Bitwise has launched its Dogecoin ETF on Wednesday, following Grayscale's debut of a similar product.

The firm said Dogecoin has "become an icon of the crypto movement."

DOGE could rise to $0.181 if it clears a key descending trendline resistance.

Bitwise launched its Dogecoin ETF on the New York Stock Exchange (NYSE) under the ticker BWOW on Wednesday, providing investors with exposure to the price of the memecoin in an ETP structure.

"DOGE began as a joke and came to become an icon of the crypto movement. It doesn't purport to transform global capital markets or convince you it has fundamentals or utility [...] And, against the odds, it has kept its relevance—and its value—longer than just about anything else in crypto," said Bitwise CIO Hunter Horsley in a statement on Wednesday.

The move follows the Grayscale Dogecoin ETF (GDOG) debut on Monday, which became the first DOGE product launched under the '33 framework. The REX Osprey Dogecoin ETF launched earlier in September, but it was registered under the Investment Company Act of 1940, meaning the ETF doesn't necessarily have to hold DOGE tokens directly, unlike those of Bitwise and Grayscale.

GDOG saw a total trading volume of $1.4 million on its first day of trading. "Not too surprising tho, we actually made a rhyme a while ago predicting this: 'The further away you get from BTC, the less asset there will be'," wrote Bloomberg ETF analyst Eric Balchunas in a Tuesday X post.

Dogecoin, which launched as a light-hearted joke based on a Shiba Inu dog, has grown over the past 12 years to become the 10th-largest cryptocurrency by market capitalization. Its debut on Wall Street follows an eventful history, including significant price changes sparked by traders on the WallStreetBets subreddit and Tesla CEO Elon Musk.

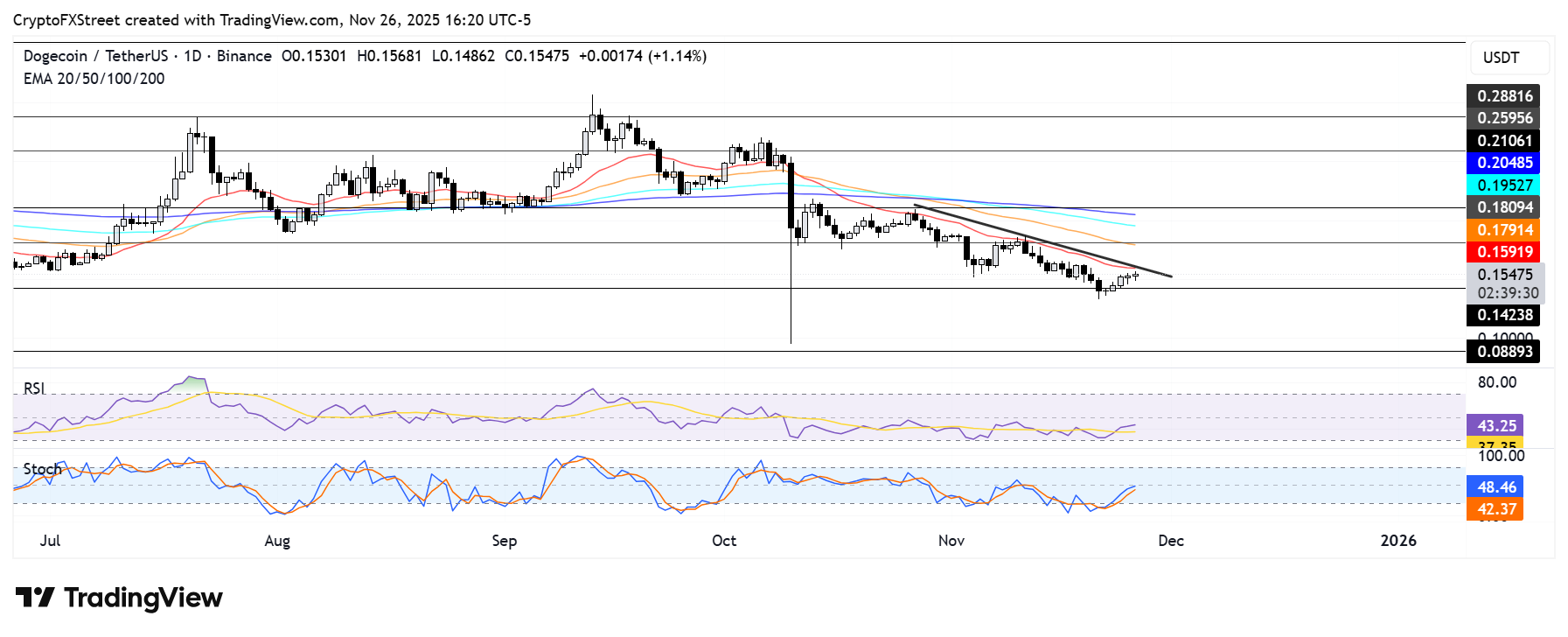

Dogecoin eyes $0.181 as it tests key descending trendline resistance

DOGE is up 2% over the past 24 hours at the time of publication on Wednesday. The top memecoin has been on a recovery path since finding support near $0.142 during the weekend.

However, its recovery faces a risk at a descending trendline resistance extending from October 27, just above the 20-day Exponential Moving Average (EMA), which has restricted any upward movement in the past month.

A rise above the descending trendline could see DOGE test the $0.181 level, strengthened by the 50-day EMA.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are testing their neutral level lines. A cross above will signal a shift toward a dominant bullish momentum.