The crypto bull run is losing momentum, and recent developments suggest a major shift in market dynamics may already be underway. From Bitcoin’s dominance slipping below key thresholds to ETF inflows drying up and altcoin selloffs intensifying, signs of exhaustion are building.

Technical analysts are watching closely, macro pressures are mounting, and traders are beginning to reassess where they put their money. In that shift, Bitcoin Hyper ($HYPER) has emerged as a structured presale alternative that’s drawing attention while the rest of the market hesitates.

Market Selloffs Trigger Fear Across the Board

Bitcoin has seen steady outflows from large holders – particularly in Asia – triggering a wave of downward pressure throughout October. On October 10, a sharp market-wide crash caused major liquidations and sparked panic among traders.

It was the first real crack in what had seemed like a solid crypto bull run. But this time, it wasn’t one big event like the FTX collapse that tanked sentiment. It was a slow grind: fading ETF hype, weaker inflows, and institutional hesitation.

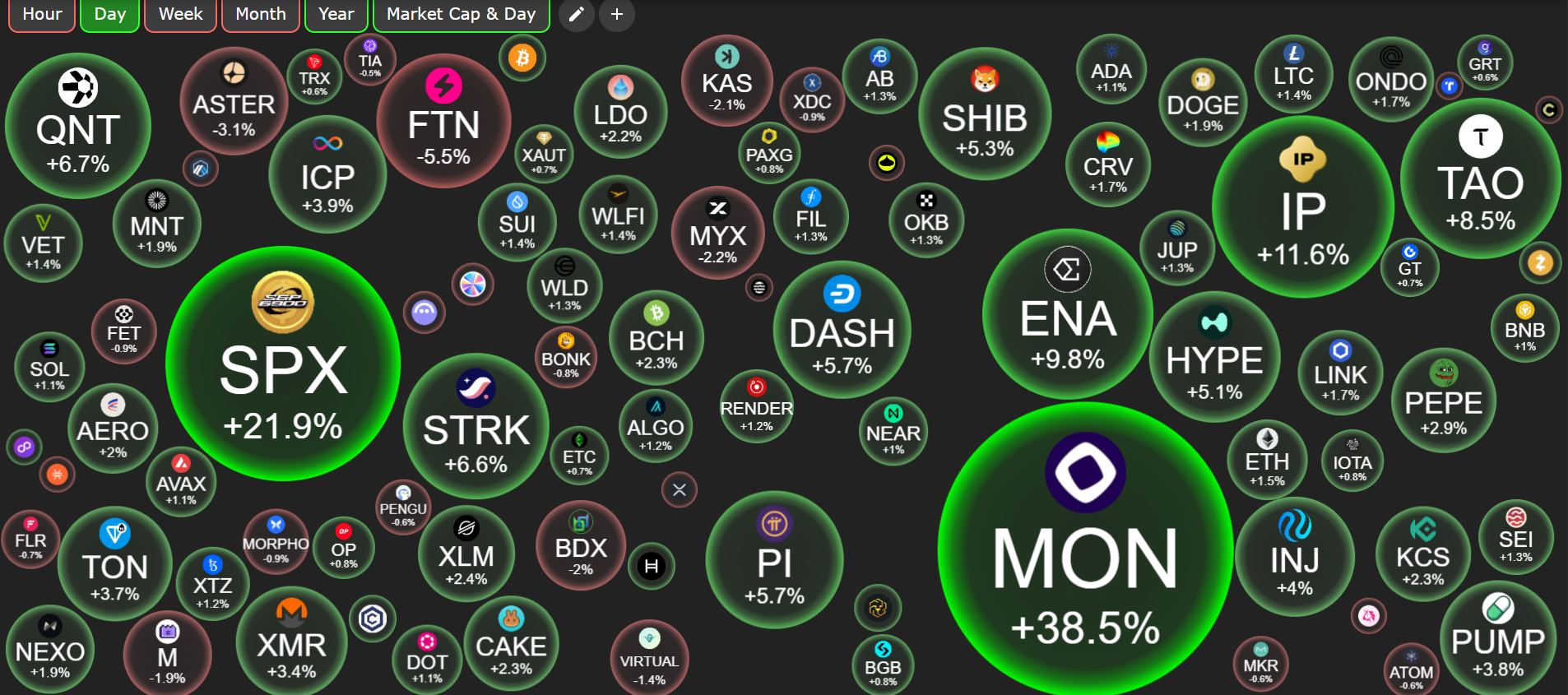

Meanwhile, altcoins are bleeding harder. Projects with no real user base or product are collapsing. Even established tokens are seeing double-digit losses as investors rotate away from speculative assets.

