Real-world assets (RWAs), serving as a crucial bridge between traditional finance and cryptocurrencies, are gradually becoming a focus of market attention. However, the current RWA market still faces numerous challenges: inefficiency, high costs, and a lack of smooth integration between the traditional financial system and the on-chain ecosystem. Bottlenecks for further development urgently need to be overcome.

To address this issue, Plume, a fully integrated and modular blockchain focused on RWA, was created. As the first RWA public chain truly serving crypto-native users, Plume aims to provide a more efficient, transparent, and convenient solution, creating a dynamic, liquid, and composable framework to redefine finance for the RWA market, making it as versatile as native crypto assets.

Raising tens of millions in funding and deploying assets exceeding one billion.

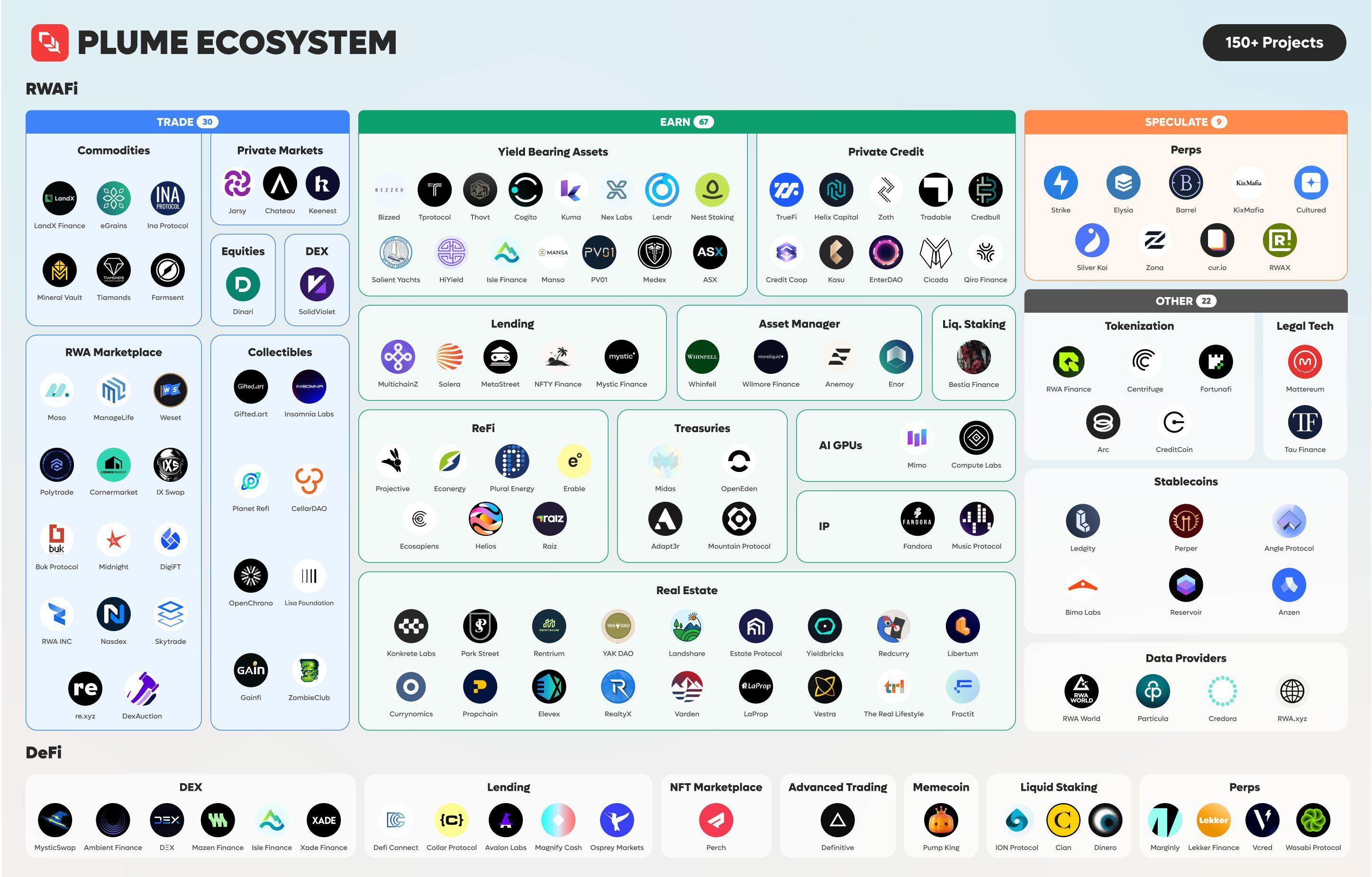

After nearly a year of rapid development, Plume Network has been recognized by the community, institutions, emerging banks, and crypto-native protocols (such as lending protocols, perpetual contract DEXs, AMMs, etc.) as the best solution for RWAfi. Currently, over 180 projects have been built on Plume, with a cumulative deployed asset value exceeding $1 billion, and hundreds of millions more assets are about to be added to the blockchain. During its two-month testing phase, Plume also achieved significant results: the number of active wallets exceeded 3.75 million, and on-chain transactions exceeded 270 million, fully demonstrating the activity of the ecosystem and the enthusiasm of users.

In November, Plume held a pre-deposit event with an initial target of $5 million, which was filled in 70 seconds, exceeding expectations. Faced with huge demand from the community, Plume then increased the limit to $30 million, and ultimately exceeded the target within 90 minutes, with oversubscription reaching 6 times the original plan.

Plume's growth potential has also been recognized by several well-known venture capital firms, and it has now raised a total of $30 million in funding. In May of this year, Plume announced the completion of a $10 million seed round of funding, led by Haun Ventures, with participation from Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures, and Reciprocal Ventures. This round of funding lays a solid foundation for Plume's innovation and expansion in the RWAfi field.

On December 18, Plume announced the completion of a $20 million Series A funding round. Investors in this round included Brevan Howard Digital, Haun Ventures, Galaxy Ventures, Lightspeed Faction, Superscrypt, Hashkey, Laser Digital (a Nomura Group company), A Capital, 280 Capital, SV Angel, and Reciprocal Ventures.

A blockchain ecosystem designed specifically for RWA, leveraging the DeFi concept.

