BitMine Immersion Technologies is showing early signs of recovery after a difficult November marked by sharp losses and persistent bearish pressure.

The company’s Ethereum-heavy treasury struggled through market weakness, but improving broader conditions are now helping BMNR regain momentum.

BitMine Could Witness A Shift

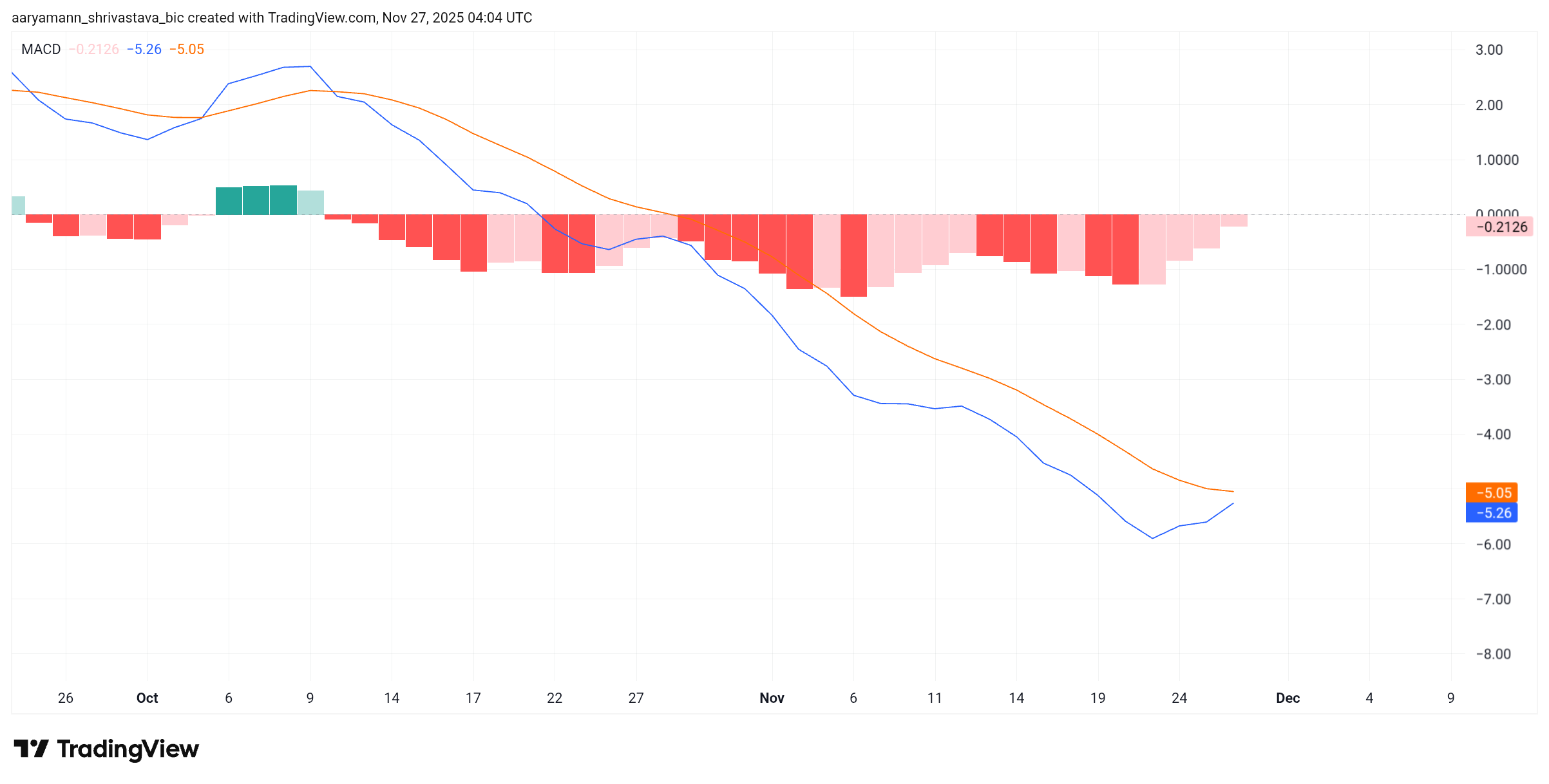

The Moving Average Convergence Divergence indicator reflects a meaningful improvement in sentiment. BMNR is nearing a potential bullish crossover, which would mark the end of a month-and-a-half-long bearish phase. The MACD line is approaching the signal line, indicating momentum is shifting from negative to positive. Such a crossover could reinforce growing confidence among investors.

