Litecoin’s recent breakout has sparked renewed optimism among traders, with growing attention on whether the asset can maintain momentum toward the $91 target despite ongoing market volatility.

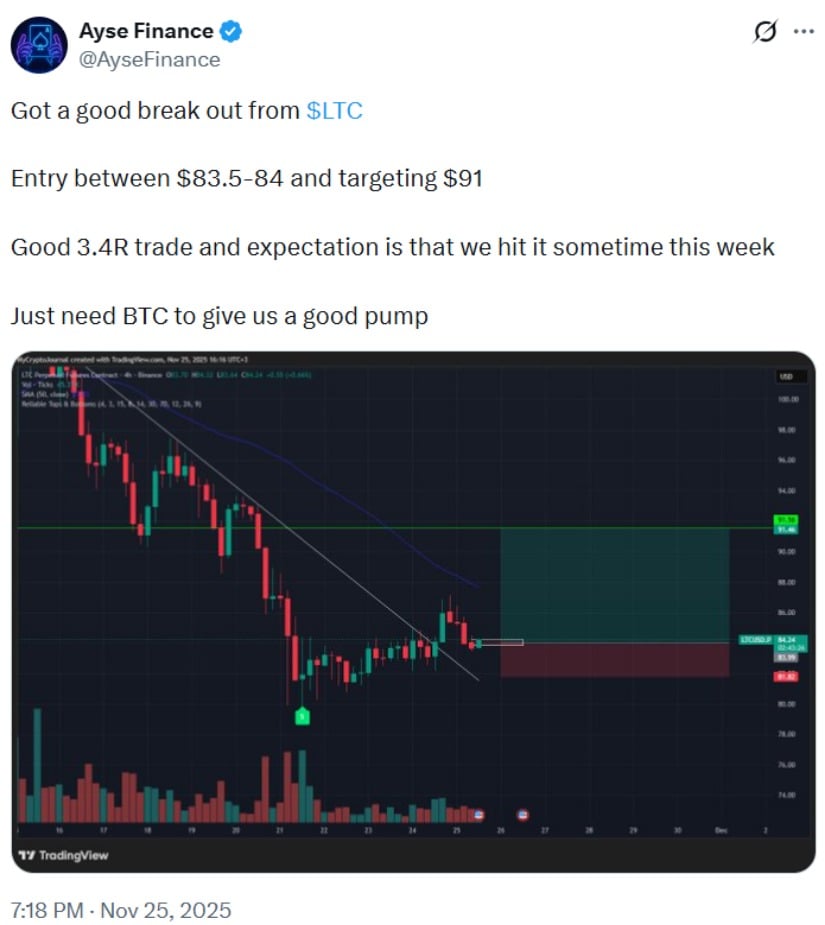

The move follows Litecoin’s push above the $83.50–$84.00 demand region, a zone analysts previously identified as a short-term accumulation area. While Litecoin (LTC) has shown a measured recovery, its trajectory remains closely tied to broader market conditions—particularly Bitcoin’s influence on altcoin sentiment.

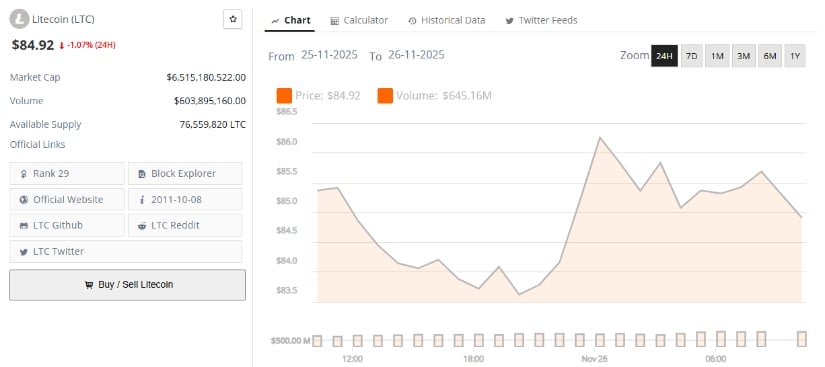

From a technical standpoint, the trade idea that targets the $91 region reflects a typical breakout-continuation structure. However, this target is scenario-based rather than guaranteed. As of November 26, 2025, LTC is trading near $84.92, representing modest gains while staying beneath a series of well-defined resistance levels. Ongoing volatility across the digital asset market continues to influence whether this early bullish structure gains follow-through.

Daily Structure Points Toward Measured Upside

Technical commentary from market analyst @cryptoWZRD_, who frequently publishes intraday chart observations, notes that Litecoin has held above the $85 support level. “We’re seeing a constructive reaction off support, with intraday targets extending to $91.50,” the analyst stated, referencing levels derived from prior daily highs and session liquidity zones.

