Trump's WLFI token slides 50% as Robinhood eyes 2026 derivatives. Ethereum price prediction targets $3,250 while DeepSnitch AI surges at $0.02477 with tools going live.

Trump’s World Liberty Financial token has already crashed 50% despite buybacks. This just goes to show how shaky utility-free political tokens are. Meanwhile, Robinhood is eyeing 2026 with a new derivatives exchange, betting retail demand will surge.

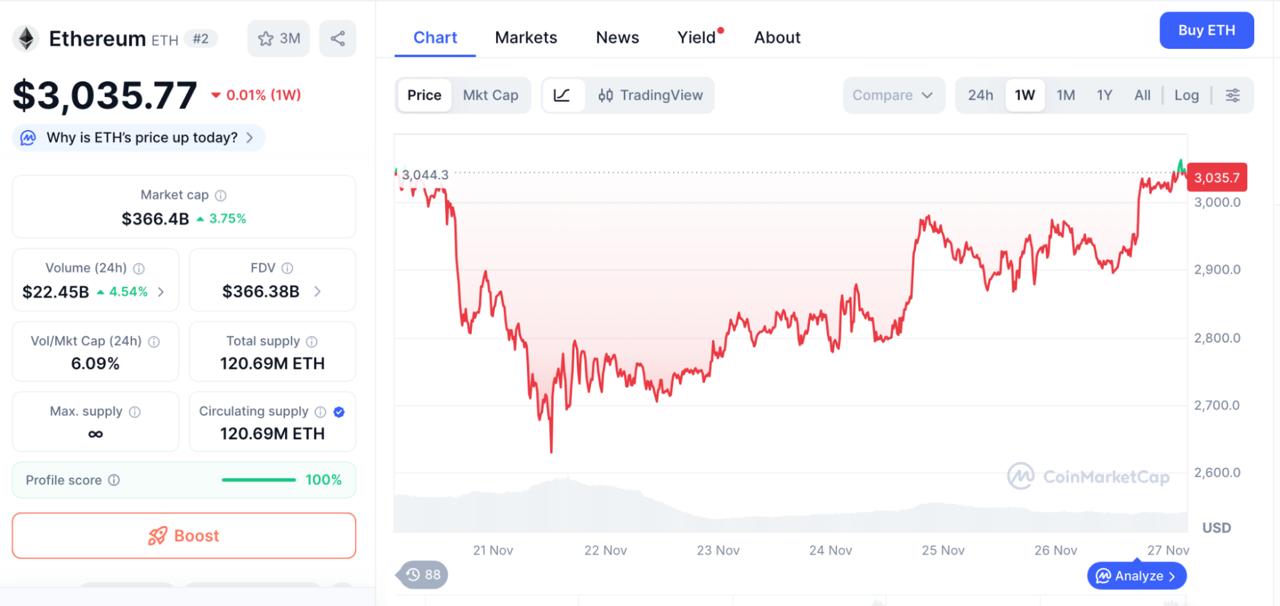

As hype projects fade, traders are shifting to assets with real traction. Ethereum sits at $2,910 with calls for $3,251 by December, but the asymmetric token of choice is almost undoubtedly DeepSnitch AI. It’s raised $600,000 at $0.02477, up 64% from launch, with live tools and staking already running. Momentum is snowballing, and early entry means everything.

Political tokens fade while real platforms build

Trump’s WLFI token has dropped 50% despite buyback announcements, a stark reminder that tokens without real utility rarely hold value. Investors bought the hype, then quickly realized there was no reason to stick around. Promises of decentralized governance weren’t enough when the token offered little beyond voting rights that most holders would never use.

Meanwhile, Robinhood’s push into crypto derivatives could bring millions of new users to crypto futures. A 2026 launch suggests it’s betting on the next bull cycle, with retail demand driving leveraged products.

The contrast here is that tokens with no utility fade fast, but platforms building real infrastructure attract lasting capital. That same logic applies across the market. ETH price will likely rise on fundamentals, but early-stage projects with live utility could move faster.

Zcash and Ethereum price predictions aren’t eyeing moonshot gains, unlike DeepSnitch AI

1. DeepSnitch AI price prediction 2026 and beyond

Ethereum still anchors smart contract infrastructure, but retail traders face a more immediate threat: constant scams in all their myriad forms. DeepSnitch AI addresses this with its intelligence infrastructure, with five AI tools built by expert on-chain analysts. Two of them, SnitchCast and SnitchFeed, are already live in the internal environment, giving retail the upper hand in no insignificant way.

No matter what’s happening with the Ethereum price prediction, ETH builds the rails, but traders still need protection on the tracks. DeepSnitch AI offers that incredible utility, with real-time intelligence. It’s a companion layer Ethereum doesn’t provide, but it’s exactly the type retail desperately needs.

The presale is at $600,000 raised, priced at $0.02477, and the network is already functioning. SnitchFeed is deployed internally with advanced detection logic for whale surges, sentiment flips, and FUD cycles. The dashboard is fully integrated, with active alerts and a global banner for urgent intel.

With AI spending projected to reach $1.5T in 2025 and November marking the strongest seasonal window for crypto, there’s only one way for DeepSnitch AI, and that’s up. At $0.02477, it has 10x potential on launch, and even 100x in the second half of 2026..

Small-cap infrastructure coins are compelling for their room to run for enormous gains, but DeepSnitch AI is especially rare for its credibility and utility. And buying later, rather than right now, could mean missing out on the full potential of these kinds of returns.

2. Ethereum price prediction in December

Ethereum is hovering at around $3,000, and technical indicators show bearish sentiment despite ETH recording 40% green days over the last month. The current forecast suggests ETH could rise around 9% to reach $3,250 by late December, with a potential upper target of $3,502 for almost 20% upside.

Texas recently snapped up $5 million in BlackRock’s Bitcoin ETF during the recent dip, showing institutional buyers are treating pullbacks as accumulation opportunities. That same logic applies to Ethereum. Network activity just hit new highs, and the Ecosystem Daily Activity Index shows a surge in real user engagement.

The Ethereum price prediction for 2026 suggests ETH could trade within a range of $2,912 to $3,505, meaning established holders might see a solid 20% return. But for Ethereum to 5x from here, it would need a market cap of over $1.5 trillion and implausible capital inflows.

3. Zcash price prediction in December

Zcash is around $508, at the time of writing, down about 24% over the past week. The privacy coin hasn’t made any especially promising moves recently, though technical indicators show neutral sentiment with 63% green days over the last month, the highest among tokens analyzed here.

ZEC could rise 56% to reach $777 by late December, with a 2025 target of $806 for 61 upside if it hits the upper range. That’s solid, but Zcash is legacy privacy in a market that’s, for all intents and purposes, moved on.

Privacy remains important, but traders care more about not getting rugged in the first place. That’s why DeepSnitch AI targeting scam prevention is simply more relevant than Zcash’s privacy features looking to 2026.

The verdict

Ethereum will likely climb toward $3,251 as fundamentals strengthen, but presale prices are where colossal upside can still be discovered. And DeepSnitch AI has raised nearly $600K, launched staking, already deploying tools in its internal environment. At $0.02477, it has all the fix-ins for 100x in the near future.

To nab your portion of these potential rewards, though, waiting is a bad idea, not least because the very tools to succeed as a retail trader in crypto are already accessible internally.