If confirmed, this would be the first bullish signal for BMNR in several weeks. A shift of this magnitude often precedes a broader trend reversal, especially when paired with strengthening market conditions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR MACD. Source: TradingView

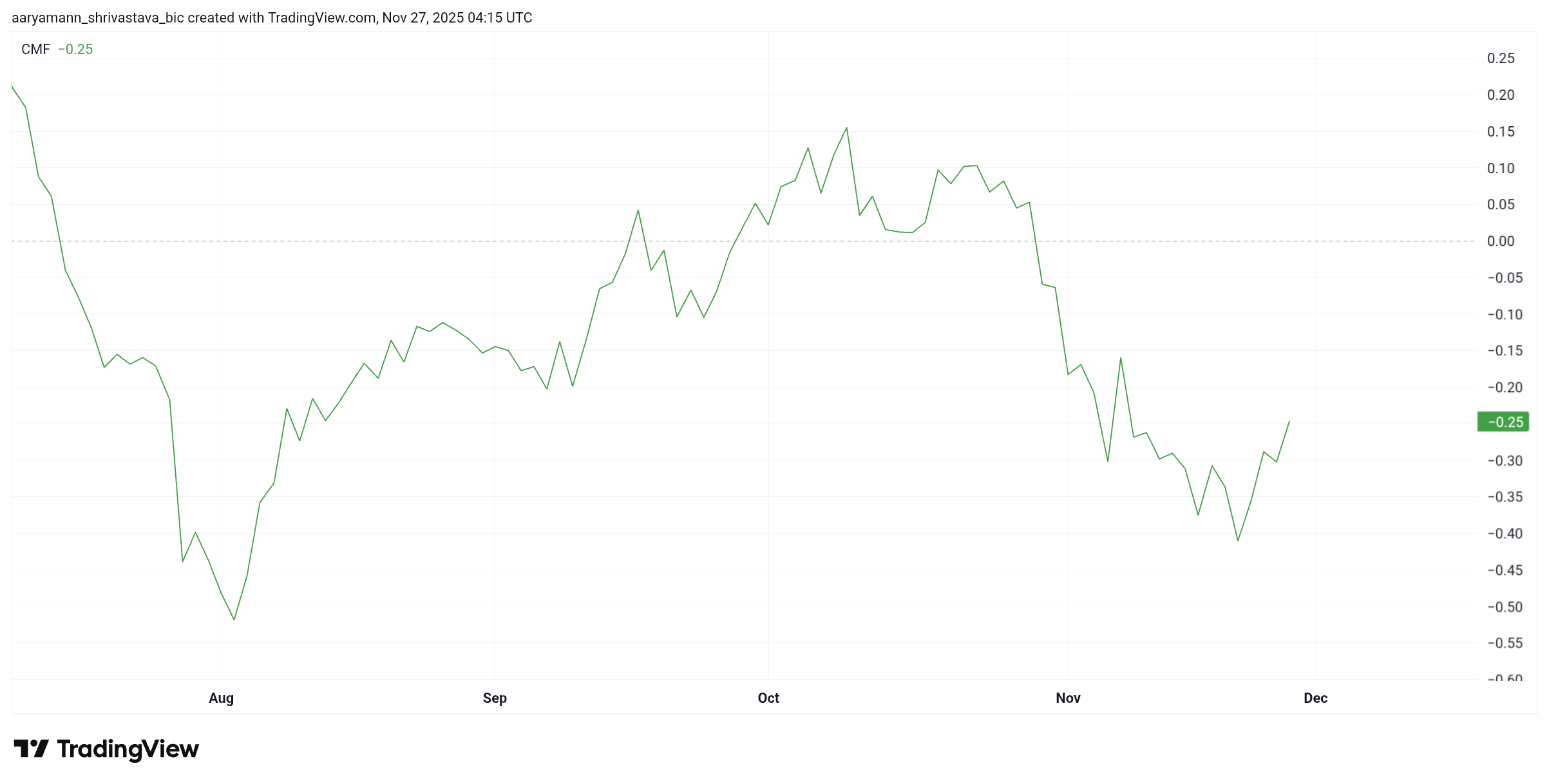

Macro indicators are also aligning in BMNR’s favor. The Chaikin Money Flow is noting an uptick, signaling that capital outflows are easing. While the indicator remains in negative territory, the upward movement shows that selling pressure is weakening. Investors appear to be reconsidering their stance as BMNR stabilizes after weeks of volatility.

A move above the zero line on the CMF would confirm the return of inflows. This shift would indicate meaningful accumulation, providing the fuel needed for a deeper recovery. As confidence rebuilds, BitMine could benefit from stronger liquidity and reduced downside risk.

