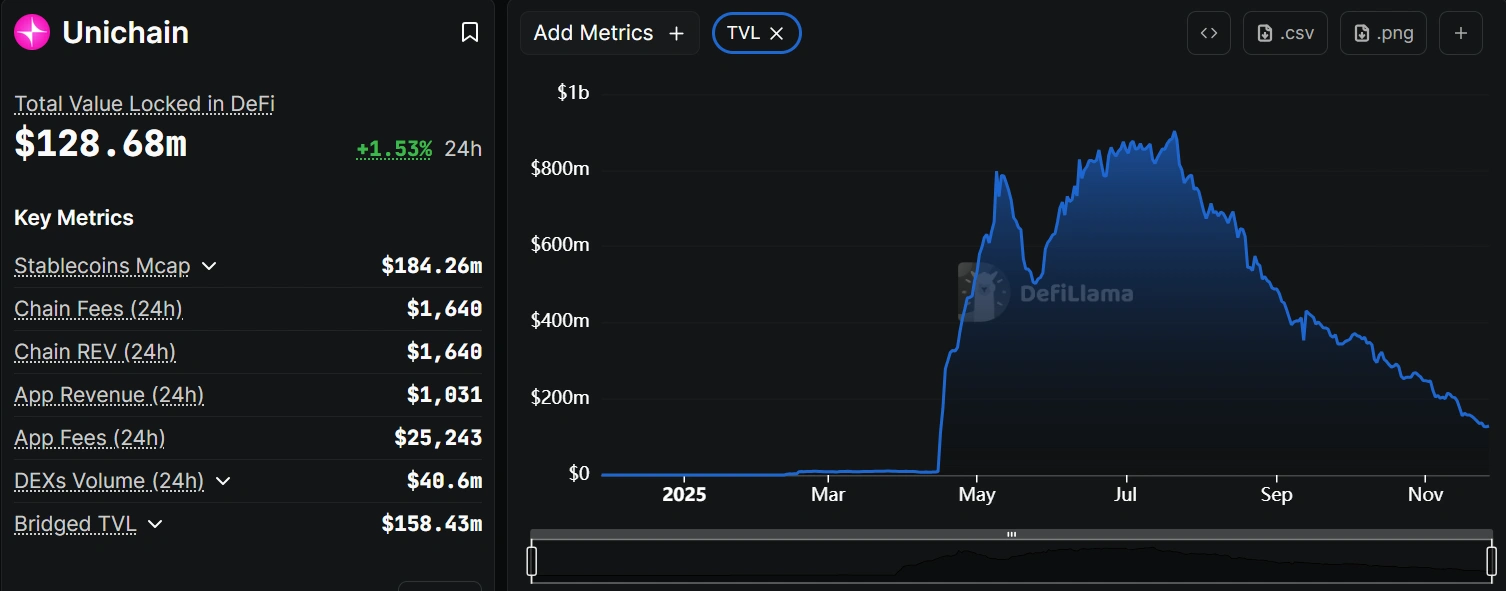

Unichain’s total value locked (TVL) has fallen by 86% from its all-time high (ATH), with observers attributing the decline to the end of its incentive program and a lack of a moat to mitigate the impact of ending such program.

Tom Wan, head of data at Entropy Advisors, who shared the Defillama chart showing the decline, also revealed that Unichain’s TVL crash is not happening in isolation, with other networks such as Linea dropping by 83% and Berachain experiencing a 91% decline from their respective peaks.

Unichain, the Layer 2 blockchain developed by decentralized exchange giant Uniswap, spent over $21 million on a campaign that started in April 2025 and was managed by Gauntlet, which distributed approximately 3.5 million UNI tokens.

The campaign saw Unichain’s TVL surge astronomically. A sizable chunk of that growth has now evaporated.

Sustainable yields versus temporary incentives

Erick Pinos, Head of Ecosystem at Nibiru Chain, noted that “incentives are very tricky to get correct” in response to Wan’s initial post.

Wan responded to Pinos, writing, “100%, I like how we at Entropy Advisors are designing DRIP on Arbitrum, which supports the program to be very reflexive to market conditions, dynamics, and performance of participating protocols and assets.”

An X user posting under the name Soleil also assessed Unichain’s predicament, writing, “Killer apps and sustainable yields are the only two elements that can keep TVLs. For Unichain, the app is basically Uniswap. When the incentives end, LPs have alternative choices in various DeFi protocols to maximize their ROI, the moat is simply not there.”

Unlike established Layer 2 networks that have cultivated diverse ecosystems of applications, Unichain’s primary draw remains its connection to Uniswap itself. Without compelling reasons to maintain capital on the network beyond incentive farming, liquidity providers have simply redeployed their assets to more lucrative opportunities elsewhere.

Eliezer Ndinga, global head of research and founding venture partner, 21shares, writing in his comment to Wan’s post, also echoed this sentiment: “Crypto in reality has a product-market fit problem without those incentives. Those then become table stakes. Protocols have so much to learn from Web 2 bootstrapping founders.”

What’s next for Unichain and the blockchain market?

Unichain is not lacking technically, as it still offers fast finality and low fees, properties that should, in principle, support sustained usage and make it appealing to builders. However, the data is saying that’s not happening at scale, and the challenge, according to observers, lies in converting transient reward-seekers into regular users of on-chain applications.

On other chains, Berachain, whose platform experienced an exploit earlier this month, is the worst hit in terms of its TVL decline. It went from an all-time high of over $3.3 billion to $273.67 million, a 91.7% decline.

Linea, on the other hand, has seen a slight recovery, moving from the 83% decline Wan reported to around 78.9% as of the time of writing.

The reasons for these declines are not unrelated to the bear market that hit the market, with Bitcoin falling close to $80,000 last week. However, the market has seen some progress with Bitcoin gaining some momentum and is now priced at over $91,000. Historically, events like this affect other blockchains, whether Layer 1 or Layer 2, and recovery may be slow and difficult.

If you're reading this, you’re already ahead. Stay there with our newsletter.