Crypto Twitter is filled with calls for caution, and retail interest is visibly cooling. The euphoria of early 2025 has faded into a quiet uncertainty that’s keeping buyers on the sidelines.

The Bitcoin Cycle: Is History Repeating?

One theory making the rounds is the 1,000-day cycle from bear bottom to new all-time high. This pattern played out in 2017 and again in 2021.

According to a now-viral chart circulating on social media, the most recent bottom was in November 2022 – meaning October 6, 2025, marks day 1,050 and could already be the top. That day, Bitcoin briefly hit $126,198.07 before retracing.

The math adds up eerily well. Past drawdowns have ranged from 77% to 84%, which would put Bitcoin’s bottom between $20,000 and $29,000 if the same pattern unfolds. Many fear that a brutal correction into 2026 is now baked in.

The historical precedent is compelling – and with no fresh catalysts in sight, technical traders are growing bearish.

That said, the market never moves in perfect symmetry. Some analysts argue that the arrival of spot ETFs, deeper institutional ownership, and better liquidity could soften the next crash.

But even if Bitcoin only drops 60%, that still leaves traders exposed to heavy losses unless they find entry points with better structure and timing.

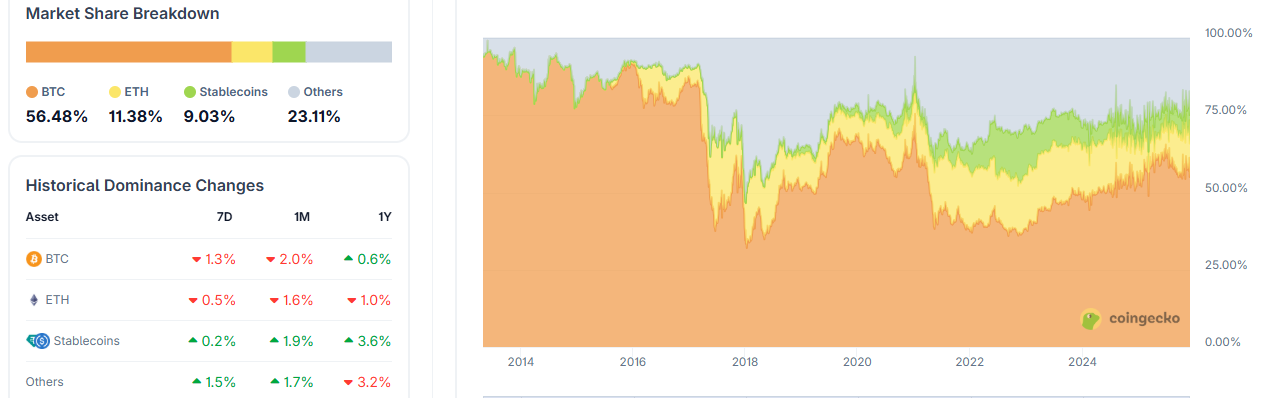

Bitcoin Dominance Drops Below 60%: Altcoin Shift Incoming

Another red flag for the crypto bull run came when Bitcoin dominance (BTC.D) slipped below the key 60% level. This threshold has historically marked the start of capital rotation into altcoins – and the beginning of altseason. It happened in 2017 and again in 2021. Both times, Bitcoin cooled off, and altcoins exploded.

This time, though, sentiment is different. Investors aren’t rushing into random meme coins or low-cap tokens.

Risk appetite has narrowed, and many are looking for structured altcoin plays that still offer upside but without the chaos of open-market volatility. That’s where presale-stage projects are gaining momentum again.

The idea is simple: get in before listing, secure a fixed price, and avoid market slippage. With Bitcoin dominance now breaking down from a clear wedge pattern, and volume shifting out of BTC, smart traders are searching for new entries that feel safer and less exposed.

Bitcoin Hyper Offers Structure in a Volatile Market

While much of the crypto space is cooling down, Bitcoin Hyper ($HYPER) is heating up. The project has already raised over $28.8 million, with more than 370 buyers in the last 24 hours.

Its current price sits at $0.013335, with a countdown ticking before the next automatic increase. What makes $HYPER stand out in this fading crypto bull run is its structure:

Fixed presale pricing with no open-market swings

Built as a Bitcoin Layer 2 chain with real scaling potential

Offers 41% staking rewards, giving early buyers strong passive incentives

Powered by Web3Payments and already attracting large traction

If the crypto bull run truly is cooling off, Bitcoin Hyper might be the smartest way to stay in the game – without getting burned.