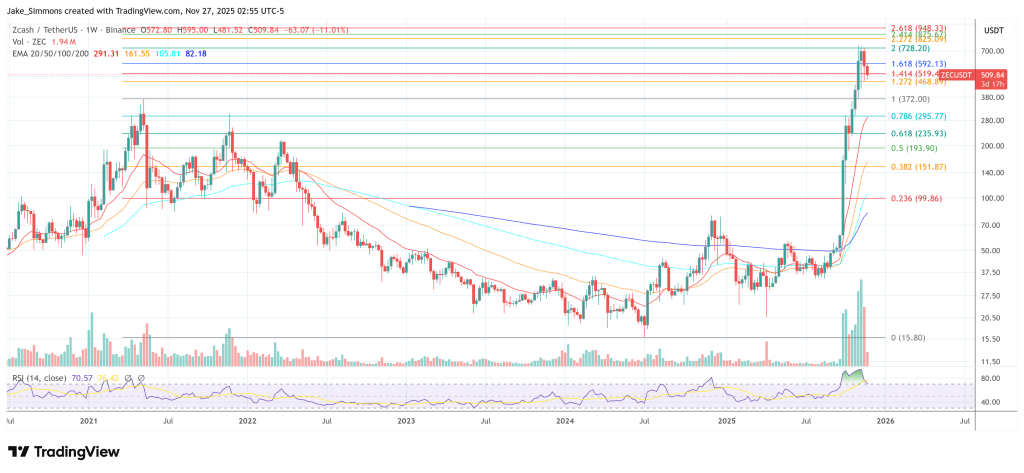

Delphi Digital researcher Simon Shockey is arguing that the real story in Zcash is no longer just its price – despite ZEC having one of the most eye-popping rallies of this cycle in recent months. “The most interesting thing about ZEC today is not the price,” he wrote on X. “It’s the fact that a GBTC-style discount dislocation just appeared around ZCSH.”

For Shockey, the Zcash trust setup only makes sense when viewed through the lens of what happened with Grayscale’s Bitcoin product. He reminds readers that “funds were built, and later blown up, on two different GBTC trades.” The first was the premium arbitrage, where Grayscale allowed accredited investors to subscribe at NAV with a six-month lock while GBTC traded at a “~30–40%” premium in public markets.

Will Zcash Follow The GBTC Playbook?

The playbook, he writes, became almost mechanical: “subscribe at NAV, lock for six months, hedge BTC exposure with CME shorts, sell GBTC at a premium, pocket the spread and lever it.” It was so widely adopted that “every TradFi family office, hedge fund tourist, and crypto-native desk was running it. It became the trade. Until, well, it didn’t…”

In February 2021, after years of trading rich to NAV, GBTC flipped to a discount. Anyone mid-lockup was now long an over-priced wrapper, paying to maintain a hedge and watching the discount widen to “-30%, -40%, even -45%.” Shockey calls that dislocation “career/cycle-ending almost overnight,” and notes that it helped detonate players like 3AC, BlockFi, Genesis and DCG.

But he stresses that GBTC’s story had a second act: once the discount was entrenched, “a different trade emerged: buy GBTC at a discount, wait for regulatory clarity or ETF approval, redeem at NAV, capture the collapse in the discount.” Value-oriented funds “were early and underwater for a while. But they were ultimately right. The discount evaporated as ETF approval became inevitable.”

Shockey’s contention is that a structurally similar phase may now be opening around Grayscale’s Zcash trust. “This morning Grayscale filed to convert ZCSH, their Zcash trust, into an ETP,” he writes. “That filing immediately creates the early outline of a GBTC-style discount trade.”

He highlights that ZCSH recently traded around 33.50 dollars per share, even though “yesterday’s trust data, with a lower ZEC price, showed NAV around forty-one dollars per share.” By his math that is “still close to a 20 percent discount. Every ZCSH share is priced materially below the ZEC it represents.” With an implied 0.0817 ZEC per share, “you are effectively getting ZEC exposure at ~$410 per ZEC when spot is well above that.”

The key structural shift is the proposed move from a closed trust to an exchange-traded product with redemptions. “The current trust structure does not allow redemptions,” Shockey notes. “The proposed ETP would, with one-to-one withdrawals of the actual ZEC held.” If regulators sign off, “the discount should tighten and ZCSH should move toward NAV. This is exactly what happened with GBTC as ETF approval became more realistic.” He is careful to add: “Not guaranteed. Not the same trade. But structurally very similar.”

On the money-making angle, Shockey is explicit. “The discount closing is the cleanest angle. Buying ZCSH at a 20 percent discount and selling after convergence is the purest version of the trade.” Beyond that, “there is optionality if ZEC rerates during the approval window. If the privacy-oriented store-of-value narrative strengthens, ZEC can rise while the discount closes. That creates a second leg of upside that GBTC did not offer until very late.”

He argues that a ZEC ETP “could unlock new demand,” since “most funds/investors cannot hold ZEC directly due to custody and mandate issues. An ETP solves that. New pools of capital often tighten discounts by themselves.”

Narrative and political tailwinds, in his view, are real. “Bitcoin’s lack of privacy is back in focus. The quantum-risk discussion is getting louder.” He points to mainstream airtime, including comments from VanEck’s CEO about Bitcoin’s shortcomings and ZEC as a potential hedge, as a signal that the story has escaped pure crypto-Twitter.

His closing summary captures the asymmetric, time-bounded nature of the bet: “If markets keep leaning toward the idea that ZEC is absorbing the role Bitcoin stepped away from, then ZCSH becomes the cleanest vehicle to express that view. You get ZEC exposure in public markets, which could become a major driver of rerating as flows pick up, plus a built-in twenty percent discount that only exists until the ETP is approved. ZODL?”

At press time, Zcash traded at $509.84.