KEY TAKEAWAYS

Wormhole spiked 25%, fueled by news that the U.S. Department of Commerce selected its ecosystem partner.

On-chain activity and accumulation metrics strengthened the rally, with volume exceeding $500 million.

W could break resistance at $0.092 and aim for $0.12, but failure to maintain demand may drag the price back.

Wormhole (W) ranks among today’s top crypto gainers after briefly rallying to $0.10 before easing to $0.090.

‘This price action represents a 25% jump in the past 24 hours, backed by surging trading volume and rising market interest.

The rally wasn’t driven solely by technicals.

A key development involving the U.S. Department of Commerce and Pyth Network (PYTH) was a major catalyst.

This analysis reveals the drivers behind Wormhole’s sudden spike and assesses its long-term price action.

Wormhole Rockets Higher

On Wednesday, Aug. 23, Wormhole’s price peaked at $0.072.

One day later, the Wormhole team revealed that the U.S. Department of Commerce selected its ecosystem team, Pyth Network, to verify and publish economic data on-chain.

It also noted that Wormhole will be responsible for all multichain data interoperability.

“Pyth’s ability to ensure the cryptographic verifiability and immutable publication of official statistics across chains, in partnership with Womhole, marks a new chapter in how governments can interact with decentralized technology,” The team stated.

Following the development, PYTH’s price spiked by 120%, while W joined the rally.

Amid this price action, Wormhole’s trading volume spiked above $500 million, according to Santiment data.

The surge in volume alongside the price increase signals that the rally is backed by strong market participation rather than weak, low-liquidity moves.

High volume during an uptrend reflects genuine demand, which reduces the likelihood of an immediate fakeout.

If this momentum holds, the elevated trading activity could fuel further price appreciation in the short term.

Still, it also means Wormhole’s price may experience sharper swings, as increased liquidity attracts both speculators and profit-takers.

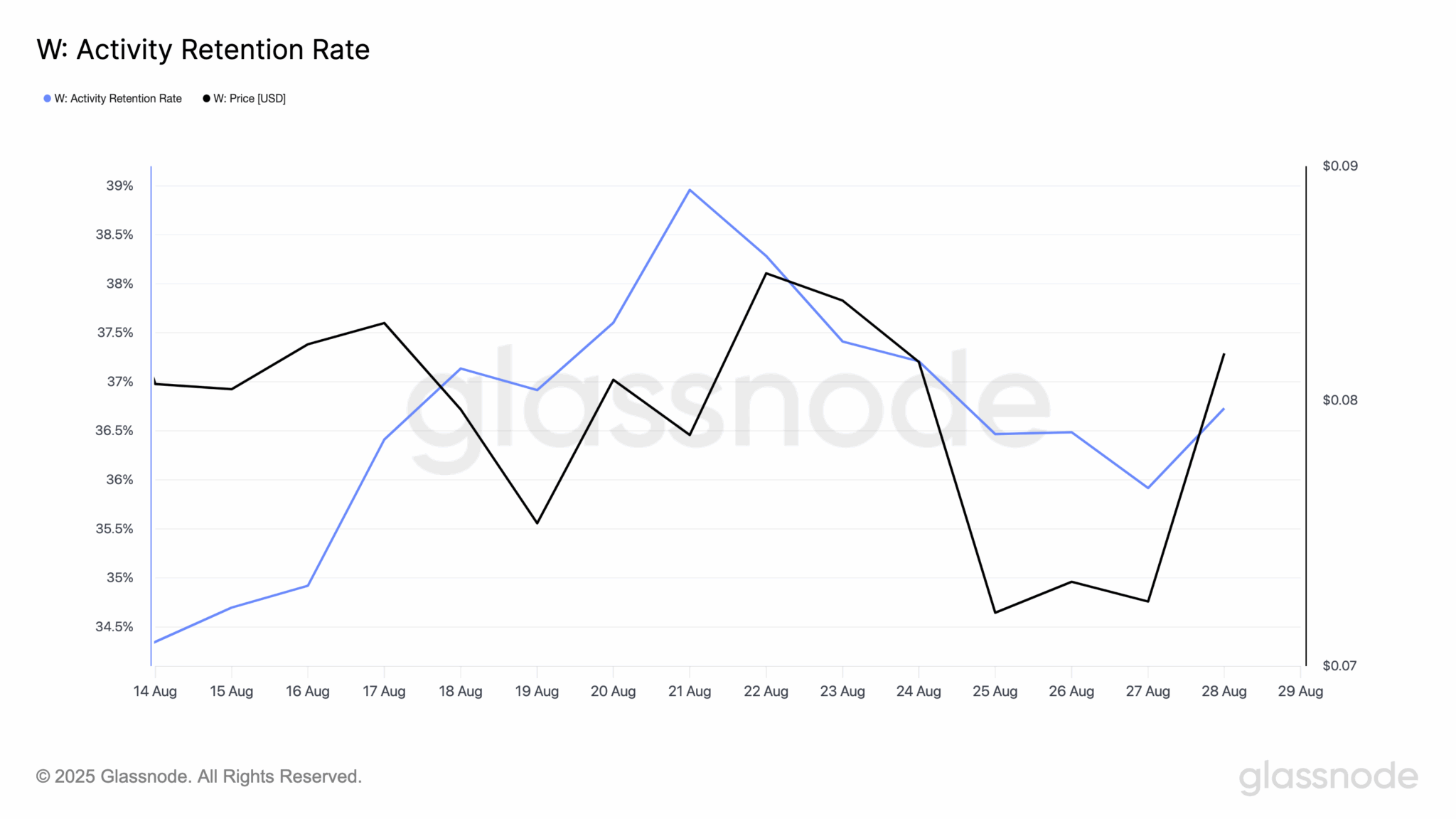

Utility Signals Strength

Besides that, Wormhole’s Holder Accumulation Ratio has spiked, highlighting stronger engagement among its user base.

