XRP succumbs to pressure below its $2.30 resistance amid sticky bearish sentiment in the crypto market.

UAE's FSRA green lights Ripple's RLUSD stablecoin as a lending protocol in the Middle East region.

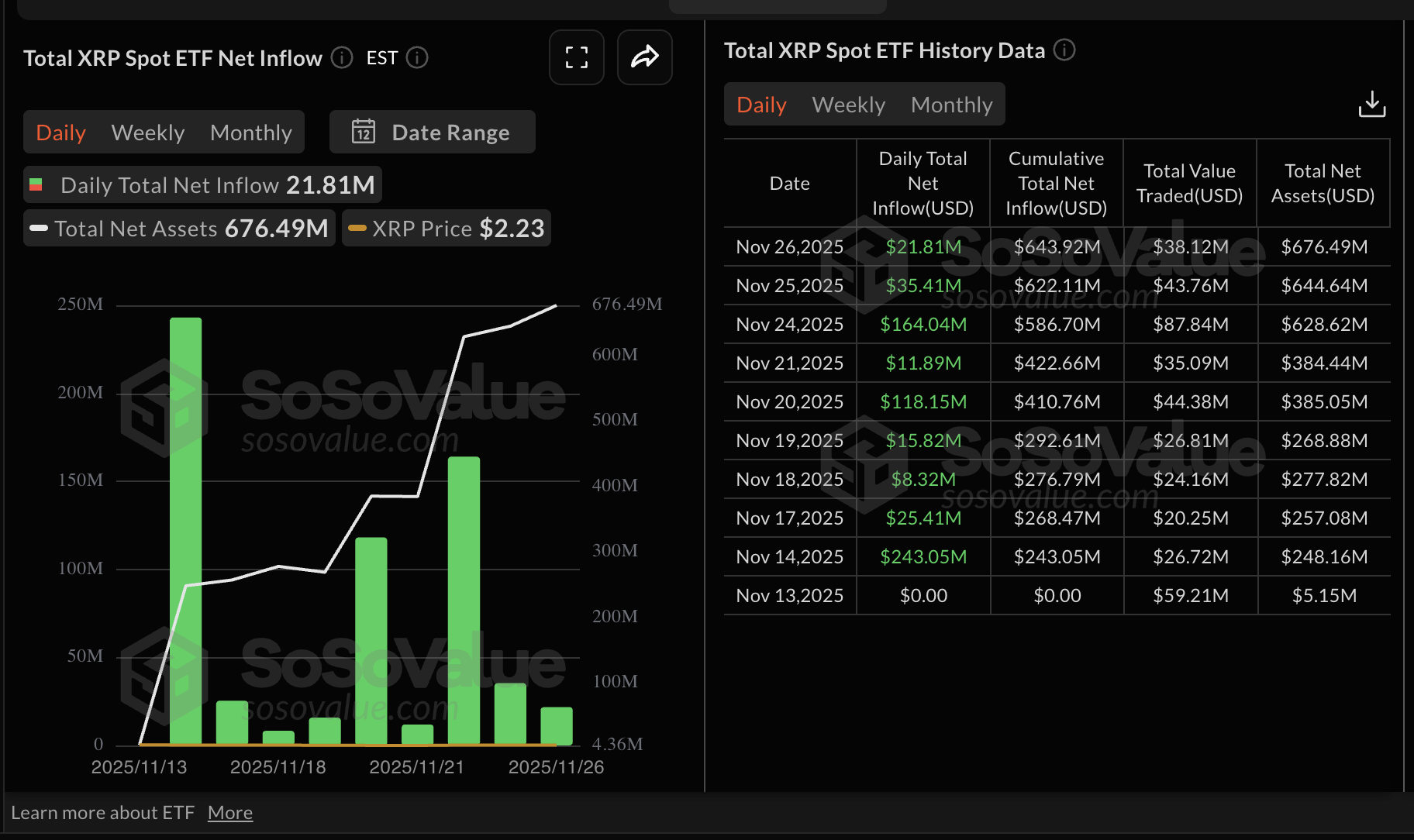

XRP ETF inflows extend the positive streak for nine consecutive days, underscoring growing institutional interest.

Ripple (XRP) is losing momentum, trading at around $2.19 at the time of writing on Thursday. Bulls' attempts to shape the uptrend toward key hurdles at $2.36 and $2.52 failed to gain traction amid resistance at $2.30.

Despite the broader cryptocurrency market's bearish outlook, XRP spot Exchange Traded Funds (ETFs) continue to record steady inflows, reflecting growing institutional interest.

Ripple RLUSD receives regulatory green light in UAE

Ripple USD (RLUSD), a Ripple-backed stablecoin, has been recognized as an Accepted Fiat-Reference Token by the Financial Services Regulatory Authority (FSRA) in Abu Dhabi, allowing its use within the Abu Dhabi Global Market (ADGM).

The regulatory approval implies that RLUSD is now eligible for use by Authorised Persons licensed by the FSRA to provide regulated financial services, provided they comply with the obligations set out in relation to Fiat-Referenced Tokens.

"The FSRA's recognition of RLUSD as a Fiat-Referenced Token reinforces our commitment to regulatory compliance and trust – two non-negotiables when it comes to institutional finance," Jack McDonald, Senior Vice President of Stablecoins at Ripple, stated.

Arvind Ramamurthy, the Chief Market Development Officer at ADGM, praised Ripple for achieving this regulatory milestone, adding that he "looks forward to seeing them make use of our robust regulatory framework, designed to support the sustainable growth of innovative firms and ensure the highest international standards of governance and compliance."

RLUSD is a regulated stablecoin issued under the New York Department of Financial Services (NYDFS). It boasts a market capitalisation of over $1.2 billion, according to CoinGecko. The stablecoin, launched in late 2024, is designed for institutional use while meeting regulatory expectations.

XRP ETFs recorded nearly $22 million in inflows on Wednesday, bringing the cumulative net volume to approximately $644 million and net assets to $676 million. The steady inflows, now on their ninth consecutive day, indicate that institutional investors are paying attention to altcoin-based ETFs.

Technical outlook: XRP dips as bears return

XRP is trading at $2.19 at the time of writing on Thursday, weighed down by prolonged bearish sentiment across the crypto market. The 50-day Exponential Moving Average (EMA) at $2.37, the 100-day EMA at $2.51 and the 200-day EMA at $2.52 slope lower and remain stacked above price, preserving downside pressure.

A recovery would face hurdles at the above--mentioned moving averages. The Moving Average Convergence Divergence (MACD) histogram stands in positive territory and has widened, placing the blue MACD line above the signal line.

Still, the Relative Strength Index (RSI) at 46 is neutral and has eased, suggesting fading upside momentum. The SuperTrend descends and sits at $2.40, also capping rebounds. The descending trend line from the record high of $3.66, reached on July 18, limits gains, with resistance seen at $2.67.

The momentum indicator holds above the zero line and edges higher, indicating strengthening buying interest. A close above the SuperTrend could open the path toward the trend-line barrier, while failure to reclaim it would keep the bearish bias intact below the declining averages.