Davis defense. They insisted that if Edel Finance were genuine, they’d have allocated the supply upfront based on your tokenomics. “Hiding behind your tokenomics is a weak excuse for what we found,” they added.

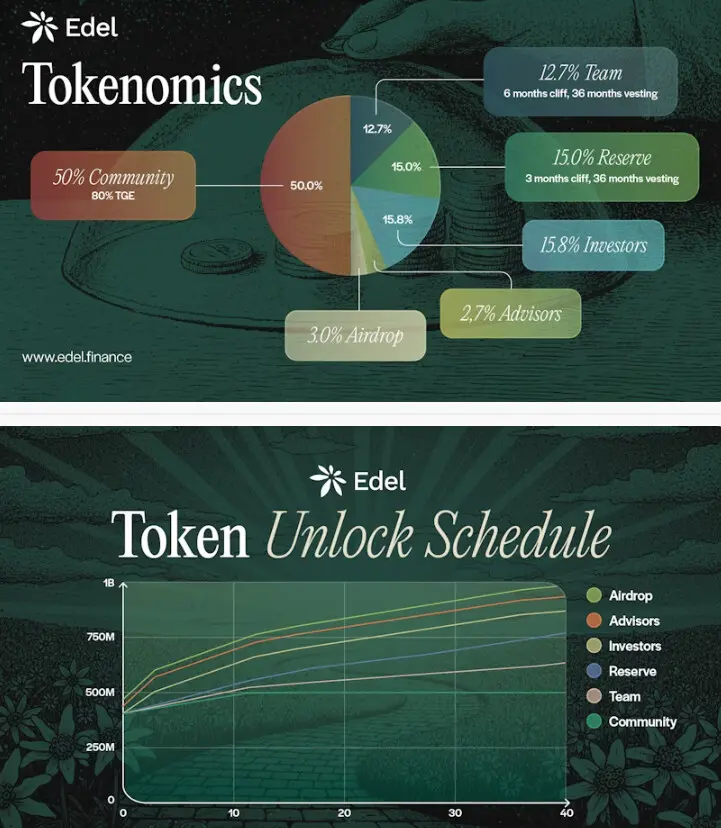

As per the Edel Finance tokenomics, only 12.7% of the token supply was allocated to the team, through a 36-month vesting schedule consisting of six-month cliff unlocks.

The Hayden Davis defense quoted claimed, “I sniped my own token without telling anyone, but trust me it’s fine.” He is a controversial co-creator of the Official Melania Meme (MELANIA), the Libra (LIBRA) and Wolf of Wall Street-themed Wolf (WOLF) memecoins. He launched the Wolf of Wall Street-themed memecoin with an insider supply of over 80%. This led to the token crashing by 99% within two days.

Bubblemaps stated that some of those snipers and the token deployer already dumped using the same playbook. Bubblemaps responded that the 50% EDEL token supply in the vesting schedule originated from the token deployer and has “nothing to do with the snipe.”

Sharpen your strategy with mentorship + daily ideas - 30 days free access to our trading program