KEY TAKEAWAYS

Since its all-time high in April 2024, Wormhole’s price has experienced massive sell-offs.

Most token holders are yet to realize gains as trading volume also plummets.

W’s price will likely hit another all-time low as bears continue to dictate the direction.

Wormhole (W) plunged to an all-time low of $0.15 on Feb. 3, marking a 90% decline over the past year. This price decrease has left only 1% of Wormhole holders in profit.

Once touted as a game-changer for multichain interoperability, the token is now struggling under intense selling pressure.

With demand waning and no clear signs of recovery, is this the capitulation phase before a rebound, or will Wormhole price continue to hit lower values?

Wormhole Price Continues to Sink

The Wormhole token launched in April 2024, nearly a year ago. During that period, the project distributed 617 million tokens in airdrops.

Interestingly, around this same period, W hit an all-time high of $1.61. Since then, Wormhole’s price has struggled to sustain an extended increase.

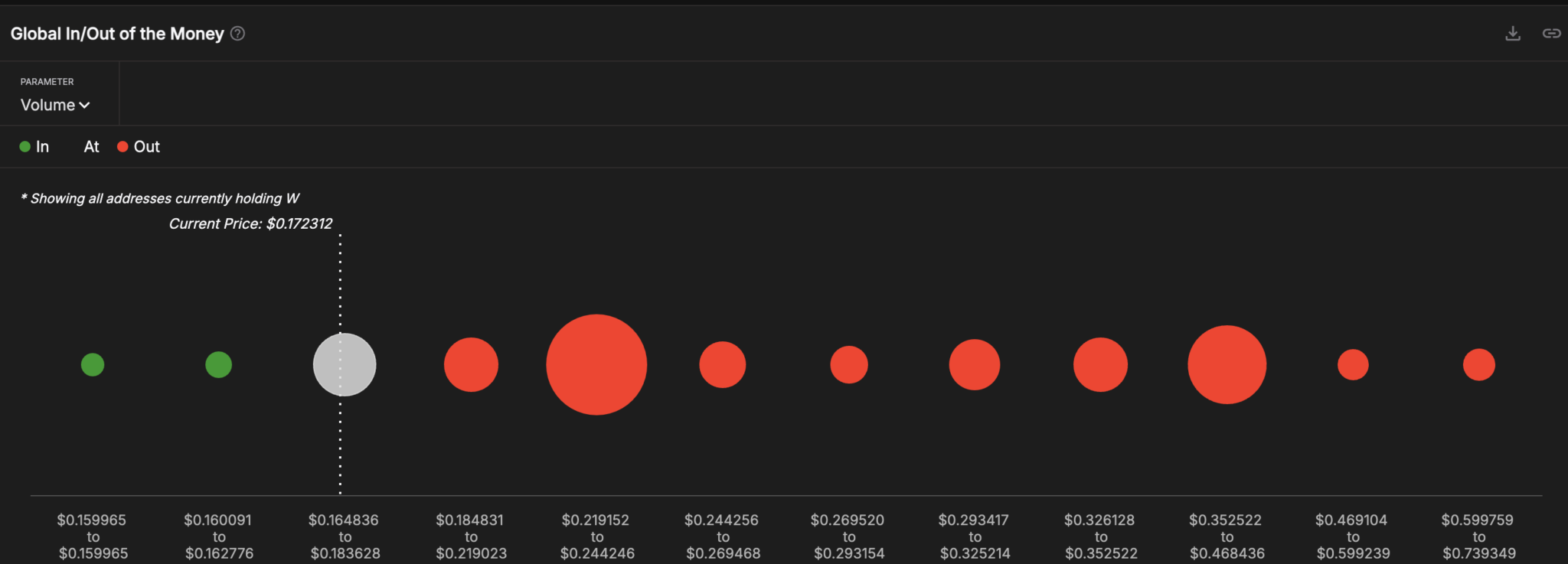

Even though the token now trades at $0.17, this underwhelming performance has left 96% of its holders in unrealized losses.

According to IntoTheBlock data, 1% of W holders are in profit, while others are at their average on-chain cost basis.

In most cases, a decline signals the bottom, indicating that a rebound could be next. But in W’s case, this might not be so.

One reason for this is its trading volume. Around the time Wormhole’s price hit an all-time low, the volume was over $220 million.

The hike in volume at the time and the price decrease indicated selling pressure. Today, W’s volume has fallen below the $40 million mark.

From a price perspective, falling volume signifies a lack of liquidity. When this happens, the price experiences suppression, which makes it difficult for the cryptocurrency to experience a rally.

Thus, if Wormhole’s volume continues declining, the altcoin’s value might fail to recover.

No Recovery in Sight

From a technical perspective, W’s price correction accelerated after it dropped below the 20-period Exponential Moving Average (EMA). The decline below the 20 EMA (blue) indicates a bearish trend.

Should Wormhole’s price remain below this threshold, the token’s value might continue to slide. Further, the Bull Bear Power (BBP), which compares the strength of buyers (bulls) to sellers (bears), has dropped to the negative region.

This drop implies that bears have the upper hand. Therefore, if bears continue to dictate the direction, W’s price might drop below $0.10.

On the other hand, if bulls neutralize bearish dominance, Wormhole might experience a relief rally. If that happens, the cryptocurrency might rise toward $0.25.

However, the 0.236 Fibonacci level will be key in reaching this point. Should the token rise above this resistance, it might hit $0.25. Failure to do so might keep it swinging sideways.