This metric tracks the percentage of addresses that were active during the previous 30-day period and have remained active in the current one.

In other words, it reflects how consistently participants interact with the asset over time.

For example, a 70% retention rate means 7 out of 10 previously active addresses stayed active in the next period.

A higher ratio suggests sustained participation and reinforces the asset’s utility and long-term adoption potential.

Conversely, a drop would indicate waning interest and declining on-chain activity.

Therefore, the spike indicates rising on-chain activity that could keep Wormhole price trading higher.

W Price Prediction: Rally to Continue

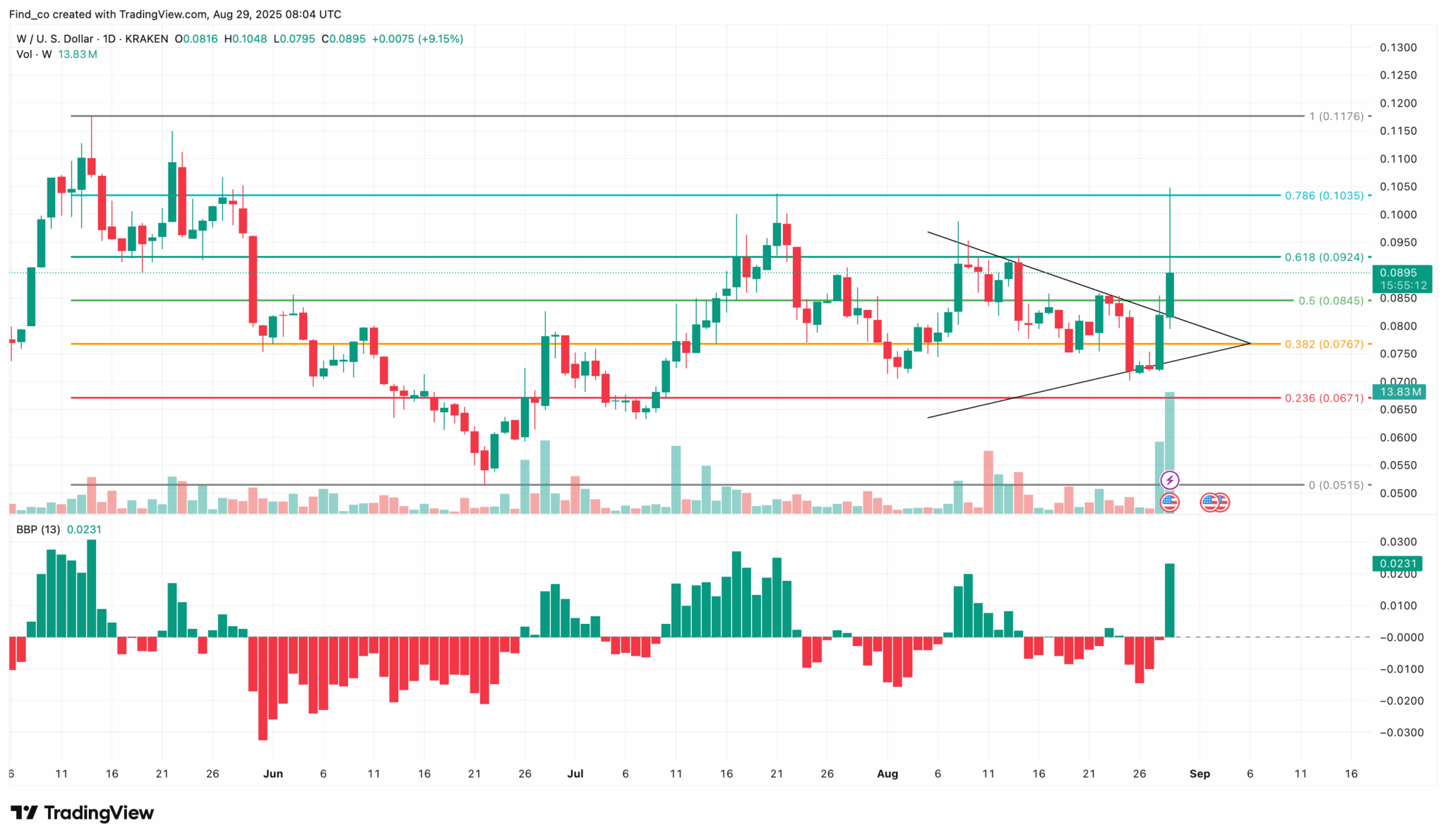

From a technical perspective, the daily chart shows Wormhole breaking above the upper trendline of a symmetrical triangle, signaling a potential bullish breakout.

Adding strength to this outlook, the Bull Bear Power (BBP) has flipped positive for the first time since August 23, suggesting buyers are finally regaining control after weeks of pressure from bears.

If this remains the same, Wormhole’s price might break the resistance at $0.092.

Once that happens, the altcoin’s next target could be a rally toward $0.012.

However, if bears take over and selling pressure increases, this prediction might not happen. In such a scenario, W’s price might slide to $0.067.