Monad’s native token MON is going through turbulent trading in the first week following its airdrop. Arthur Hayes, founder of BitMEX and crypto influencer, predicts the token may sink further.

Arthur Hayes is bearish on Monad’s MON, even calling for a total crash. The token, still in its early stages of price discovery, had a day in the red, erasing previous gains.

Hayes shifted his opinion on Monad, just days after posting about the token as a potential runner to a new price range. MON remains risky, and while Monad aims for long-term development, its token may face a sluggish altcoin market.

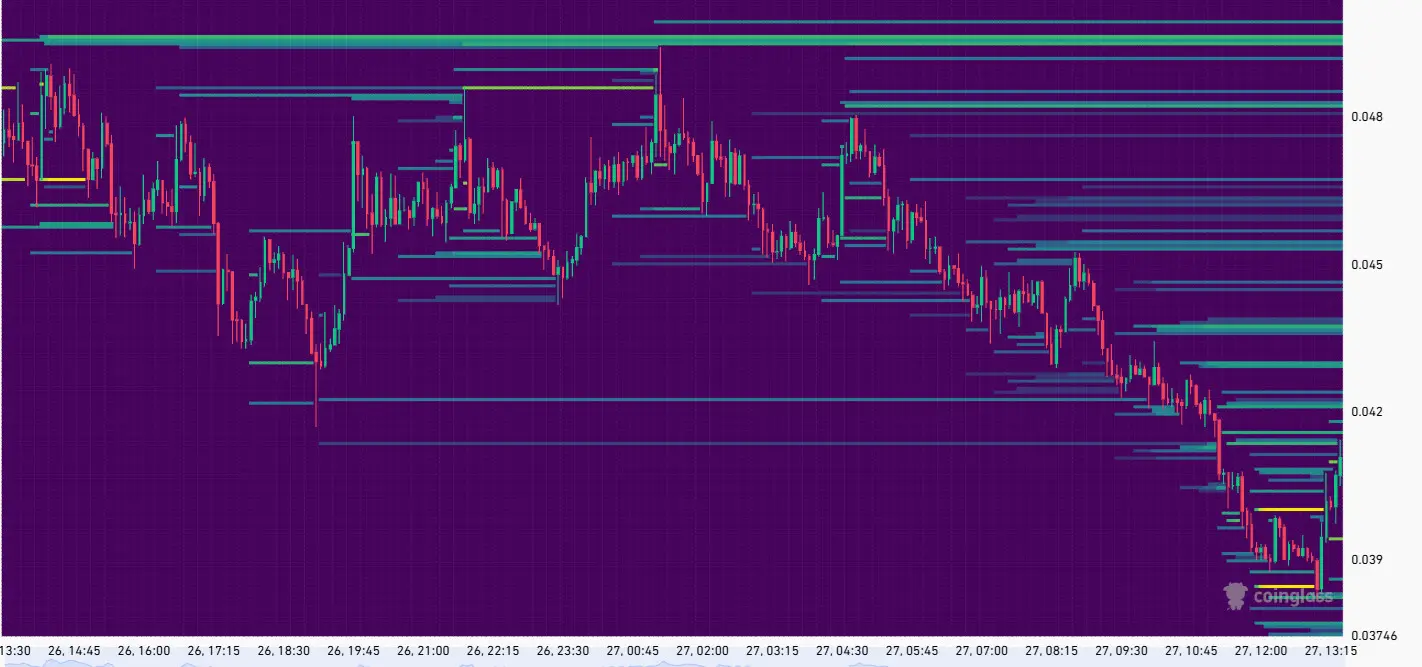

MON dipped to $0.039, down over 14.5% for the day. MON peaked at around $0.047 after the peak activity during its first day of trading.

Monad is getting aggressively shorted

Monad started with multi-chain versions and several markets. The token boosted its activity on Hyperliquid, trading among the top 10 most active tokens, alongside ASTER and PUMP.

Whales are shorting MON, with long positions paying negative fees. MON spot and derivative markets are also split, with different selling and buying pressures. Based on the liquidation heatmap, MON has built up short liquidity up to $0.05, suggesting a potential reversal to that level.

The token’s open interest is still building up, with over $65M on Binance. Although MON has a highly active perpetual futures market. Coinbase and Bybit lead the spot market, with over 37% of the token’s total volumes. Binance has drawn in over 89% of MON derivative trading.

The recent price drop liquidated all available long positions, though traders were reluctant to bet on a token expansion.

MON drop raises suspicions about market maker effects

The Monad project has been open about its relationship with Wintermute, one of the major crypto market makers. Ahead of the airdrop, the Monad team also listed all its market makers, with Wintermute taking the top spot.

Wintermute, along with other market makers, has agreed to a loan of MON. The difference is that Wintermute can borrow MON for a year, while all other market makers have a month of supply.

The chief concern is that market makers would dump MON in the short term, then buy back at a lower price to return the loan. Additionally, MON may suffer from market maker errors, where liquidity is overwhelmingly on the sell side. Market makers also have unique access to unlocked MON tokens, while other early backers may have to wait for the vesting period.

MON also raises skepticism for being a low-float, VC-backed project. After years of price weakness from similar tokens, MON may be exposed to selling pressure, causing a long-term slide. Projects with losing tokens almost never manage to revive the price.

Additionally, MON trades in its Solana version, with nearly 12K holders. Most of the top whales have sold their MON, though with limited earnings of up to $85K.

Join a premium crypto trading community free for 30 days - normally $100/mo.