XRP (XRP) is showing signs of stabilization after recent market volatility, holding a key support level near $2.14.

The cryptocurrency rebounded from lows around $1.95, and technical indicators combined with ETF inflow data suggest a cautiously positive short-term outlook.

XRP Bounces From Key Support

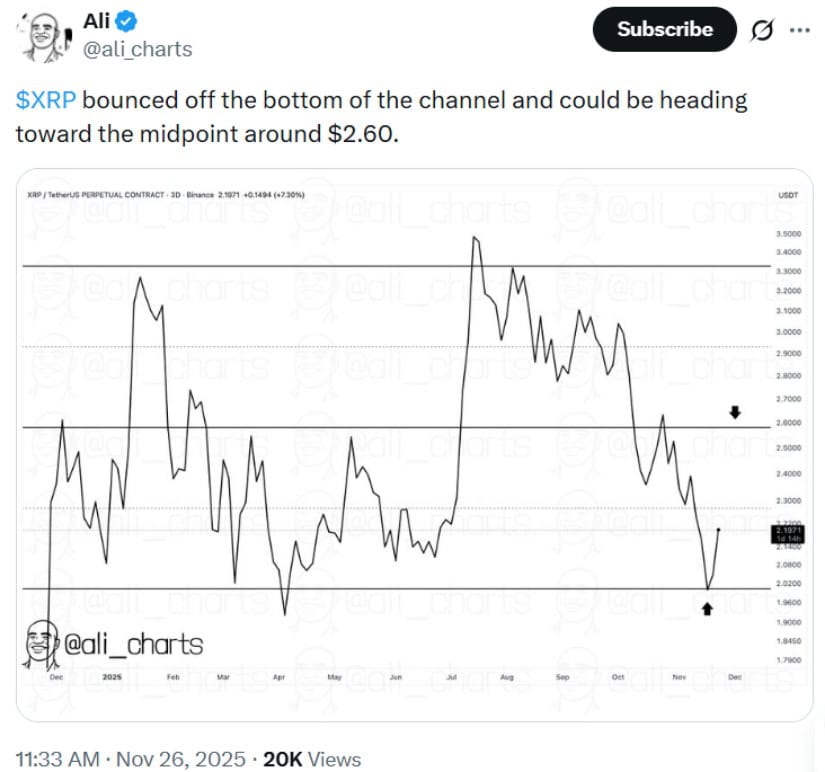

Using the 3-day XRP/USDT chart on TradingView, XRP’s price chart highlighted a bounce from the lower boundary of a descending channel around $1.97 on November 26, 2025. This rebound helped the asset recover to approximately $2.20.

XRP rebounds from channel support, eyeing a potential move toward $2.60. Source: @ali_charts via X

On-chain analyst Ali Martinez commented on X: “$XRP bounced off the bottom of the channel and may test the midpoint near $2.60.”

The descending channel is a pattern showing where the price has consistently faced resistance and support, and the channel midpoint indicates a potential target if upward momentum continues. Analysts note that rebounds from such levels are often tested over multiple trading sessions.

ETF Inflows Support Market Sentiment

Recent market data shows $164 million in inflows to XRP-related ETFs over the past week, according to Farside Investors’ November 25 report. While inflows do not guarantee price appreciation, they reflect growing institutional interest in XRP.

XRP trades within an ascending channel, holding support at $2.14 with potential targets up to $2.35. Source: CryptoAnalystSignal on TradingView

Crypto strategist CryptoAnalystSignal noted, “The price is moving within an ascending channel on the 1-hour timeframe, holding above key support at $2.14, which may support short-term momentum.”

The ascending channel indicates a gradual upward trend on a smaller timeframe, showing areas where traders see buying and selling interest. Additionally, XRP’s adoption via RippleNet, which reportedly serves over 300 banking partners worldwide, adds a broader utility context, though transaction volume has been mixed.

Understanding the Wyckoff Reaccumulation Pattern

Technical analysis indicates XRP may be in a Wyckoff reaccumulation phase, a pattern traders associate with potential bullish continuation during sideways market periods.

XRP shows potential for short-term gains as analysts highlight key accumulation patterns. Source: @ChartNerdTA via X

ChartNerd, a technical analyst on X, described the phases as follows:

Phase A: Initial supply halt and buying climax

Phase B: Secondary tests of support and minor resistance breakouts

Phase C: “Spring,” or temporary dip near recent lows

Phase D: Last point of support and a potential breakout across resistance

Phase E: Upward markup if demand exceeds supply

ChartNerd noted the structure reflects accumulation by larger holders, which can precede price recovery.

Some analysts interpret Wyckoff patterns as potentially bullish, but outcomes vary depending on liquidity, timeframe, and market conditions. Machine-learning forecasts from SoSo Value suggest a short-term scenario where XRP could reach $2.28 by November 30, though these projections are conditional and subject to market volatility.

Trading Observations and Target Ranges

Current trading indicators show XRP stabilizing above the 100-period moving average on the 1-hour chart, often used by traders to gauge short-term trend direction. Traders typically monitor support zones and potential resistance levels for decision-making.

Example observed ranges include:

Near-term target: $2.21

Secondary target: $2.28

Longer-term target: $2.35

These figures are illustrative, based on chart patterns and historical price behavior. Market participants should interpret them as reference points rather than guaranteed outcomes.

Final Thoughts

XRP’s price today demonstrates a combination of technical support and institutional interest. Key support at $2.14, coupled with recent ETF inflows, provides a stabilizing backdrop. Wyckoff Reaccumulation patterns suggest potential for short-term upward movement, though results remain contingent on market liquidity and broader crypto conditions.

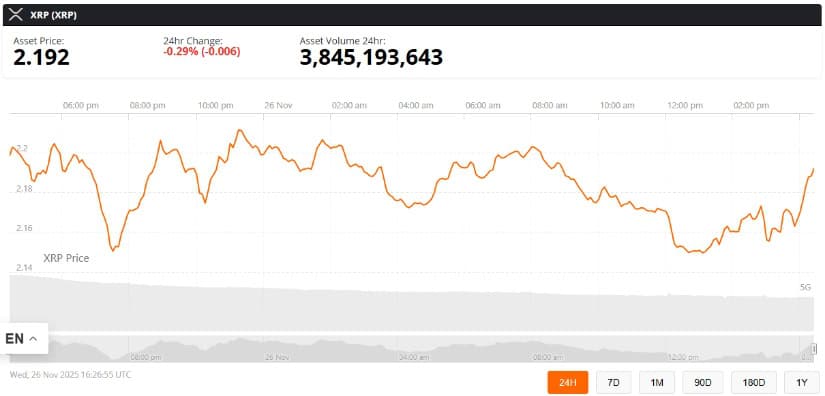

XRP was trading at around $2.19, down 0.29% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Investors and observers should consider support levels, inflow trends, and ongoing market volatility when evaluating XRP’s performance. Caution is advised, as technical signals are indicative, not predictive, of future price movements.