While there are already many Layer 1 blockchains in the industry, and the constant influx of new projects into the sector intensifies competition, Plume recognized the need to create a blockchain specifically designed for RWA due to the customized requirements for access control, compliance, and liquidity in the on-chain operations of real-world assets. This was achieved by embedding more customizations and functionalities at the network level.

Unlike traditional RWA models, Plume, leveraging DeFi principles, aims to create a more efficient and accessible ecosystem for crypto users and traditional financial institutions—the first and only protocol focused solely on RWAfi. RWAfi is a new model in blockchain finance, meaning that tokenized RWAs are composable and flexible like native crypto assets. Based on this focus on adopting crypto-native principles, Plume prioritizes composability, liquidity, permissionlessness, and interoperability, designing its products and services around RWAfi, starting from building what crypto users truly need.

Plume's modular infrastructure is designed to support the tokenization and management of real-world assets. Its core architecture consists of the tokenization engine Arc, smart wallets, and the on-chain data highway Nexus. Through the collaborative work of these components, Plume provides a seamless and secure environment for managing multiple asset classes, ensuring compliance, and facilitating data integration.

Arc aims to simplify the creation, registration, and management of tokenized RWAs. It supports the tokenization of both physical and digital assets and integrates with compliance and data systems to ensure the accuracy, security, and compliance of every asset on the network. As an efficient asset tokenization engine, Arc's architecture enables asset issuers to tokenize assets quickly and cost-effectively, while automated compliance checks reduce operational complexity and costs.

Plume's smart wallet aims to truly enable composability for RWA assets, offering customizable controls for managing digital assets, yield instruments, and contract-based interactions. Users can access advanced DeFi features such as yield generation and liquidity management through this smart wallet. It maximizes functionality while maintaining asset security and user control.

Nexus is a fundamental component of the Plume architecture, bringing real-world data to the blockchain to power new use cases such as prediction markets, DeFi applications, and speculative indices. Nexus's data pipeline integrates reliable off-chain data and connects to external sources, delivering real-time, actionable insights directly to the blockchain. By providing accurate, real-time data, users can make informed decisions about tokenized assets, thereby enhancing the functionality and accuracy of on-chain financial products.

In terms of core functionality, Plume focuses on accelerating the on-chaining of real-world assets, liquidity, and regulatory compliance, providing a comprehensive framework covering liquidity management, built-in anti-money laundering (AML) compliance, and data access capabilities.

