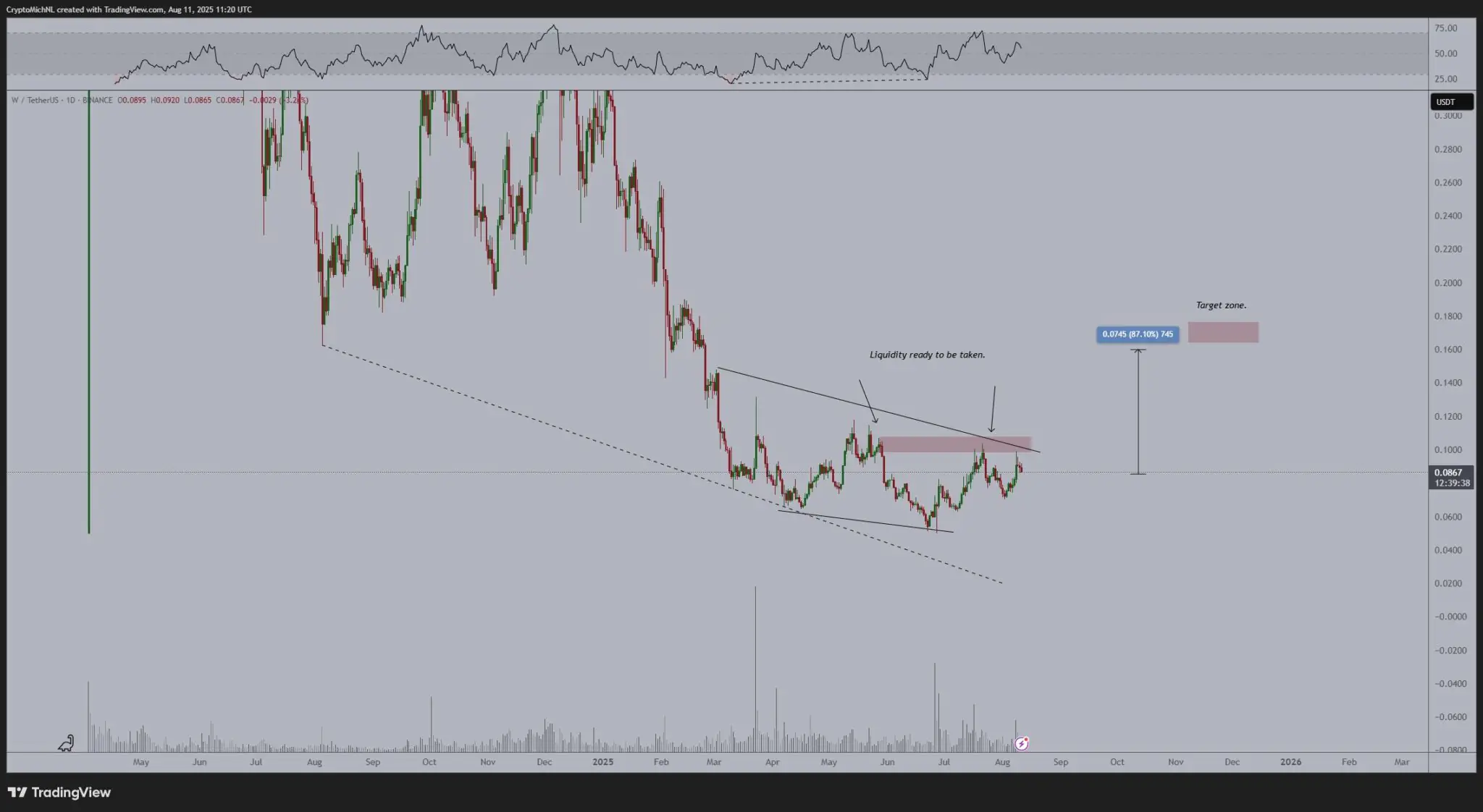

Wormhole’s native token (W) is trading at $0.08745, marking a 13% gain over the past week after breaking a multi-week descending trendline.

The rally peaked at $0.09216 on August 10, but the token has since retraced slightly, with 24-hour trading volume dropping 5.5% to $48.5 million – a sign of cooling momentum.

Technical indicators reflect mixed sentiment. The Relative Strength Index (RSI) has pulled back to 49.4 from overbought levels, while the MACD histogram remains slightly positive. Key support lies at $0.085, in line with the 50-day EMA at $0.0818. A decisive break below this range could trigger stop-loss selling. Traders are also eyeing the 4-hour VWAP at $0.0927 as a potential breakout confirmation point.

Factors Driving W’s Price Action

Institutional Partnerships

Recent collaborations with BlackRock’s BUIDL fund, Ripple’s XRPL, Apollo, and Securitize have strengthened Wormhole’s position in tokenized finance. These alliances are expected to support the upcoming MultiGov multichain governance system and Settlement protocol upgrades, aimed at boosting cross-chain transaction volume tenfold by 2026. Notably, BlackRock’s expansion of BUIDL to Solana via Wormhole in July coincided with a 12.7% surge in W’s price.

Market Risks and Competition

Wormhole operates heavily within the Base Network, which experienced a 19-minute block production halt on August 5 due to a spike in token launches. While W was unaffected directly, the incident highlighted scalability risks in ecosystems where it plays a key role. At the same time, competition from LayerZero – which holds 58% of the cross-chain messaging market compared to Wormhole’s 27% – and new entrants like Axelar’s Bitcoin bridge remain challenges to growth.

A planned fee-sharing mechanism set to launch in Q4 2025 will redirect protocol revenues to W stakers. Currently, 47% of the token’s supply is staked across five chains, though yields remain undisclosed. If designed well, the system could encourage long-term holding, but subpar APRs risk sparking sell-offs, as seen with Aave’s GHO in 2024.

Analyst Predictions

Crypto analyst Michaël van de Poppe believes W is poised for further upside, citing strong partnerships and liquidity conditions. He sees an 80%+ short-term target if the market breaks higher. However, other analysts warn of potential dips to $0.065–$0.075 in August, citing competition and historical volatility.

Outlook

Whether W can sustain its recent gains will depend on its ability to hold above key support levels while converting its institutional relationships into tangible on-chain adoption.

A successful breakout above $0.0927 could pave the way for further upside, but any weakness below $0.0818 would likely shift momentum back in favor of bears.