Hyperliquid (HYPE) is tightening around the $35–$36 zone as buyers step in, raising fresh questions over whether a broader rebound could set the stage for a push back toward $42 and beyond.

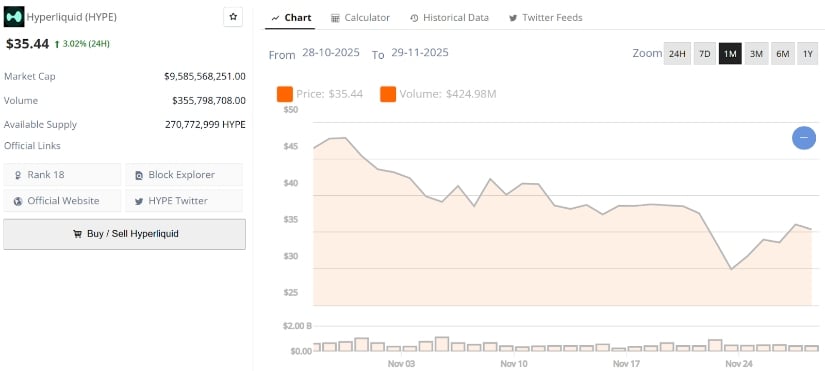

Hyperliquid price is holding steady around $35–$36 after a volatile month-long decline that pushed the token from the mid-$40s into the low-$30s. Despite the broader weakness, recent market data suggest early signs of reversal. With momentum compressing and key indicators starting to shift, traders are watching for whether HYPE can sustain this recovery attempt or if another leg lower is still possible.

The current consolidation comes at a time when order-flow dynamics, ecosystem growth, and technical backdrops are beginning to converge. This has brought Hyperliquid Price Prediction discussions back into focus as analysts reassess potential next moves.

Technical Context: HYPE Stabilizes After Breakdown

Over the past few weeks, HYPE has traced out a classic breakdown-and-retest structure. Price lost the $35.8 area, flushed into the $28–$29 zone, and then bounced back toward the prior breakdown point. Moves like this are common in trending markets and often define whether a trend resumes or transitions into a broader basing phase.

Hyperliquid’s current price is $35.44, up 3.02% in the last 24 hours. Source: Brave New Coin

With HYPE now oscillating between roughly $31.5 and $36, traders are watching how the market behaves around this compressed range. A decisive move in either direction could set the tone for December and early 2025.

Breakdown Retest Highlights Critical Zone

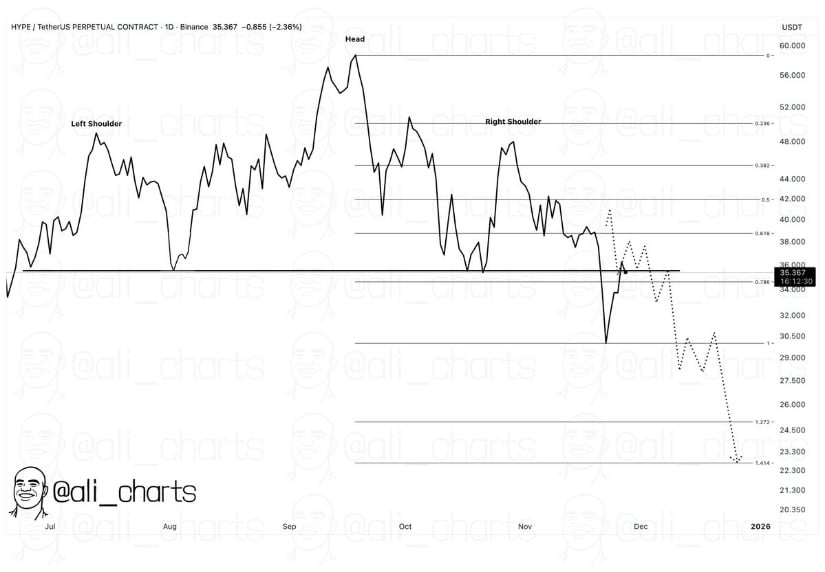

One of the more closely followed views comes from Ali Martinez, whose chart frames the current action as a retest of the breakdown zone. In his structure, $35.8 stands out as the key pivot: previously a support shelf, now acting as resistance after the November drop. The earlier wick to $28.5 marked a notable flush where sellers exhausted before buyers stepped back in.

HYPE retests the crucial $35.8 breakdown level, with buyers defending the low-$30s as the market decides whether this rebound has real momentum. Source: Ali Martinez via X

From this perspective, holding above the low-$30s while repeatedly pressing into $35.8 would signal growing demand and absorption of overhead supply. Conversely, a clean rejection from this level followed by a move back under $31 to $32 would suggest that the downtrend still has room to extend and that the prior bounce was merely corrective.

HYPE Reclaiming $35.8 Could Target $42.3

A roadmap shared by Crypto TXG adds more specific levels to that structure. His view notes that after losing $35.8 and bottoming at $28.5, HYPE has flipped back into attack mode, now testing the same level from below. If the market manages to close convincingly above $35.8, his primary upside marker sits near $42.3, where previous reactions and liquidity pockets align.

HYPE presses back into the $35.8 pivot. Source: Crypto TXG via X

The same model also outlines the risk case. A failure to break $35.8 with conviction could lead to another pullback towards $31.5, and if weakness persists, a full retest of the $28 to $29 region remains on the table.

Order Book Strength Adds a Constructive Layer

Jesse Peralta’s order-book snapshot adds a different angle: active buy-side liquidity has increased noticeably, with several stacked bids appearing between $35–$36.5. This suggests that buyers are attempting to absorb short-term volatility and may be preparing for a potential rotation higher. Such order-book behavior often appears ahead of local bottoms, especially during periods of moderate liquidity.

Buy-side liquidity builds between $35 and $36.5, with stacked bids hinting at early accumulation and a potential shift in short-term momentum. Source: Jesse Peralta via X

The bullish skew in active orders reinforces the idea that HYPE remains one of the stronger alts structurally, even after its recent pullback. Stronger bid density near the lows helps create a cushion while also setting the stage for potential range expansion if resistance levels break.

Final Thoughts: Will HYPE Reclaim the $50 Mark in 2025?

Looking further out, the key question for many traders is whether HYPE can revisit or reclaim the $50 region at any point in 2025. Medium-term Hyperliquid Price Prediction scenarios depend heavily on how the market handles this current cluster around $35–$36 and whether broader altcoin liquidity rotates back into high-activity protocols.

A sustained move above $42–$43 would be the first major step, as that zone marks prior distribution and a logical area for profit-taking. Clearing it with strong volume would add weight to the idea of a larger recovery arc, potentially extending toward $50 later in the cycle. Without that kind of follow-through, any rally is more likely to remain a mid-range bounce rather than a full trend reversal.