Bitcoin’s resurgence toward the $91,000 level has sparked renewed optimism in the crypto market, but for many investors, the real opportunity lies in altcoins to buy now.

With BTC up 15% from the recent November low and ETF inflows reversing their outflow streak, sentiment is shifting. And while Bitcoin’s push toward $100,000 is back in focus, sharp eyes are tracking the altcoin space for higher upside to Bitcoin Hyper.

Bitcoin Recovers, But Resistance Remains Strong

The Bitcoin price is currently trading around $91,010, having posted a 4.07% gain in the past 24 hours. Despite the bounce, BTC is still down 28% from its all-time high, and analysts warn that resistance at $93,500 and $95,000 could trigger more volatility before any clean breakout to six figures.

The recent move has been supported by a return of ETF inflows and lighter trading volumes around Thanksgiving, creating thinner liquidity and sharper price swings.

Still, altcoins like Ethereum have also started showing strength after weeks of downward pressure. The rising tide appears to be lifting most boats – especially those with strong narratives and pre-launch growth.

Bitcoin ETFs Post $128M Inflow Over Two Days

Spot Bitcoin ETFs, which had faced days of net outflows, saw a sharp turnaround on November 25 and 26, recording $128.70 million in net inflows, according to Coinglass data. Fidelity’s FBTC, BlackRock’s IBIT, and Ark’s ARKB all posted green numbers, reflecting renewed institutional confidence in the sector.

On November 26 alone, ETFs recorded $21.12 million in fresh capital despite a small outflow from Fidelity. BlackRock and Bitwise were among the biggest contributors, pushing total spot ETF inflows beyond $58 billion to date.

Daily volume across these funds topped $4.89 billion, helping reinforce the Bitcoin price above the $90,000 support line.

While this bounce has caught headlines, the rotation into early-stage altcoins is gathering more serious traction among traders looking for exponential upside over defensive blue-chip exposure.

Kaspa, Solana, and Hyper Projects Surge in Presale Sentiment

Beyond Bitcoin, coins like Kaspa and Solana have seen rising social metrics, but one newer name is starting to dominate altcoin investor discussions: Bitcoin Hyper.

This layer-2 protocol running on Bitcoin infrastructure has introduced a presale model that’s now closing in on $29 million raised, with over 620 million tokens sold.

The pricing curve is dynamic – meaning investors entering early are already sitting on marked-up value as the price moves toward its next bracket.

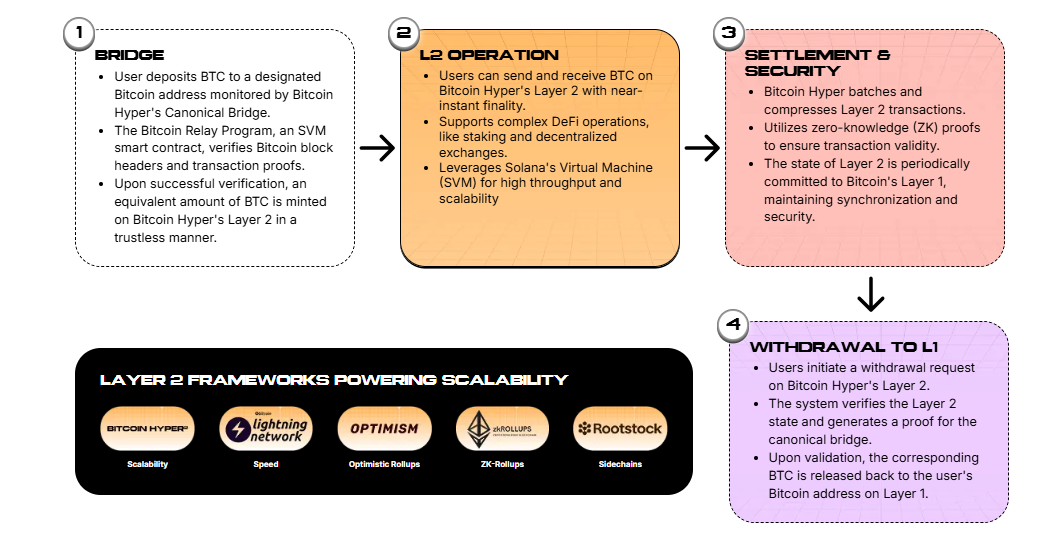

Bitcoin Hyper isn’t just riding sentiment – it’s delivering metrics. The token uses the Solana Virtual Machine (SVM) to power fast, low-fee smart contracts on top of Bitcoin’s base layer.

This allows BTC to interact with SVM-based dApps, creating a new use case for wrapped Bitcoin assets while reducing transaction costs from $10 to a few cents.

With crypto moving toward more modular and scalable design, Bitcoin Hyper is positioned as one of the few real-world utility tokens built directly on Bitcoin’s security model while enabling DeFi-like flexibility.

Bitcoin Hyper: Why This Infrastructure Token Is Gaining Ground

For traders actively searching for altcoins to buy now, Bitcoin Hyper offers a compelling mix of structure, momentum, and timing.

The presale currently prices the token at $0.013335, with a hard cap that’s nearly reached. Over $28.58 million has already been secured, and the project is backed by full audits from Coinsult and Spywolf.

Add in 41% APY staking for early buyers and a native bridge that unlocks BTC into a faster, fee-optimized layer-2 environment, and it’s easy to see why buyers are calling this a high-upside pick in a market still finding its footing.

Unlike meme-driven tokens, this presale is structured with strict tokenomics and investor incentives baked in from the start.

The entire system is being built for low latency, low fees, and real yield – a major shift away from speculative-only coins that often lose steam after launch.

With BTC holding strong support and ETF capital returning, the broader narrative may be swinging back toward fundamentals. And Bitcoin Hyper appears to be timing its presale launch perfectly for the next leg of adoption-driven growth.