Ethereum price prediction moved back above $3,000 yesterday, as the crypto market recovery continued this week. The second-largest crypto is trading at $3,041, up 4.22% over 24 hours. Despite this rebound, ETH is still trading nearly 40% below its ATH.

The rebound triggered after the 4-week extended selling drove the price into the oversold zone, prompting dip buyers to step in. ETH is on its way to close the first weekly green candle after a month.

The significant buying interest in Spot Ethereum ETFs also helped build bullish momentum. Over the last 4 consecutive days, ETH ETFs recorded net inflows of $291.70 million. Data from Coinglass shows that net inflows in Ethereum’s ETF products have now surpassed $12.9 billion. Another major focus for ETH next week is the Fusaka upgrade, which aims to address network congestion.

$ETH ETF inflow of $60,800,000 ? yesterday.

BlackRock bought $50,200,000 in Ethereum. pic.twitter.com/v3bHQhA5wa

— Ted (@TedPillows) November 27, 2025

In this rebound, another project is grabbing the market’s attention – Bitcoin Hyper. The presale project has now raised over $28.5 million, with an expert prediction of 20x-50x gains in the first quarter of 2026. Explore why Bitcoin Hyper could challenge Ethereum price prediction in the coming months.

Fusaka Upgrade and ETH ETF Inflows Drive Momentum

Ethereum is gaining attention this week as the Fusaka upgrade approaches. The aim of the upgrade is to speed up confirmations, cut transaction fees, and make NFT minting cheaper. When a network becomes faster and more affordable, activity usually rises because users feel more comfortable moving tokens, minting NFTs, and trying new apps.

? BREAKING: #Ethereum's #Fusaka upgrade is set to boost scalability and efficiency, priming the network for the next wave of #Web3 innovation and adoption.

Upgrade scheduled for December 3rd. https://t.co/T0QSBwEEMt pic.twitter.com/GOreYK4z12

— Joshuwa Roomsburg (@Joshuwa) October 10, 2025

A key part of Fusaka is PeerDAS. Instead of forcing nodes to store and verify everything, it lets them check a few random chunks of each data package. If those pieces look correct, the entire package is considered intact. It works like quickly inspecting a couple of boxes on a pallet instead of opening every single one.

Ethereum also saw a strong boost from ETF activity. The spot U.S. ETH ETFs brought in $60.8 million on November 26, with BlackRock’s ETHA alone adding $50.20 million. These inflows matter because ETF providers must buy ETH to support their shares, creating steady demand that can help stabilize prices on slower market days.

Ethereum Price Prediction: Traders Eyeing $3,500 Next

After struggling with bearish pressure in the past month, the Ethereum price has finally returned to $3,000 psychological mark. Volatility remained high over the last few days, but the altcoin has posted steady green candles, driving the price 17% higher from its recent low.

Ethereum Price Chart. Image Courtesy: TradingView

Ethereum Price Chart. Image Courtesy: TradingView

Expert traders believe that if the price sustains above $3,000 mark, the next stop could be the $3,500 support level. However, ETH has to clear several overhead resistances near the $3,200–$3,400.

The lower support zones will also act as crucial levels for the crypto. First is the near-term support zone around $2,800–$3,100; failure of these levels could invalidate the current rebound and initiate the new leg of the bear rally. If ETH falls decisively below $2,500, it could trigger further selling pressure and push prices lower.

Bitcoin Hyper: The Rising L-2 DeFi Project

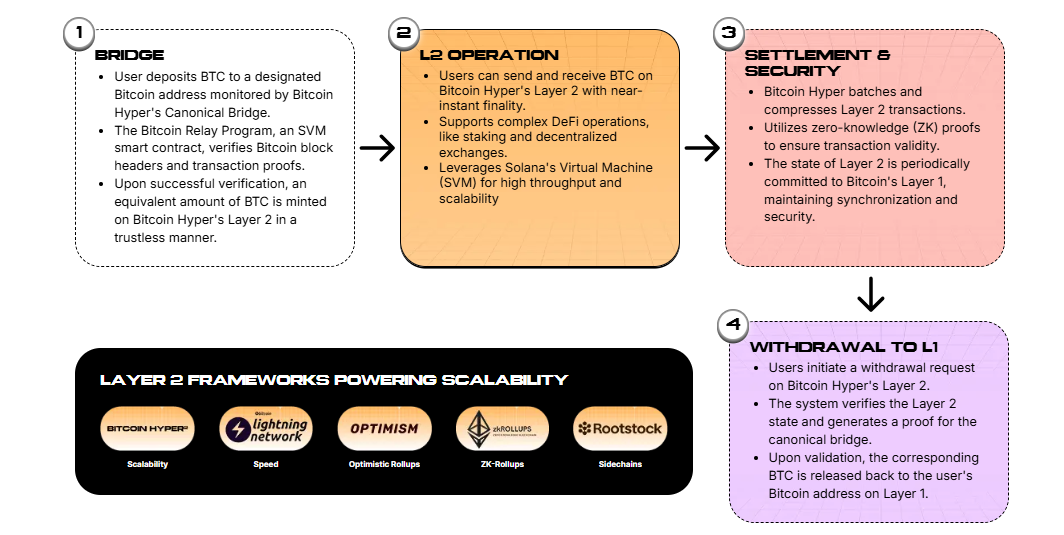

While the Ethereum price prediction navigates turbulence, Bitcoin Hyper is gaining steam. It is the first layer-2 on Bitcoin, designed to address problems such as slow speeds, high transaction costs, and scalability issues in the Bitcoin network. Experts believe the HYPER network is providing a setup similar to what ERC-20 did for Ethereum.

While Bitcoin dominated the market, it lacked scalability for smart contracts, leading most DeFi, NFTs, and on-chain innovation to move to Ethereum and other smart-contract chains. Bitcoin Hyper is precisely addressing the gap in 2025 by providing developers with a fast, scalable way to build directly on Bitcoin.

The protocol does not rely on Bitcoin’s slower base layer but uses the Solana Virtual Machine (SVM) to handle high throughput and smart contract execution. This method delivers Solana-like speed and scalability while retaining Bitcoin’s security.

A non-custodial Canonical Bridge lets users move BTC between layers with 1:1 wrapped conversions. Once on the L2, they can tap into fast gaming apps, AI tools, meme-coin trading, NFTs, and full DeFi ecosystems, and then swap back to BTC whenever they want. The network also uses ZK rollups to sync its state to Bitcoin’s main chain, adding an extra layer of protection.

HYPER Presale Demand Explodes Amid Market Rebound

The massive demand for Bitcoin Hyper’s presale is differentiating it from just another presale. The project has already raised $28.5 million in just a few months of launch and sold over 625 million tokens. The project has already been backed by crypto whales across different communities, demonstrating investor trust similar to that seen in the Ethereum price prediction.

Why Bitcoin Hyper is gaining global momentum

Massive TAM while revolutionizing $2 trillion Capital

41% p.a. staking reward for presale investors

Strict security audit by Coinsult and Spywolf, and ranked #1 in the 2025 crypto presale list

$26.8Million+ raised and well-maintained presale traction

Tokens available at a discounted price of $0.013335

Strong project fundamentals and presale momentum have positioned Bitcoin Hyper as one of the largest presales of the year. However, the low-price opportunity is closing in less than 8 hours as the price is scheduled to increase.