Texas snaps up $5M in BlackRock's Bitcoin ETF amid the BTC dip. This highlights DeepSnitch AI, one of the biggest crypto presale launches expected in 2026.

Texas has made a major Bitcoin move, purchasing $5 million worth of shares in BlackRock’s spot Bitcoin ETF, with another $5 million allocated for a self-custodied Bitcoin buy. This institutional endorsement signals a significant shift in government attitudes toward cryptocurrency, and retail investors are now searching for the next low-cap gem.

With more than $600,000 raised, early backers already in profit, and its January launch closing in, DeepSnitch AI sits in a price range that still leaves room for a major run once trading opens. If you’re hunting for that life-changing 100x before 2026, this might be the play.

Texas said, “Hold my beer,” and bought the dip

The Texas state government made the purchase on November 20, a move highlighted by Lee Bratcher, president of the Texas Blockchain Council. According to Bratcher, Texas will eventually self-custody Bitcoin, but as the process is being finalized, the initial $5 million allocation was made through BlackRock’s IBIT ETF.

“$10M is allocated from general revenue, but not all $10M has been allocated,” Bratcher added.

Pierre Rochard, CEO of The Bitcoin Bond Company, hit CT with some serious hopium: “In five years, we went from ‘governments will ban bitcoin’ to ‘governments are only buying a small amount of bitcoin’. Hyperbitcoinization has happened, is happening, and will continue to happen.”

Texas now sits alongside Wisconsin, Harvard, and Abu Dhabi as IBIT holders. Bloomberg’s Eric Balchunas pointed out IBIT is probably the only ETF owned by all three. Absolutely wild for a fund that’s not even two years old.

Top altcoins to watch: Could DeepSnitch AI pull a real 100x?

DeepSnitch AI: The 100x moonshot

Governments are out here buying Bitcoin. Whales see your trades before you even click the button. Institutions have entire teams and algorithms working around the clock. And you’re refreshing charts on your phone, hoping for the best. It’s not exactly a fair fight.

DeepSnitch AI gives everyday traders access to the kind of market intelligence that used to be available only to big players. It shows you what major wallets are doing, helps you avoid getting dumped on, and lets you make decisions with real information instead of guesswork.

The community interest proves it. More than 13.9 million DSNT tokens are already staked, earning passive rewards. The launch is not years away. It is coming in January, which makes this one of the few presales with a short and clear timeline. And there are rumours that Tier-1 exchanges are looking at DSNT for listing as soon as it goes live.

Right now, people are quietly stacking DSNT while the presale is still open. Once January arrives and the token lists, this price will disappear for good. You are either early or you miss the early window

Rain (RAIN) market update

Rain has emerged as a standout performer, surging over 100% following Enlivex Therapeutics’ announcement of a $212 million private placement to establish the first prediction market token treasury strategy.

The Nasdaq-listed biotech firm plans to use RAIN as its main treasury reserve asset, marking a historic milestone for decentralized prediction markets. For 2026, RAIN has a pretty solid setup. If adoption stays steady, it could land around $0.80 to $1.20. If more companies start using RAIN the way Enlivex is, a bullish range of $1.50 to $2.50 makes sense.

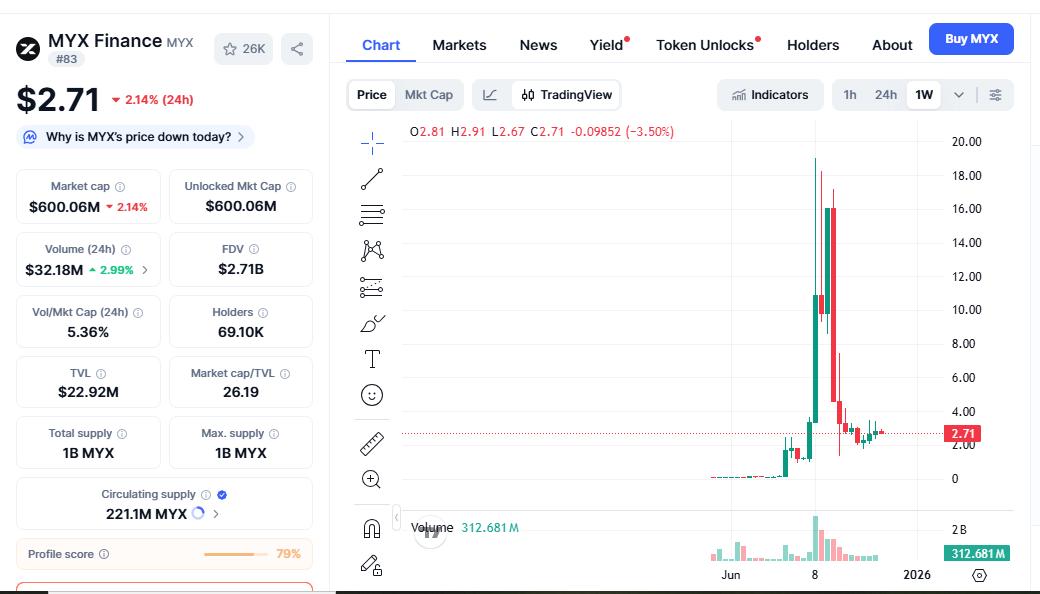

MYX Finance (MYX): Leverage degen paradise

Trading around $2.71 on Nov 26, MYX has a market cap of approximately $600 million. The recent V2 upgrade added portfolio margining and expanded beyond EVM chains into ecosystems like Solana, which has opened the door for a much wider user base.

MYX has been one of the wildest movers of 2025, exploding from under $0.05 in June to an all-time high above $19 in September. The exchange offers on-chain perpetual trading with zero slippage and up to 50x leverage, which is exactly why degens keep piling in.

If the market heats up again, MYX could easily stay one of the top high-volatility plays that could make fortunes.

The bottom line

Texas jumping into a Bitcoin ETF is a big sign that crypto is going mainstream, but smart investors know the real upside isn’t in the big names anymore. It is in early projects with room to run. That is where DeepSnitch AI fits in. It is a low-cap presale with real, working tools and a January launch right around the corner. With rumors of major exchange listings already floating around, the 100x potential is exactly why traders are paying attention.

The presale is heating up fast, and this might be the lowest price you will ever see DSNT again. If you want to stay early, check out the official DeepSnitch AI site, hop into Telegram, and follow the project on X for the newest updates.

Frequently asked questions

What is the DSNT growth outlook for 2025-2026?

The DSNT growth outlook is strong because the presale price is still low, the tools are live, and Tier-1 listing rumors keep building hype. If volume hits the way people expect, DSNT could see an explosive launch.

How much could a $1,000 investment be worth if DSNT does 100x?

If the DeepSnitch AI 100x potential plays out, a $1,000 entry could turn into $100,000. Early presale buyers get the biggest upside because they enter before listings.

Is DSNT safe to invest in?

DeepSnitch passed audits from Coinsult and SolidProof, which is a good sign. Still, it is crypto, so nothing is risk-free. Only invest what you can handle.