Tether has quietly overtaken every central bank to become one of the most aggressive buyers of gold in recent months.

Given Tether’s vocal commitment to the long-term future of crypto, its aggressive shift into gold has left people wondering what has prompted the change.

Tether Outbuys Central Banks

Gold’s record 56% surge in 2025 is often attributed to concerns about fiscal dominance, rising public debt, loose monetary policy, and declining trust in major currencies.

These concerns have prompted central banks in countries such as Kazakhstan, Brazil, and Turkey to increase their gold purchases, thereby reinforcing the metal’s status as the world’s most trusted safe-haven asset.

A recent Jefferies analysis, however, revealed a surprising twist. Tether bought 26 tonnes of gold in the third quarter — more than any central bank. By the end of September, the company’s total holdings had reached approximately 116 tonnes, valued at roughly $14 billion.

Tether’s presence in the gold market extends far beyond its tokenized product, XAUt, which holds fewer than 12 tonnes despite a $1.6 billion market cap. Jefferies reported that the company has been expanding its bullion reserves to support both USDT and XAUt.

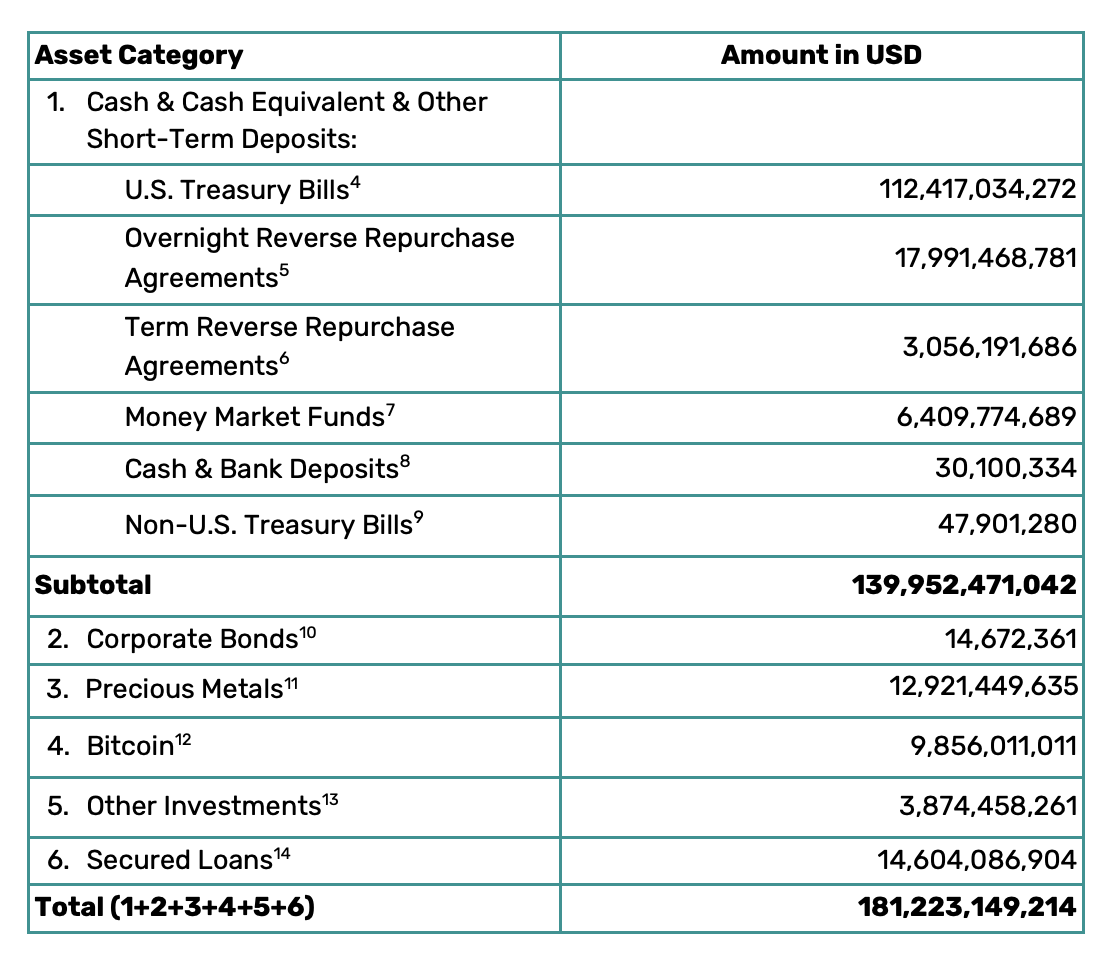

USDT’s circulation grew from $174 billion in the third quarter to $184 billion by mid-November, according to Reuters. Gold has become a larger part of its backing as supply has increased. Precious metals now account for approximately 7% of Tether’s reserves, valued at around $13 billion.

Tether asset breakdown as of September 2025. Source: Tether.

In total, Tether holds about 104 tonnes of gold for USDT and 12 tonnes for XAUt. The scale and consistency of these purchases underscore its growing influence in the bullion market.

However, the timing of this rapid accumulation has raised a new layer of controversy.

A Move at Odds With the GENIUS Act

Tether’s growing bullion position sits awkwardly beside the new US GENIUS Act. The law bars any compliant issuer from holding gold as part of its reserves. It pushes firms seeking approval to rely on cash, Treasury bills, or other liquid and transparent assets.

Tether has already announced a GENIUS-compliant token called USAT, which will avoid gold entirely. Yet, the company continued to add to the bullion backing USDT even after the law was passed.

Why Tether doubled down on gold during this shift is still unclear. Gold prices have also cooled since hitting $4,379 in mid-October. The metal now trades more than 6% below that peak.

Even so, Tether’s commitment to physical gold highlights a deeper convergence of crypto and traditional safe-haven assets.

Different Havens, Different Risks

The convergence between gold and Bitcoin, often referred to as “digital gold,” is not entirely surprising. Both attract buyers who fear weakening major currencies. Many see finite-supply assets as protection against long-term debasement.

In practice, however, the two markets behave very differently.

Bitcoin has grown rapidly over the past decade but remains highly volatile. Recent price swings made that clear. The token plunged sharply over the past two months, acting more like a high-beta tech asset than a monetary hedge.

Stablecoins operate on a different promise.

They offer instant redemption at par and rely on reserves meant to stay stable. Yet the crypto sector continues to show vulnerability to sudden stress. A rapid shift in sentiment can happen at any time.

If demand for stablecoins were to collapse, pressure would fall directly on the assets backing them. That includes Tether’s growing pile of gold. A sharp market reversal could prompt bullion sales, drawing a traditionally steady asset into the turbulence of crypto-driven markets.