What to Know:

Texas buying bitcoin via an ETF signals growing state-level comfort with regulated BTC exposure, but it primarily benefits long-term, low-beta allocators.

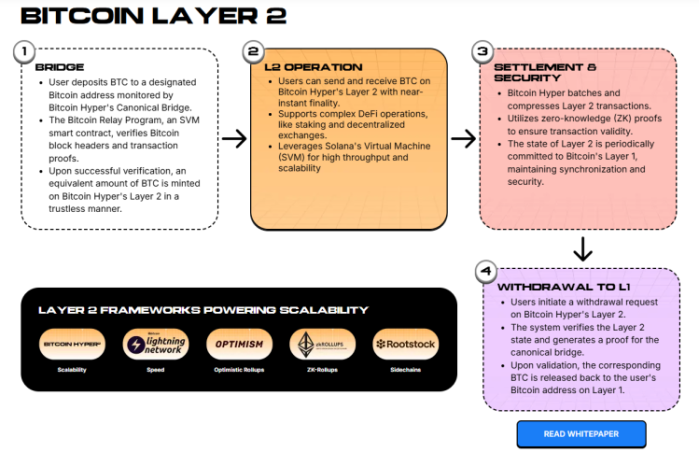

As institutions choose ETFs, crypto-native investors may look one layer deeper, into Bitcoin Layer 2 infrastructure, for higher potential upside.

Bitcoin still struggles with low throughput, variable fees, and limited programmability, keeping most complex DeFi and gaming activity on alternative smart contract chains.

Bitcoin Hyper aims to solve this by bringing SVM-based, high-throughput smart contracts to a Bitcoin-secured Layer 2, targeting payments, DeFi, NFTs, and gaming.

Texas just became the first US state to buy bitcoin, doing it not through a cold wallet but via BlackRock’s spot $BTC ETF.

For institutions and treasuries, that’s a historic green light: clean regulatory rails, audited custody, and Bitcoin exposure that fits neatly into a traditional portfolio.

For you as a retail investor, though, ETFs cap the upside. You get price tracking, not yield, leverage, or early-stage asymmetry.

When a sovereign-scale buyer like Texas enters through an ETF, it reinforces Bitcoin as a macro asset, but it also pushes smaller investors to ask where the next outsized growth might actually come from.

That’s why early-stage Bitcoin infrastructure plays are suddenly back in focus. Instead of just holding ‘paper BTC’ via an ETF, some are rotating into projects trying to fix Bitcoin’s biggest pain points: slow confirmation times, rising on-chain fees, and a scripting model that makes complex DeFi almost impossible.

That’s the gap Bitcoin Hyper ($HYPER) is aiming to fill.

As more headlines frame Texas’s move as the start of state-level Bitcoin adoption and another win for institutional adoption, a parallel conversation is happening in crypto-native circles.

If institutions are content with ETF exposure, can agile investors position one layer closer to the innovation stack, into Bitcoin Layer 2s like Bitcoin Hyper, where the risk is higher but so is the potential upside?

Why State-Level Bitcoin Adoption Highlights Layer 2’s Gap

Texas opting for a BlackRock ETF underscores a simple reality: institutions want Bitcoin exposure without on-chain friction. However, the Bitcoin base layer still processes around 7 transactions per second, with confirmation times measured in minutes and fees often spiking to several dollars when mempools become congested.

That’s fine for a state treasury or pension fund that treats $BTC like digital gold. It’s a problem if you’re trying to build payments, DeFi, or gaming experiences that feel like Web2: sub-second execution, predictable sub-cent fees, and composable smart contracts.

That performance gap is exactly where Bitcoin Layer 2 projects are racing to compete.

You’re already seeing multiple design paths emerge: pure payments, sidechains targeting EVM developers, and newer rollup-style architectures trying to anchor security on Bitcoin while offloading execution.

In that mix, Bitcoin Hyper is positioning itself as the Solana Virtual Machine (SVM)-powered option, aimed at high-frequency, Solana-style workloads, but has settled back on Bitcoin.

Why Bitcoin Hyper Is on Investors’ Radar Now

Where many Bitcoin L2 designs bolt on EVM, Bitcoin Hyper takes a different route: integrating the Solana Virtual Machine so developers can deploy high-throughput Rust smart contracts on a Bitcoin-secured stack.

The claim is aggressive; execution that can outperform Solana itself, but with architecture built around extremely low-latency Layer 2 processing and real-time SVM execution.

Under the hood, Bitcoin Hyper uses a modular approach: Bitcoin L1 acts as the settlement and security anchor, while a single trusted sequencer orders and executes transactions off-chain before periodically anchoring state to Bitcoin.

That design enables sub-second finality, low-cost swaps, lending, gaming, and NFT trades in wrapped $BTC, while still inheriting Bitcoin’s base-layer trust assumptions.

This is where investors start running the ETF-versus-early-stage math. The Bitcoin Hyper presale has already raised $28.5M with tokens at $0.013335, suggesting some market conviction that a Bitcoin-native SVM chain could capture meaningful DeFi and dApp flows.

Whale tracker data reveals significant purchases, including ones of $396K and a whopping $500K.

If Bitcoin continues to institutionalize via ETFs, the next leverage point for growth may be infrastructure that turns idle BTC into productive capital. That’s the bet behind $HYPER: that users will want fast swaps, lending, staking, and gaming in BTC terms, not just passive price exposure.

Learn more about Bitcoin Hyper or join the $HYPER presale.

This article is for informational purposes only and does not constitute financial, investment, or trading advice; always do your own research.

Authored by Aaron Walker for NewsBTC – https://www.newsbtc.com/news/texas-bitcoin-etf-vs-bitcoin-hyper-layer-2