Plume leverages its network of compliance partners to perform compliance verification on tokenized assets, ensuring transactions comply with relevant regulatory requirements. By integrating compliance directly into the platform, it simplifies regulatory compliance and user registration processes. With integrated compliance capabilities, users can confidently participate in RWAfi trading and access broader opportunities on the Plume network, provided they meet the necessary legal standards.

In key areas of asset liquidity and market efficiency, Plume promotes liquidity through partnerships with trusted liquidity providers and the deployment of yield-enhancing mechanisms. Its trading functionality enhances liquidity options for the RWA token, supporting market activity through staking, yield farming, and integration with DeFi protocols. This allows users to participate in asset trading by reducing slippage and improving asset stability, and to take advantage of liquidity and yield opportunities in the RWA market.

Focus on real benefits, with a primary focus on serving native crypto users.

As a unique area where blockchain technology intersects with traditional assets, RWA's immense potential stems from the traditional financial industry. Perhaps for this reason, most RWA projects are currently led by individuals with traditional finance (TradFi) backgrounds, attempting to bring traditional financial products to the blockchain. However, mainstream blockchain users tend to be more crypto-native than traditional financial users, making it difficult for most products to find a foothold in the market.

Plume believes that to truly drive RWA growth, it's essential to prioritize the needs of on-chain users. Their RWAfi philosophy goes beyond simply putting RWAs on-chain; it's about tailoring products that are easy for users to understand and accept, while integrating the traditional and crypto-native worlds, following what users are already doing. This is because on-chain users are typically the most dynamic and innovative when exploring RWAfi application scenarios, and they have a strong demand for real returns, liquidity, and composability. Essentially, Plume addresses these needs in a DeFi-like manner, aligning its products with the market. Users superficially interact with decentralized finance products, but behind them are real-world assets that generate tangible returns.

As an open, permissionless blockchain, Plume provides an easy-to-use, compliant, and efficient tool for putting assets on-chain, allowing anyone to freely build and drive development without restrictions. Among the hundreds of protocols that Plume has already attracted, these assets cover a wide range of categories. Currently, Plume's asset categories can be broadly divided into three types: collectibles, alternative assets, and financial instruments. Collectibles include wine, art, watches, sneakers, and Pokémon trading cards; alternative assets mainly include private equity lending, real estate, or green energy projects; and financial instruments primarily consist of stocks or corporate bonds.

However, for the vast majority of crypto users, the asset category itself is not important; its use and potential returns are what matter. Therefore, based on the goal of benefiting existing on-chain users, Plume focuses its efforts on the three most important use cases for crypto users. The first is yield farming, which involves earning returns through depositing funds and cyclical operations, while achieving high efficiency and convenience. The second is trading, including buying and selling, lending, and traditional spot trading. The third is speculation, mainly involving derivatives and other similar high-risk investment operations. Plume focuses on assets and application scenarios related to these protocols, making them more aligned with the actual needs of crypto users.

Plume focuses on generating real returns through yield-generating assets and expanding the use cases for crypto ecosystems and RWAs by bringing in real users through existing markets. For example, Plume partnered with Projective Finance, an RWA project in the renewable solar sector, to offer users the opportunity to earn returns from $100 million worth of solar assets. Projective Finance tokenizes “leveraged commercial solar construction loans and post-construction operating assets” that will serve development projects in public school districts. Plume Network states that “these projects have 100% contractual revenue and predictable costs.” According to the statement, both teams believe that the school districts’ commitment to these development projects reduces the overall risk of the tokenized projects and anticipates yields between 9% and 18%.

In addition to emphasizing on-chain user needs, Plume also serves traditional financial institutions, addressing key compliance and liquidity challenges in driving institutional adoption. This dual-service strategy positions it to innovate and break through in the RWAfi space, meeting the distinct core needs of both crypto-native users and traditional financial institutions.

Looking ahead, Plume, with its mainnet launch imminent, will further enhance the scalability and security of its infrastructure, and further integrate to improve data privacy. In terms of ecosystem development and RWA expansion, it will undoubtedly add more asset classes, including tokenized luxury goods, stocks, and new forms of commodities. Furthermore, by expanding its partnerships with financial institutions, Plume will make tokenized RWA more accessible to institutional investors. This strategic positioning not only fosters connections between the crypto world and traditional finance but also makes Plume a crucial bridge driving the development of RWAfi.