Ethereum’s price has spent the past several days under intense pressure. The leading altcoin has broken below $3,000 and is now probing deeper into ranges that were previously considered secondary support.

The latest technical read points to a single leverage point on the chart that now determines whether this recovery attempt can continue or whether the market is preparing for another leg lower.

Where The Real Leverage Sits: $2,830 To $2,835

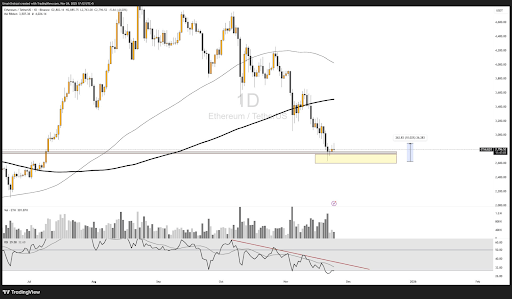

Ethereum’s price decline in November recently pushed it into a demand zone around $2,680 on November 21, where buyers finally stepped in to produce a 10% rebound back up to $2,970. The RSI trendline, which had been sloping downward for weeks, has now been reclaimed. This shift is significant because it indicates that momentum is no longer deteriorating at the same pace as before.

Even with that bounce, the cryptocurrency has not fully escaped danger. This is based on a technical outlook by a crypto analyst known as Umair Crypto on the social media platform X. The most important finding in the technical analysis is not the bounce itself but the location of the largest recent whale orders.

Roughly 4,000 to 5,000 ETH blocks were executed between $2,830 and $2,835. That narrow band has now become the market’s true leverage point.

As long as the Ethereum price is trading above $2,835, these whales are in profit. The psychological impact of that cannot be overstated, as large players do not usually abandon positions that are above their entry zone.

This is why the price has repeatedly reacted within tight candles around this level, and there is always a possibility for a rebound if Ethereum continues to hold this area. Momentum will build naturally as trapped shorts unwind and sidelined buyers follow the strength in trading volume and RSI.

The Bigger Breakdown Starts Below $2,770

Failure to hold above the leverage zone between $2,830 and $2,835 will lead directly into the second important leverage at $2,770. If Ethereum were to close below this level, the same whales who supported the bounce would instantly become vulnerable. Their positions would move underwater, and many of them may be forced to become sellers.

This zone is visible with the clusters of red circles visible at lower points on the short-term chart below. A breakdown under $2,770 would reopen the lower part of the support box and drag Ethereum back to its lowest price level since June.

Ethereum is currently trading at $2,908, up by 1.5% in the past 24 hours and just a little bit above the recognized leverage zone between $2,830 and $2,835.