KEY TAKEAWAYS

TOSHI soared 80% in hours, jumping to $0.0010 after Upbit listed the token.

Despite that, Sentiment remains negative, which could fuel an extended rally.

TOSHI’s price broke out of a symmetrical triangle, with the CMF above zero.

Toshi (TOSHI), the memecoin mascot of the Base blockchain, just exploded, surging 80% in hours.

The rally came right after South Korean exchange Upbit announced that it had listed the token.

Before the news, the TOSHI memecoin traded at $0.00060. But within hours of the listing, it rocketed to $0.0010, igniting fresh hype across the market.

Now, the big question is: can TOSHI extend this breakout run, or will the gains vanish as quickly as they came?

In this analysis, CCN breaks down the drivers behind the surge and what might happen next.

Base Mascot Token Toshi Pumps

TOSHI isn’t just the mascot of the Base blockchain — its name carries layered inspiration.

Developers derived it partly from Bitcoin’s creator, Satoshi Nakamoto, while also drawing inspiration from Coinbase CEO Brian Armstrong’s cat.

Earlier today, Upbit revealed that it had listed the TOSHI memecoin.

“New Digital Asset TOSHI Trading Support Guide. Supported Markets: KRW, USDT Market Trading Support Start Time: Scheduled for 2025-09-17 15:00 KST,” The exchange wrote on X.

Volume Surges, Yet Crowd Doubt Lingers

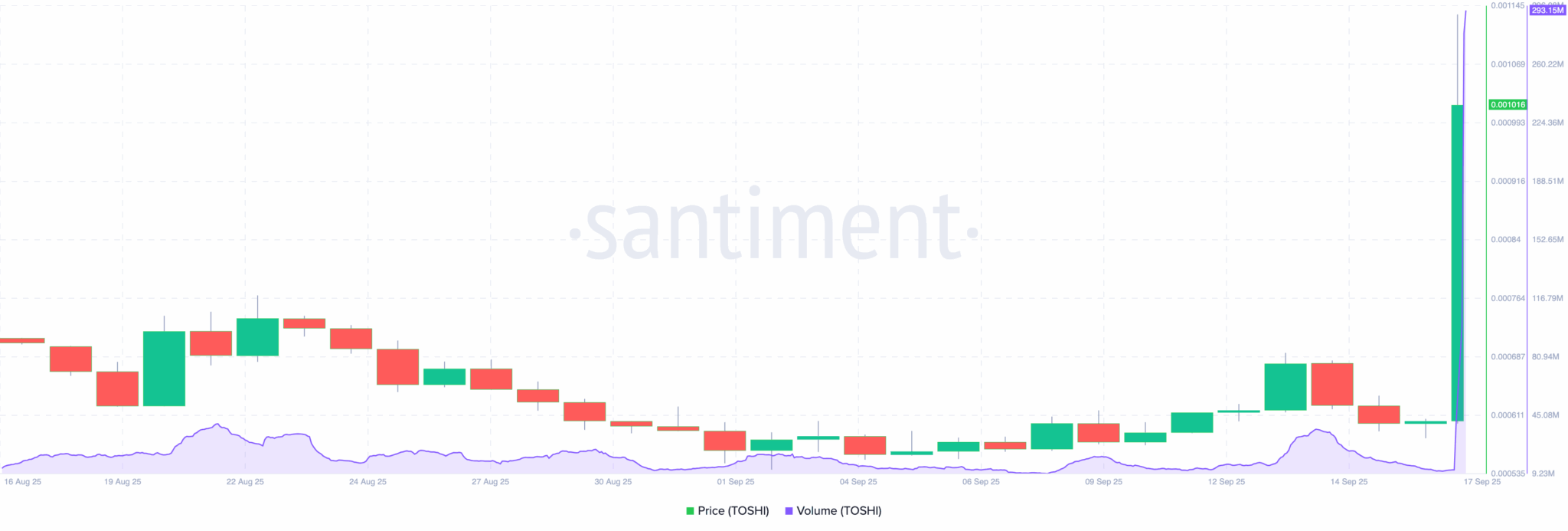

As with many Upbit listings, trading activity exploded. At press time, TOSHI’s volume has surged to $293.15 million — its highest level since January.

If this momentum continues and volume keeps rising alongside price, TOSHI’s price could easily climb well above $0.0010 in the short term.

