Stellar price is trading near $0.26, up 2.09% over the past 24 hours, as the asset extends its intraday recovery despite broader higher-time-frame weakness.

The market has shown renewed short-term bullish structure, but long-term technical indicators still point to caution as momentum remains fragile.

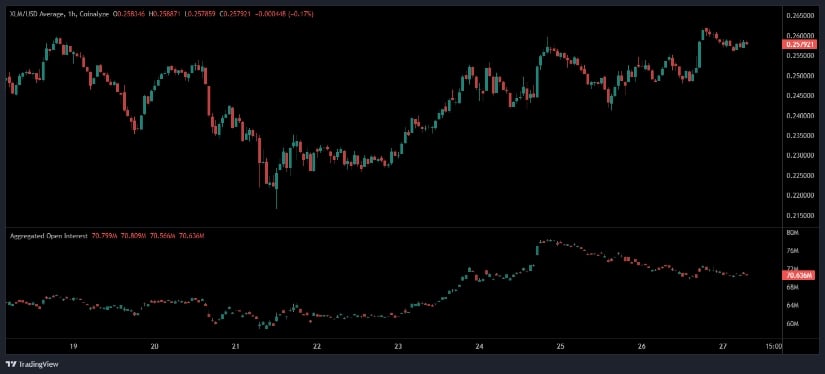

XLM Breaks Out of Short-Term Downtrend and Forms Clear Intraday Uptrend

From the 22nd onward, the coin shifted from a mild downtrend into a well-defined intraday uptrend, climbing from the $0.22 region toward $0.26. The structure of higher highs and higher lows signals that buyers have regained control following the earlier selloff. This trend is further supported by sustained dip-buying interest, with recent candles closing near the upper end of the range, reflecting strong short-term demand.

Source: Open Interest

The recovery momentum was most pronounced during the rally into the 24th, where bullish pressure intensified and confirmed the intraday breakout. While the broader macro trend remains uncertain, the recent price behavior shows clear tactical strength and improving market sentiment in the lower timeframes.

Open Interest Rises During the Rally, Then Eases as Price Consolidates

Aggregated open interest rose sharply during the breakout, particularly during the strong upward push on the 24th. This OI expansion, paired with rising price signals, fresh long positions entering the market, rather than short liquidations. Such alignment between growing interest and advancing price typically reflects trend confirmation and strengthening conviction among traders.

However, after OI peaked near the top of the range, it began to cool off while price stabilized around $0.26. This pattern indicates profit-taking or controlled de-leveraging, rather than aggressive short selling. As long as price holds above the key breakout region between $0.24 and $0.245, the intraday uptrend remains intact. A failure to defend this zone would suggest that the long build-up is unwinding more decisively.

XLM at $0.26 with $8.33B Market Cap

According to BraveNewCoin, the coin is currently priced at $0.26 with a market cap of $8.33 billion and a 24-hour volume of $208.5 million. The circulating supply stands at 32.31 billion tokens, placing the crypto at Rank 24 globally.

The modest 2% daily gain aligns with its recent intraday recovery, though the asset still trades well below the multi-month resistance zone near $0.30. While short-term sentiment is improving, long-term structure remains under pressure.

Daily Chart Still Shows Macro Downtrend Despite Intraday Strength

From a higher-time-frame perspective, XLM remains stuck in a broader downtrend. The daily chart shows a consistent pattern of lower highs and lower lows, and every attempted bounce toward the $0.30 resistance has faded quickly. Despite the recent intraday push, the overall trend remains controlled by sellers.

Source: TradingView

The MACD sits at –0.0131, below the signal line at –0.0126. Although the histogram is neutral, momentum remains firmly in negative territory. This suggests that while selling pressure has slowed, buyers have not yet generated a convincing trend reversal.

The Chaikin Money Flow (CMF) at –0.08 indicates mild capital outflow and minimal accumulation. Even with the intraday strength, there is no clear sign of sustained buying interest on the daily chart.