LTC’s roughly 3% increase to $85.55 on November 25 coincided with Bitcoin’s 2.5% rise. Historically, Litecoin tends to reflect Bitcoin’s momentum, particularly during periods of macro uncertainty. That correlation is not fixed, but analysts commonly observe that LTC/BTC strength or weakness helps signal directional bias.

Litecoin shows a strong breakout with an $83.5–$84 entry targeting $91, offering a favorable 3.4R setup that hinges on supportive momentum from Bitcoin. Source: @AyseFinance via X

In lower timeframes, multiple independent traders have noted a higher-low structure forming from the $82.00–$82.50 demand area. A higher-low typically suggests early buy-side interest, though it requires further confirmation through volume expansion. Liquidity markers at 86.61, 88.89, and 91.96 align with previous intraday swing points—areas where price has historically interacted due to concentrated orders. A break above 84.48 (TP1), for example, would indicate that buyers are absorbing sell-side pressure at the first major liquidity pocket.

Market Context and Litecoin’s Broader Role

Launched in 2011 by Charlie Lee, Litecoin remains one of the longest-operating decentralized payment networks. Known as “digital silver,” LTC is frequently used for lower-cost, fast transactions across exchanges, payment providers, and merchant platforms. Its consistent activity base continues to support its relevance in discussions about long-term Litecoin value.

Community-driven forecasts—such as the viral fractal models promoted by social media commentator @MASTERBTCLTC—have circulated widely, but these models often lack methodological transparency. Professional analysts typically view such projections as high-risk sentiment indicators rather than meaningful predictive tools.

Litecoin is rebounding strongly from the $82–$82.50 demand zone, with a higher-low structure and rising momentum pointing toward liquidity targets at, $86.61 and $88.89. Source:Mastercrypto2020 on TradingView

On the weekly timeframe, Litecoin recently fell below a short-lived trendline that had supported prior upward movement. Resistance at the $91.50 region remains critical, having rejected the price multiple times earlier in November. Only a sustained close above this level would signal a shift toward the next resistance cluster between $104 and $112. Current market structure, however, shows reduced volume and narrowing volatility—conditions that generally precede consolidation rather than aggressive moves.

Technical Context Based on Current Market Structure

Based on my review of daily and weekly charts, Litecoin’s structure shows balanced conditions, reflecting neither extreme bullish nor bearish pressure. The recent daily close around $85 formed a neutral candlestick, signaling indecision rather than trend continuation.

Litecoin closed bullish on the daily chart, suggesting further upside potential as traders look to lower time frames for efficient scalp opportunities. Source: @cryptoWZRD_ via X

Independent analysts following LTC crypto trends commonly highlight three key conditions:

A confirmed breakout above $91.50 is required for trend acceleration. This level aligns with past supply zones where sellers have consistently halted upside moves.

Multiple closes below $85 would weaken the short-term structure. This zone previously acted as demand, so losing it on volume would shift the bias toward a corrective phase.

The LTC/BTC pair still lacks convincing upside signals. Sustained green candles on this pair are typically needed before strong momentum emerges in LTC/USDT.

These observations reflect a scenario-based approach rather than deterministic forecasting. Technical analysis offers probability frameworks—not certainties—and should be interpreted with appropriate caution, especially during macro-driven markets.

Litecoin’s Fundamental Role and Long-Term Considerations

Despite short-term fluctuations, Litecoin maintains a well-established fundamental base. Its decade-long operational history, consistent settlement reliability, and familiarity among payment processors contribute to continued demand. These attributes often feature in long-term Litecoin predictions and LTC price prediction 2025 models.

Key factors influencing Litecoin’s long-range trajectory include:

Merchant adoption and ongoing payment integrations

Incremental network upgrades and ecosystem improvements

Market-wide liquidity cycles that affect alternative assets

Regulatory developments surrounding payment-focused cryptocurrencies

Supply dynamics connected to the Litecoin halving cycle

While halving events have historically influenced the price of Litecoin, their impact today is moderated by a more mature and efficient market structure. Analysts caution against assuming that past halving reactions automatically repeat under different liquidity and macro environments.

Final Thoughts

Litecoin’s price behavior continues to reflect its long-standing role as a reliable, payment-focused cryptocurrency with consistent network usage. While the scenario targeting the $91 region remains structurally possible, analysts emphasize the importance of conditional confirmation—particularly through volume, market breadth, and Litecoin’s relationship to Bitcoin.

Litecoin was trading at around $84.92, down 1.07% in the last 24 hours. Source: Brave New Coin

As of the latest market data, Litecoin trades in the $83–$85 range, maintaining stability but not yet demonstrating the momentum required for a breakout. A disciplined, evidence-based approach—paired with routine reassessment—remains essential for navigating both short-term fluctuations and broader trends in the evolving Litecoin news landscape.