Stablecoins are a linchpin for the crypto markets. Since the beginning of the July 2017 bull run, Tether’s USDT, the largest and longest-running stablecoin, which had a market cap of $108 million, has seen its market capitalization grow an astounding 170,600% to $184 billion.

Some of this stablecoin demand came from crypto exchanges needing a stable asset to trade without formal bank access to the US dollar. Clamor from people living in places that don’t have access to the greenback was another.

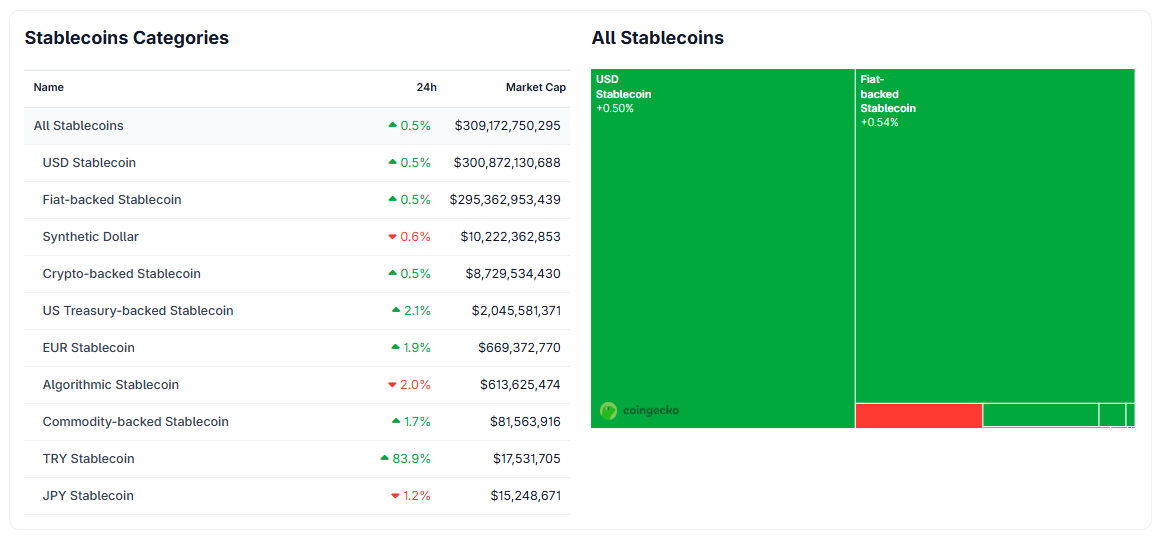

Different Categories of Stablecoins. Source: CoinGecko

Now, with clear guidance available for stablecoins via the US CLARITY Act, a rush to enter this business is underway. This is made clear by the sheer number of stablecoins available today.

Data aggregator CoinGecko lists a brain-bending 370 stablecoins. That seems excessive. Why so many stablecoins? And how does this dynamic impact the broader crypto market?

Stable But Not Equal

The vast majority of stablecoins exist to peg to the US dollar and provide access to American dollars. But what many likely do not know is that many of these stable tokens are constructed quite differently from one another.

“There are different types of stablecoins, largely categorized by the collateral backing them,” Ryne Saxe, CEO of Eco, which provides stablecoin infrastructure, told BeInCrypto. “Those backed by real-world assets, like fiat currency or treasuries, those backed by cryptoassets, and other so-called ‘algorithmic’ stablecoins that have no collateral backing.”

The major types of stablecoins – fiat-backed are by far the most popular: Source: Shamlatech

Examples of real-world asset-backed stablecoins are Tether and USDC, which are backed by US Treasuries and fiat, or government-issued cash.

Cryptoasset stablecoins include Sky, formerly known as MakerDAO, which has a grab-bag of blockchain-based assets as its backing.

The algorithmic types include Ethena’s USDe, which uses what’s known as a “delta’neutral” strategy using crypto hedged against short positions.

There’s also commodity-backed stables like Tether Gold, but this is a much smaller subsection of the market overall – most stablecoins people are using today are real-world-asset-backed – Tether’s USDT and USDC have a market cap of $404 billion.

“The aim of stablecoins isn’t to replace the US dollar or any other currency, but to digitize it and bring those benefits to a wider audience,” said Boris Bohrer-Bilowitzki, CEO of Concordium, a blockchain firm integrating digital identity. “For retail, they offer an infinitely better user experience – you simply buy and hold, without any requirement for extensive financial or trading knowledge.”

A Gaggle of Stablecoins

For the average consumer, or “retail” as Bohrer-Bilowitzki mentioned, there might be one problem ahead: There are too many different stablecoins. And they aren’t all the same.

In addition to being different in terms of their backing, they are spread across many different blockchains.

In addition to the already-listed 370 stablecoins on CoinGecko, there’s a mad rush of big names getting into the stablecoin game.

US Bank is testing a stablecoin on the Stellar blockchain. Klarna is launching a stablecoin on Tempo, a totally new payments-based chain championed by Stripe.

Also, Revolut is working to test stablecoins on Polygon. The cross-chain compatibility required to accommodate this introduces additional risks.

“Stablecoins introduce new dynamics that differ from traditional off-chain digital dollars,” said Rebecca Liao, CEO of Saga, a web3 and AI protocol. “Because they’re digital, programmable, and often on public blockchains, there’s exposure to smart contract bugs, liquidity shocks, and runs if confidence falters.”

It’s important to remember events like 2023, when a run at Silicon Valley Bank led to a panic.

“When Silicon Valley Bank collapsed, $3.3 billion of Circle’s reserves got stuck,” noted Konstantins Vasilenko, Co-Founder at Paybis, a crypto on/offramp. “It recovered in days, but that’s the kind of event that shakes confidence.”

Algorithmic-type stablecoins may be the most vulnerable to security risks. An algo stable token helped bring down the entire crypto market in 2022, when Jenga-style algorithmic stablecoin Terra Luna had too many blocks taken out of its proverbial tower.

”Algorithmic stablecoins are definitely riskier, which Terra effectively proved when $40 billion vanished almost overnight.” added Vasilenko.

The People Want Bucks

It may be that these risks, especially from a security and liquidity standpoint, are being dismissed amid all the stablecoin hype today.

Everyone’s seeing the future, a global, seamless dollar market can speed up the flow of money movement across people and apps.

That’s too powerful to dismiss for financial incumbents, many of whom have to deal with byzantine infrastructure and compliance just to move money around globally offchain.

The US Dollar is the most commonly converted currency in the world. It is regularly used as a benchmark in the Forex market. Eleven foreign countries, territories, and municipalities around the world use USD as their official currency.

And dollar-denominated stables, with a whopping $94 billion trading volume per day, provide a hegemony, a dominance for American interests. This is where the trading impact comes in.

There’s money to be made in arbitrage and moving stables around to different DeFi protocols and exchanges.

That’s why DeFi stablecoin trading protocol Curv is doing so well – its ecosystem is worth about 1 billion dollars in market cap – and the CurvDAO token has held up remarkably well – despite market doldrums.

Along with Hollywood, Silicon Valley, and Wall Street, the dollar is a unique and singular phenomenon the United States exports.

For traders, stablecoins have been a godsend for moving money around exchanges, and the more that exist, the better for them.

For the average person, a variety of different stables can be confusing if they are not aware of the underlying assets they are using.

“Honestly, most people won’t know they’re using stablecoins, and that’s the point,” added Paybis’s Vasilenko. “The best payment experiences are invisible. You tap your card, the money moves, and you don’t think about what’s happening in the background.”