BMNR CMF. Source: TradingView

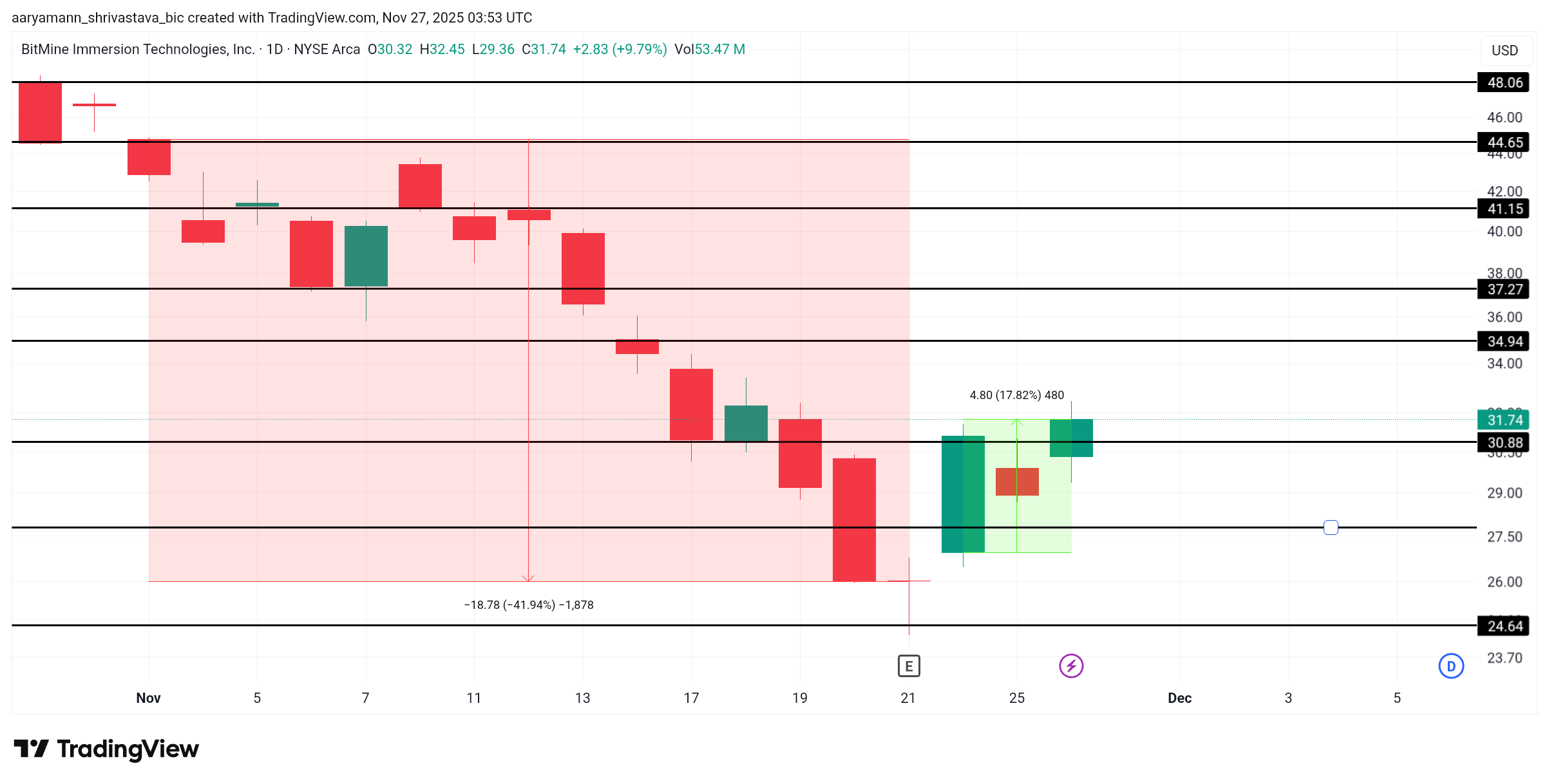

BMNR Price Takes On The Bearishness

BMNR has fallen nearly 42% since the beginning of the month, reaching one of its lowest daily closes. However, the stock has climbed 17.8% this week, now trading at $31.74. This rebound marks its strongest performance in nearly two months and hints at a potential trend shift.

The next major targets for BMNR are $34.94 and $37.27, with $41.15 serving as the key upside milestone. Given the improving momentum signals, these levels are attainable if bullish pressure continues. A confirmed technical reversal would help propel the stock toward these resistance zones.

BMNR Price Analysis. Source: TradingView

If momentum fails to develop, BMNR may remain capped below $34.94 or slip back under $30.88. A breakdown could push the stock toward $28.00 or even $24.64, invalidating the bullish thesis and extending its period of weakness.