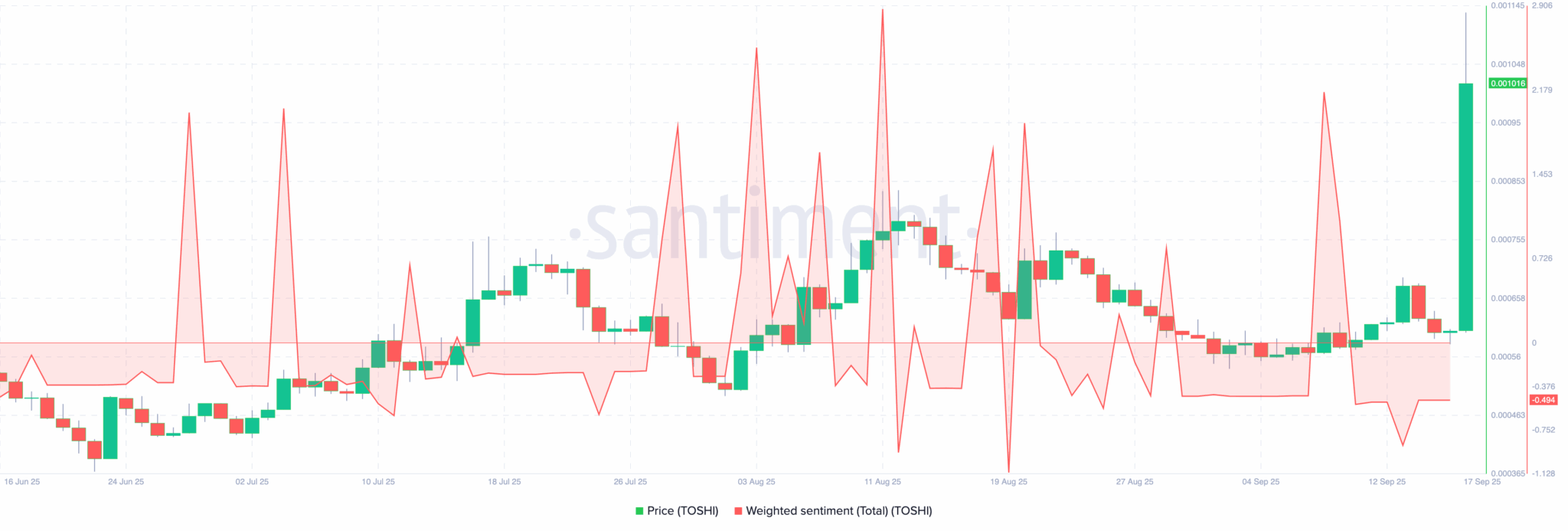

Meanwhile, despite the TOSHI memecoin price spike, Weighted Sentiment remains negative. In other words, social media chatter hasn’t been overwhelmingly positive about the memecoin.

Paradoxically, this could be a bullish sign. Prices move opposite to crowd expectations, and historically, extreme negative sentiment has increased the odds of further price gains.

With that in mind, TOSHI’s price breakout may still have room to run, as skeptical sentiment could fuel a contrarian rally.

TOSHI Price Prediction: Only the Start

From a technical standpoint, the daily chart shows TOSHI breaking out of a symmetrical triangle, signaling renewed bullish momentum.

Supporting this move, the Chaikin Money Flow (CMF) has climbed above the zero line to 0.13, indicating stronger capital inflows.

At the same time, the Moving Average Convergence Divergence (MACD) has formed its first bullish crossover since Aug. 6, reinforcing the case for upward momentum.

If this trend holds, the TOSHI memecoin could break past the wick at $0.0012. A successful push above that level may open the door for a run toward $0.0018 in the short term.

However, the bullish outlook depends on sustained demand. If buying interest fades, TOSHI’s price could slip below support at $0.00079, with a deeper drop potentially sending it to $0.00068.

More to Come?

At the same time, it’s worth noting that TOSHI’s breakout could spark a broader memecoin mania on the Base network.

The rally not only shines a spotlight on TOSHI but also highlights the growing appetite for meme-driven plays within the ecosystem.

Adding to the excitement, Base has recently confirmed that it is working toward launching a native token.

If introduced, such a move could attract fresh liquidity into the chain, amplifying activity across its tokens.

In that scenario, TOSHI and other Base memecoins could see even greater upside, as new capital flows into the ecosystem and fuels speculative momentum.